Of late, there are a few masters talk / write in youtube and facebook on warrants.

They talk on gearing, premium and etc but I have yet to read / watch any of them talking about Volatility.

I want to emphasize here is that Volatility is equally important / critical in evaluating a warrant.

Let me make an example of call warrant on company XYZ, i.e. XYZ-CW.

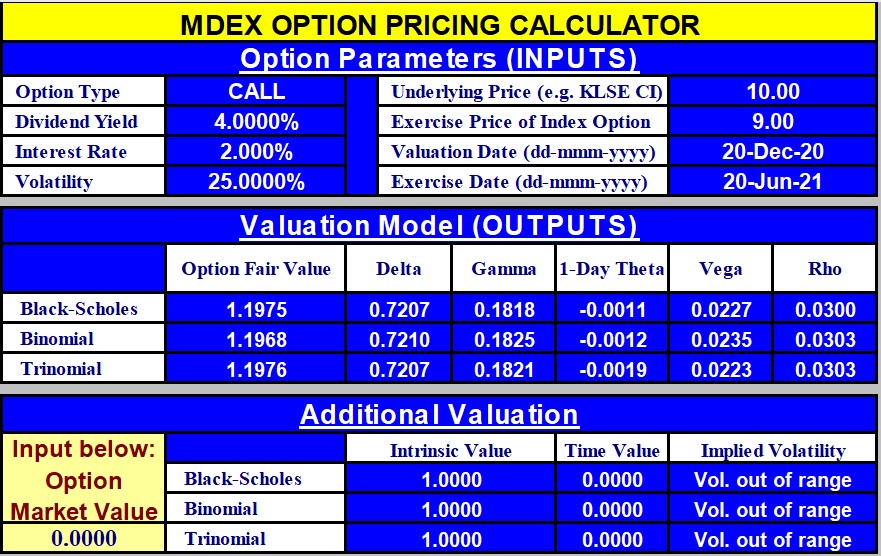

1) Mother = 10.00

2) Exercise Price = 9.00

3) Exercise Ratio = 1

4) Interest Rate = 2%

5) Dividend Yield = 4%

6) Valuation Date = 20.12.2020

7) Expiry Date = 20.06.2021

If XYZ's Volatility is around 25%,

Currently DIGI, MAYBANK, PETGAS, PPB, SIMEPLT's latest 90 days volatilities are around that 25%.

Then the fair value for XYZ-CW is 1.20.

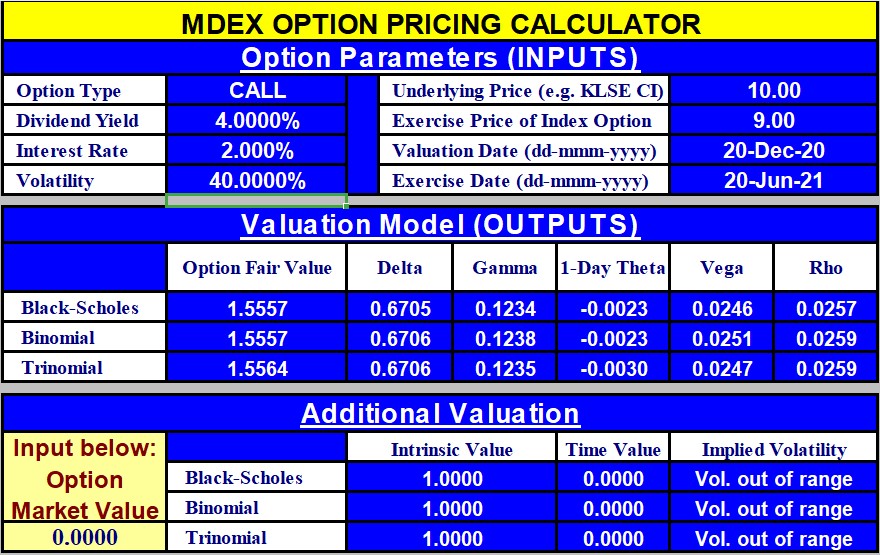

If XYZ's Volatility is around 40%,

Currently AXIATA, PBBANK, PCHEM, PETDAG's latest 90 days volatilities are around that 40%.

Then the fair value for XYZ-CW is 1.56.

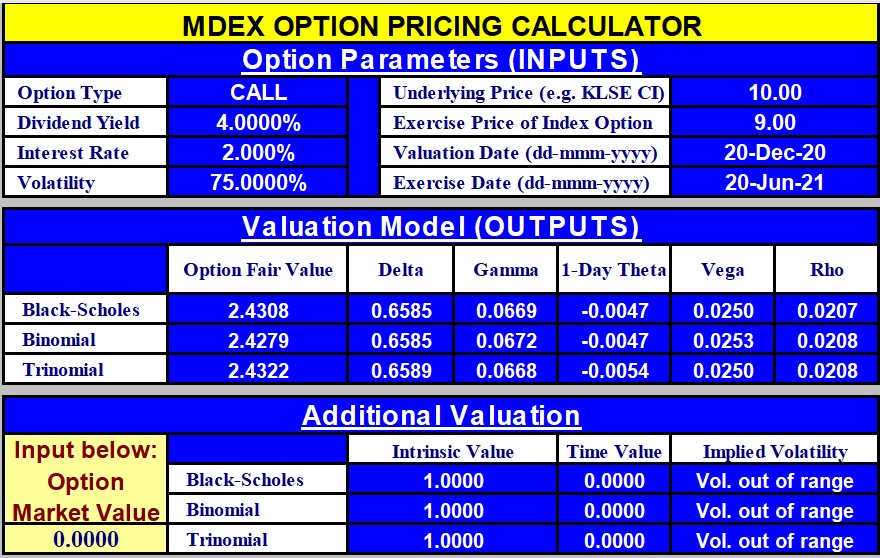

If XYZ's Volatility is around 75%,

Currently TOPGLOV's latest 90 days volatilities are around that 75%.

Then the fair value for XYZ-CW is 2.43.

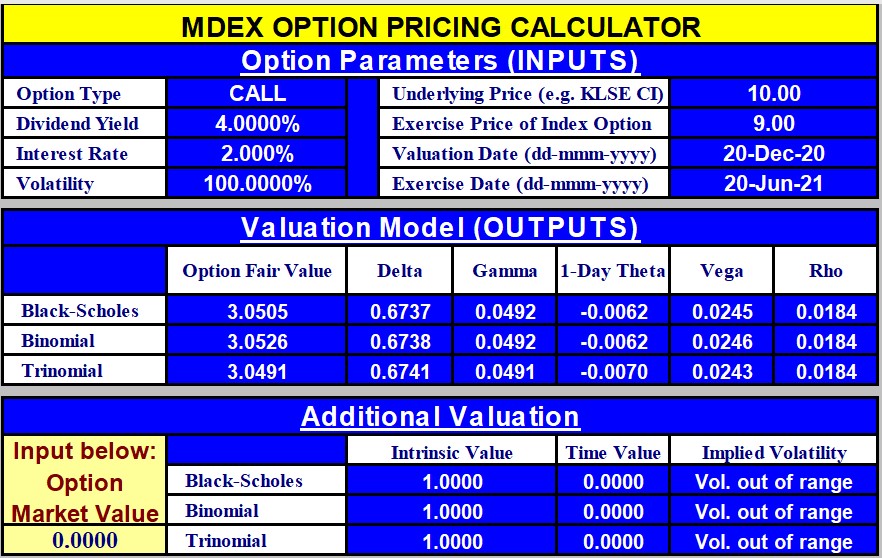

If XYZ's Volatility is around 100%,

Currently SUPERMX's latest 90 days volatilities are around that 100%.

Then the fair value for XYZ-CW is 3.05.

Important Notes:

1) Volatility of a mother share will change from time to time, what you need to input into the calculator is the future volatility that nobody can be sure. What we can do is to get a clue from the historical volatility, and make a guess for the future.

2) Trade at your own risk.

https://klse.i3investor.com/blogs/gambler/2020-12-20-story-h1538308834-Volatility_is_Critical_in_Warrants_Fair_Value_Calculation.jsp