Plant Efficiency is a Vital Determinant of Profit Margin of Energy Payment

Under the 25 years power purchase agreement, IPP operators of coal power plants in Vietnam under BOT are entitled to Capacity and Energy Payments.

- Capacity Payment is based on capacity made available during the year

- Energy Payment is based on electricity generated

In this article, I will only focus on the Energy Payment (EP)

How is EP Calculated ?

EP = (Cost per Btu x Agreed Heat Rate x Kwh electricity generated) + Variable O&M Costs

Where ;

Cost per Btu is derived by dividing the total cost of fuel by the total heating value (Btu) of the fuel. Fuel include coal and Heavy fuel oil (HFO).

Cost Per Btu = Total Cost of Fuel / Total Heating Value

Note : I do not have information on the composition of different type of fuel that make up the agreed heating value. This is important as HFO is costlier than coal but HFO is only required when operating at less than 60% load factor. The agreed heating value must have taken into consideration the potential range of operating conditions. Therefore, plant will achieve higher profit operating at higher load factor. However, for the purpose of this article, we shall ignore this variation factor.

We shall ignore the minor O&M costs for simplicity.

Therefore, the profit element of the EP is actually the difference between the EP and the actual cost of fuel consumed for power generation. A power plant with higher efficiency will consume less fuel per Kwh electricity produced.

Profit = EP - Actual cost of fuel consumed

Rationale behind the EP formula

This formula for computation of EP satisfies both the Vietnam Government and BOT operators.

- The BOT operators are encouraged to operate the power plant at maximum efficiency to maximise their profit

- The Vietnam government is assured of maximum plant efficiency to minimise pollution

- The Vietnam government is assured of no exploitation of natural resources due to low efficiency in power generation by the BOT operators

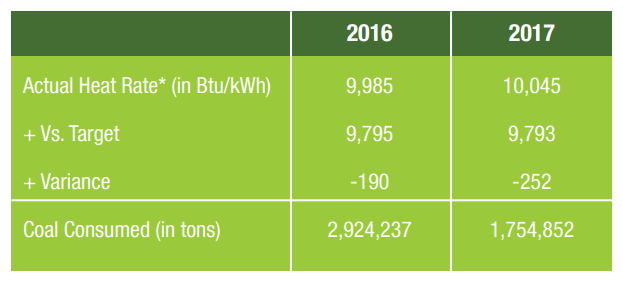

For Mong Duong II, the agreed heat rate for EP is 9,795 for Year 2016

This suggests that the power plant needs to achieve 34.8 % plant efficiency.

Because approximately 3,412 Btu/hr equals 1 kW, we can determine the efficiency of a power plant by dividing 3,412 by the heat rate.

Source : https://aesvcmmongduongpower.com.vn/AES-sustainability-report-2016-2017.pdf

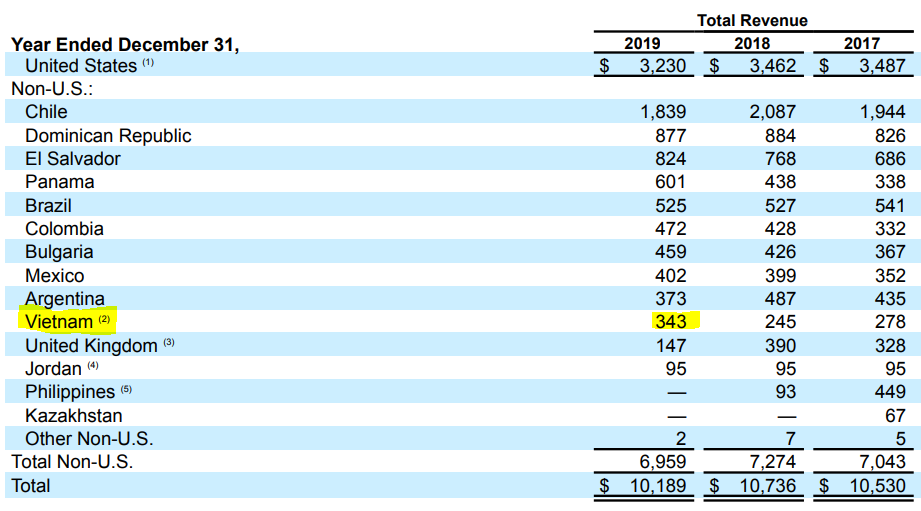

Mong Duong II generated EP of USD343m in 2019

Source : AES Corporation - Revenue by country

How efficient is the Subcritical Coal Power Generation Technology of China ?

China's coal plants : New efficiency benchmarks

By James Varley 13 Dec 2019

Since 2004, China has been replacing small, low efficiency, coal plants with larger, more efficient units, and the “six year action plan”, launched in 2014, has set new annual average efficiency targets that must be achieved by coal plants if they are to remain on the grid: 39.6% (net, LHV) for 300 MW units; and 40.9% for 600 MW units. For these 300 MW units to achieve the annual average efficiency target of 39.6% specified in the six year plan, their efficiency under rated conditions needs to be higher than 42%.

https://www.nsenergybusiness.com/features/chinas-coal-plants-new-efficiency-benchmarks/

This suggests that for 600MW units, their efficiency under rated conditions needs to be higher than 43.3%

Jaks Hai Duong Power Plant is adopting 2 X 600MW subcritical technology from China.

Given that the the heat rate benchmark agreed between Mong Duong II and the Vietnam EVN is 9,795 Btu/Kwh (34.8% efficiency), what is the potential profit from Energy Payment if Jaks Hai Duong power plant is able to achieve 43.3% plant efficiency ?

Profit = percentage differential in plant efficiency above the agreed efficiency x Revenue

Therefore, potential EP profit based on Mong Duong II revenue for 2019 is;

Profit = (43.3% - 34.8%) / 34.8% x USD343m

Profit = 24.4% x USD343m = USD84m (1)

Earnings based solely on Capacity payment

Extracted from my previous article;

"Jaks Resources - Peer Comparison With Mong Duong II"

Earnings = Capacity Payment – Loan receivable repayment – Interest Expense

Earnings = USD253m – USD67m – USD1,287m x 6% (Est)

Earnings = USD109m (2)

Conclusion

It is highly likely that Jaks Hai Duong Power Plant (JHDP) has the same agreed Heat Rate as Mong Duong II. Therefore, based on the 2019 revenue of Mong Duong II, earnings of JHDP is likely to be;

Total Profit = (1) + (2) = 84m + 109m = USD193m = RM810m (@4.2 USD/RM)

This is equivalent to;

@30% sharing, Earnings = RM243m, EPS = RM0.37

@40% sharing, Earnings = RM324m, EPS = RM0.50

Therefore, at PE ratio of 10, Jaks is worth between RM3.7 to RM5.0

Just another perspective. Happy Investing !

DK66

P/S : Please press "Like" if you agree with the write up so that I know how many actually agreed with me.

quote from :

https://klse.i3investor.com/blogs/Jaks%20resources/2020-03-14-story-h1484838111-Jaks_Resources_Effect_of_Plant_Efficiency_On_Profit.jsp

https://klse.i3investor.com/blogs/jennylohsharing/2020-12-17-story-h1538255240-Jaks_Resources_Effect_of_Plant_Efficiency_On_Profit.jsp