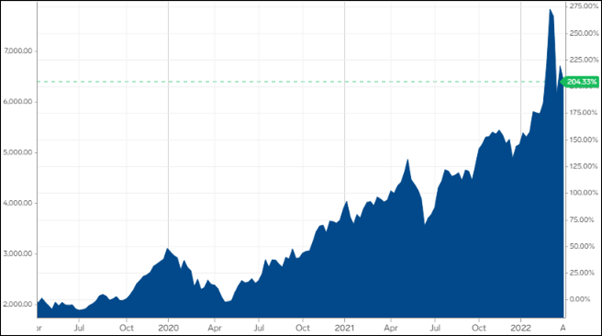

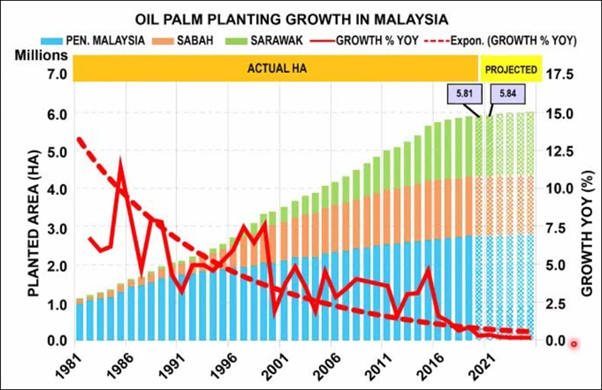

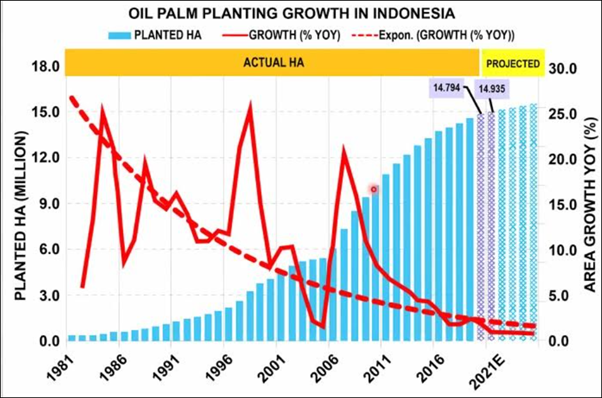

The 2 charts below are showing the slowdown in new planting throughout Indonesia and Malaysia due to land shortage since 2015. With the aging palm tree profile across both countries, the replanting programme will also temporarily limit palm oil supply in the short to medium term. As a result, CPO price started to go up about 2 years ago to hit historical high as shown on the chart below.

CPO price chart

As agricultural land becomes limited, oil palm replanting is key to boosting palm oil yield across Indonesia and Malaysia. It is important replant to sustain supply because Indonesia and Malaysia produce about 85% of the world’s palm oil need.

Due to land shortage, plantation companies with larger planted acreage is a very important consideration for investors. The table below shows Jaya Tiasa is the most undervalued.

|

Name |

Price Rm |

Market cap Million Rm |

Planted hectares |

Market cap ÷Ha |

|

|

JayaTiasa |

1.11 |

1,081 |

70,000 |

15.4 |

|

|

Sarawak Pl |

2.87 |

804 |

35,000 |

23.0 |

|

|

Boustead |

1.10 |

2,464 |

75,000 |

32.8 |

|

|

Cepatwawa |

1.17 |

373 |

10,000 |

37.8 |

|

|

SOP |

6.20 |

3,580 |

88,000 |

40.6 |

|

|

Ta Ann |

5.94 |

2,642 |

50,000 |

52.8 |

|

|

Hap Seng |

3.05 |

2,440 |

35,000 |

69.7 |

|

Jaya Tiasa price chart below: