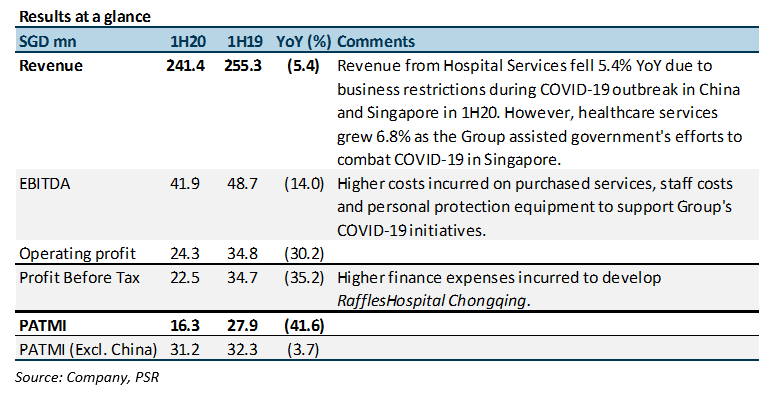

- 1H20 revenue was below initial estimates by 9% due to impact from COVID-19 resulting in slower business momentum.

- Decline in Hospital Services (-5.4% YoY) partially offset by better Healthcare Services (+6.8% YoY) due to the Group’s support of the government’s COVID-19 initiatives in Singapore.

- Halt in hospital and clinic operations in China during 1H20 as a result of the COVID-19 outbreak expected to set the Group’s breakeven timeline back by up to a year.

- We maintain our NEUTRAL recommendation with a lower TP of S$0.94 (prev S$0.99). We revise our FY20e earnings downwards by 25% taking into account pressure from slowing business momentum observed in 1H20.

The Positives

+ Healthcare Services saw revenue grow 6.8% YoY from S$116.6mn to S$124.6mn in 1H20 as the Group rendered services to assist the government’s effort to tackle the COVID-19 pandemic, providing an alternative sources of income. These included providing air-border screening at Changi Airport, swabbing of foreign workers at the dormitories, as well as providing medical services to COVID-19 patients at the Changi Exhibition Centre-Community Care Facility.

The Negatives

– Hospital Services fell 5.4% YoY from S$148.1mn to S$126.6mn on business disruptions across China and Singapore. Initial outbreak of COVID-19 in China saw operations in China affected in 1Q20. This was followed by the 2-month Circuit Breaker in Singapore with non-essential activities (including services such as dental and health-screening) mandated to cease, hurting the Group’s business momentum in 1H20. As a result, Group revenue declined from S$255.3mn to S$241.4mn (-5.4% YoY) in 1H20.

– Operating margin was lower (1H20: 10.0% vs. 1H19: 13.6%) due to higher staff costs (+4.8% YoY) and purchased and contracted services (+24.0%). To support manpower demands from COVID-19-related projects with the government, the Group incurred higher outsourced recruitment agency costs as well as salaries from hiring of temporary staff. The increased costs were partially offset by government grants such as the Job Support Scheme (JSS), higher wage credit and property tax rebates. Nevertheless, operating profit fell 30.2% YoY to S$24.3mn (1H19: S$34.8mn).

Outlook

Gradual return to normalcy observed across operating geographies. Raffles Medical has started to observe return of patient load in 3Q20 to pre-COVID-19 levels as both China and Singapore started to ease restrictions on businesses. As cross-border travel begins to ease, Hospital Services is likely to recover, as foreign patients make up 20 to 30% of revenue in Singapore. Margins will also revert to previous levels as contribution from in-patient services pick up.

Setback to operations in China

RafflesHospitalChongqing (RHCQ) was slated to breakeven in FY21. However, the hospital saw less patient load in 1H20 with travel restrictions. As a result, the Group expects breakeven to be delayed by up to a year, prolonging gestations period and cost. RafflesHospitalShanghai is currently in the final stages of out-fitting and is expected to begin operations at end-FY20. However, this is barring further delays should the COVID-19 situation take a turn for the worse.

Maintain NEUTRAL with revised TP of S$0.94 (previous TP S$0.99).

We revise our FY20e earnings estimate downwards by 25% after considering the slowing business momentum in 1H20. However, we expect business to recover by FY21. The current shift in business dynamics does not represent the nature of the Group’s business in a steady-state environment as Hospital Services segment was depressed from business restrictions during the pandemic. We expect business momentum from Hospital Services segment to return gradually with healthier margins moving forward.

Nevertheless, the Group has maintained strong cash position and distributed 0.5 cents in interim dividends for 1H20, steady from a year ago. The Group is expected to remain profitable for the remaining of FY20.

Source: Phillip Capital Research - 29 Jul 2020

https://sgx.i3investor.com/servlets/ptres/14411.jsp