Author: | Publish date:

NTA is quite similar with the net worth of one company, where it can be calculated by having the total assets to be deducted by total liabilities, which is normally the total equity shown in a company’s balance sheet.

However, a tangible asset is hard to be assessed based on each company’s business model, as clothing company’s NTA will be their clothes and shops; technology companies’ NTA will be their plants, equipment and machinery.

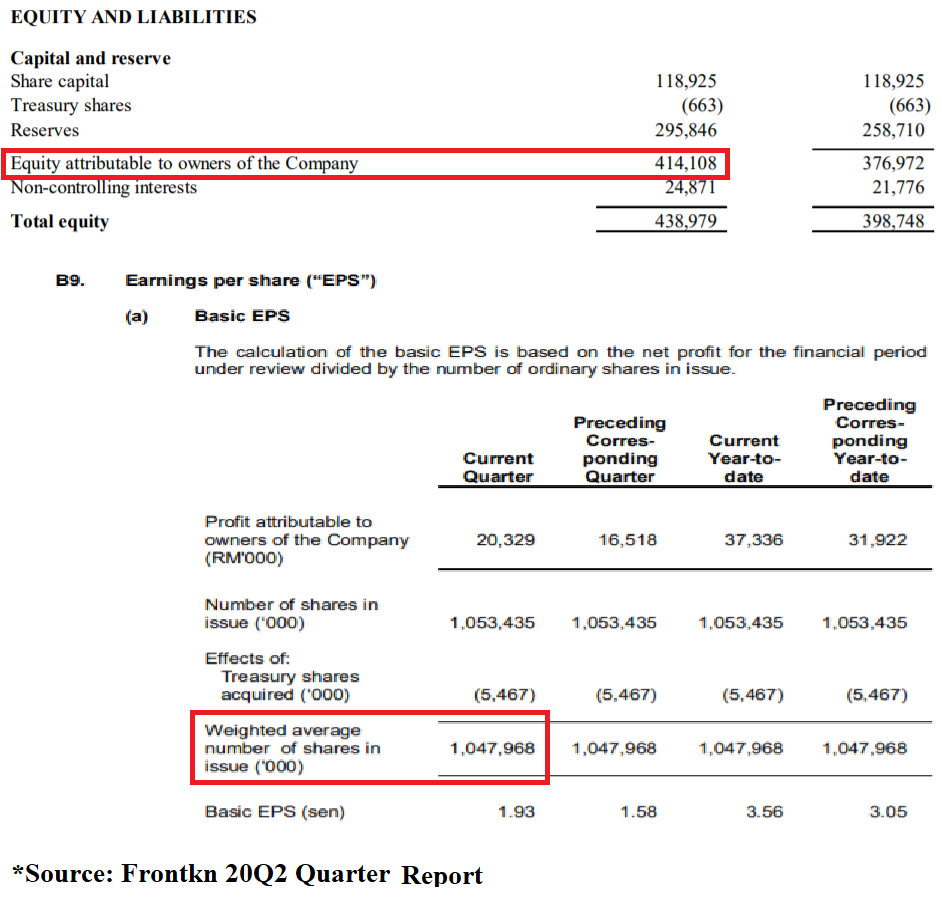

Hence, the easiest way to get the NTA is to directly take the total equity will do, and divide it with total number of shares, to calculate NTA per share. However, some companies may have subsidiaries where the part of the equities will belong to their subsidiaries, so in that case, we shall take only the Equity attributable to owners of the Company. On the other hand, some companies may buy-back their shares or providing ESOS to their employees, hence when finding the number of shares in the quarter report, we shall take the Weighted average number of shares in issue.

有形资产净值也可以相等于一家公司的价值,我们可以用公司的总资产剪掉公司的总负债来获得有形资产净值,而这个值也相等于公司在资产债务表里的的股本。

但是,我们其实难于评估到底公司的有形资产包括了什么。譬如说,服装公司的有形资产包括了他们的衣物以及店面,亦或者科技公司的有形资产会是它们的器材以及工厂。

因此,最简单获得有形资产净值的方法就是直接拿公司的股本即可,然后将它除于公司的总股票数量,以获得每股有形资产。但是,一些公司并不能那么容易得获取这个数值。比如说当公司有自己的子公司时,它们的股本也会被分薄,所以这种时候我们只可以拿属于母公司的股本 (Equity attributable to owners of the Company)。

另外,一些公司会以公司的名义会买回他们本身的股票,或者给予员工们ESOS,那么它们的股票总数量也会被影响。所以当我们要从财报里获取股票总数量时,最好是用已经调整过的数量 (Weighted average number of shares in issue)。

For more information, visit: https://www.facebook.com/InvestingKnowEverything/