KPS (5843) is famous for making a killing on the disposal of its water asset.

From its divestment of SPLASH in April 2019 for RM765mil, KPS received RM570mil upfront cash payment and will be receiving additional RM195mil over the next 9 years, which will include a 5.25% interest rate. KPS had declared a special dividend of RM175mil or 32.6 sen per share following the divestment. The special dividend is in addition to final dividend of 4.25 sen per share.

KPS has subsequently ventured into industrial packaging, electronic manufacturing services (EMS) and plastic injection moulding.

Let’s delve into the key assets of KPS and their potential values.

KPS owns 2 integrated plastics injection moulding/EMS companies:

1. KPS acquired Toyoplas Manufacturing (Malaysia) Sdn Bhd for RM311mil in 2019.

2. KPS acquired CPI (Penang) Sdn Bhd for RM250mil in 2018.

Toyoplas and CPI recorded combined net PAT of RM65mil last year.

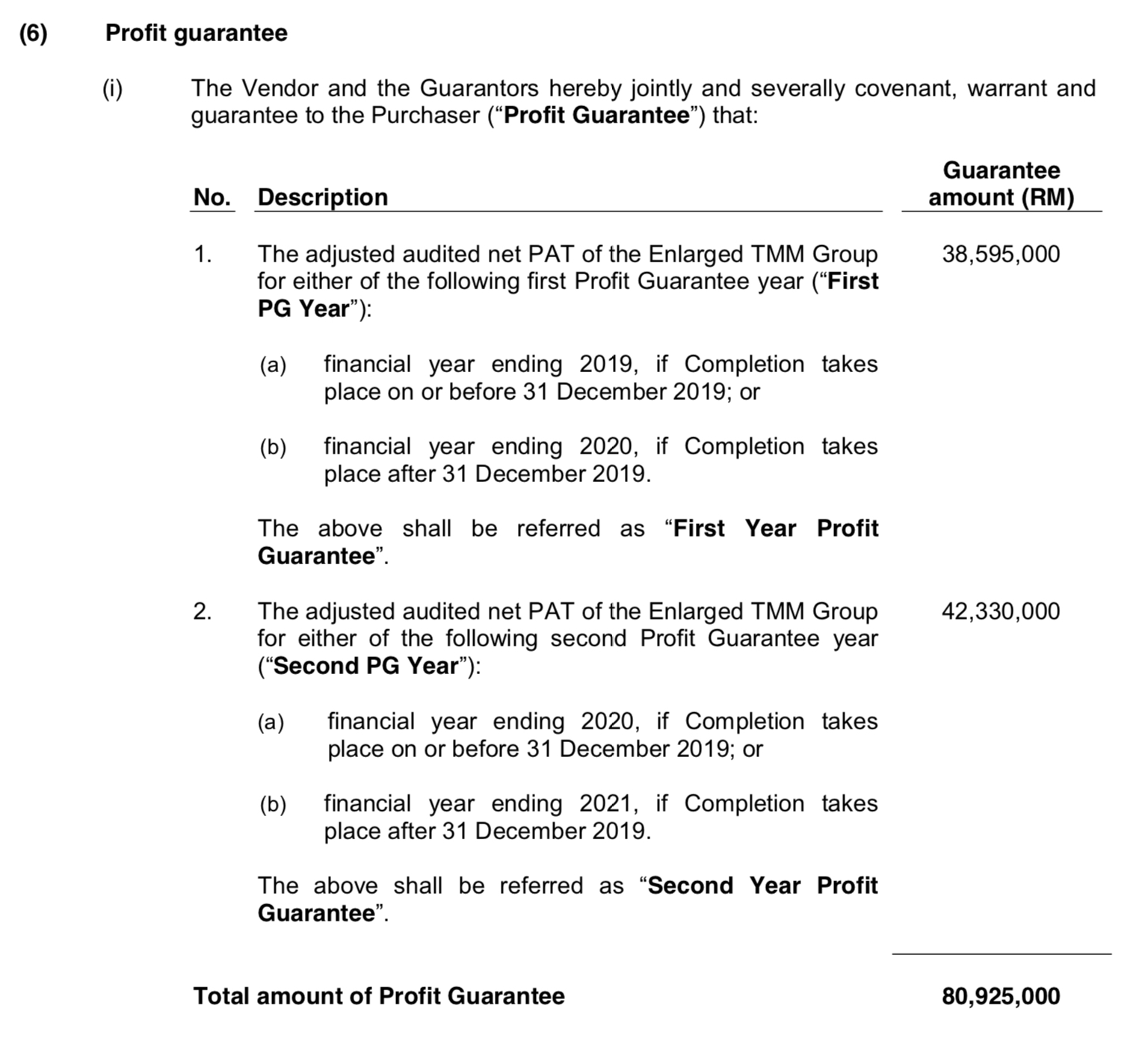

The acquisition of Toyoplas comes with a net profit guarantee of RM38.6mil in FY19 and RM42.3mil in FY20.

KPS says that the acquisition of Toyoplas presents KPS with an opportunity to expand its plastic injection moulding business, which is currently undertaken by CPI.

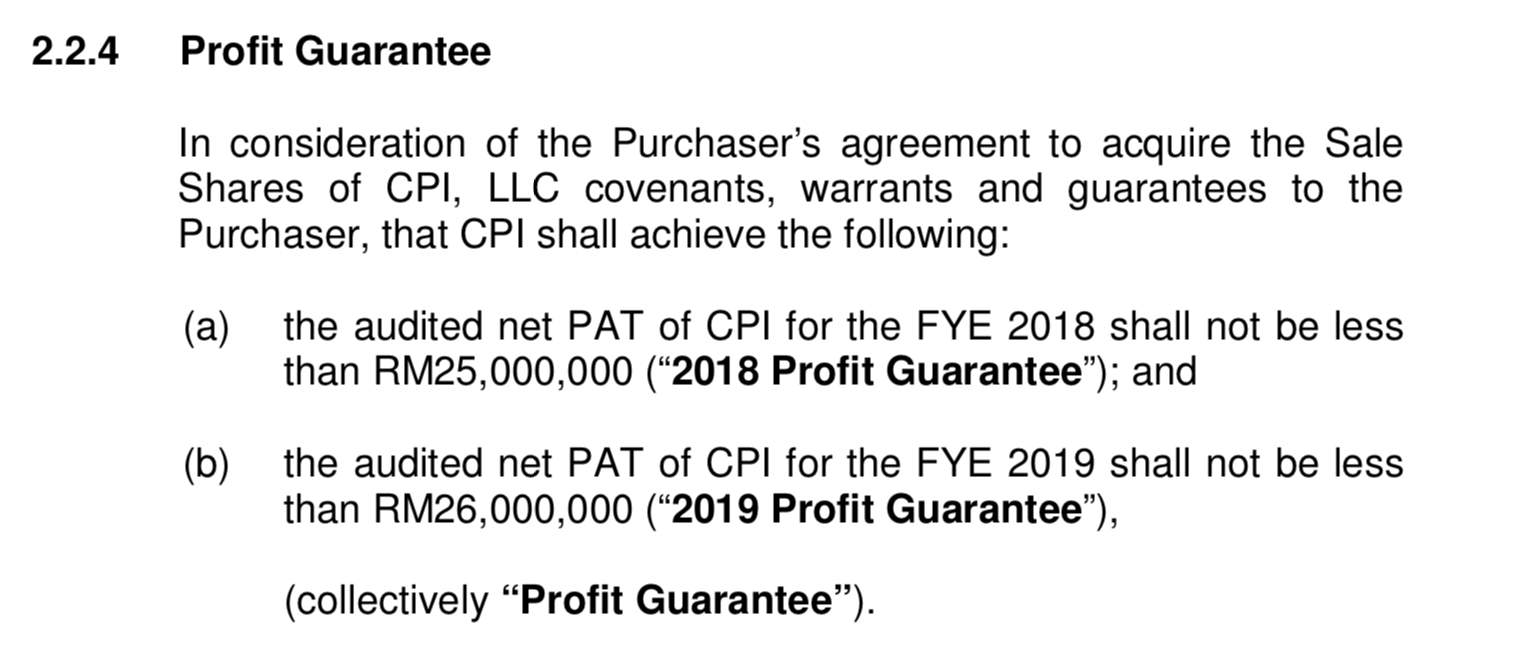

The acquisition of CPI comes with a net profit guarantee of RM25mil in 2018, and RM26mil in 2019.

Simple valuation on KPS’s EMS business vs peers

| Market cap RM mil | Net profit | Trailing PER | Net margins | |

| SKP RESOURCES |

2,350 |

75.7 |

31 |

4.1% |

|

ATA IMS |

2,734 |

78.3 |

34.9 |

2.3% |

|

VS INDUSTRY |

4,463 |

115.9 |

38.5 |

3.6% |

|

TOYOPLAS + CPI |

1,365? |

65 |

21 |

11.4% |

SKP RESOURCES, ATA IMS and VS INDUSTRY are trading at trailing PER of more than 30x. Using the lowest PER range of 31x for the peers, KPS’s EMS business is worth RM2,015mil. That’s more than 4x KPS current market cap of RM468m!

If we assume a 40% PER discount to the industry average for its smaller size, it’s EMS business is worth RM1,365mil. With 537.4mil share outstanding, that translates to RM2.50 per share!

To be extremely conservative, we are assuming a very big discount in spite of its superior double digit profit margins when compared to its peers’ low single digit margins.

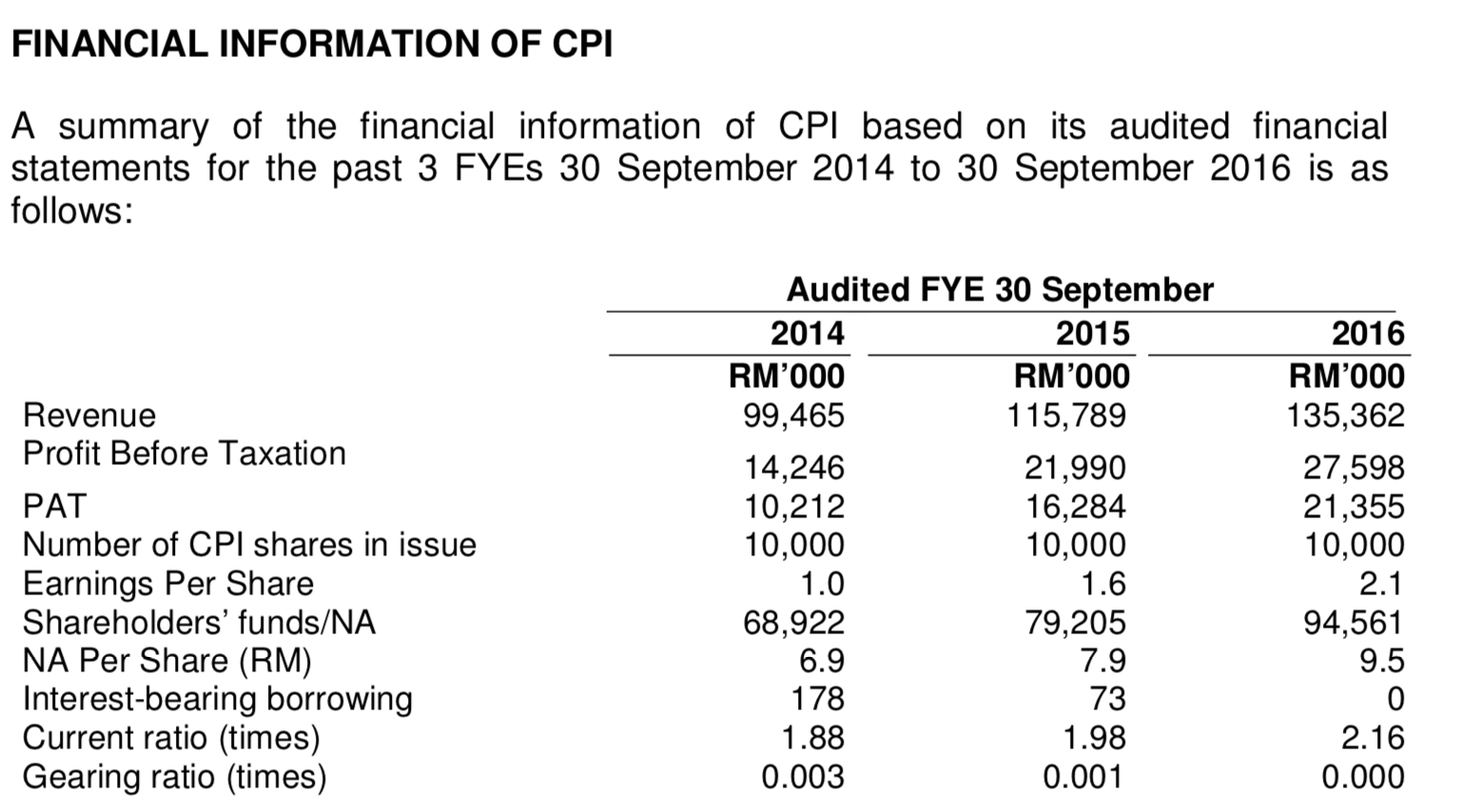

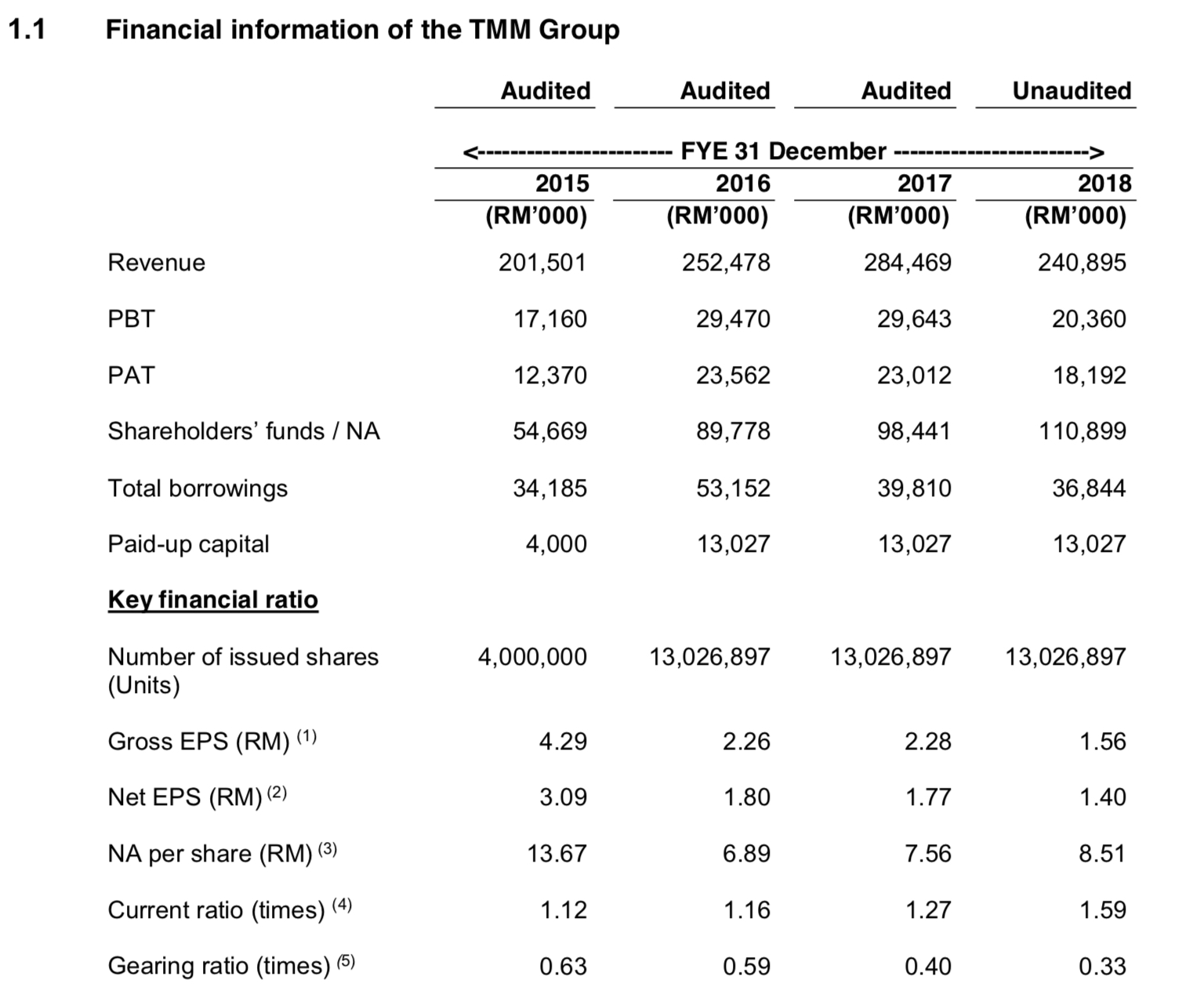

Both CPI and Toyoplas are very profitable businesses, as shown below.

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=85247&name=EA_GA_ATTACHMENTS

https://disclosure.bursamalaysia.com/FileAccess/apbursaweb/download?id=94747&name=EA_GA_ATTACHMENTS

3. KPS acquired Century Bond Bhd, an integrated packaging solutions provider, for RM208mil in Nov 2016. Century Bond recorded net PAT of RM15mil in 2016. With an est. 60% market share in Peninsular Malaysia’s cement bag market, CBB is the largest bag supplier in Peninsular Malaysia. Going forward, CBB plans to strengthen its position in the non-cement bags market.

https://www.theedgemarkets.com/article/kps-launches-rm210m-takeover-bid-century-bond

4. KPS has a 20% stake in Sprint Holdings, the highway operator of the Sprint highway. The 20% stake is said to be worth RM174mil.

http://bernamamrem.com/viewsm.php?idm=34812

5. Other assets potentially worth more than RM300mil.

- 60% stake in King Koil mattress business (acquired for RM116mil in 2016)

https://www.theedgemarkets.com/article/kumpulan-perangsang-buys-60-stake-king-koil-mattress-owner

- 51% stake in Aqua-Flo’s water chemical products (recorded share of profit of RM2.9 mil last year)

- 51% in KPS-HCM (assets held for disposal worth RM92mil.)

- 40% stake in NGS Energy (recorded share of profit RM7.3mil last year)

- 60% stake in Smart pipe (acquired for RM5.1mil in 2016)

- Investment properties worth RM87mil.

Financially, KPS had total shareholders equity of RM956mil or RM1.78 per share. It had low gearing ratio. As of 30 June 2020, it had cash of RM251mil and total borrowings of RM564m. That translates to net debt of RM312mil on total assets of RM2,147mil.

Valuation summary

| RM mil | |

| EMS business (Toyoplas + CPI) | 1,365 |

| Century Bond | 208 |

| SPRINT 20% stake | 174 |

| Other assets | 300 |

| Total assets | 2,047 |

| - Net debt 30 June 2020 | 311 |

| + SPLASH remaining payments | 173 |

| Net Assets | 1,909 |

|

Fair Value (after 40% holding co discount) |

1,145 |

| No of Shares outstanding | 537.4 |

| Fair Value Per Share | RM2.13 |

| Potential upside | 145% |

No matter how you cut it, KPS looks extremely undervalued at RM0.87.

All information provided here should be

treated for informational purposes only. It is solely reflecting

author's personal views and the author should not be held liable for any

actions taken in reliance on information contained herein.

https://klse.i3investor.com/blogs/Momentum/2020-11-15-story-h1536429342-The_Crown_Jewel_of_KPS_Dissecting_the_Hidden_Value_in_this_Under_Apprec.jsp