Kenanga Digital Investing - Dividend Magic

Fully Automated Robo Advisor

Another new addition to the Robo-advisor stratosphere! This time from Kenanga and it is called Kenanga Digital Investing (KDI). The platform is fully A.I.-driven with little to no human involvement. Most of the Robo-advisors we have in Malaysia right now are a mix of A.I. plus fund manager’s decisions. The only other similar one is from MyTheo.

First off, they’re licensed by the Securities Commission (SC). In terms of governance and licensing, that is as safe as it can get.

As for its execution, the algorithm used by Kenanga Digital Investing is fully A.I.-driven with machine learning capabilities. In the online briefing I attended, Kenanga mentioned that they’ve backtested all the portfolios from 2004. The results shown and presented to us were positive.

Kenanga Digital Investing – KDI Save and KDI Invest

KDI Save – Cash Management Fund

KDI offers two main products to clients and investors. The first is their Cash Management Fund (CMF) – KDI Save. They’re offering fixed returns at 3.0% p.a. with zero fees and calculated on a daily basis. This is one of the highest I’ve seen. And, you don’t have to start off with a huge amount, the minimum is RM100. However, it is capped at RM200,000, anything above that, it’ll be a 2.25% return p.a. Still decent.

KDI Invest – A.I. Driven Investing

KDI Invest is further broken down into five different funds based on your risk profile.

- Very Conservative

- Conservative

- Balanced

- Growth

- Aggressive Growth

From the backtesting results (from 2004 to 2021) I sighted during KDI’s briefing, the annualized return for the five funds ranges from 6% to 14%. The maximum drawdown was in the range of 10% to 16% for all five funds. Which is pretty damn good.

Kenanga Digital Investing – How to Start?

The steps from registration to execution are simple and straightforward. Before that, there is a special promotion for Dividend Magic readers.

Click Here to Sign Up

Referral code: 100108

Using the above link, you’ll receive RM20 for free upon successful activation of your account with a minimum transacted amount of RM100 into KDI Save or RM250 into KDI Invest. This RM20 will be paid out within 30 days.

Do also note that this promotion is only applicable to the first 500 successful referrals and valid up to 31st May 2022.

The next step to registering is to key in your personal details and to take a clear picture of the front and back of your IC.

You then answer a few simple questions regarding your investment goals and horizon. You’ll be recommended with one of the five portfolios based on your answers. However, you’re still free to pick one on your own. As I’ve still got a long time-horizon ie. 20+ years, I went with the KDI Invest – Aggressive Growth portfolio.

Benefits Kenanga Digital Investing (KDI) – What sets it apart?

Their cash management fund – KDI Save is currently one of the best I’ve found. No fees, a 3% return, and one-day withdrawals. It is perfect for my emergency funds now instead of placing them in fixed deposits or a savings account. I plan to move my funds here. Keep in mind that funds over RM200K earn a lower rate of 2.25%. Which is still higher than FDs!

As for KDI Invest, I’m happy with the returns shown from their backtesting. Would love to see them go further back than 2004 though. I’ll be trying this out for a year and then compare it to my returns from my investments in StashAway.

The fully A.I.-driven approach sounds good to me, and the maximum drawdowns, even for their most aggressive portfolio was only 16%.

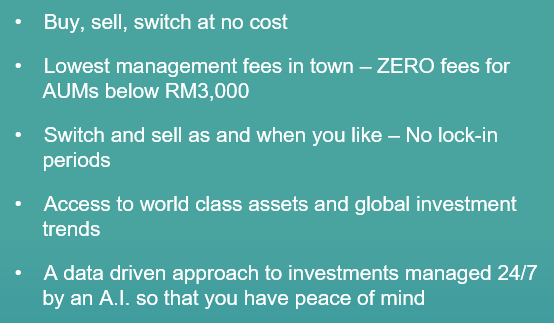

Lastly, FEES! I know how everyone, myself included is always concerned about fees. KDI Invest employs a tiered system.

The fees are in line with other Robo-advisors, even cheaper at some tiers. They’re also not charging anything for investments RM3,000 and below.

Also to note, the minimum investment amount is RM250.

End.

I’m definitely going for their cash management fund – KDI Save. And I’ll be testing the waters first with RM3,000 in KDI Invest for a few months. If all is good, I’ll be doing DCA via Kenanga Digital Invest for the long term.

I am a certified financial planner with the Financial Planning Association of Malaysia, a passionate investor looking for financial independence as well as hoping to educate Malaysians on financial literacy.

Aiming to become financially independent by 35 years old, I enjoy living a frugal lifestyle (with the occasional lavish spending) while meticulously adding to my portfolio of dividend growth stocks. I’m here to show you what real investing is really like, and that anyone can invest.

There will be losses, there will be gains, I aim to be 100% transparent in my investment journey, documenting all aspects of it. This is my promise to you.

Do join us on FACEBOOK.

Also, our our FB Group where we hope to have some more enlightened discussions on investing.

Onwards and upwards!

https://dividendmagic.com.my/kenanga-digital-investing/