Koon Yew Yin 5 Jan 2021

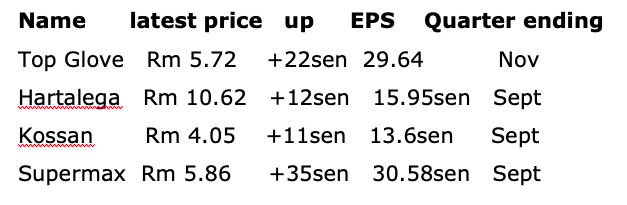

Today all the glove stocks rebounded. Investors should be interested to see the EPS and share prices of the 4 largest glove makers for comparison so that they can select the best stock to buy.

Among all the stock selection criteria such dividend yield, cash flow, NTA, debt etc the most powerful catalyst to push up share price is EPS growth rate.

For example, currently most of the property companies are selling below their NTA even though they may have healthy accounts. The share prices of property companies remained depressed because they do not have profit growth prospect. As you can see, there are so many unsold properties everywhere.

When an investor buys a stock, he expects to earn from share price increase and dividend. As almost all the listed companies do not give out more that 5% per annum, he can only make profit if the share price goes up. The share price can only go up if the company continues to report increasing profit. Supermax has gone up the most because it has the best profit growth rate.

Supermax reported EPS 30.58 sen for 1st quarter ending September. It made 100% more than its previous quarter. Supermax profit for its 2ndquarter ending December should be another new record high. The company will report its 2nd quarter result in Mid-January.

http://koonyewyin.com/2021/01/05/eps-comparison-of-4-largest-glove-companies/