Koon Yew Yin 12 March 2021

Dominant is underratedI read this comprehensive article on Dominant from i3investor.com. If you do not want to read this long article, you can read my conclusion at the end of this piece. I am obliged to tell you that Dominant is one of my investment stock holdings.

Company background

Dominant Enterprise Berhad which commenced operation in 1992, is involved in the manufacturing of environmentally friendly engineered wood mouldings, laminated wood panel products as well as the distribution and export of a wide range of wood products to over 20 countries around the world. Dominant distributes wood panel and building material products to furniture manufacturers, interior designers, and construction-related players in Malaysia, Singapore, Australia, Thailand and Vietnam. The manufacturing segment manufacture laminated wood panel products, wrapped medium density fibreboard mouldings and furniture components for furniture manufacturers and interior design industries.

Investment thesis

Competitive strength and good track record.

A leading wood-based exporter in Asia. The Group currently has subsidiary presence in Malaysia, Singapore, Australia, Thailand and Vietnam. The Group aims to strengthen its footprint in all these countries through increased production capability, introduction of new products to the markets and developing new industries in each of these countries. With the Group’s excellent track record in exceptional product quality and timely delivery, we are optimistic that we will be able to capture a larger piece of the pie.

The Company has also earned a good reputation as a reliable and quality supplier when it supplied wood panels and other building materials to some prestigious and major building projects in Singapore, such as the Republic Plaza, Changi Airport Airfreight Terminal 5 and extensions of the DBS Bank building. Today, one of the subsidiaries of Dominan ranks as one of the major wood panel importers in Singapore.

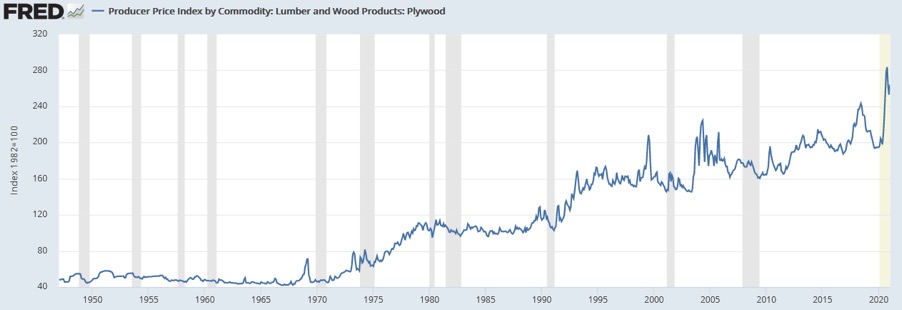

Improving margin on up-cycle

Historically, Dominan has hit record profit in 2018 when average selling price (ASP) of the plywood hit the previous peak of 240 USD. However, the latest ASP has reached the all-time high of 280 USD. This can be seen from the spike in margin to 4.9% in the latest earning quarter as compared to ~2% pre-covid. The management of Dominan has attributed this improvement to better margin as well as effective costs management.

Work-from-home boom is a bust for big office furniture makers

Major corporations such as Google, Microsoft and Facebook have adopted work-from-home (WFH) policies to help contain the spread of the virus. Some have even gone to the extent of providing employees with one-off cash allowances to purchase home office furniture. Also, the cash handouts as part of the stimulus from the US government are reported to have spurred consumer spending on items such as home furnishing. This bodes well for furniture companies operating out of Muar, Johor, deemed the “heartland” of the local industry. Public Invest Research expects the growth in demand for Malaysian furniture to resume once the global economy recovers and returns to normal in 2021, with potential earnings growth of 37% and 20% in FY21 and FY22 respectively. Although some of the furniture maker has reported margin compression as a result of weaker USD and rising material costs, Dominan as supplier of the raw material for the furniture industry is the beneficiary from this trend.

Expansion plan

The construction of the Group’s Dengkil factory and Ipoh warehouse was expected to be completed by Dec 2020. This plant will increase their production capability, allowing Dominan to cater more effectively to market demand.

In 2019, the Group has also entered into an agreement to purchase 3 parcels of land in Muar totalling 18.4 acres, for RM12.8 million. The land parcels are expected to be delivered in December 2021.

Steadily growing plywood market

Amid the COVID-19 crisis and the looming economic recession, the plywood market worldwide will grow by a CAGR of 7.9% from 2019 to 2027 based on the report by Businesswire (range of projection: 2.3% by Market Watch to 25.5% by Simplywall.St)

Financials

FY21-FY22 could be see a potential recovery in earnings for Dominan from the impact of Covid-19, however bottom line would be slightly dragged by potential higher cost. Moving forward, I am bullish on FY21’s growth on the back of improving margin and dirt-cheap valuation.

Good earnings record

Dominan has always been profitable with steadily growing revenue and net profit with 5-year CAGR of 8.8% and 2.5% respectively from 2014 to 2019. This could be the result of the group’s competitive strength backed by an experienced management team as not many players in the same industry were able to display similar result during the stated period due to margin compression. For the 12-month period ended 31 December 2020, the drop in earnings was due mainly to the imposition of Movement Control Order (“MCO”) by the Malaysian Government, to tackle the COVID-19 pandemic. The latest earning quarter has delivered the highest net profit since 1Q19 which has reflected the rising margin due to higher ASP.

Conclusion:

Based on the following facts:

1 Its price chart is up trend which is most important.

2 Due to Covid 19 pandemic, more people have to work at home in most countries around the world. As a result, more wooden furniture is required.

3 Company expansion to increase production. Just completed Dengkil factory and Ipoh ware house.

3 Rising profit margin due to higher ASP.

It is safe to assume its annual EPS is 4 times its latest quarter ending Dec EPS 5.44 sen = 21.8 sen. Based on PE 10, its share price should be Rm 2.18 per share.

http://koonyewyin.com/2021/03/12/dominant-is-underrated/