As per my previous post on the Potential Impact of Vaccine Approval on Glove Stocks,

historical data shows that vaccine approvals will not sink glove

stocks. For sure it may dampen sentiment or push some investors to sell

but it will not directly end the glove bull run. In the longer term,

there is an indirect impact i.e. if an effective vaccine is found and is

widely administered worldwide, it will reduce the threat of COVID-19

and the world may no longer need to wear masks and buy less gloves.

However, we should all know by now how long this process will take. It will not happen in the next 2-3 quarters and also, glove manufacturers sales orders have already been locked in for 400+ days with deposits in the pocket. There has never been so much clarity on future sales and profits.

So if vaccine approval doesn't affect the bull run, what does? The answer is: PAT (Profit After Tax).

Now the answer may seem obvious to most of us but we take it for granted that it is common sense that share prices should go up if PAT goes up. But who has had the time to really track back share price vs PAT performance to see if there is really a strong positive correlation? Well, I had some free time while "working" from home so here's what I found.

Past 10 Years Share Price and Quarterly PAT for Top Glove

Note: Numbers above the Qs (quarterly results) are PAT in RM millions.

If you managed to squint your eyes to check out the quarterly PATs you'll see that the share price goes up whenever PAT rises, and goes down when PAT heads south. There is a strong positive correlation.

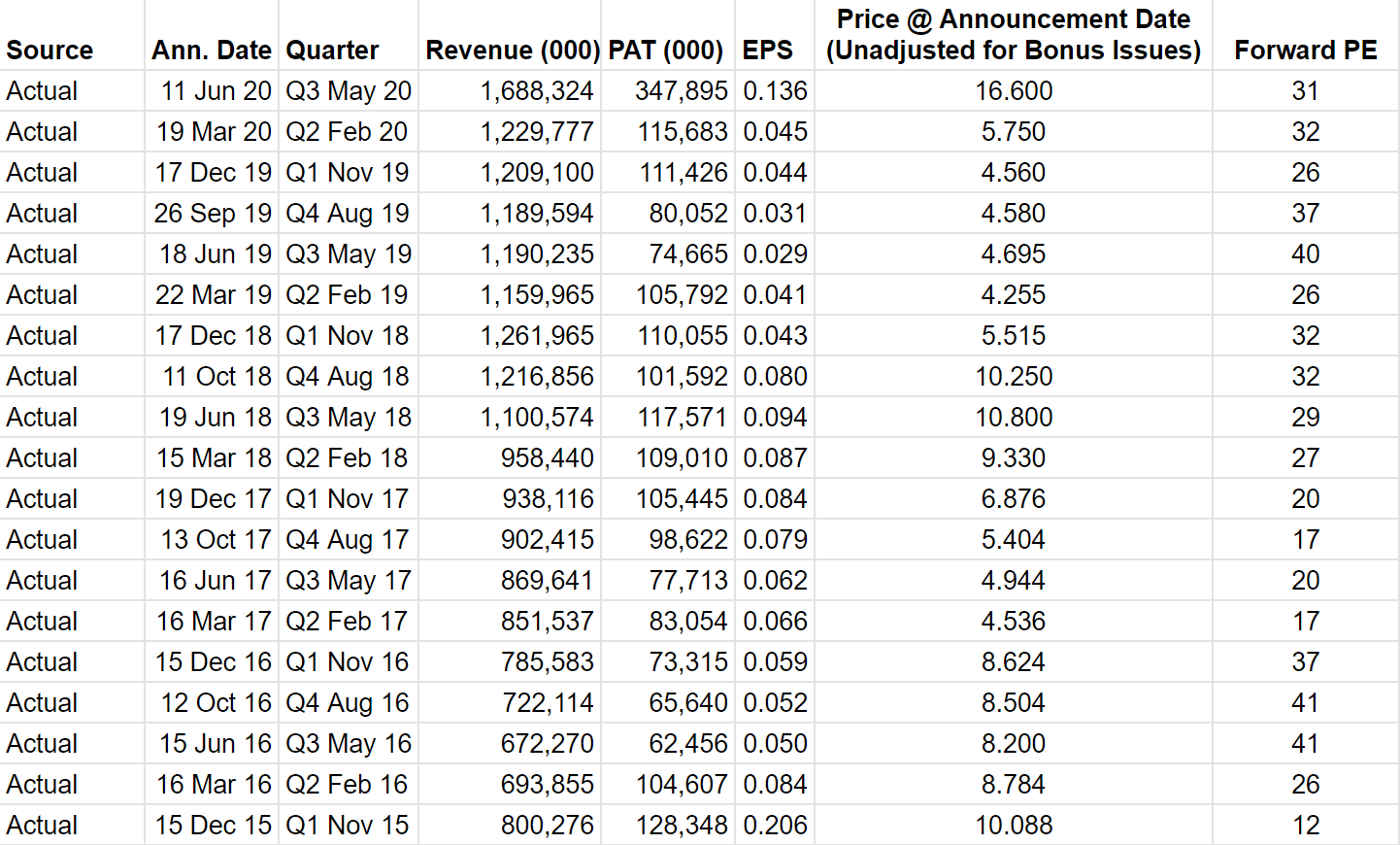

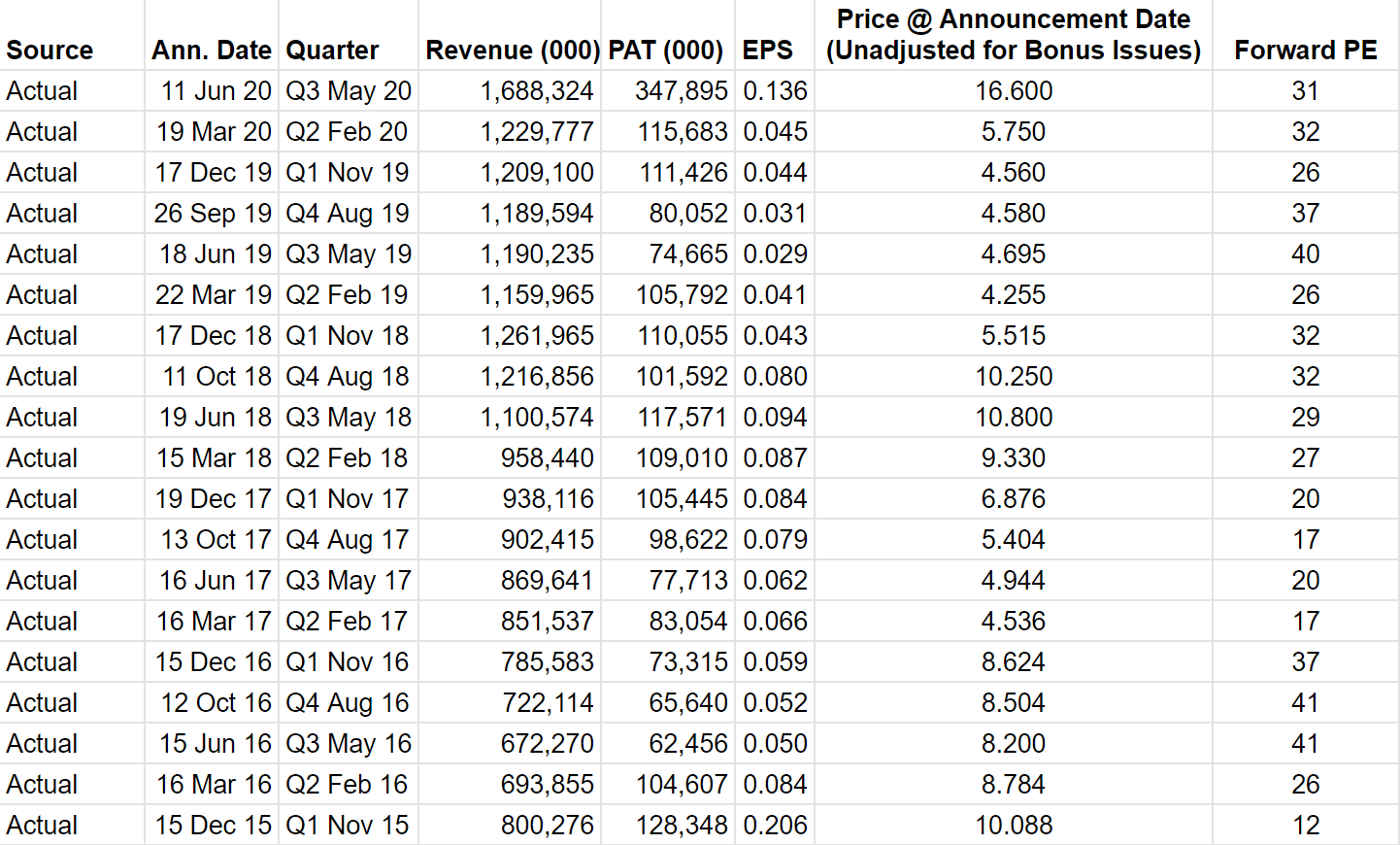

Below you can see in detail the PAT, EPS, share price and forward PE (quarter PAT X 4) for the past 5 years' quarters. The forward PE has been fairly consistent, averaging at 29.

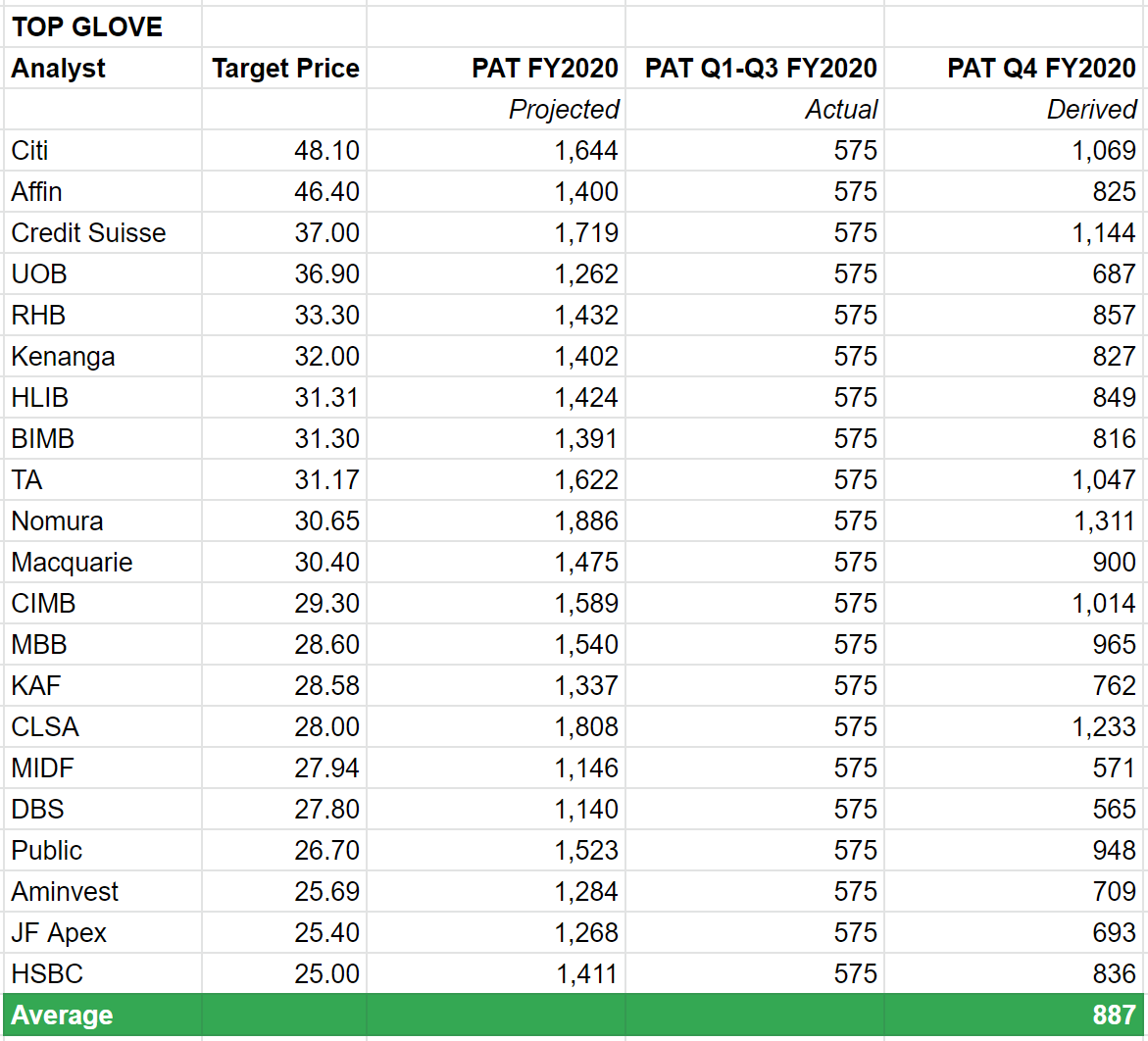

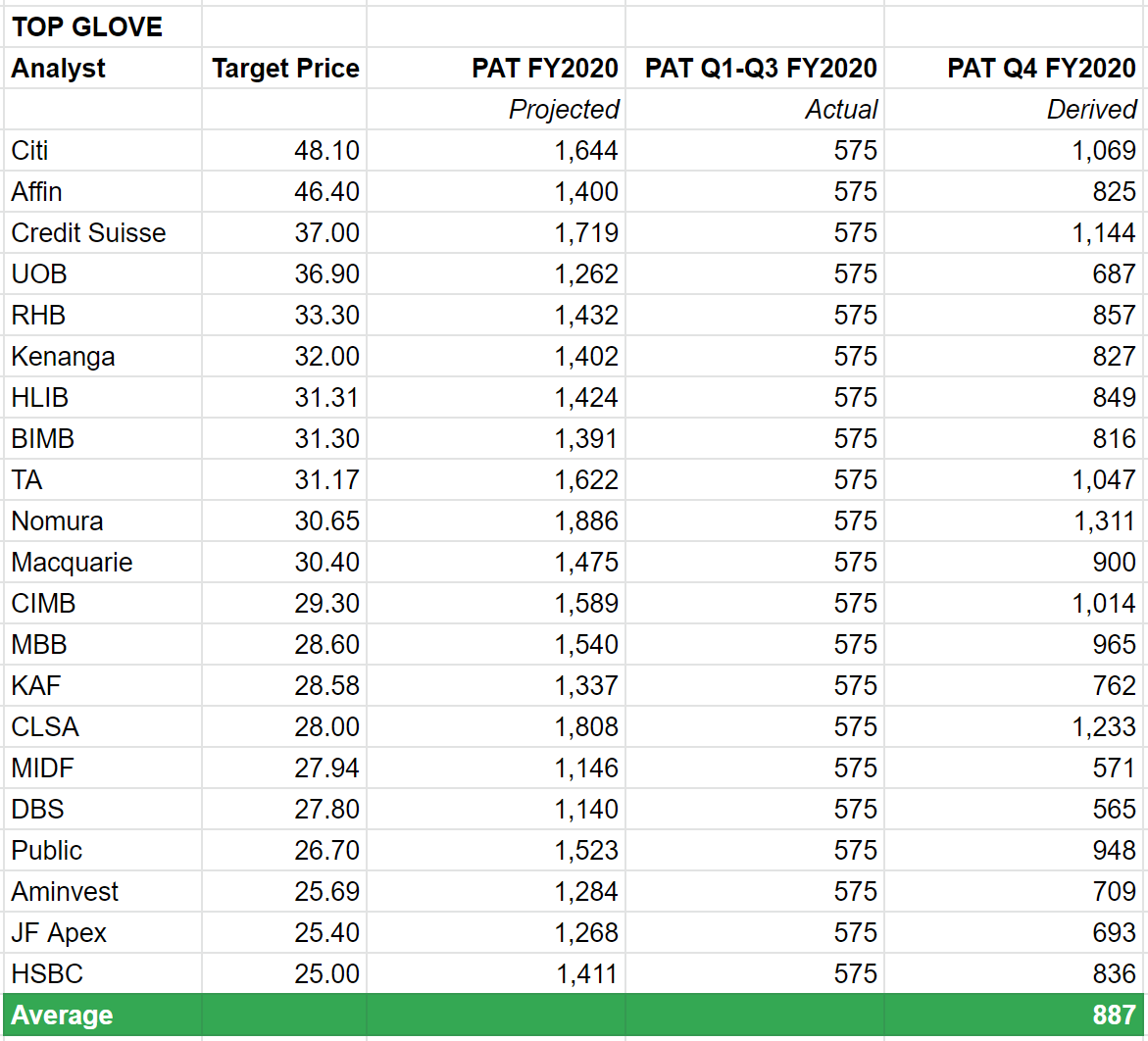

Estimated PAT and Share Price for Top Glove for Q4 FY2020

Note: Q4 2020 PAT derived by using FY2020 PAT estimates and deducting actual Q1-Q3 FY2020 PAT. PAT in RM millions.

Note: Q4 2020 PAT derived by using FY2020 PAT estimates and deducting actual Q1-Q3 FY2020 PAT. PAT in RM millions.

There are already many estimates on Top Glove's upcoming Q4 2020 PAT by various sifus so I will not dare to offer mine. Instead, let's look at the analyst reports and their estimates for Q4 2020 above. Derived PAT estimates for Q4 2020 range from as low as RM565m to as high as RM1,233m. On average, the Q4 2020 PAT is approximately RM887 million. This is more than 2X Top Glove's Q3 2020 PAT of RM348 million.

Based on that fairly conservative estimate of RM887m PAT and historical forward PE of 29, Top Glove's share price should be RM38 (RM12.67 after Bonus issue). A higher PAT of RM1 billion should see Top Glove's share price at RM43 (RM14.33).

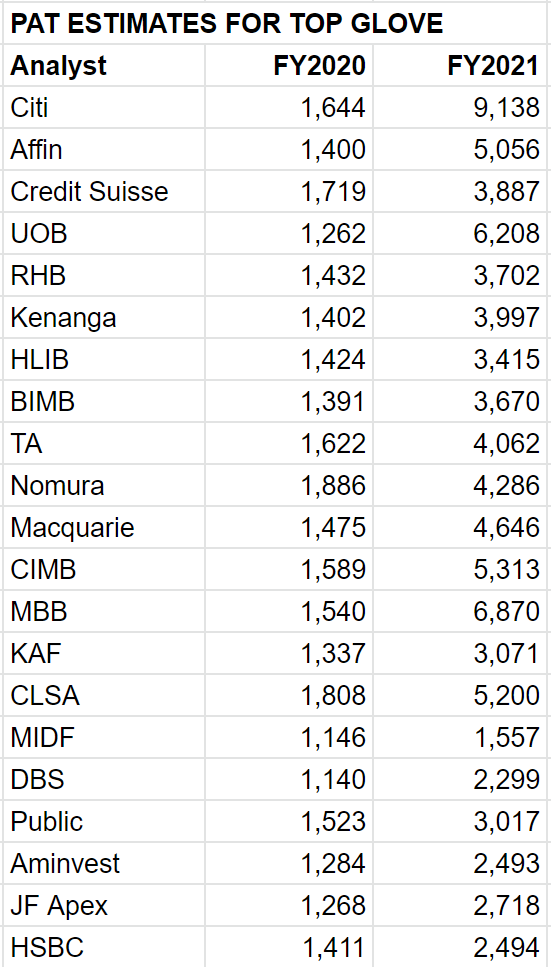

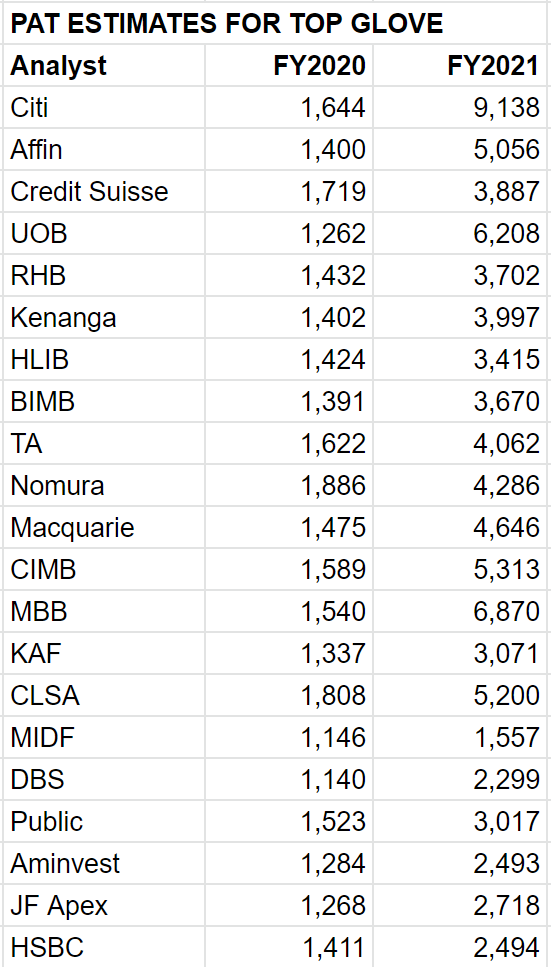

Let's not even talk about FY2021 estimated PAT (below) - not a single analyst has lower PAT for 2021.

Of course share price will not go up or down in a straight line so do expect turbulence and attempts to shakeout weak holders and contra players. At this stage, we are in a bear trap (read more about it here) with constant news flow hinting and outright shouting that the glove bull run is over. But remember: For gloves, as long as PAT continues to grow, the share price will continue to rise regardless of vaccines, etc.

IGNORE THE NOISE. STAY FOCUSED ON PAT.

Important Note

The above information is not a recommendation to buy or sell gloves or any other stock. I'm just sharing my personal research for educational and discussion purposes. I am not a professional stock analyst nor am I an investment expert. I have not verified the chart or information provided by the news/web sources above. Please do your own due diligence and/or consult a professional financial advisor when making any investment or financial decision.

https://klse.i3investor.com/blogs/glovesvsvaccine/2020-09-04-story-h1513318067-Gloves_Top_Glove_Supermax_Harta_Kossan_it_s_all_about_PAT.jsp

However, we should all know by now how long this process will take. It will not happen in the next 2-3 quarters and also, glove manufacturers sales orders have already been locked in for 400+ days with deposits in the pocket. There has never been so much clarity on future sales and profits.

So if vaccine approval doesn't affect the bull run, what does? The answer is: PAT (Profit After Tax).

Now the answer may seem obvious to most of us but we take it for granted that it is common sense that share prices should go up if PAT goes up. But who has had the time to really track back share price vs PAT performance to see if there is really a strong positive correlation? Well, I had some free time while "working" from home so here's what I found.

Past 10 Years Share Price and Quarterly PAT for Top Glove

Note: Numbers above the Qs (quarterly results) are PAT in RM millions.

If you managed to squint your eyes to check out the quarterly PATs you'll see that the share price goes up whenever PAT rises, and goes down when PAT heads south. There is a strong positive correlation.

Below you can see in detail the PAT, EPS, share price and forward PE (quarter PAT X 4) for the past 5 years' quarters. The forward PE has been fairly consistent, averaging at 29.

Estimated PAT and Share Price for Top Glove for Q4 FY2020

There are already many estimates on Top Glove's upcoming Q4 2020 PAT by various sifus so I will not dare to offer mine. Instead, let's look at the analyst reports and their estimates for Q4 2020 above. Derived PAT estimates for Q4 2020 range from as low as RM565m to as high as RM1,233m. On average, the Q4 2020 PAT is approximately RM887 million. This is more than 2X Top Glove's Q3 2020 PAT of RM348 million.

Based on that fairly conservative estimate of RM887m PAT and historical forward PE of 29, Top Glove's share price should be RM38 (RM12.67 after Bonus issue). A higher PAT of RM1 billion should see Top Glove's share price at RM43 (RM14.33).

Let's not even talk about FY2021 estimated PAT (below) - not a single analyst has lower PAT for 2021.

Of course share price will not go up or down in a straight line so do expect turbulence and attempts to shakeout weak holders and contra players. At this stage, we are in a bear trap (read more about it here) with constant news flow hinting and outright shouting that the glove bull run is over. But remember: For gloves, as long as PAT continues to grow, the share price will continue to rise regardless of vaccines, etc.

IGNORE THE NOISE. STAY FOCUSED ON PAT.

Important Note

The above information is not a recommendation to buy or sell gloves or any other stock. I'm just sharing my personal research for educational and discussion purposes. I am not a professional stock analyst nor am I an investment expert. I have not verified the chart or information provided by the news/web sources above. Please do your own due diligence and/or consult a professional financial advisor when making any investment or financial decision.

https://klse.i3investor.com/blogs/glovesvsvaccine/2020-09-04-story-h1513318067-Gloves_Top_Glove_Supermax_Harta_Kossan_it_s_all_about_PAT.jsp