SOLUTN (0093) SOLUTION ENGINEERING HOLDINGS BHD A NET CASH TECH COMPANY WORTHWHILE TO KEEP !!!

A NET CASH TECH COMPANY WORTHWHILE TO KEEP !!!

Hello

to all readers out there. Our market was quite vibrant today, wich

continuation of sentiment in penny stock counters dominating the trend.

Well you know what they say, "if you can't fight them, join them".

Having said the above, the stock which I'd like to talk about today is SOLUTION GROUP BERHAD (SOLUTN - Stock Code 0093, ACE Market, Technology - Digital Services)

BASIC INFORMATION ABOUT SOLUTN

SOLUTN was founderd in 1988 with core businesses in a few field:

i) Teaching equipment development and supply for engineering education

ii) Industrial automation

iii) Industrial lubricants

Market Capitalization : RM 30.65 million

Shares Float : 306.45 million

Website : http://www.solution.com.my/

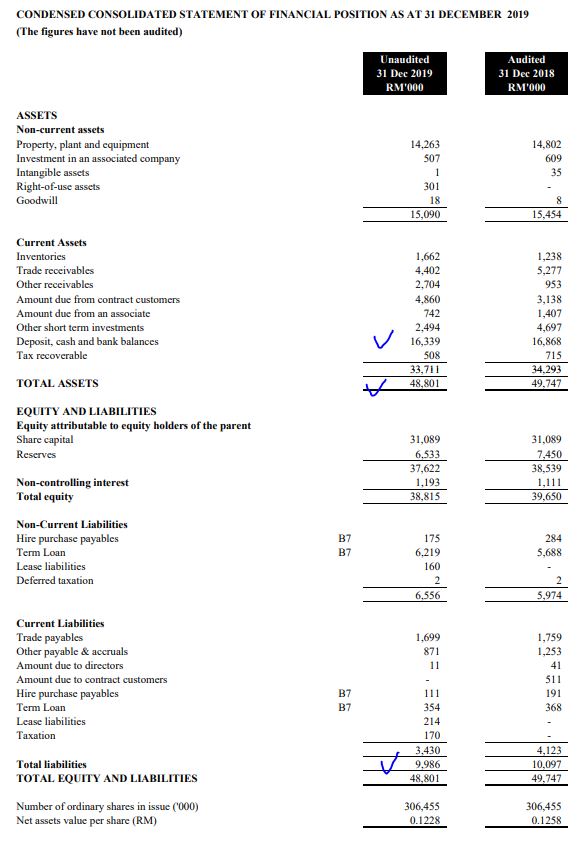

1. NET CASH COMPANY - WITH ASSETS FAR SURPASSING LIABILITIES

Refer below latest Assets Versus Liabilities sheet for SOLUTN.

As we can see they

have total ASSETS of RM 48.8 mil against LIABILITIES of RM 10 million.

Also to be noted a cash total of RM 16.3 million in the bank which is

more than enough to pay off all existing current and long term

liabilities, which makes this company a NET CASH company.

2. BUSINESS PROSPECTS TO IMPROVE AFTER COVID19 PANDEMIC EASENING

Following are the prospects of the group, post COVID19 pandemic, as extracted from their latest QR and also Annual Report:

a)

Engineering Equipment Segment : Government allocation of RM 5.9 billion

for TVET program, which SOLUTN is able to capitalize on as their

expertise in development, training and supply of engineering equipment

for higher level institutions

b)

Industrial Automation Segment : As Malaysia moving towards Industry

4.0, thsi will lead in demand for industrial automation & system

integration services, as SOLUTN will be able to offer this to companies

willing to invest

c)

Industrial Lubricants Segment : As more vehicles go back to the road

post COVID19, lubricant utilization is expected to pickup in upcoming

quarters

d)

Solar Power New Business Segment : SOLUTN has successfully registered

as a SEDA system integrator in first half of 2019 for the design, supply

and installation of photovolatic system. They foresee this segment to

contribute positively to FY2020 revenue

3. TECHNICAL ANALYSIS - FORMING CUP AND HANDLE PATTERN, PENDING

BREAKOUT ABOVE EMA365 AT 10 CENTS ON THE BACK OF IMPROVED

TRADING INTEREST IN THE STOCK

Refer below the basic price and volume chart with key EMAs for SOLUTN daily chart :

A few observations on the daily chart chart:

i. SOLUTN had been trading at 34c in July 2017 and started to downtrend

ii.

Recently hit a lot in March 2020 during the flash crash, however we can

observe that low volumes selling during the low prices, indicating only

weak sellers exiting

iii.

Refer Circle 1, SOLUTN had formed a Cup and Handle Pattern with

breakout pending at EMA365 of 10c, which would see further upside should

a strong breakout happen

iv.

Refer Circle 7 & 8, after the recent retracement, it looks like

volumes of buyers are starting to take interest in this stock again and

coincidentally, the next EMA resistance of EMA200 at 22c is the point of

cup and handle breakout

v. Refer Circle 2, it it seen that volume trading is significantly increasing in this counter

vi. Resistance levels 13c and 16c next to be tested for further uptrend

4. CHEAPER ENTRY INTO SOLUTION VIA SOLUTION-WARRANTS A (SOLUTN WA)

Following is the profile of SOLUTION-WARRANTS A, for traders looking at lower cost entry into this stock. A few comments:

i. Maturity is July 2021, hence another 13 months to go to expiry

ii. Premium of 120% is considered quite reasonable, with the amount of life left for this warrant

iii. Strike price of 20c, which is 10c from the latest mother shares closing price

iv. Potentially, price can break out above 3c, if the mother shares are able to trade at least within 13-15c range or above

CONCLUSION

Considering all the above, I opine that current price for SOLUTN is attractive due to below:

i) Net cash company

ii) Business prospects improving post COVID19 pandemic

iii) Chart showing bullish cup and handle pattern, pending breakout above 10c towards 13c and 16c

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer

: The above opinion is never intended to be a BUY CALL whatsoever. I am

sharing my observations ONLY based on fundamental; past history;

current trading pattern; charts etc. Please make your own informed

decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-06-22-story-h1508909242-A_NET_CASH_TECH_COMPANY_WORTHWHILE_TO_KEEP.jsp