Master-Pack (7029) just announced a special dividend of 2 sen per share.

In total, dividends for this year will total 6 sen per share, the highest among its peers. The second highest is Muda 4 sen per share.

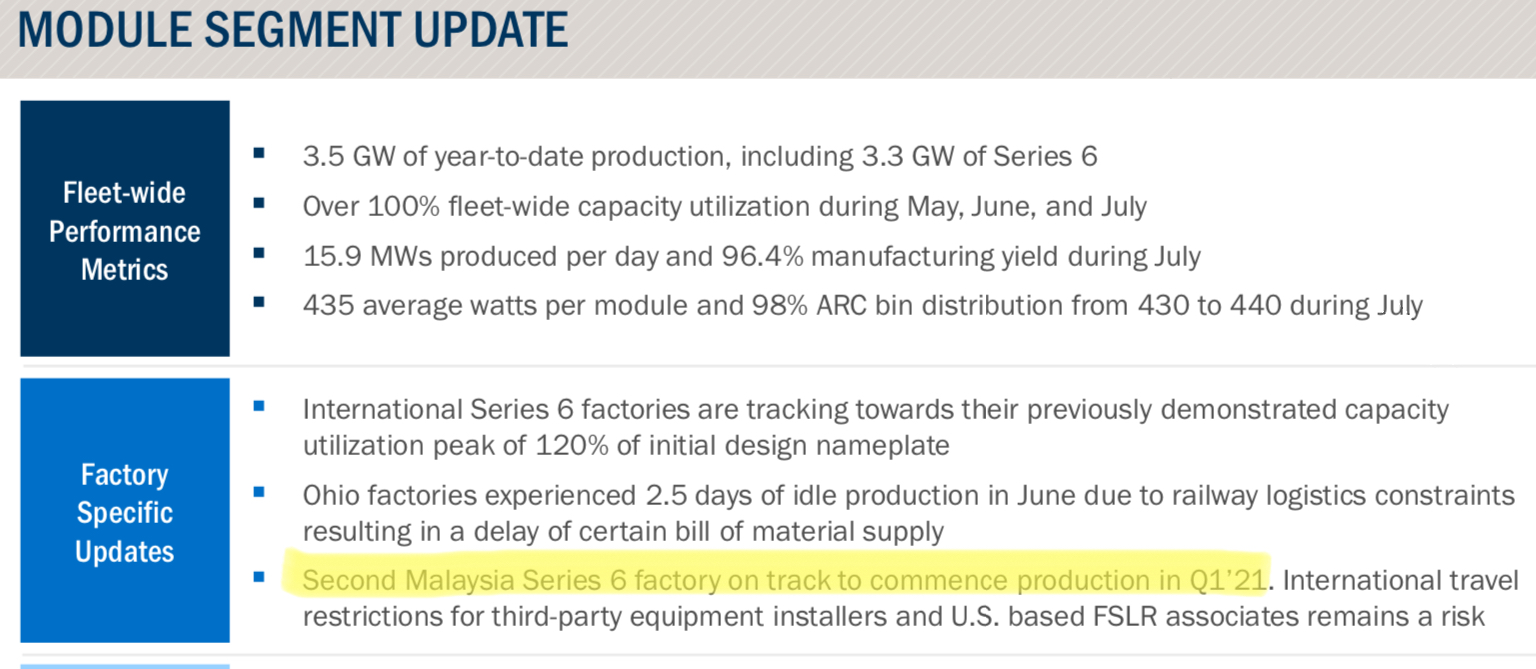

A great sign before the arrival of 2021! First Solar, one of the largest solar panel manufacturer in the world, is scheduled to start it’s second factory in Malaysia in 1Q21.

Simple valuation on Master-Pack vs peers

|

Market cap RM mil |

Net profit |

Trailing PER | ROE | Financial.Position | |

|

MUDA |

738 |

53 |

13.9 |

5.5% |

Net debt |

|

PPHB |

218 |

20 |

10.9 |

7.6% |

Net debt |

|

BOXPAK |

163 |

9 |

18.1 |

3.7% |

Net debt |

|

MASTER |

100 |

15.7 |

6.4 |

15.9 |

Net cash |

MUDA, PPHB and BOXPAK are trading at trailing PER of 11x to 18x. Using the mid PER range of 15x for the peers, MASTER is worth RM235.5mil. That’s more than 2x MASTER current market cap of RM100m!

Previous Post

Master (7029) The Hidden Jewel in Renewable Energy Industry: The best recovery play riding on the booming solar industry

Master-Pack (7029) is arguably the best recovery play, riding on the expansion of First Solar Inc in Malaysia.

First Solar, one of the largest solar panel manufacturer in the world, is scheduled to start it’s second factory in Malaysia in 1Q21.

Master-Pack has over the last 28 years, made a name for itself as an innovative niche player in the packaging industry.

Sales to the solar industry has been booming for last few years, growing by a CAGR of 77% from 2016 to 2019.

Thanks to First Solar.

| Sales to Solar Industry |

RM. Mil |

| 2016 |

24 |

| 2017 |

52 |

| 2018 |

69 |

| 2019 |

135 |

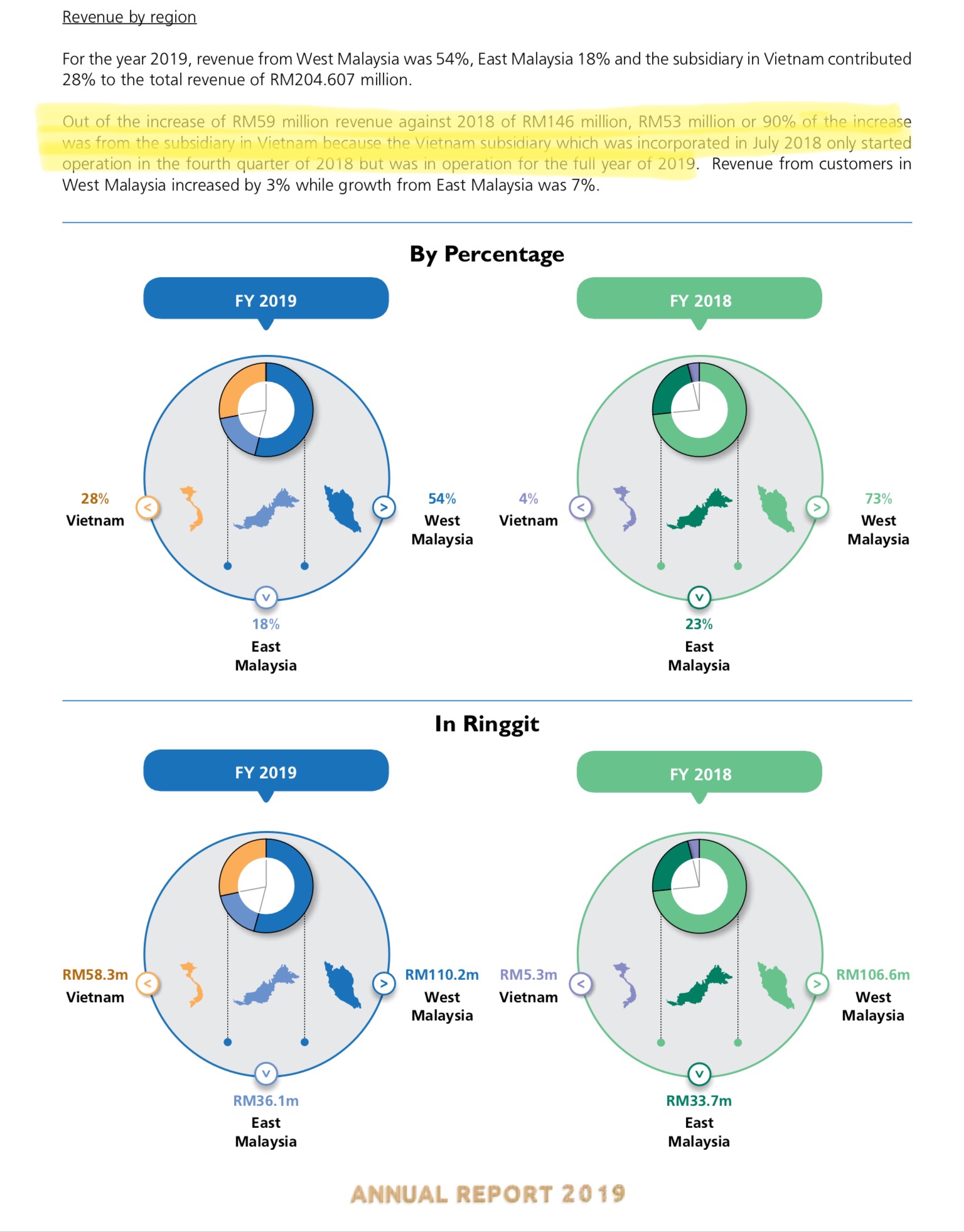

Master-Pack has also been tapped to serve First Solar’s operations in Vietnam starting July 2018. This is no small feat as US companies are very stringent on choosing their suppliers and usually looking on build long term relationships.

Master-Pack Vietnam’s operations started in 4Q2018 and running at full capacity in 4Q2019.

Vietnam contribution grew 11x to RM58.3mil in 2019.

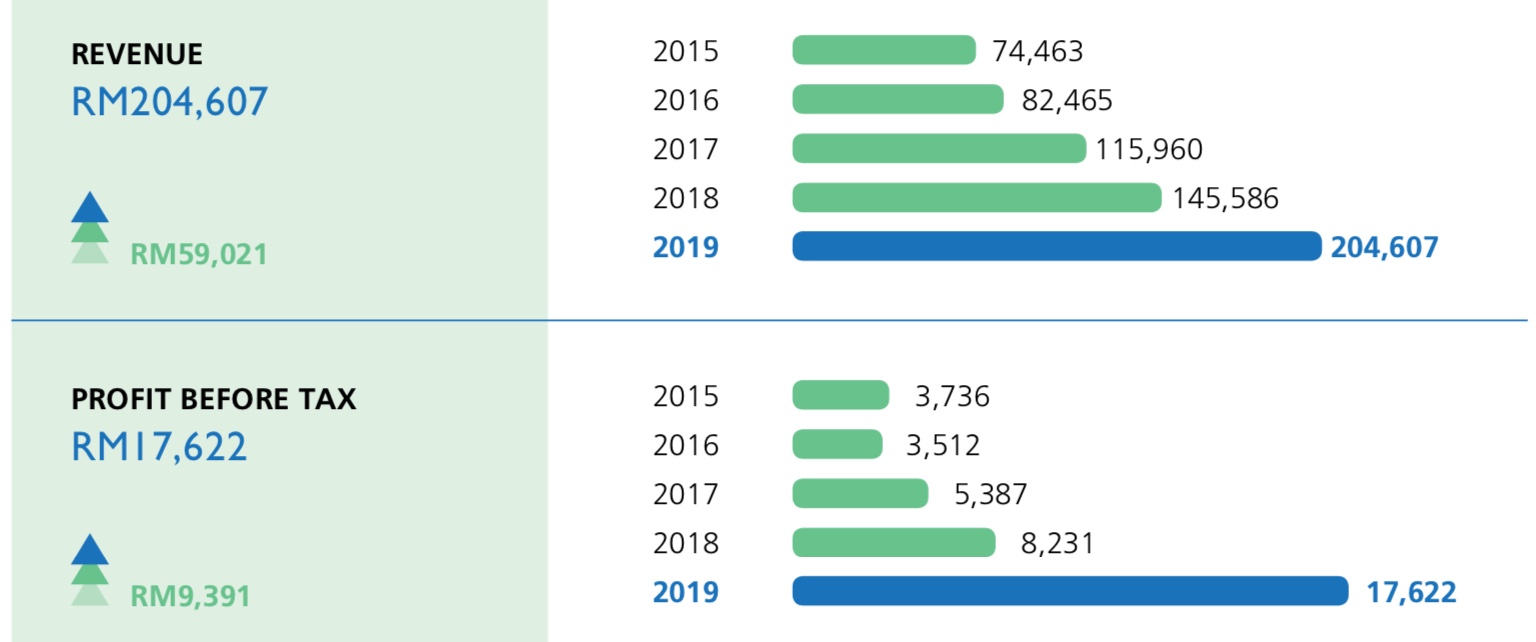

Thanks to new contribution from Vietnam operations, Master-Pack profit before tax more than double to RM17.6mil in 2019.

Over the period from 2015-2019, revenue and profit before tax grew by CAGR of 28% and 48% respectively.

Temporary blip in earnings

All is well until Covid-19 hit. For the first 9 months of 2020, Master-pack’s performance was affected by TEMPORARY drop in revenue due to business interruption from MCO and change in product model by its major customer I.e. First Solar.

Nevertheless, Master-Pack still able to remain profitable.

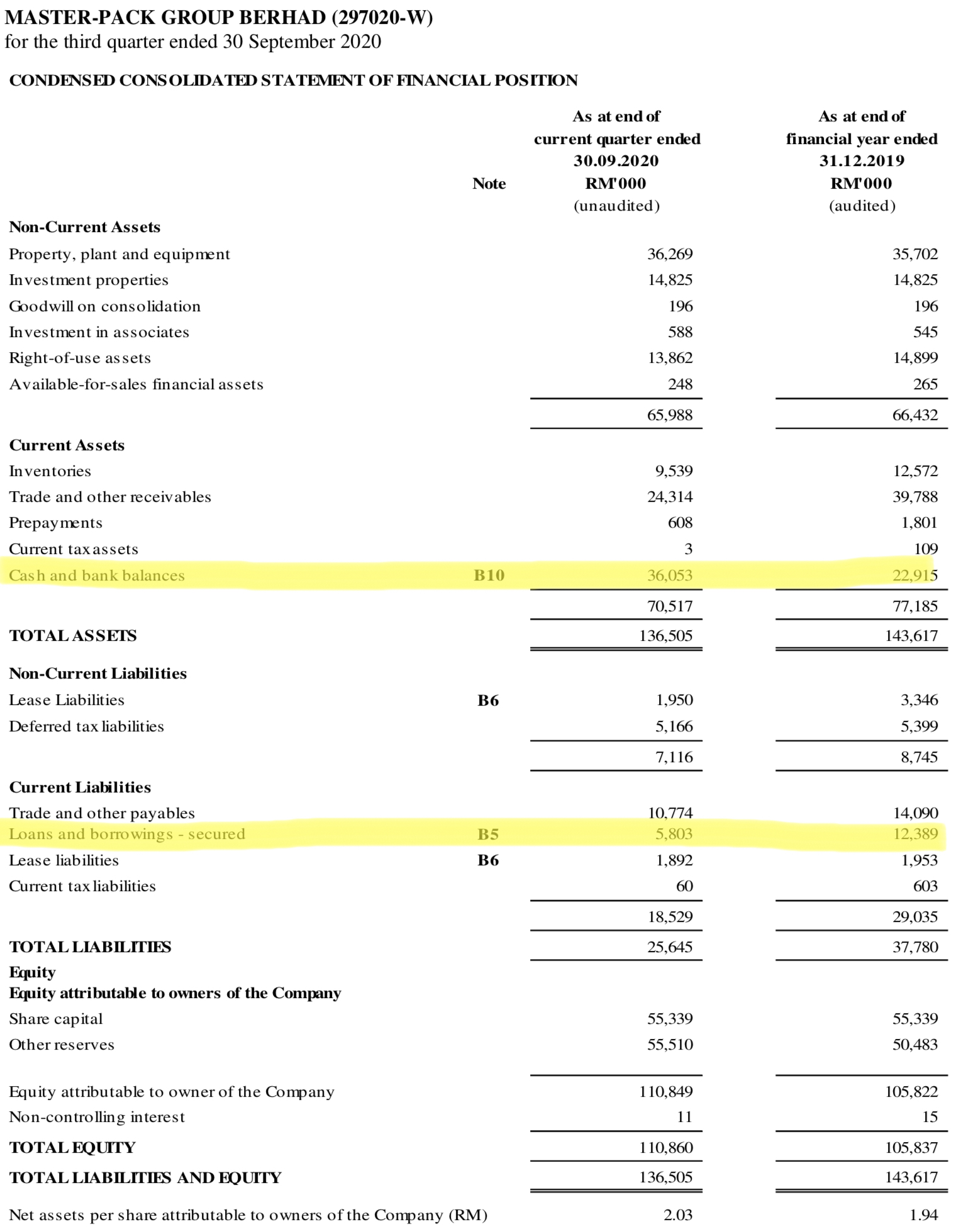

In fact, Master-Pack’s net cash position improved substantially from RM10.5mil to RM30.2mil.

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=211770&name=EA_FR_ATTACHMENTS

Financially, Master-Pack has a sturdy balance sheet with net cash position of RM30.2mil.

As of 30 Sept 2020, it had cash of RM36.1mil and total borrowings of RM5.8m. It had total shareholders equity of RM110.8mil or RM2.03 per share.

Simple valuation on Master-Pack vs peers

|

Market cap RM mil |

Net profit |

Trailing PER | ROE | Financial.Position | |

|

MUDA |

738 |

53 |

13.9 |

5.5% |

Net debt |

|

PPHB |

218 |

20 |

10.9 |

7.6% |

Net debt |

|

BOXPAK |

163 |

9 |

18.1 |

3.7% |

Net debt |

|

MASTER |

100 |

15.7 |

6.4 |

15.9 |

Net cash |

MUDA, PPHB and BOXPAK are trading at trailing PER of 11x to 18x. Using the mid PER range of 15x for the peers, MASTER is worth RM235.5mil. That’s more than 2x MASTER current market cap of RM100m!

If we assume a conservative PER of 11x which is the lowest for its peers, MASTER is worth RM171mil. With 54.6mil share outstanding, that translates to RM3.13 per share.

If you include the net cash position of RM30.2mil, MASTER is worth RM3.68 per share!

In fact, Master-Pack should be valued higher than its peers because Master-Pack has the highest profitability ratio “ROE” in the industry. ROE indicates how well a company's management deploys shareholder capital. In this case, Master-Pack generated the highest return for shareholders when compared to its peers.

Bear in mind this valuation does not include the additional revenue from Master-Pack Vietnam (which achieved full capacity only in 4Q2019) and First Solar new second factory in Malaysia.

Safe to say that Master-Pack could grow their earnings in 2021 riding on the start of First Solar’s new second factory in Malaysia.

https://s2.q4cdn.com/646275317/files/doc_financials/2020/q2/2020-08-06-Earnings-2Q-2020-PDF.pdf

All information provided here should be

treated for informational purposes only. It is solely reflecting

author's personal views and the author should not be held liable for any

actions taken in reliance on information contained herein.

https://klse.i3investor.com/blogs/Momentum/2020-12-28-story-h1538429082-Master_7029_Beneficiary_of_Booming_Solar_Demand_Just_Announced_A_Specia.jsp