The writer had shared before on net cash companies, stating that companies that have a lot of cash is like having an extra bonus on their business. However, the writer also mentioned that net cash companies are not necessary the best option, and we can also sometimes consider to invest in net debt companies. The rest of this article will state the reasons.

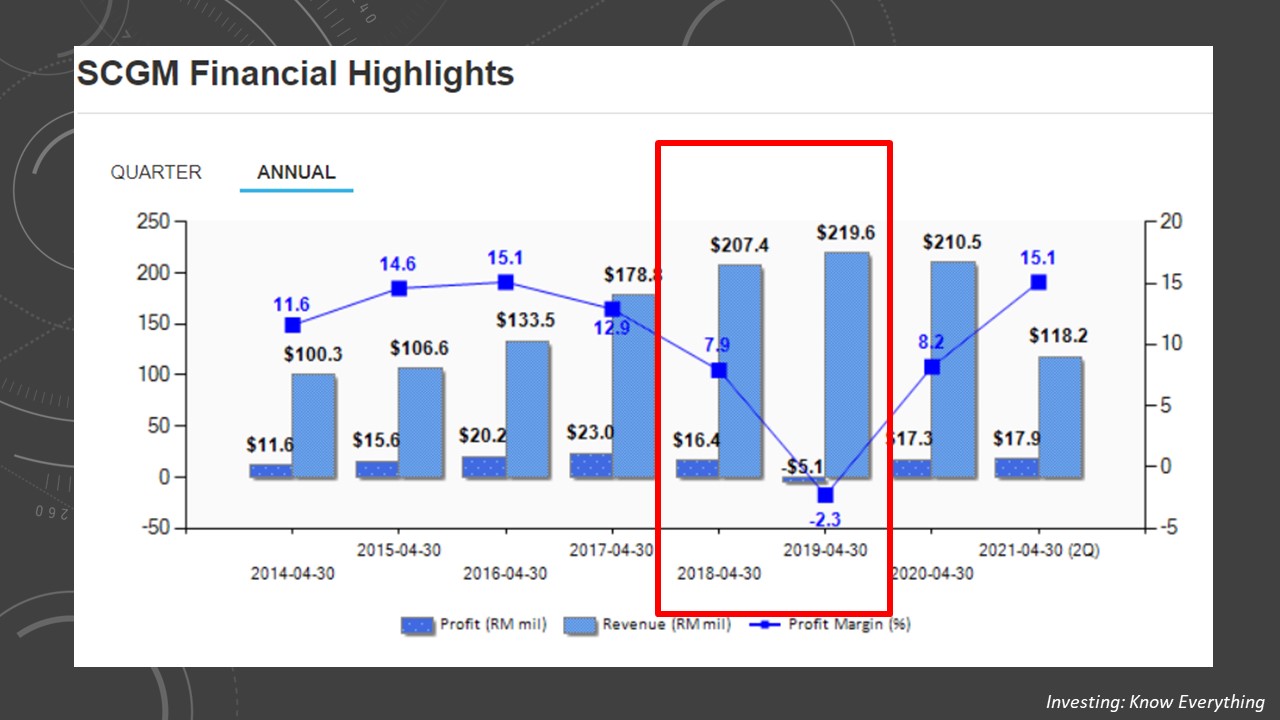

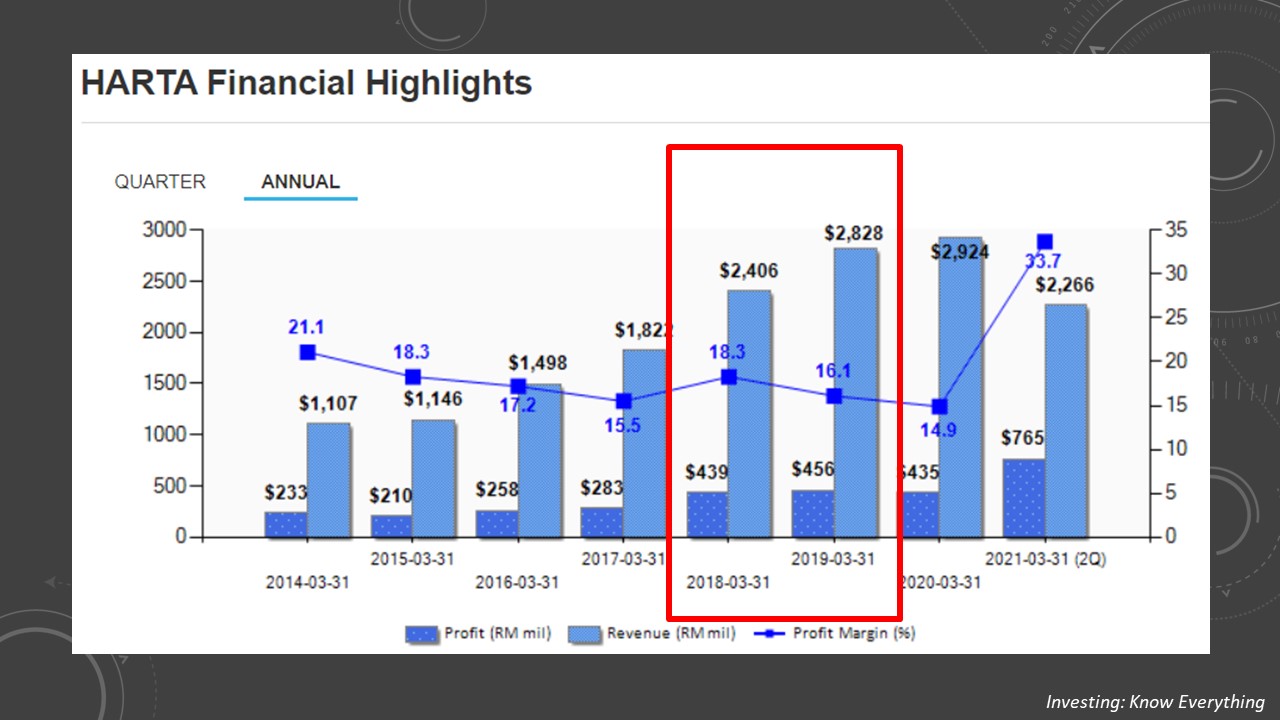

First, we will need to find out what caused the companies to bear this huge amount of debt, is it due to the capital expenditures that the company did, or is it because the company would like to pay dividends to their fellow shareholders? We will first talk about the first one. There are companies who have not enough money to complete their capital expenditure and have no choice but to borrow from banks. Examples given here are HARTA and SCGM, both companies are net debt companies in FY2019, and HARTA has turned to a net cash company in FY2020, and is able to repay more borrowings after the surge in glove price.

We can see that companies that undergoes capital expenditure will have their profit reduced due to depreciation. This can be shown as HARTA’s revenue increased in FY2019 but its profit remained stagnant, and SCGM’s reported a loss in FY2019 despite its revenue improve compared to last year. Hence, the more capital expenditure a company did, the more the company will have their profit deteriorated by depreciation.

On the other hand, there are some companies that tend to borrow money from bank, just to pay dividends to their shareholders. This is because dividend is one of the element that attract investors, especially dividend investors. Hence, investors that do not look into a company’s report will fell into this dividend trap, where the companies are just using other people’s money to pay the dividend while the company itself is unable to repay these debts. These companies shall be avoided at all cost, because this means that the company is unable to generate profit and convert it into cash. Without sufficient cash, the company will not be able to pay dividend hence discouraging fellow investors to invest in their company.

In short, net cash companies are definitely a good sign for maintaining their healthy cash flow, but we should not disregard net debt companies too. All we need to know why are the company facing such debt, and what are the reasoning behind. If it is for the company’s future, it shall be a good buy when others have yet to realise this company. However, if it is not, we shall then avoid these types of company at all cost.

笔者在之前曾经分享过关于净现金的公司,当时说过有很多现金的公司就好像公司有多一层保护罩一般。但是,笔者也说过净现金公司也不一定是投资最好的选择,我们也可以有些时候考虑投资在净负债的公司。接下来这篇文章会解释为什么。

首先,我们要先知道公司因为什么背负上如此大的负债,是否因为做扩张,亦或者是为了拿借来的钱来给股东们股息呢?我们首先来说说第一种。有些公司因为不够钱扩张而向银行贷款。这里可以给的例子包括了HARTA和SCGM,这两家公司在各自的2019财政年都属于净负债公司,而HARTA在2020财政年正式变回净现金公司,有在今年手套价格大起的时候能够还掉更多的贷款。

我们也可以看到做扩张的公司都会因为折损而让公司的盈利有所下滑。我们可以看到HARTA的营业额在2019年是有所上升的,但盈利却没什么成长,SCGM在2019年是亏损的,但同时营业额却比上年更高。因此,我们可以说当一家公司所做的扩张越多时,盈利会因为折损而更严重的下滑。

另一方面,也有一些公司会从银行贷款,只为了给股东们派息。这是因为股息是吸引投资者的元素之一,特别是对股息投资者来说更加吸引。因此,不看年报的投资者们就会掉入这个股息陷阱,也就是公司会用别人的钱来派股息,而公司本身也没有能力还这笔债务,这种公司应该尽可能避免,因为这代表了公司并不能够有收入,并将这些收入转换成现金。在现金不足的情况下,公司就不能派股息,从而减低投资者想投资在这家公司的欲望。

总结,净现金的公司在维持健康现金流的情况下是绝对占优的,但我们不能就这样忽视了净负债的公司。我们需要知道的是为什么公司会负债,是因为什么。如果是为了公司的前景,那这会是一项蛮不错的投资,特别是当别人还没意识到这家公司时。但是,如果不是这个原因的话,那么我们就应该避免这类型的公司。

For more EXCLUSIVE content, visit: https://www.facebook.com/InvestingKnowEverything/

请关注笔者的脸书专页以获得独家资讯。