[Why MCEMENT is considered a deep value stock that worth your second look?]

[Upside]

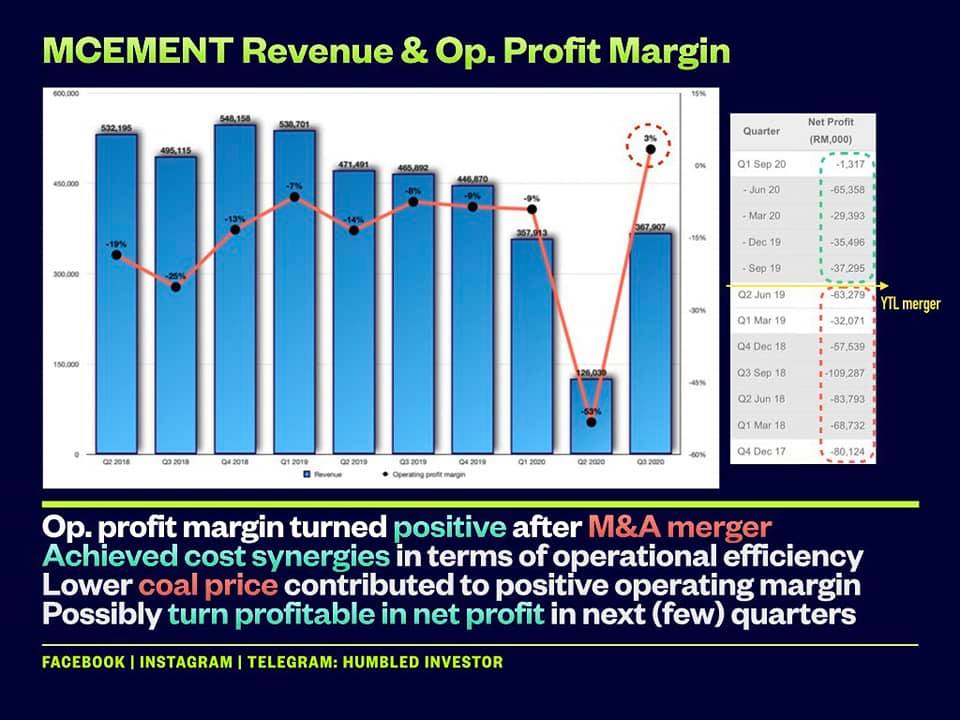

1. M&A Synergies (operational, distribution and logistical

synergies) resulted in improvement in profit margin. The cost synergies

should reflect better than current valuation in the future.

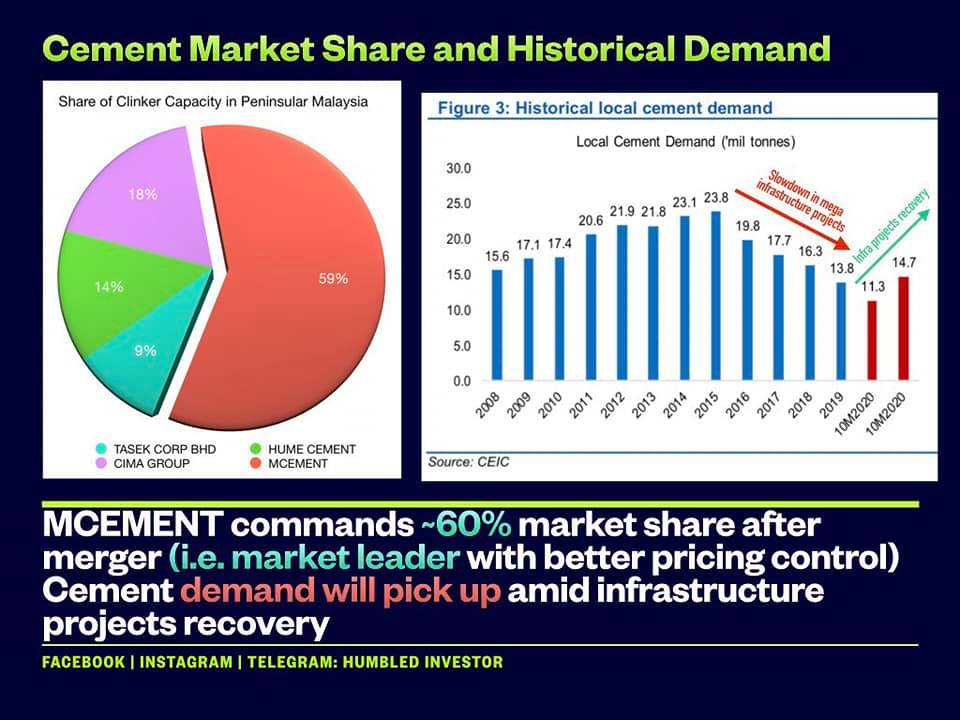

2. Economy recovery would revive property and construction sectors which will then increase demand for cement.

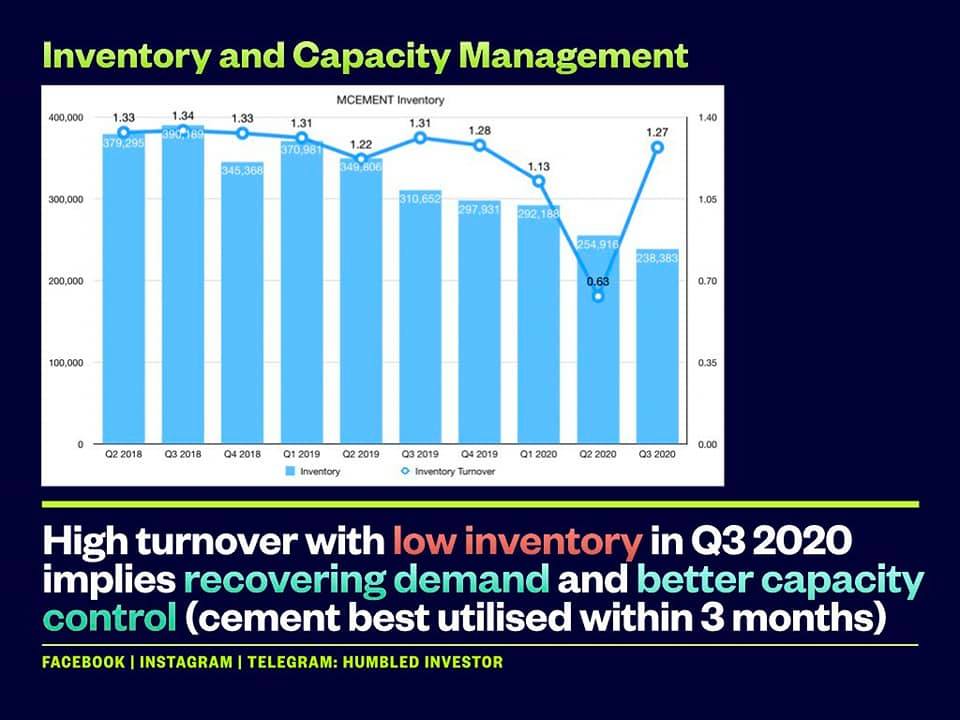

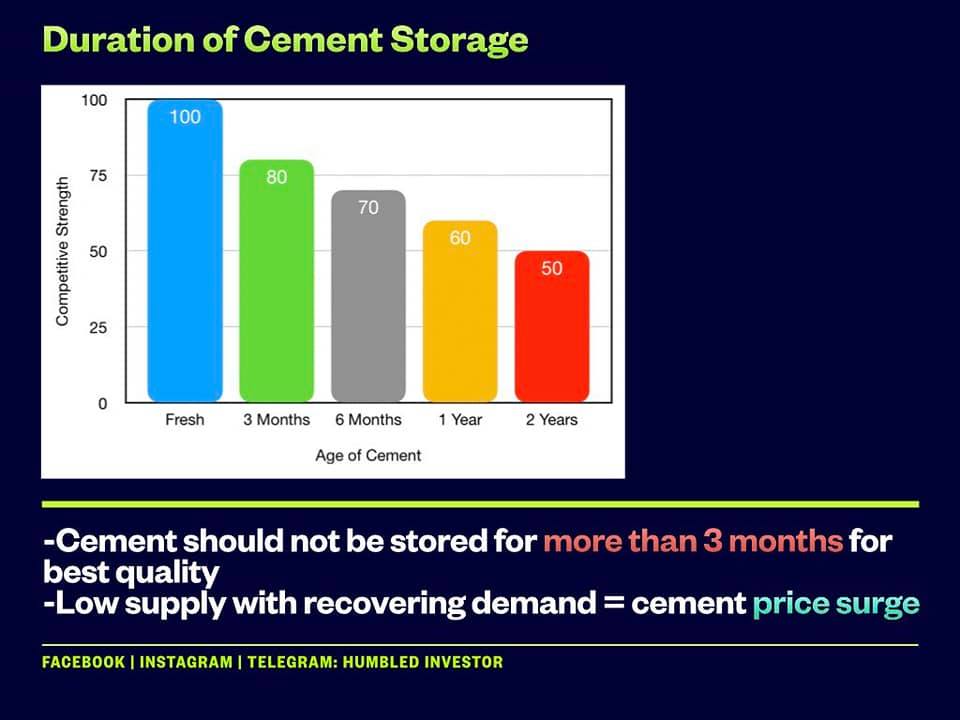

3. Cement has a short shelf life of 3 months. Better inventory

management will help to accomodate with incoming demand from the revival

of various big infra projects.

4. Cement price will be better managed after sector consolidation (with

MCEMENT remains as the market leader with 60% market share).

5. Technical chart wise, the 20-years chart showed a huge support at

RM1.80 level and YTL acquired Lafarge (nka MCEMENT) at RM3.75. MCEMENT

currently trading at RM2.36.

6. Potential to turn net profit in the next few quarters.

[Downside]

1. Demand remains sluggish if MCO continues with further delay in property/infrastructure projects.

2. Coal price has increased from 10-year low of RM210/MT to RM350/MT.

However, MCEMENT might be able to transfer the increase in production

costs to customers as MCEMENT now has better bargaining power against

its customers after sector consolidation.

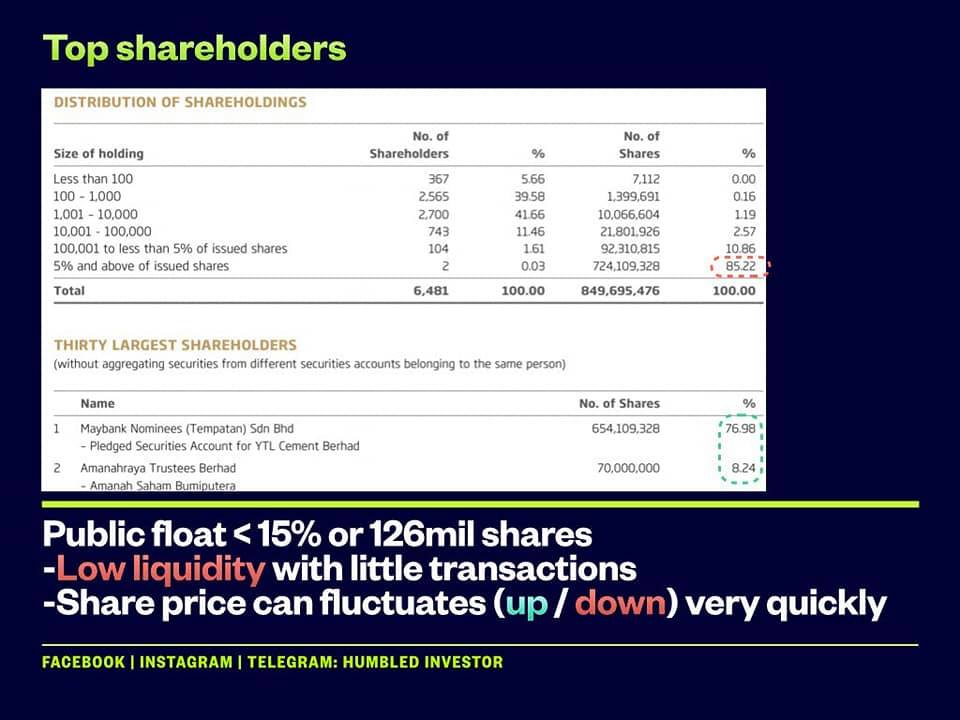

3. Market risk and volatility risk due to low public shareholding spread at 22.95% (excluding ASB).

4. Huge amount goodwill contributing 35% of total assets which are

subject to annual impairment review. However the risk of further

impairment is relatively low. This is because the goodwill arising from

the acquistion of Lafarge Aggregates back in 2004 amounting to RM9mil

has been impaired downwards to RM1.4mil as of June 2020 (-85%

impairment) due to the lack of synergies to the existing business.

If you want to learn more, feel free to join us at:

_________________________________________________________________

All information provided here should be treated for informational

purposes only. It is solely reflecting author's personal views and the

author should not be held liable for any actions taken in reliance on

information contained herein.

No buy call. No sell call. No bullshit. Only content.

If you think the article / information is useful to you, you can

<SHARE> this article and support us by <LIKE> and

<FOLLOW> our Facebook page "Humbled Investor". Thank you so much

for supporting.

https://klse.i3investor.com/blogs/HumbledInvestor/2021-02-21-story-h1541198748-_Humbled_Investor_Malayan_Cement_Bhd_MCEMENT.jsp