8 things I learned from the 2022 SUNREIT 5176 SUNWAY REAL ESTATE INVESTMENT TRUST AGM - Shak Chee Hoi

Listed in 2010, Sunway REIT is one of the largest diversified REITs Malaysia. Its assets are mostly located in townships developed by its sponsor, Sunway Berhad, across the Klang Valley, Penang, and Perak.

Over the past decade, the REIT’s total property value grew from RM3.5 billion in 2010 to RM8.7 billion in 2021 as the number of assets in its portfolio increased from 10 to 18. I attended its recent virtual annual general meeting to find out how the REIT will benefit from the recent reopening of borders in Malaysia to tourists.

Here are eight things I learned from the 2022 Sunway REIT AGM.

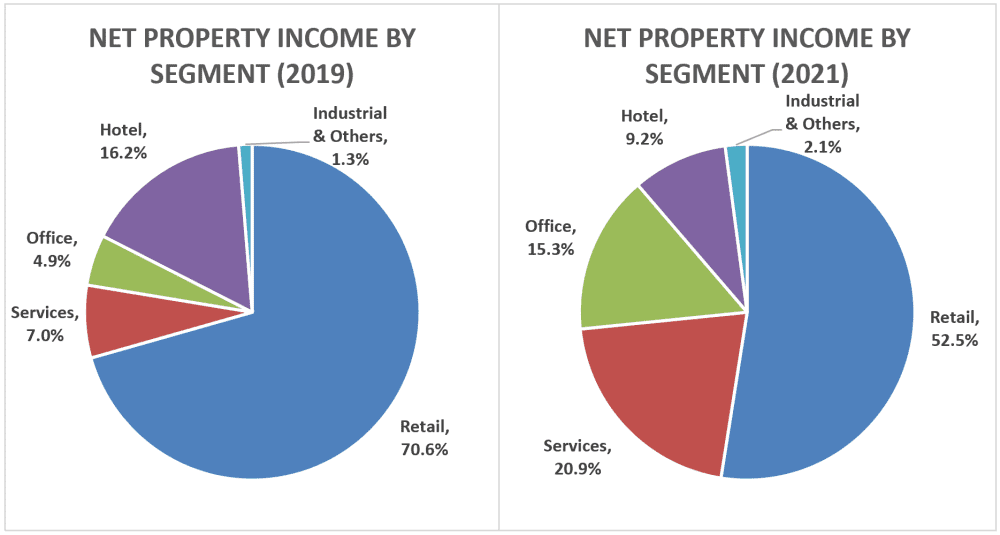

1. Gross revenue increased 21.3% year-on-year to RM675.6 million in 2021 as the financial period ended 31 December 2021 consisted of 18 months. Likewise, net property income increased 9.7% year-on-year to RM457.1 million in 2021. The retail segment continued to be the main financial contributor to the REIT by making up more than half of the REIT’s net property income both pre and post-pandemic.

Source: Sunway REIT 2019 and 2021 annual reports

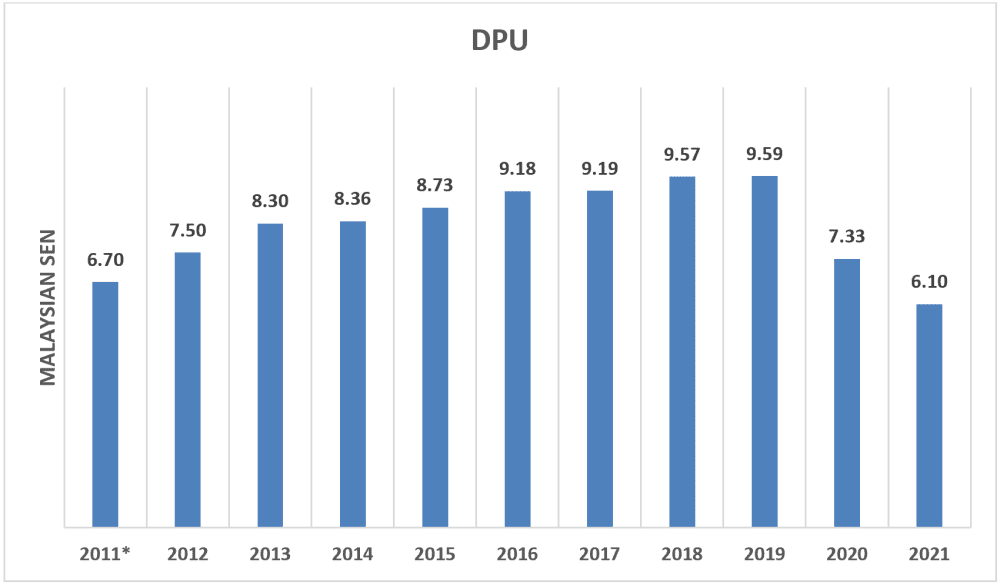

2. Distribution per unit (DPU) was down from 7.33 sen in 2020 to 6.10 sen in 2021 because of COVID-19 and the negative rental reversions to retain mainly retail tenants in 2021. The retail and hotel segments were the REIT’s largest segments pre-pandemic, and these two segments were significantly impacted by the virus outbreak. The REIT provided up to RM160 millions of rental assistance and marketing support to its tenants.

3. Compared to the previous financial year, the retail segment recorded poorer financial results across the board. There is light at the end of the tunnel as the REIT’s retail occupancy rate improved from 95% in 2020 to 97% in 2021. Their shopping malls continue to be relevant to shoppers as shoppers returned eagerly each time movement restrictions loosened in Malaysia. Moving forward, retail tenants will most likely adopt a click-and-mortar approach to sell to customers. CEO Dato’ Jeffrey Ng Tiong Lip added that the REIT’s retail footfall and tenant sales are gradually recovering and have almost returned to pre-pandemic levels as at end-2021.

The ongoing expansion wing of Sunway Carnival Shopping Mall will increase its nett lettable area by three quarters and be opened to shoppers in 2022. The REIT also supported the government’s vaccination rollout by providing rental-free spaces as vaccination centres.

4. The management made good use of the movement control order periods to close and refurbish its flagship Sunway Resort Hotel. Twenty-one new rooms will be added to the existing 439 rooms and the hotel will be opened to guests in 2022 in stages. The REIT’s hotel occupancy rate dropped from 53% in 2020 to 32% in 2021. The entire hospitality industry underperformed in the past two years because of the closure of international borders, limited operation capacity, as well as reduced business travel, conferences, and events.

5. The Office, Services, and Industrial & others segments held up quite well in 2021. The newly acquired The Pinnacle Sunway boosted the REIT’s average office occupancy rate from 78% in 2020 to 84% in 2021 and provided the segment with a new income stream. Sunway university & college campus as well as Sunway Medical Centre (Tower A & B) registered positive annual rental reversions and contributed positively to the Services segment. Income from the sole factory in the Industrial & others segment remained consistent as the lease is on a triple-net basis. Its next rental review date will be in 2022.

6. Sunway REIT undertook a number of asset enhancement initiatives in 2021. The link bridge from Sunway Resort Hotel to Sunway Pyramid Shopping Mall was refurbished at the cost of RM24 million , while 46,000 square feet of additional net lettable area was created. Meanwhile, the management spent RM20 million to convert the rooftop of Sunway Resort Hotel into 30,000 square feet of office spaces. The newly completed area was preleased to tenants.

7. Sunway REIT has replaced its ‘TRANSCEND 2025’ strategy with a more ambitious ‘TRANSCEND 2027’ roadmap in line with the trends brought on by the pandemic. The REIT aims to grow its property value from the existing RM8.7 billion to between RM14 billion and RM15 billion, and diversify into foreign real estate markets. Sunway REIT’s existing assets and previous acquisitions were limited to West Malaysia.

Meanwhile, the management also wants the beef up the property value contribution from the Services and Industrial & others segments from the current 12% to between 20% and 30%. They are looking to acquire stable, DPU-accretive, and high-growth industrial assets such as factories, warehouses, healthcare facilities, campuses, and data centres (as owners not operators). This is a wise move to wean off the dependence on the Retail and Hotel segments as well as to diversify its property concentration risk in case another pandemic hits. In general, industrial assets faired well during the pandemic.

8. In Ng’s point of view, some companies may opt for hybrid working arrangements post-pandemic such as working from home and split-team arrangements. However, some companies in the Klang Valley still prefer their staff to return to the office when COVID-19 cases drop.The demand for office space in strategic locations such as transit-oriented and integrated developments will still be there.

The occupancy rate of Sunway Tower remained low in 2021 at 32%. In the past, many unitholders suggested the sale of this office building since it has been underperforming for many years. However, the management has not given up on this asset. They managed to secure more tenants in 2022 to increase its rental occupancy. In any case, this office building contributed just 0.2% of the REIT’s net property income and made up of 1.4% of total property value in 2021.

The fifth perspective

Sunway REIT was one of the REITs in Malaysia that distributed increasing DPU to unitholders year after year alongside KLCCP Stapled Group before COVID-19.

Source: Sunway REIT annual reports, *annualised DPU

Moving forward, Malaysia has reopened its borders. The REIT’s Retail, Hospitality, and Services segments are well-poised to recover from the return of foreign tourists and international students as well as the pick-up in business activities and medical tourism.

https://fifthperson.com/2022-sunway-reit-agm/

Lotus Cars appoints new China president

8 hours ago