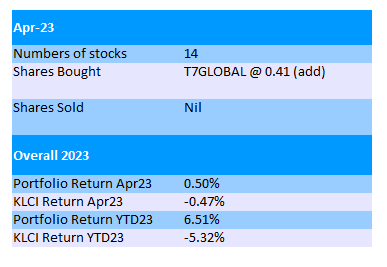

Summary For April 2023

My Portfolio @ End of Apr23

In Apr23, my portfolio inched up just 0.5% while KLCI dropped 0.5%.

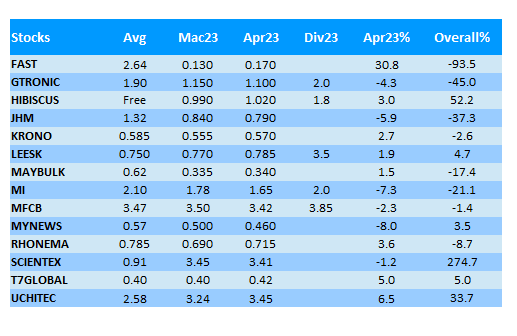

MyNews continued to fall after its loss-making result announcement, while MI lost 7.3% may be because investors have anticipated a poor upcoming result.

Uchitec advanced 6.5% after it announced a surprise special dividend of 5sen, bringing its total dividend to 30sen for FY22.

This is a good 9.1% dividend yield at share price of RM3.30.

I added more T7Global's shares into my portfolio and there was no sell transaction in Apr23.

MI's FY23Q1 result was a bit of disappointment to me.

Although a poorer result was widely expected, the 62% drop in net profit QoQ (FY23Q1 PATAMI RM6.4mil, EPS 0.71sen) was too much.

Its SEBU & SMBU both suffered due to lower demand from customers.

It seems like the suffering will continue into FY23Q2 and hopefully second half of the year will be better.

Gtronic is almost the same story as MI. Its revenue & net profit in FY23Q1 dived 23% & 72% respectively compared QoQ (PATAMI RM3.3mil, EPS 0.49).

Similarly, lower volume loadings from customers is the main reason. This trend might continue for the rest of the year.

Almost all tech related stocks suffers in the first quarter of 2023, as semiconductor industry has entered its downcycle.

Rhonema has just released its FY23Q1 result. Compared QoQ, revenue dropped 10% but PATAMI increased by 2% (RM3.1mil, EPS 1.41sen).

The only surprise was the drastic drop of its dairy revenue from RM4.85mil in immediate preceding quarter to just RM0.34mil in current quarter.

Rhonema is currently via its 49% owned A2 Fresh Holdings Sdn Bhd, owned 35% equity interest in Jemaluang Dairy Valley Sdn Bhd who undertakes a dairy project in Sungai Ambat, Jemaluang, Mersing of Johor.

It has proposed a final dividend of 1sen, making the total dividend 2sen for FY22.

The net profit for Maybulk in FY23Q1 also dropped significantly by 53% QoQ (RM5.3mil, EPS 0.54sen).

Contribution from shipping dropped as expected but the newly acquired shelving & storage solution business contributed PBT of RM1.57mil in 2 months for the first time.

There is a profit guarantee of RM6mil for the new business in FY23.

For those companies who have already released their quarterly results so far, I think 80-90% of them were not that good.

We are now witnessing an economy downturn with high inflation. I guess most people have started to feel the pressure of inflation in their daily life this year.

Many businesses are having a hard time as consumers tighten their belts.

In early May23, Malaysia Bank Negara unexpectedly raised the OPR to 3%, which is the rate in the pre-Covid era.

For Malaysian Ringgit, recently it has weakened against the USD, after going strong since the end of last year.

Stock market in Malaysia has not been doing well for quite some time now, even though other region's stock markets seem to fare better.

Overall, second quarter of 2023 might be even worse but I hope that things will turn brighter in the second half of the year.

http://bursadummy.blogspot.com/2023/05/my-portfolio-apr23.html