Some of the new bird may not really known Sunsuria...but the legend story of our Casio King Mr.Robert Tan Hwa Choon will always on our mind. Sunsuria is formerly known as Malaysia Aica which had been listed in Bursa Malaysia more then few decade. In year 2014, Malaysia Aica was RTO by low profile businessman Tan Sri Ter Leong Yap and later the company change to SunSuria Bhd.

Sunsuria Bhd is an investment holding company. The company through its subsidiaries is engaged in property development. Sunsuria's business segments are Property development, and Investment holding and others. It derives most of its revenues from Property development.

The Fundamental of company:

Current PE: 9.02

Debt to Cash: 1.77

Current Ratio: 3.42

NTA: 1.13

Cash: 162 Mil

Current liabilities: 245.35Mil

Current Assets: 838.29 Mil

Shareholder Fund 1,015Mil

CONCLUSION: Healthy FINANCIAL

The Company announce venture into Healthcare industry in 18/6/2020 (sources from the edgemalaysia) and expect to contribute positive earning in 1st half 2021. On 19/August/2020, Sunsuria had been named in Forbes Asia's Best Under A Billion 2020 list, which highlight 200 Asia Pacific public companies with less than US$1 Billion in revenue but consistent top-and bottom line growth advance.

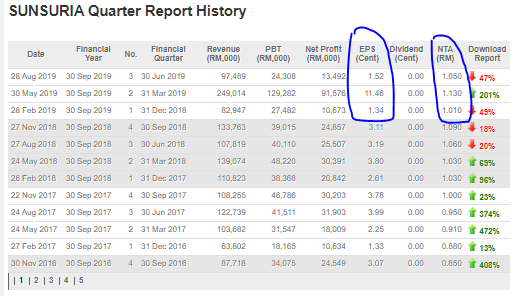

Steady company earning since 2016.

Share price performance:

The share price hitting the high in 2017 at 1.70 but consolidate to 60sen level in March 2020. Even at 60 sen level, the company is still 100% away from its fair value of NTA 1.13.

At the current 43 sen level is nearly at least another 200% to go to its fair value of NTA 1,12.

When you observe the fifteen Malaysian companies had been named is Forbes Asia's Best Under A Billion list, you will find that Sunsuria Bhd is the cheapest company (in term of share price) which is just 43sen while other company likes liihen, Uchi Tech, Revenue Grp, Johore Tin, AME Elite, Frontken and so on is far high value.

THIS MEAN SUSNSURIA IS FAR MORE WORTH THAN 43SEN....

A promising outlook for Sunsuria as they are venture into healthcare and some project in one belt one road(China).

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

https://klse.i3investor.com/blogs/wwwtexmatcom/2020-08-21-story-h1512450275-OVERLOOKED_HEALTHCARE_GEMS_SUNSURIA_3743.jsp