Dear fellow readers,

As our telegram Public Channel followers have finally broken 3000, my gesture of thanks for all the support these years has led me initiate a new weekly segment of "Tradeview Weekend Time".

As our telegram Public Channel followers have finally broken 3000, my gesture of thanks for all the support these years has led me initiate a new weekly segment of "Tradeview Weekend Time".

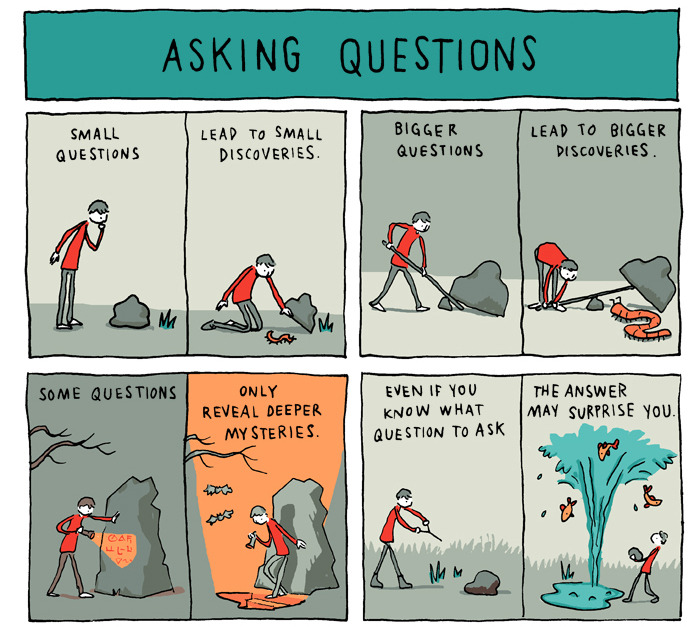

This is not about what I

do during my weekend but rather I shortlist 5 questions from public

during the week about the share market / economy that either emailed me,

left a comment or private message me and share my answer or feedback to

the public.

I think it is only fair

that communication be two ways where readers who enjoy my writing have

the opportunity to question, debate, criticise or exchange views. As

such, I encourage all of my readers who are keen to ask a question to do

so. Whatever the question it may be, I am sure it will benefit others

as well in this learning process.

Without further ado, let me kick off the segment with the following 5 Questions :

Q1. Dear Trade View,

What is the most cost effective way to invest in overseas market like Singapore, US, or HK? I

understand some local brokerage houses do allow trading in foreign

shares (via nominee account) but at hefty brokerage cost and dividends

received are subject to charges. Was wondering if there is a more

economical way to invest in overseas shares?

Thank you.

Regards,

VJ (names are altered for anonymity)

Ans :

There

are many ways. The simplest would be using existing securities firms

with foreign arms such as CGS-CIMB, Maybank Kim Eng, RHB, Kenanga

amongst others. However, your concerns are valid in the sense these

securities firm would make higher rates in terms of per transaction cost

& FOREX.

The

only alternative is using platforms like Ameritrade or Interactive

Brokers. Please note however that for these platforms, you have certain

risk in that it is overseas based (listed on US stock market) and some

worry in the event of potential default. Additionally, Ringgit is not

one of the preferred currencies so you will have to find ways to

transfer the funds into these platforms. Transferwise is one the method.

The good thing about these platforms, cost is much lower with a lot of

markets available for you to invest in. Avoid etoro or those mirror

trade platforms. Make sure to research on the companies' standing before

signing up.

Ps: We are not sponsored by any of the firms above in highlighting the companies services.

Ps: We are not sponsored by any of the firms above in highlighting the companies services.

Q2. Hi Tradeview,

May I know if glove share price can still go up more. I worri bout windfall tax & China supply. Pls advise. TQ

Sally

As Malaysians, we do have a unique lifetime opportunity with the world biggest glove makers controlling 65% of world market share all congregating here in our KLCI. If foreign fund were to invest in anything, it will be our glove makers. Therefore, I think for glove sector with strong earnings, there is still upleg. Windfall tax or not, my view it is unconscionable for the government to impose such tax as to deter the supply of life saving PPE for frontliners battling Covid-19 and potential second wave. There will be backlash if the government does so and this industry requires more support not discouragement. If indeed they do impose, the % would be small and rather meaningless in the grand scheme of things. For China supply, it is funny becaue currently both Blue Sail and Shandong Intco are the world biggest manufacturer of plastic Vinyl gloves. The world is phasing out and rejecting such gloves hence no choice but for these China players to adapt or risk losing even more market share. Malaysia is leader in both Nitrile and Rubber Latex gloves. The industry took 30 years to reach this level. I have written extensively on this, you can refer here : http://www.tradeview.my/2020/06/tradeview-2020-in-conclusion-is-glove.html

Q3. Hi, do u write all by yourself, have a team to support u or get ur articles from other writers as well? Can I write for u 2 share?

CC

Thank you for your support. All writings are done by myself and my small team will do some fact findings, content creation for me that's about it. I bounce my ideas off many industry players and other financial professionals in my writings. If you would like to share some writings of your own, feel free to email to me at the address below. I will vet through and if I do publish, credit will be given to you. Not me.

Q.4 Hi, I'm David, a reader of Tradeview.

May

i know why RHB Bank is recommended instead of other battered down

financial institution such as Maybank? Cuz i was told it is always safer

to go after the bigger one

Thank you.

Not wrong with the notion of "Too big too fail". However, RHB Bank is not a micro bank. It is the 5th largest bank after Maybank, Public Bank, CIMB Bank, Hong Leong Bank with a market cap of RM19 billion. When investing in banks it is quite complex as you need to assess the balance sheet, Net Interest Margin (NIM), Gross Impaired Loan (GIL), overall macroeconomics consideration. Assessing banks also is not a simplistic view of PE ratio multiples as a lot of weightage is placed on Price to Book Value ratio (PTBV). Banks are generally safer investment if you can buy when market is low as it is a barometer of economic health for an economy. We like RHB Bank in comparison to others now because it does not have as high a bad debt provision / NPL, valuation is rather cheap in comparison to others and mid term outlook is more positive. At the end of the day, investing must take into account risk reward ratio, upside vs downside, dividend yield, potential gain amongst many other factors.

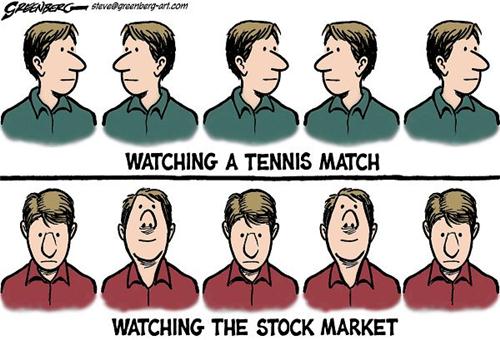

Q.5 Hello, do u think

I shud move FD savings to the share market? All my friends are making

money recently. I feel silly for holding my savings wit miserable FD

rate.

TQ - Roy

I do not know your understanding of the share market. If you have 0 knowledge, then going to the share market now, you are being very rash. It is important to first understand then deploy the cash. The first thing you should do is to read up and study on the matter widely or even seek out a good mentor. Then test out your knowledge using those "training / practice platforms". If you are able to do well, you can start trying your hand. Please note, the market is a treacherous place that punishes the fools, the greedy, the impatient and the egomaniacs. FD savings is guaranteed and risk free. You don't have to do anything. Indeed it is at historic low, but unless you are confident with your ability, do not risk your hard earned money. It is not worth it being swayed by hearsay / bragging by your friends.

Telegram channel : https://telegram.me/tradeview101

Website / Blog : http://www.tradeview.my/

Facebook : https://www.facebook.com/tradeview101/or

Email me to sign up as private exclusive subscriber : tradeview101@gmail.com

Food for thought:

https://klse.i3investor.com/blogs/tradeview/2020-07-04-story-h1509742212-_Tradeview_2020_Tradeview_Weekend_Time_Q_A_4th_of_July.jsp