How to convert 30,000,000,000 of 1sen into million? We just take away 2 zero, that will be RM300 million. Now a day, if we saw a 10sen coin on the floor, we will not even bend down to pick it up, further more if it is a 1sen coin!! So what is this bargain about?

The trick is to tie this ICPS/ICULS with mother share future intrinsic value (exercise price). If the mother share appreciate, this convertible preference shares/loan stocks will appreciate in tandem.

Below are examples of few issuances of this 1sen bargain.

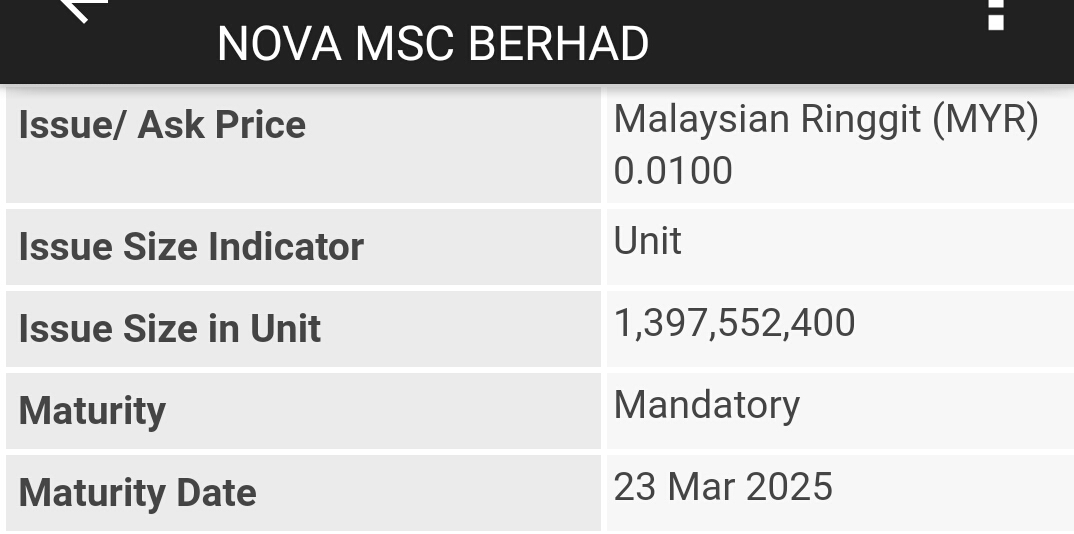

NOVAMSC-PA at 8sen around 700% gain off this 1sen issuance.

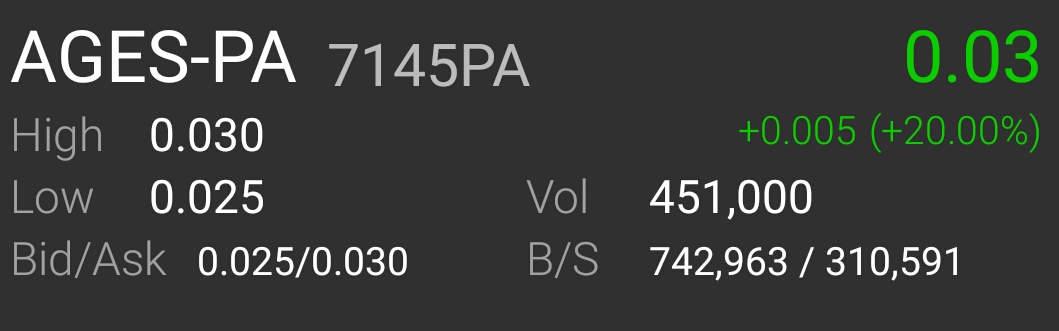

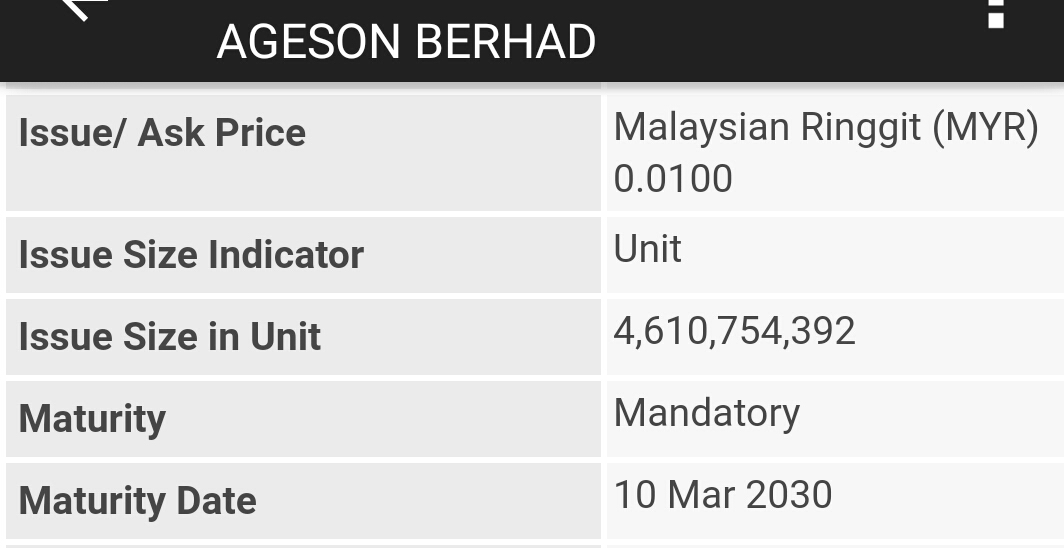

AGES-PA at 3sen around 200% gain off this 1sen issuance.

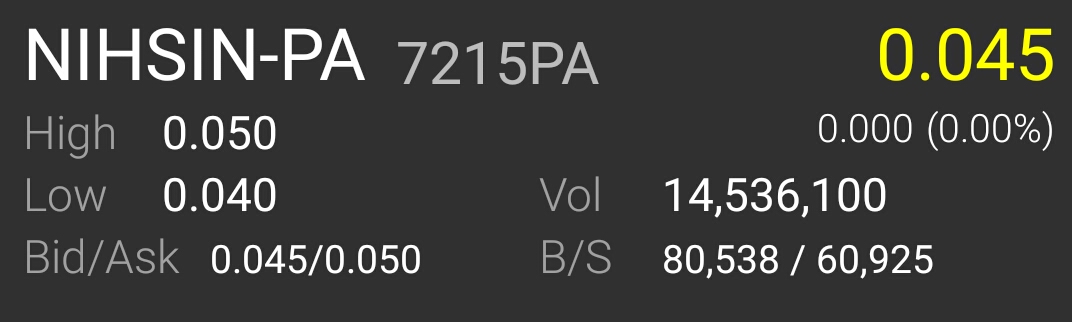

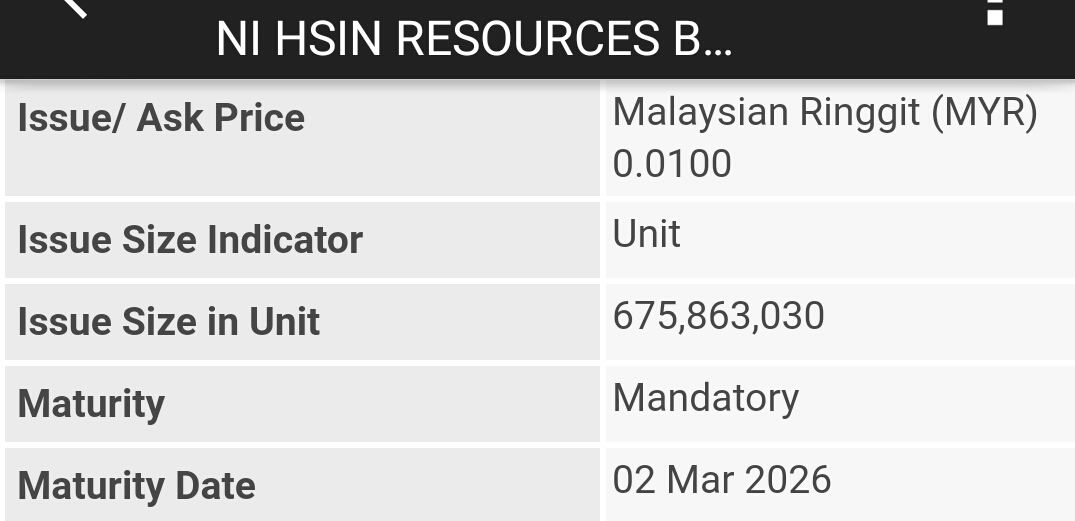

NI HSIN-PA at 4.5sen 350% gain off this 1sen issuance. (Today listing)

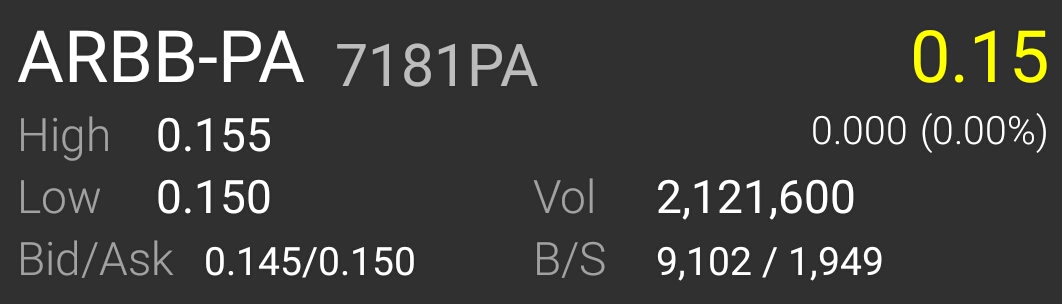

ARBB-PA at 15sen around1400% gain off this 1sen issuance.

As we can observe, this issuances are usually by penny stocks with very low downside. How low downside can this 1sen drop? The upside, as seen in ARBB-PA, can be quite high.

Source of snapshots: klse screener.

Caution 1 : Not ALL Preference Shares/Loan Stocks are the same. Please read through all the small print carefully.

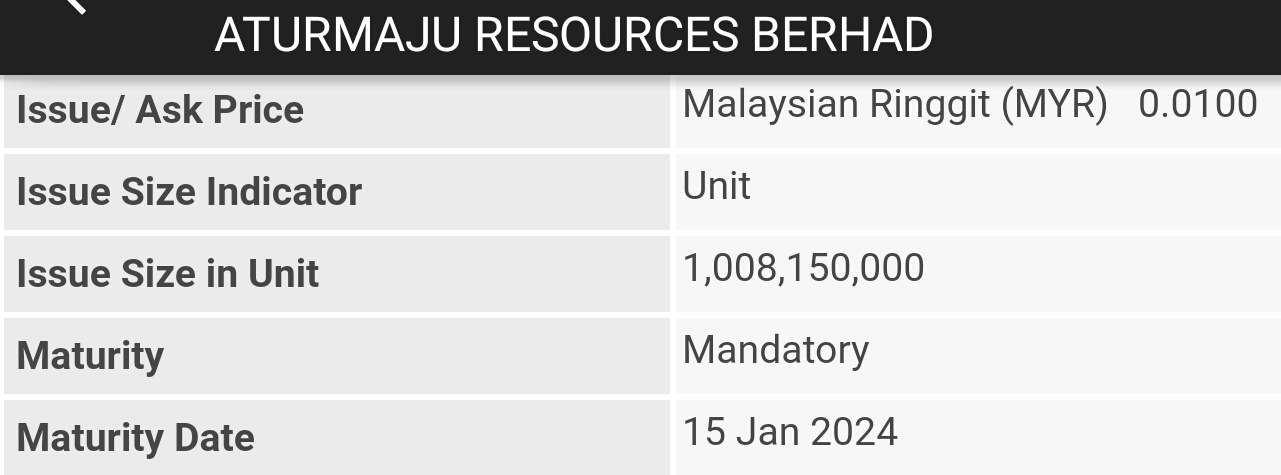

Below are some of the details of AGES ICULS.

Proposed

Rights Issue of ICULS : Proposed renounceable rights issue of up to

30,677,176,092 10-year zero coupon ICULS to raise the Maximum Gross

Proceed.

Renounceable:

Renounceable right offering rewards shareholders, compensating them for

the share dilution that's associated with a new issuance. A

renounceable right allows each share to maintain a proportional

ownership stake in the business but also allows shareholders to receive

cash from the sale of the right if so preferred.

Rights

Issue: An issue of shares offered at a special price by a company to

its existing shareholders in proportion to their holding of old shares.

ICULS:

Up to 30,677,176,092 10-year zero coupon Irredeemable Convertible

Unsecured Loan Stocks of Ageson to be issued pursuant to the Proposed

Rights Issue of ICULS.

Irredeemable:

These Convertible Unsecured Loan Stock do not have any incorporated

clause with respect to their redemption and thus cannot be bought back

at the choice of the issuing company.

I am not so sure on the adjustment of ICPS AGES-PA exercise price; hope some one can advise.

Please correct me if I have made some wrong interpretation.

Caution 2: Due to the AGES ICPS/ICULS close gap and issuing size, the risk of investing could be quite high. Please seek expert advise.

Happy Trading

Disclaimer: The above opinion does not represent a buy, hold or sell recommendation; just a personal opinion and for sharing purposes only. Any offences and errors are unintentional; my apology in advance.

https://klse.i3investor.com/blogs/BLee_AGES/2021-03-08-story-h1542067522-AGES_ICULS_The_30_Billion_of_1sen_bargain.jsp