This is another series of powerful yet simple article for all our dear retail investors in Bursa Malaysia.

Bursa Malaysia has gone through a series of uncertain movement for the past three months with investors left being frustrated on their stock performance.

However, we have noticed a pattern in a certain theme for the past one week and it is only getting stronger. So it is time to make use of it.

We are talking about the VALUE THEME.

First of all there are 2 main factors that has been causing the stock market perfomance to be poor over the past 3 months

1) Inflation fear which mainly affected the technology stocks and interest rates hike possibility (which affected the rest of the other sectors)

2) Covid cases rising and lockdown fear which generally affected the whole stock market.

Since the problems are clear, it is only logic to know if both these problems are going through a deeper crisis or it is being solution based right now.

As for inflation, the fears have not subsided fully and therefore it may take more time for technology stocks to react positively with good momentum.

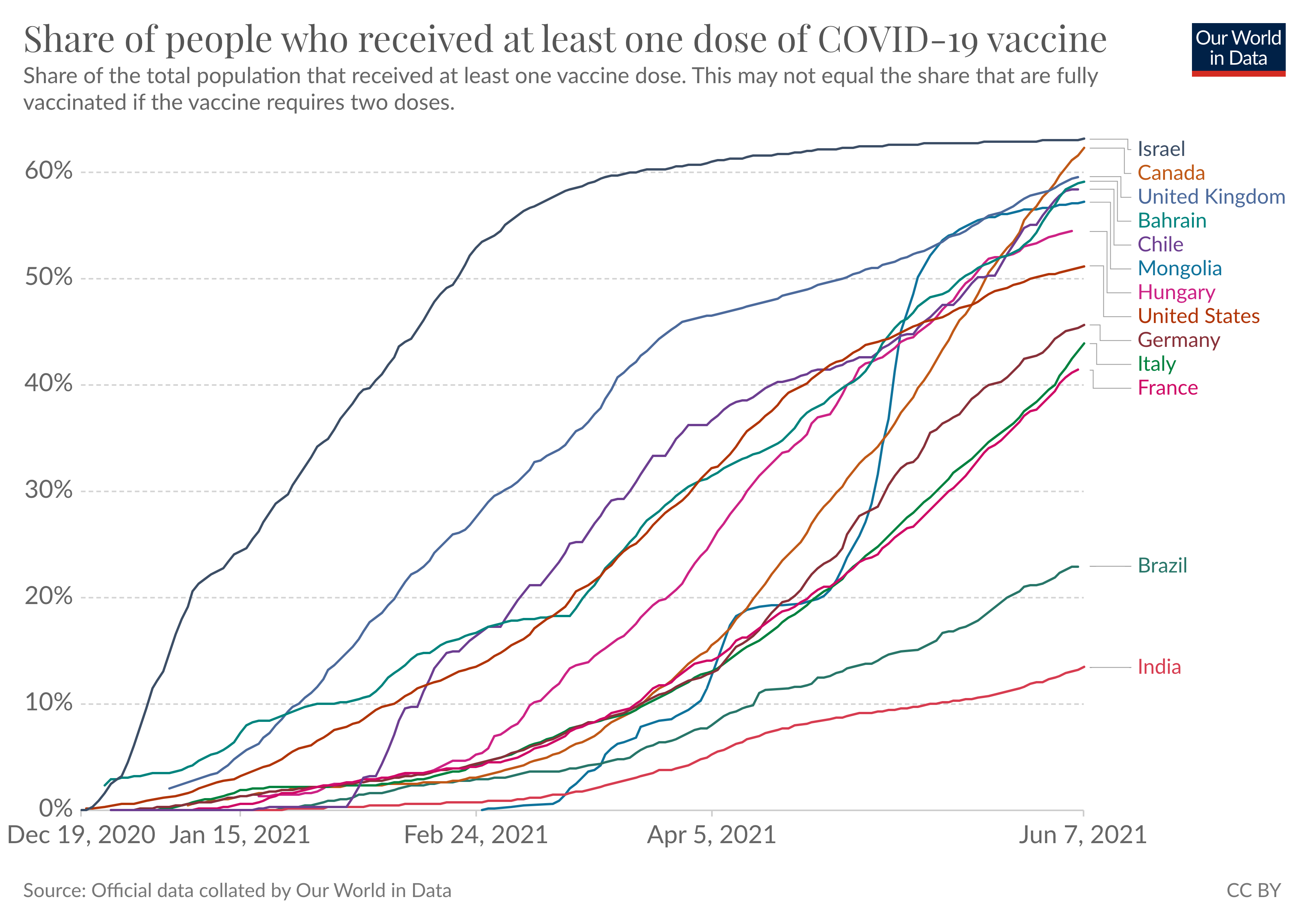

On the bright side, the second problem is being encouragingly solved by most countries around the world. The cases are being solved and the curve is starting to drop with vaccination rates increasing.

Malaysia covid vaccination rate has been increasing steadily as the government is securing more vaccines and opening up more centres for vaccination.

This is the increase in vaccination rate around the world. Source : https://ourworldindata.org/covid-vaccinations

WITH THIS IN PLACE WE ARE ONLY HEADING IN ONE DIRECTION : ECONOMIC RECOVERY

When we talk about which sector will benefit, as of now you need to understand the difference between

1) Value Stocks -

- Value stocks, often stocks of cyclical industries, may do well early in an economic recovery but are typically more likely to lag in a sustained bull market

2) Growth Stocks -

- Growth stocks, in general, have the potential to perform better when interest rates are falling and company earnings are rising. However, they may also be the first to be punished when the economy is cooling.

Source : https://www.merrilledge.com/article/growth-vs-value-investing-two-approaches-to-stocks

We in this article will be covering one sector in particular, the construction and property sector while there are also many others which fall in this category. (eg: Aviation, Consumer and Retail)

With economic recovery possibly happening very soon, this sector will be the first to recover as the economy is heading towards new infrastructures and development.

Some of the stocks in Bursa Malaysia that fall under this category includes GAMUDA, IJM, ECONBHD, WCT, SPSETIA, LBS, ECOWLD, MUHIBAH, MATRIX, E&O, KERJAYA, GRANFLO, EWEIN, GBGAQRS, ENCORP, MCT and many more. (no particular arrangement and this list is not exhaustive)

These stocks have been undervalued due to the economic turbulence and now be very attractive in the eyes of value investors, especially institutions.

Technical analysis will play an

important role in order to make use of this short term opportunity.

Kindly refer to your licensed investment advisors to know if this sector

could benefit your portfolio of stocks.

This article is intended to educate you on how to take advantage on

sectors that have been sold on uncertainty but has the potential to

reverse its direction based on prospects.

We have more for you! Follow us in our Telegram Channel @StockAdvisor FBMKLCI for more updates in Bursa Malaysia on a daily basis!

Disclaimer : All notes expressed here are solely individual point of views and we are not responsible for any buy or sell decisions made by others. Kindly use this as a reference reading material to add value to your current research and pleas verify any information stated here with a licensed individual in the capital markets industry before making any decisions.

https://klse.i3investor.com/blogs/StockAdvisor/2021-06-09-story-h1566109641-VALUE_THEME_IS_WHAT_YOU_REALLY_NEED_TO_FOCUS_NOW.jsp