Sarawak Plantations (SPLB MK)

-

We reaffirm our positive view on SPLB with earnings estimated to grow at a robust CAGR of 47% over the next 3 financial years, supported by organic growth and its transformation plan.

-

SPLB stands to reap benefits from acceleration in higher palm products price and improvement in FFB production.

-

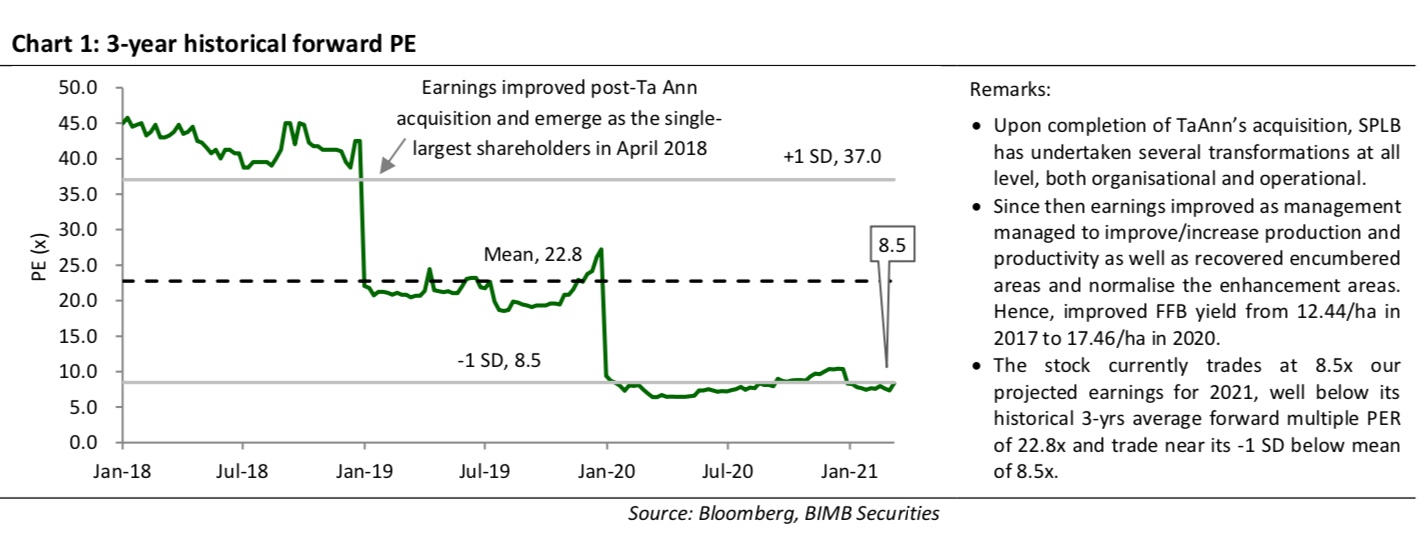

Low valuation. SPLB current valuation implies an 8.5x its 12-months forward PE, below the current sector’s average of 21.9x and its 3-years average forward PER of 22.8x. SPLB now trade near -1SD below 3-yrs mean with gearing of 4%

A new SPLB has emerged following Ta Ann acquisition

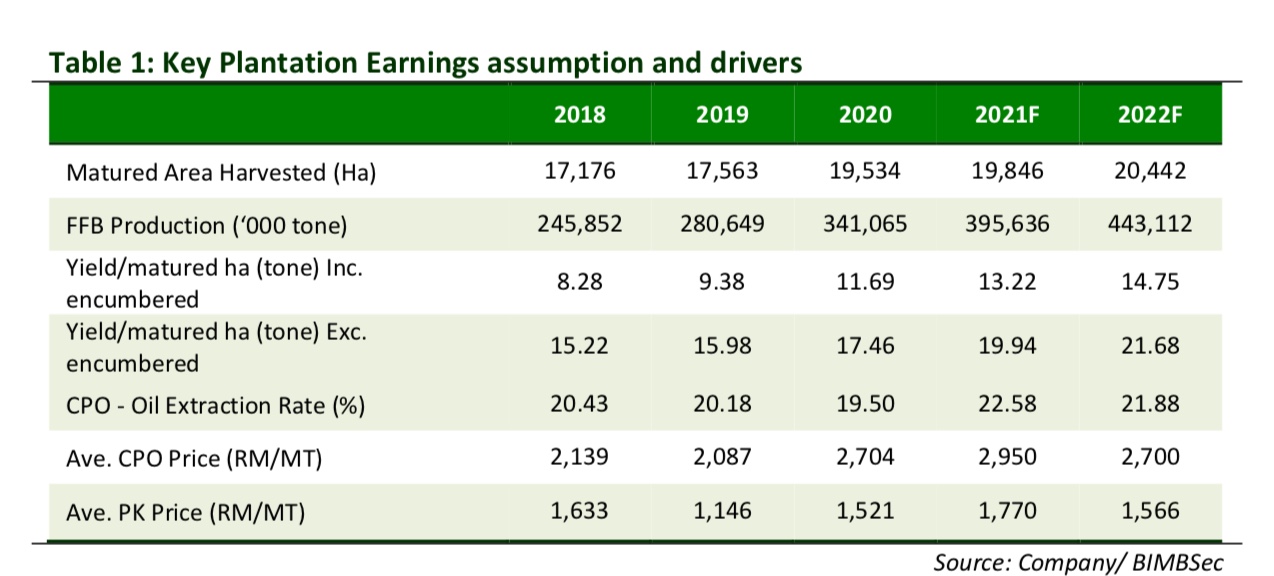

SPLB is now a much organised and efficient company, in our opinion, following the entry of Ta Ann as shareholder in 2018. We believe that SPLB is transforming into superior company post-FY20 as we believe 1) its harvestable areas and crop profile has improved, hence will generate better yield and production growth, and 2) higher FFB, PK and CPO production will partially offset any potential downward-swing of palm products price.

SPLB is on a growth trajectory

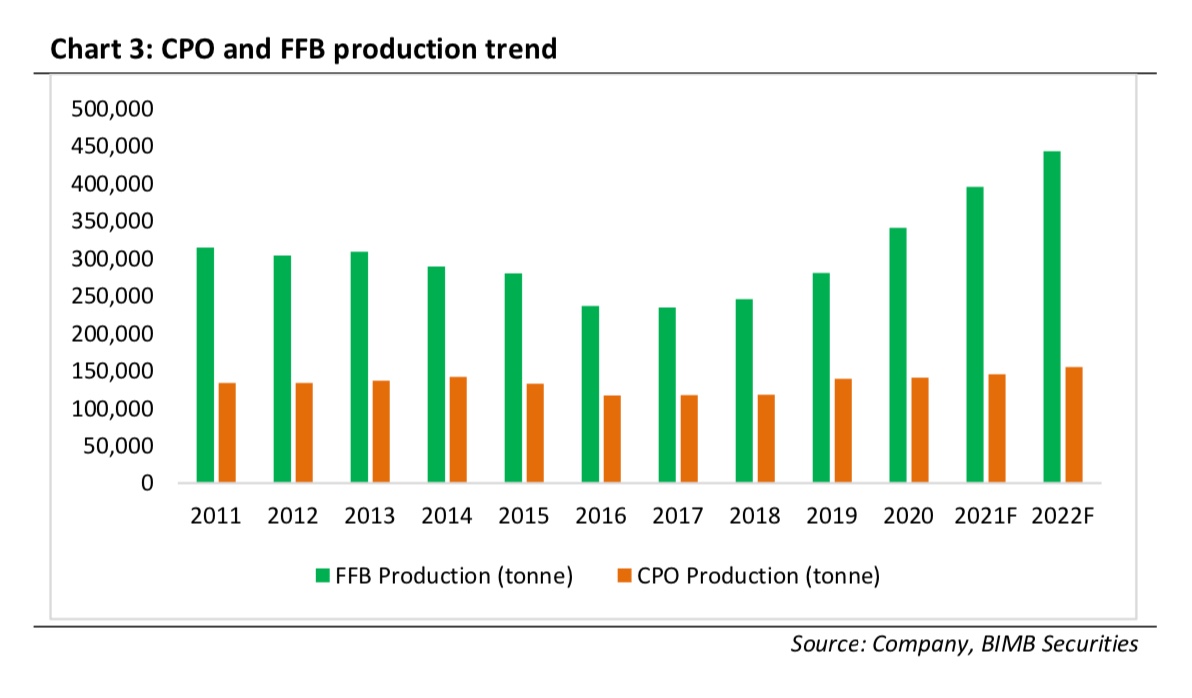

We foresee that SPLB is on its way to boost its earnings, estimated to grow at 3-year CAGR of 47.3% on the back of 12.7% increase in revenue; supported by higher production, ASP of palm products and costs savings. Central to our forecast is improvement in production resulting from increase in harvestable areas and FFB yield, aided by better palm product prices.

FFB production expected to grow as yield improve.

The entry of Ta Ann has developed operating synergies by allowing SPLB to leverage on Ta Ann expertise via knowledge sharing and estates management practice to improve yield as well as to deal with NCR land issues.

| SWKPLNT | HAPSENG | TSH | FGV | |

|---|---|---|---|---|

| Market Cap (RM m) |

641.8 |

1,471.4 |

1,449 |

4,925 |

| Net Profit FY21 |

75.4 |

57.2 |

75.3 |

215.6 |

| PER (x) |

8.5 |

25.7 |

19.2 |

22.8 |

| Div Yield |

4.3% |

1.4% |

1% |

1.5% |

| ROE |

10.4% |

5.3% |

5.4% |

3.5% |

Source: BIMB Securities/Bloomberg

https://klse.i3investor.com/blogs/supergrowthinvest/2021-05-04-story-h1564259899-SPLB_We_believe_the_stock_is_currently_undervalued_compared_to_other_pl.jsp