SYF - DON'T FORGET TO WATCH THIS EXPLOSYF COUNTER

CLOSELY !!!

Hello to all readers out there. In recent weeks, I saw that furniture related counters have rallied on the prospect of "Work From Home" as a new normal.

Having said the above, the stock which I'd like to talk about today is SYF RESOURCES BERHAD (SYF - Stock Code 7082, Main Market, Consumer Products & Svcs - Household Goods)

BASIC INFORMATION ABOUT SYF

SYF was founded in 1995, and listed in BSKL on March 2000, with core business in:

i) Manufacturing of Furniture

i) Recent diversification into Property Development

Market Capitalization : RM 116.69 million

Shares Float : 569.24 million

Website : http://syf.com.my/

1. A NEW NORMAL. WORKING FROM HOME, BOOSTING FURNITURE

SALES FOR MALAYSIA FURNITURE PLAYERS !!!

Below is most recent analysis by PublicInvest which was published in the edge. It seems that the US-China trade war, has diverted a lot of USA order of furnitures to Malaysia.

Also, as the new normal of working from home is being practiced all over the world, Malaysia furniture makers are getting more orders due to the low cost of materials relative to other countries.

As such, SYF as one of the furniture manufacturers, shall benefit from this long term trend.

https://www.theedgemarkets.com/article/publicinvest-furniture-stocks-proxy-stronger-us-consumption

2. SMALL PUBLIC FLOAT, & DIRECTOR ADDING SHARES !!!

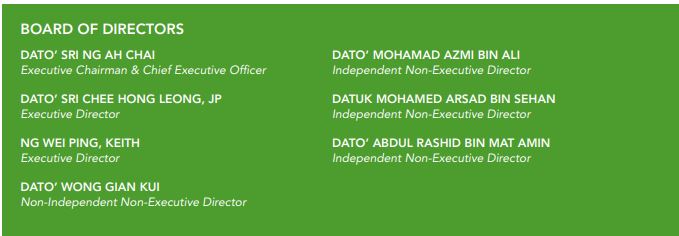

Refer below the latest list of Board of Directors in SYF:

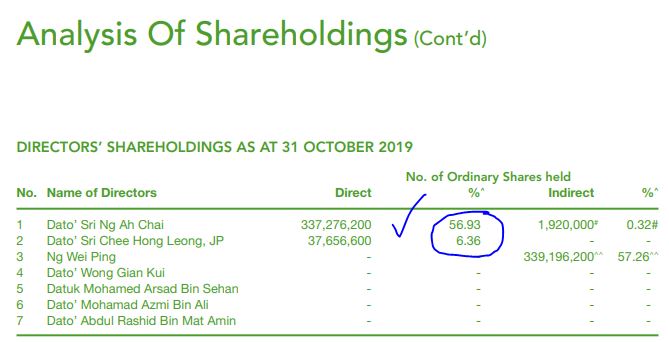

Below list of latest major shareholders

in SYF. As we can see, there is one shareholder holding a big chunk of

shares, Dato' Sri Ng Ah Chai who is the Executive Chairman / CEO of SYF.

He holds roughly 60% of total shares, this leaves an effective public

float of 40% in the market.

Also, we notice that the Executive Director, Dato' Sri Chee Hong Leong, has been adding shares in SYF just recently in this month of October 2020. Total shares added is 600,000 units.

3. TECHNICAL ANALYSIS - BREAKOUT ABOVE KEY EMAs, SIGNAL OF

LONG TERM UPTREND

Refer below the basic price and volume chart with key EMAs for SYF daily chart :

A few observations on the daily chart:

i. Refer Circle 1, there was a surge of volume entering this stock since September 2020, when furniture stocks started trending. Price hit a high of 33c, before retracing downwards towards its Support S1

ii. Refer Circle 2, where the price had managed to break out above all key EMAs such as EMA200, EMA365, to signal a long term change in trend has happened

iii. Should buyers be interested in this stock, we might see an upmove back to test the R1 resistance around 35-37c, then R2 resistance at 52-55c, before breaking upwards

CONCLUSION

Considering all the above, I opine that current price for SYF is attractive due to below:

i) Furniture sales boosted due to new normal of "Work From Home"

ii) Low public float, 40%, as the EC/CEO holding 60% of total float. Also the ED, is adding shares in October 2020

iii) Chart showing breakout of key EMAs with significant surge in volume, signalling long term uptrend

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-10-18-story-h1534704217-DON_T_FORGET_TO_WATCH_THIS_EXPLOSYF_COUNTER_CLOSELY.jsp