Philip Farms:

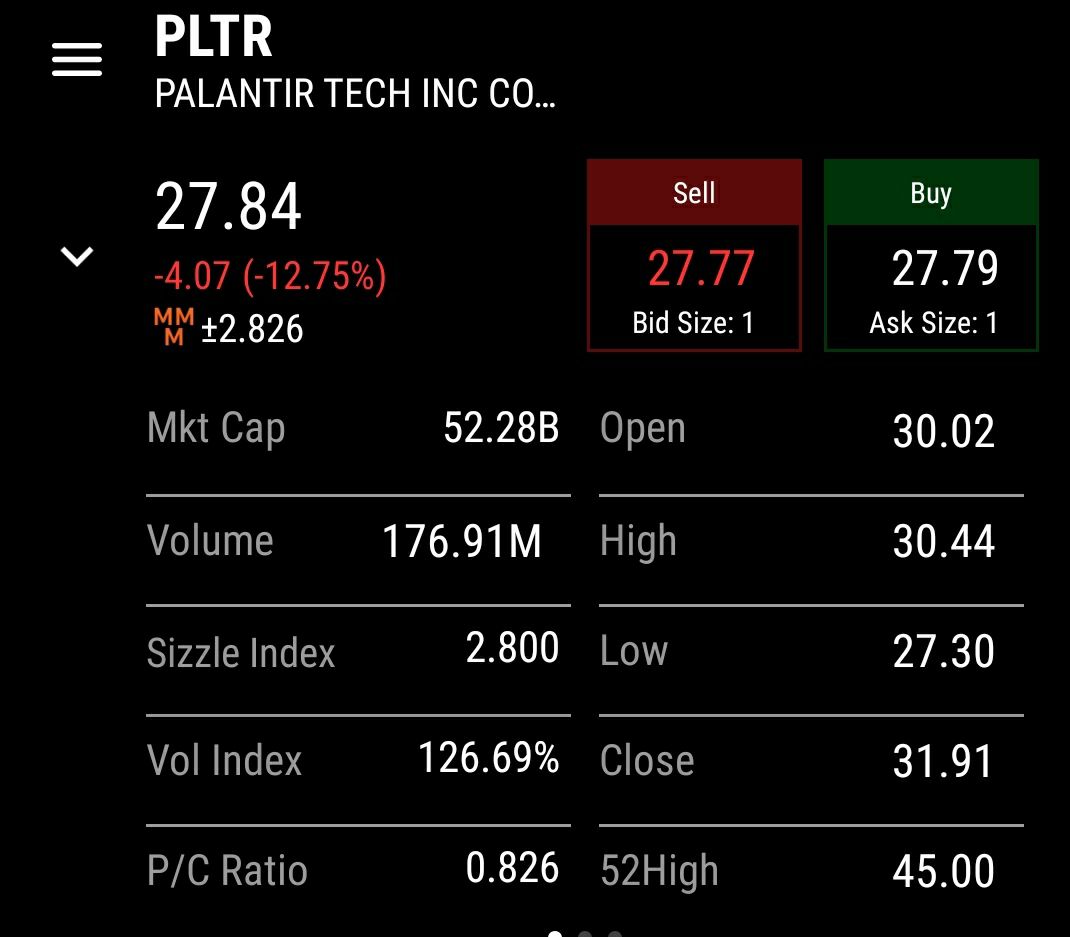

Now it is time to separate the men from the boys. It is easy to hold

unto your stocks and talk about buy and hold when things are going well.

A lot harder when you bought at a high price and it drops and all your

profits disappear. This is where mental models come in to play.Do you

sell because of the fear of lock up and stock compensation?Do you hold

because of uncertainty of the short term results?

Or do you buy because of the management performance and promises made to palantirians?

That is the hardest thing.

So it's not about how smart you are at researching or understanding and analysis.

Making money in the stock market is really more about controlling your

emotions and knee jerk reactions of fight versus flight (natgeo mental

model)

What do you do when faced with difficulty?

No one can be expected to navigate high stress conditions easily.So how

to do it? You can either learn to make good high stress decisions or

learn to only take the low stress decisions. I prefer the latter,

investing versus trading.What are low stress decisions? I say it all the

time, buy what you know.

NOT WHAT IS POPULAR.

Take for example what is popular.

https://klse.i3investor.com/m/blog/www.eaglevisioninvest.com/2021-01-10-story-h1539263202-PALM_OIL_COMPANIES_WILL_REPORT_FANTASTIC_RESULTS_IN_FEB_2021_DUE_TO_INC.jsp

Every once in a while someone comes and ask me, palm oil stocks can buy ah?

My answer to that is this: what is your area of competence? What do you

do? How are you exposed to this market? Do you have any scuttlebutt? If

you start with the proposition that " ok the industry is going up, so I

should buy" usually it means that you are late to the party.

As for this question, if you are in this industry or in commodities trading in general the question is simple.

What is the supply versus demand curve?

http://mpoc.org.my/malaysian-palm-oil-supply-and-demand-outlook-for-2020/

Basic math if you really want to buy palm oil stocks. You need to

couple high demand + high production, as this will mean the everyone

will profit. Right now even at high prices no one is buying palm oil

counters, not even the owners

Why?

It is very simple, They are production constrained due to covid19 and

worldwide production and delivery of products. Same like furniture. Same

like steel and tin etc etc

Right now as businesses start to lurch back, demand is stabilizing but

production is still very heavily start/stop. Why? Simply because

MCO/rmco/cmco etc etc is causing havoc on palm oil plantation most

important input: labor and fertilizer. I am a planter myself so I should

know.

Consider this, you need consistent fertilizer and manpower for your

trees to be able to be harvested, grown and managed. Imagine if workers

are not allowed to go to work due to approvals and fear for foreign

workers. Mati kudasai la as local smart Malaysians do not want to work

in the fields but congregate in cities to fight for jobs.

So what happens?

Shutdown, delays in harvesting and delivery to collection center. Uncle

Philip can do many things, but he definitely can't do it alone in his

small 98.5 acre farm. Not young and smart anymore. Many things can be

automated. But not everything.

So how? Should you invest in palm oil counters? My answer is yes, but

not because of a rm3600 per tonne price. You would have no idea the

average cost to sell at that price, as you would be surprised some may

have actually lost money selling at the price. Commodity prices are very

very sensitive to crisis.

But looking at the original question, how to make low stress decisions,

my answer is this. One should buy based on long term trends, not short

term fluctuations

I do believe definitely in trend is your friend. But low stress

decisions making means understanding what trends to look at in 5 years.

When people start going green again and moving away from unhealthy food

and productions

They will realize that palm oil still produces more energy dense

sustainable source than many comparative forms ( soy and corn USA

ethanol, middle East crude, etc etc) and moving forward people will have

no choice to favour palm oil in cooking products due to price and

perception by federal public

When will this perception change? When it is more beneficial to them.

There will definitely be a shift in perception followed by a spike in

price cycle. This I can guarantee will happen sooner or later. When? No

idea, definitely not in the short term

In 5 years? Maybe. In 10 years? Guaranteed. Something like this is

guaranteed to happen once in between. When? Dunno la. So what to do in

between is more about managing expectations and watching paint dry than

running around like a headless chicken. The groundwork has already been

layed, just need to wait for chickens to hatch.

Same with Palantir, You can already see their long term targets. And

their class leading products in helping big companies drive efficiency.

As long as competitors like IBM and Fujitsu have given up fighting and

decided on collaborating. And no clear major competitor is around. You

know that eventually palantir will do well. When? That's where the brain

stops and the heart starts.

When Warren buffet was asked what was the best tool for compounding

money? His reply: RATIONALITY. When they asked bill gates what was the

biggest requirement to be successful? FOCUS.

Secret page: the scuttlebutt.

https://www.reddit.com/r/wallstreetbets/comments/lkngg9/former_pltr_engineer_dd_part_2_usability/?utm_source=share&utm_medium=mweb

https://klse.i3investor.com/blogs/Telegram/2021-02-17-story-h1541114276-My_thoughts_on_palm_oil_industry_And_the_recent_drop_in_palantir_result.jsp

https://klse.i3investor.com/blogs/Telegram/2021-02-17-story-h1541114276-My_thoughts_on_palm_oil_industry_And_the_recent_drop_in_palantir_result.jsp