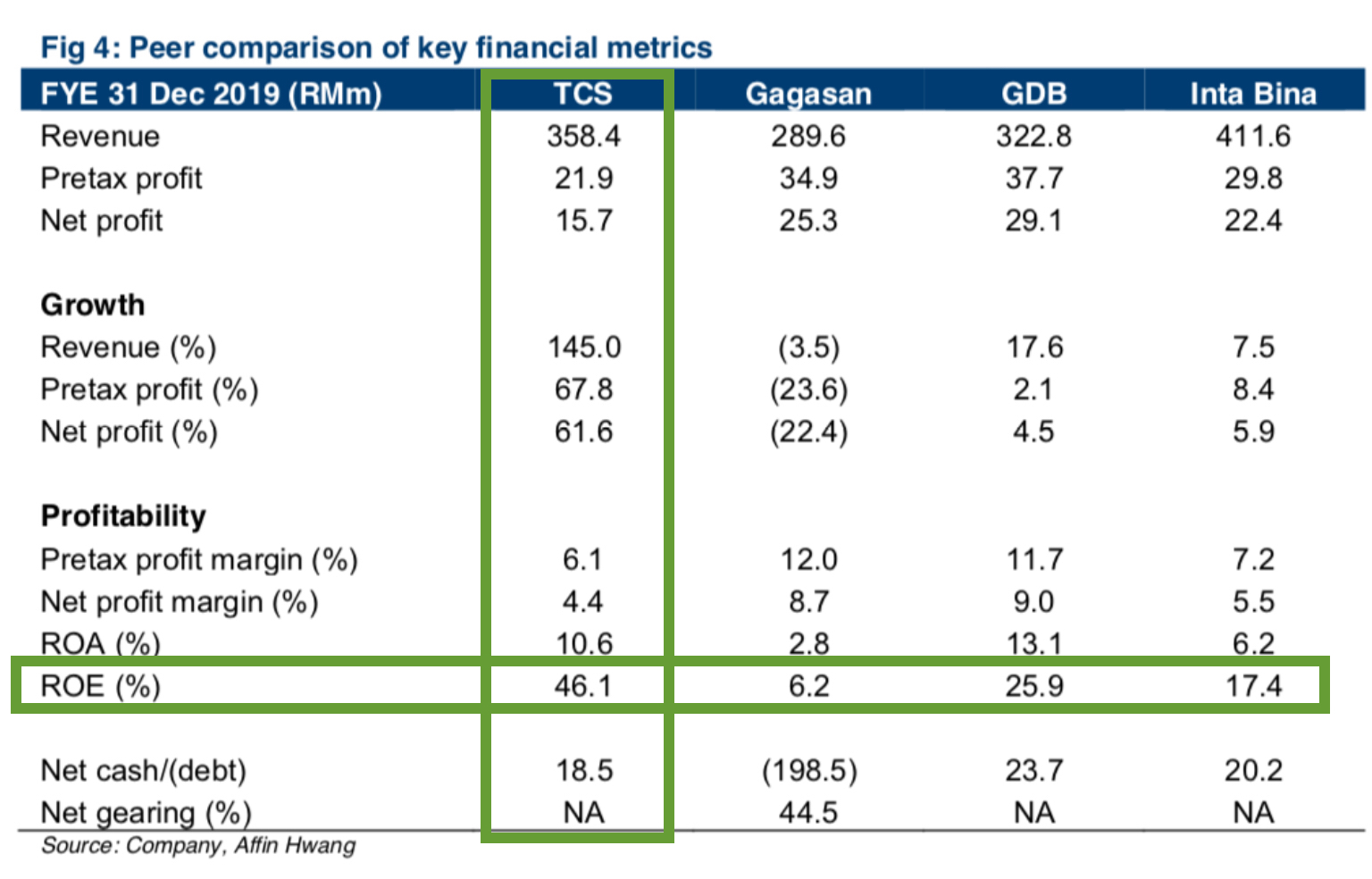

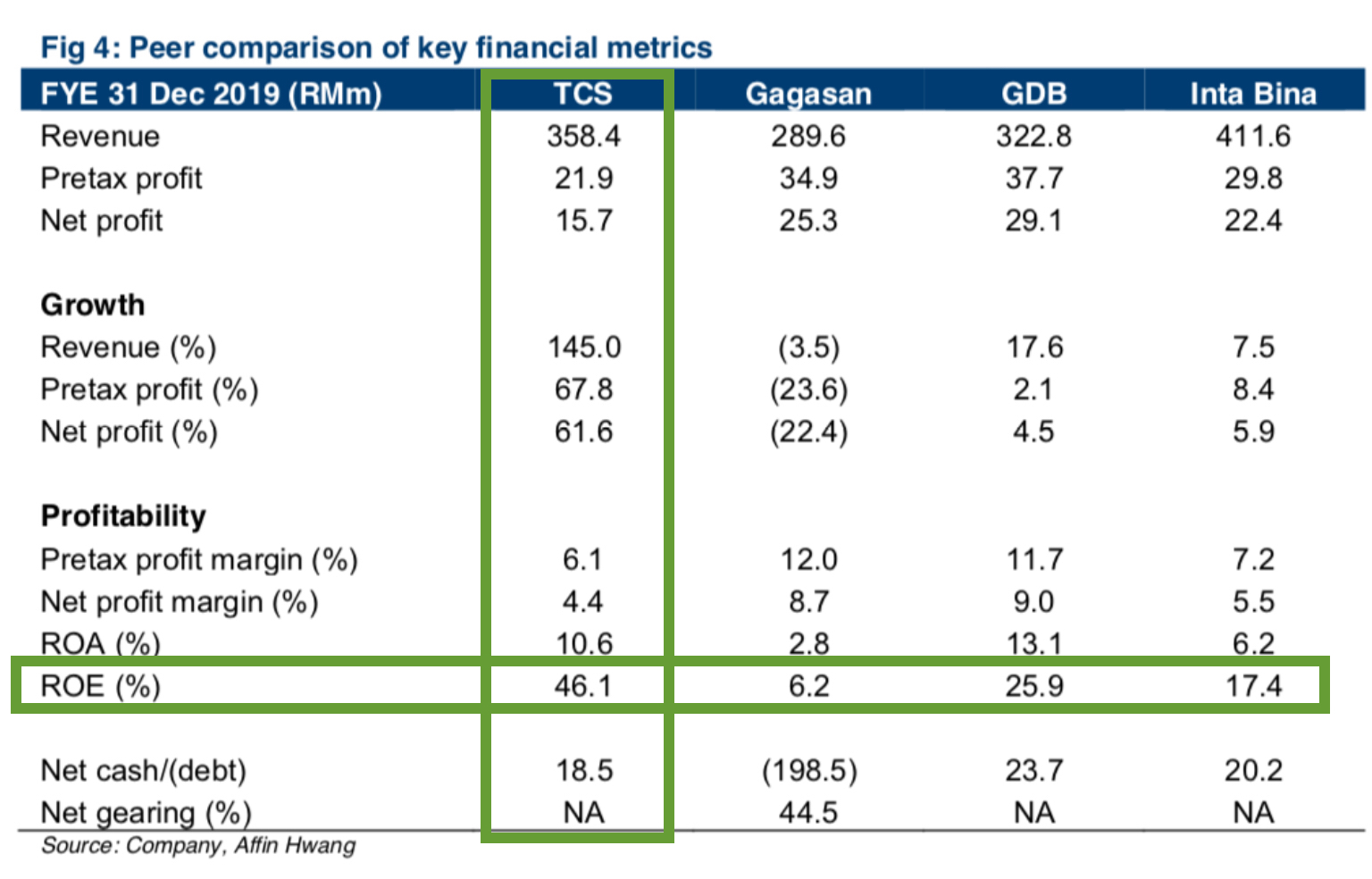

TCS (0221): TCS GROUP HOLDINGS BERHAD is the industry-best in generating return on it’s shareholders’s equity.

Compared with peers focusing in building construction, TCS generated relatively high ROE. It’s ROE was 46.1% in 2019, almost twice the second highest ROE of 25.9% for GDB.

Revenue and earnings growth were also superior to peers.

According to AffinHwang Capital Research, TCS achieved a 3-year revenue CAGR of 51% in 2017-2019, driven by higher progress billings and order book expansion. Tracking the revenue growth, net profit saw a 3-year CAGR of 45% in 2017-2019.

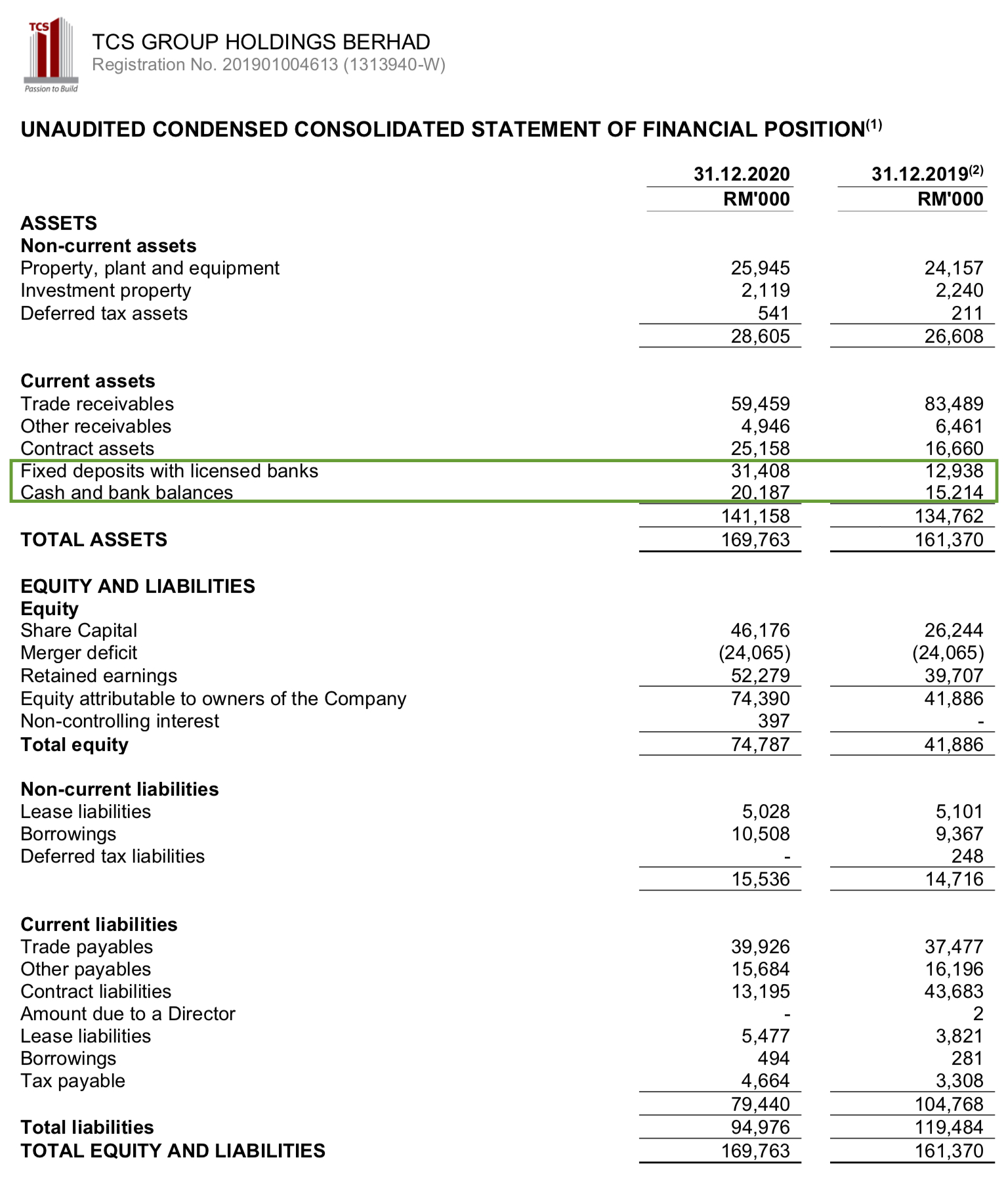

TCS is in net cash position of

11.3sen/share, equivalent to 20% of share price. Its strong financial

position will support the company’s plan to expand its order book.

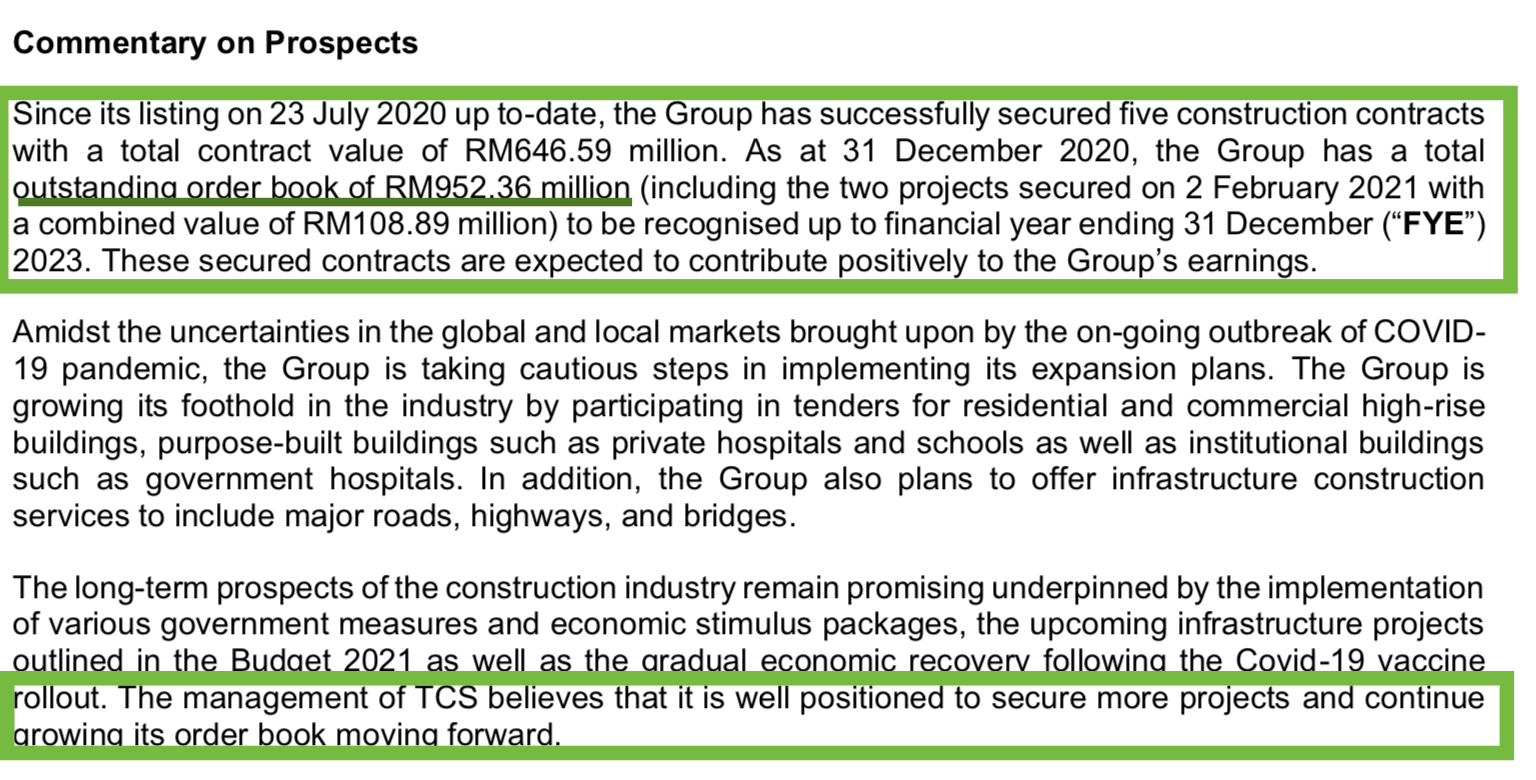

Outstanding order book almost tripled to RM952.36m

TCS’s outstanding orderbook almost tripled from 360.57m in July 2020 to RM952.36m as at 31 Dec 2020, equivalent to 3.9x its 2020 revenue. What this means is earnings are poised to grow even in the unlikely case of 0 new project secured this year.

TCS has a good track record in completing projects ahead of schedule. It has good working relationships with major property developers, such as IJM Corporation, SP Setia, Tropicana and UM Land and has received repeat work orders from them.

TCS has submitted tenders for new projects with a total value of RM2.6bn, with historical success rate of 20-30%.

In latest 4QFY20 quarterly report, the

management of TCS said it believes that it is well positioned to secure

more projects and continue growing its order book moving forward.

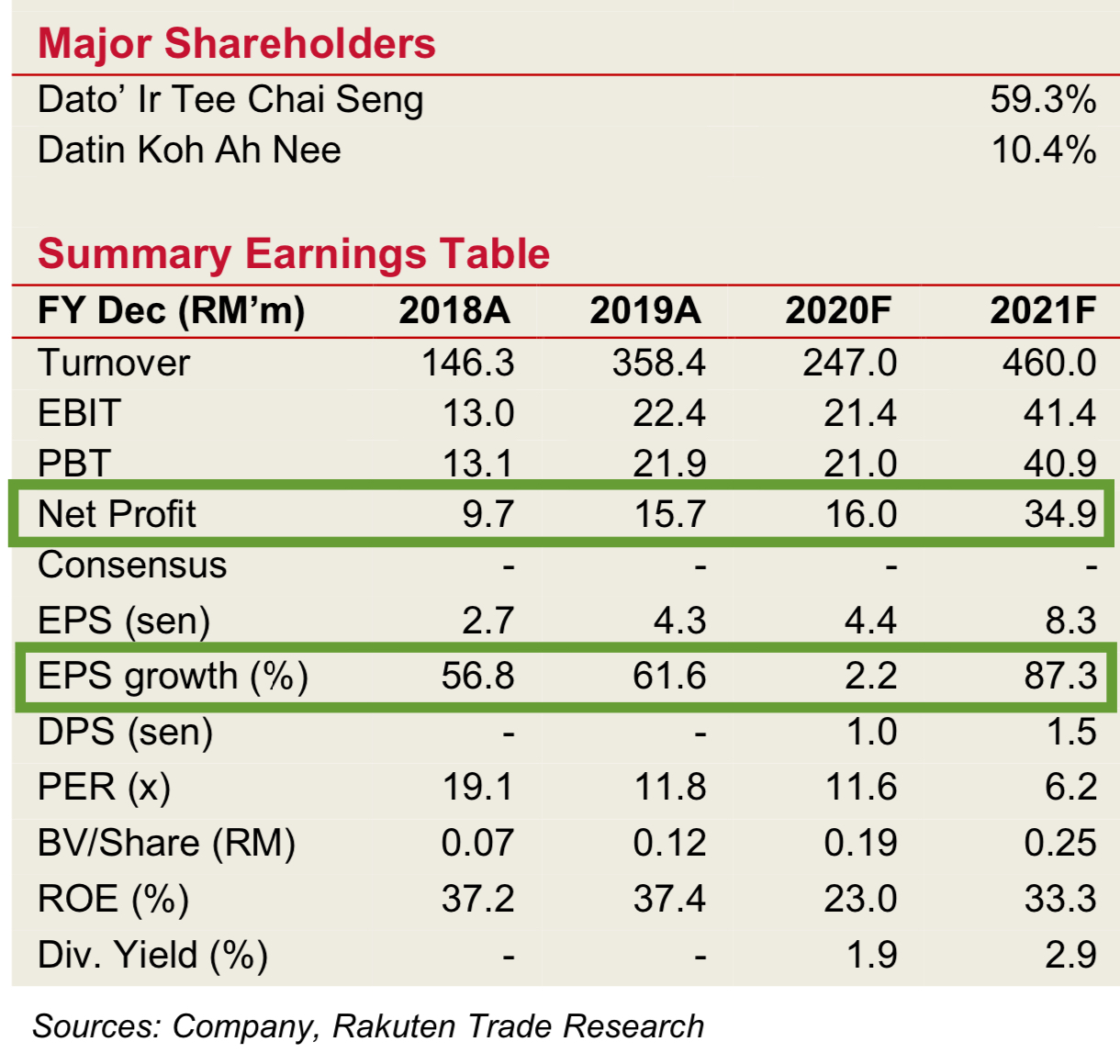

Rakuten recommend Buy with TP of RM0.75

Rakuten Trade Research is the only only broker covering TCS.

Rakuten: We

remain favourable on TCS as our construction recovery pick.

Fundamentals are solid with strong growing orderbook and healthy balance

sheet with net cash position.Continue to recommend BUY with a target price of RM0.75 based on 9x FY21 PER.

Looking

forward, we expect orderbook to continue growing driven by the

resumption of construction activities by the government especially

within the infrastructure sector.

Rakuten’s TP of RM0.75

is based on only 9x FY21 PER, which is very conservative for a company

with industry-best ROEs and superior revenue and earnings growth.

Rakuten expects TCS’s earnings to grow 87.3% in 2021.

If you assume a reasonable PER of 12x, TCS is potentially worth RM1.16 (108% upside to current price).

Disclaimer: All

information here reflects the author’s personal views/thoughts and

should not be considered as investment advice. It is very important to

do your own analysis before making any investment based on your own

personal circumstances. No content here constitutes - or should be

understood as constituting - a recommendation to enter in any securities

transactions.

Appendix

Company background

Incorporated in 1998, TCS is primarily

involved in the provision of construction services for buildings,

infrastructure, civil and structural works in Malaysia with track record

of completing its construction projects ahead of schedule.

Over the years, revenue growth was mainly

centred on residential projects, as the segment contributed 77.9% to

sales as compared to 22.1% from the commercial projects in FY2019.

Project scope covers terrace houses,

bungalows, apartments, condominiums, shop offices, shopping complex,

high-rise and purpose-build buildings and other infrastructure works.

TCS has achieved CAGR of 51% in revenue between 2017 and 2019 on the back of rising orderbook.

The group has established relationships

with key clients notably IJM Land Group, Worldwide Holdings and

Tropicana Group. As at 30 Apr 2020, unbilled order book stands at

RM463.8m with visibility until FY23. Major on-going projects are located

at Putrajaya (48.2%) and Kuala Lumpur (34.2%), including projects such

as Putrajaya Sentral, Tropicana Urban Homes and Setia City Residences.

Since TCS’s debuted on ACE Market in

July last year, the group continues to secure new projects despite

challenging landscape during the period. Outstanding orderbook

registered a sturdy growth from RM420.0m as of June 2020 to RM898.3m as

of Sept 2020, providing earnings visibility over next 3 years. Among the

latest project wins are RM323.0m from Mah Sing M Arisa Project,

RM146.3m from Vista Sentul Residences Project and RM68.4m from Sime

Darby Elmina Green Three.

The group are also in plan to expand infrastructure construction services.

Tenderbook stands at RM2.6bn, with historical success rate of 20%-30%.

Looking

forward, we expect orderbook to continue growing driven by the

resumption of construction activities by the government especially

within the infrastructure sector.

https://klse.i3investor.com/blogs/Chongkh888/2021-04-03-story-h1542929356-TCSGH_Industry_best_ROE_superior_revenue_and_earnings_growth_net_cash_p.jsp