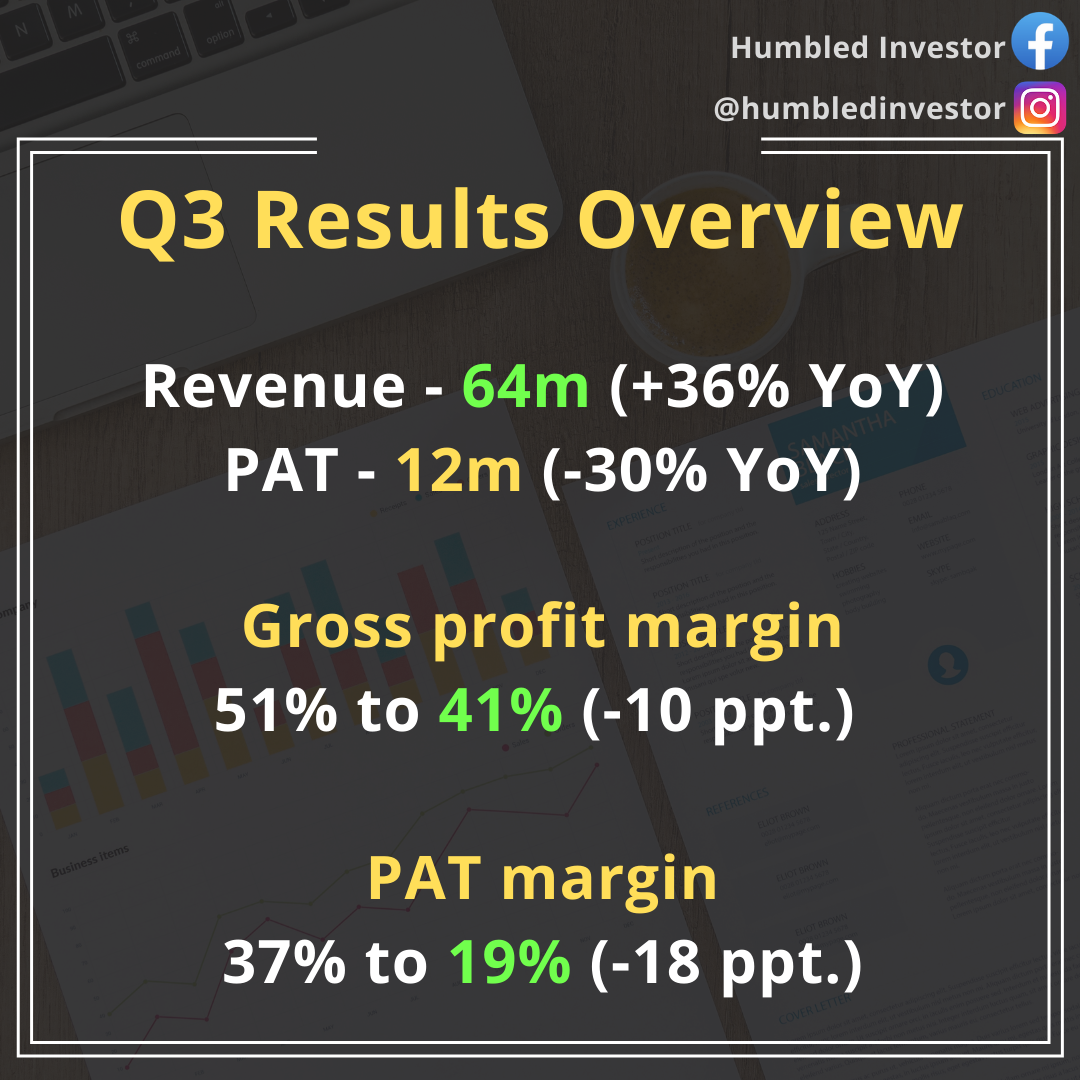

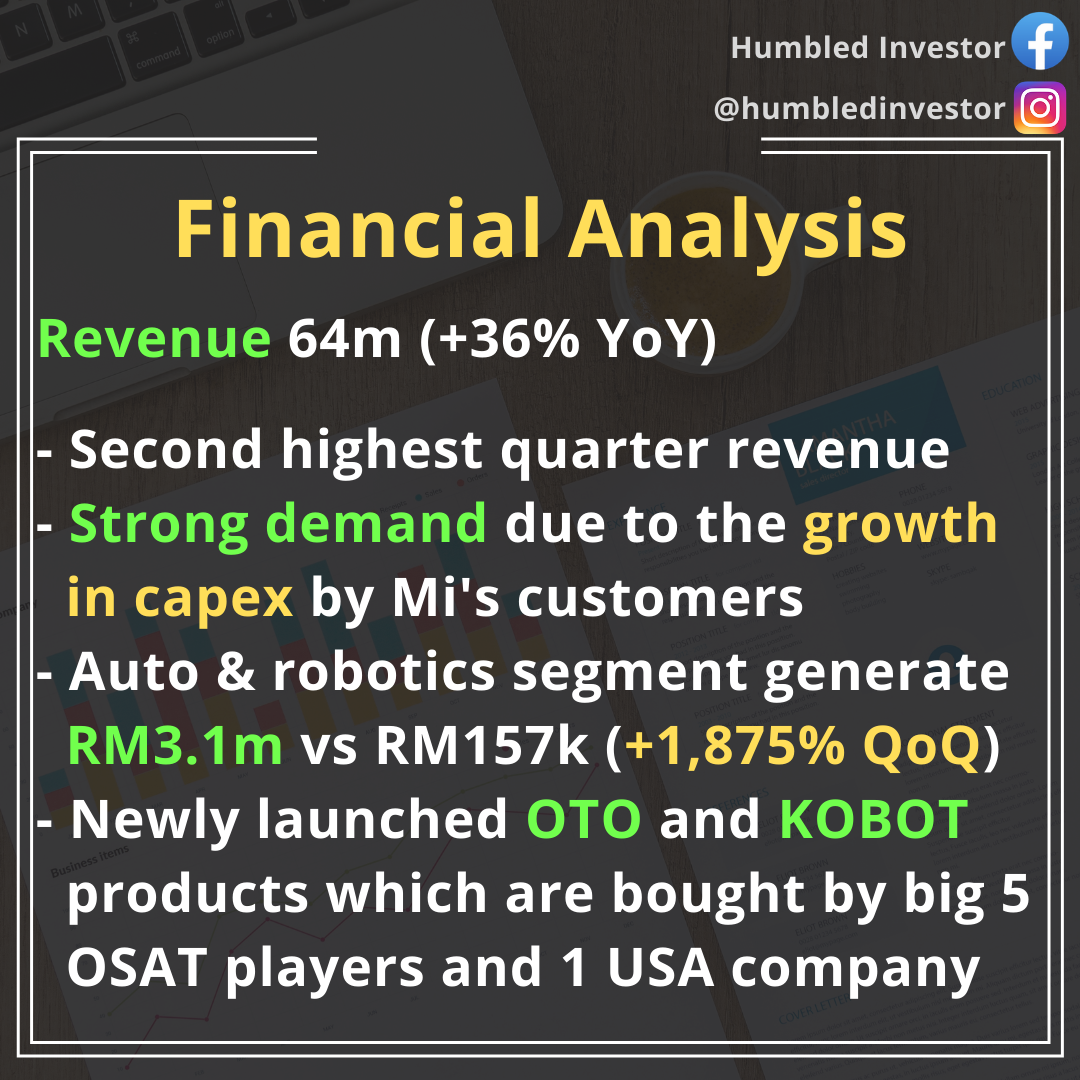

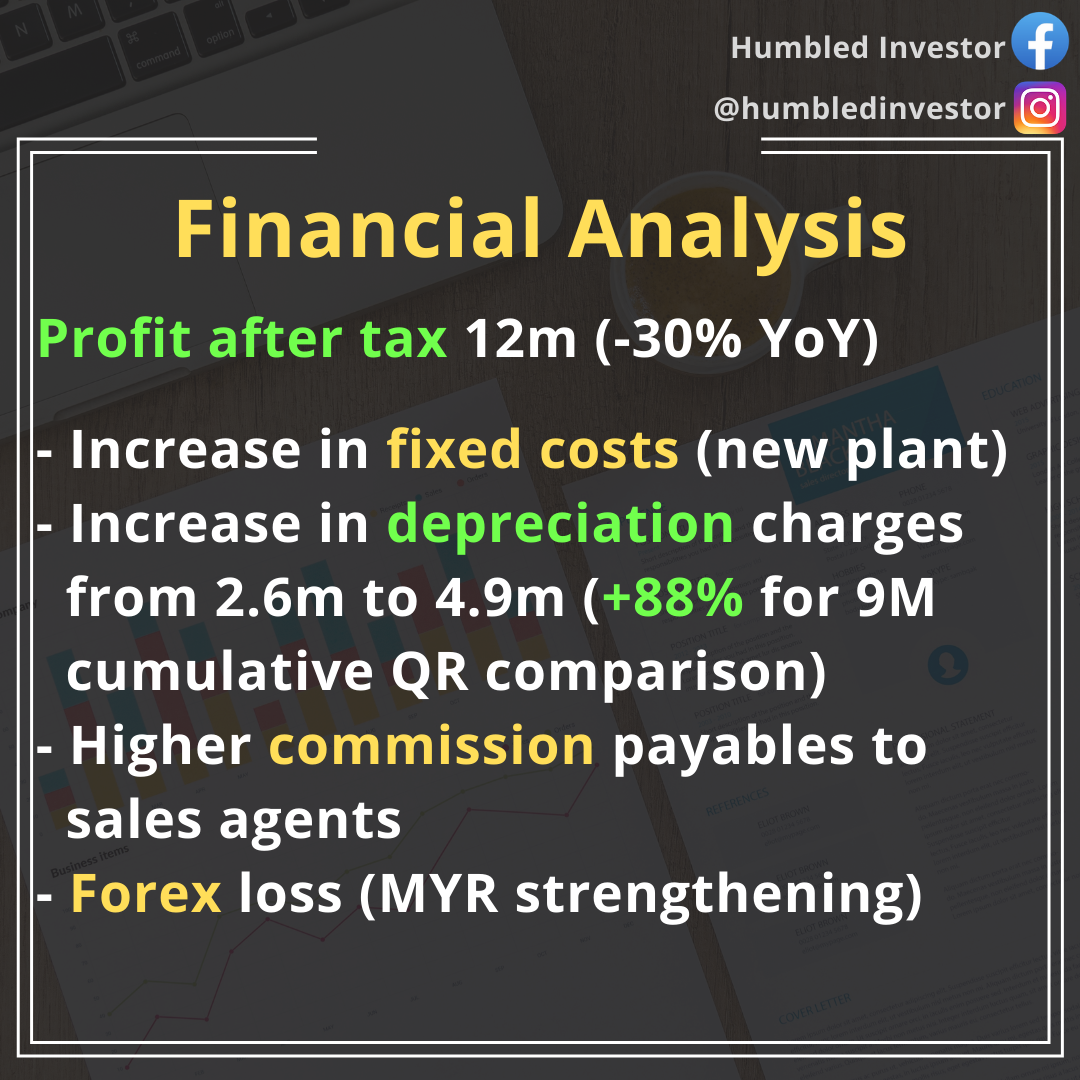

Mi Technovation - The risk of setting up a new plant

However, from the start of our coverage on Mi (24 May), the share price

has sky-rocket from RM2.38 to RM4.68 (+97%). This is contributed by the

strong growth prospect from the new factory and high margin business

despite the risks of running a new factory which is discussed in the

slides above.

You may refer to here for Mi's

business overview (with competitive advantages explained) and why I did

not invest in Mi last year.

Follow us and don't forget to share this to your friends!

_________________________________________________________

All information provided here should be treated for informational

purposes only. It is solely reflecting author's personal views and the

author should not be held liable for any actions taken in reliance on

information contained herein.

No buy call. No sell call. No bullshit. Only content.

If you think the article / information is useful to you, you can

<SHARE> this article and support us by <LIKE> and

<FOLLOW> our Facebook page "Humbled Investor". Thank you so much

for supporting.

https://klse.i3investor.com/blogs/HumbledInvestor/2020-10-23-story-h1534798458-_Humbled_Investor_Mi_Technovation_The_risk_of_setting_up_a_new_plant.jsp