After reading KC's answer to John's question, is GPACKET-WB a big frog?

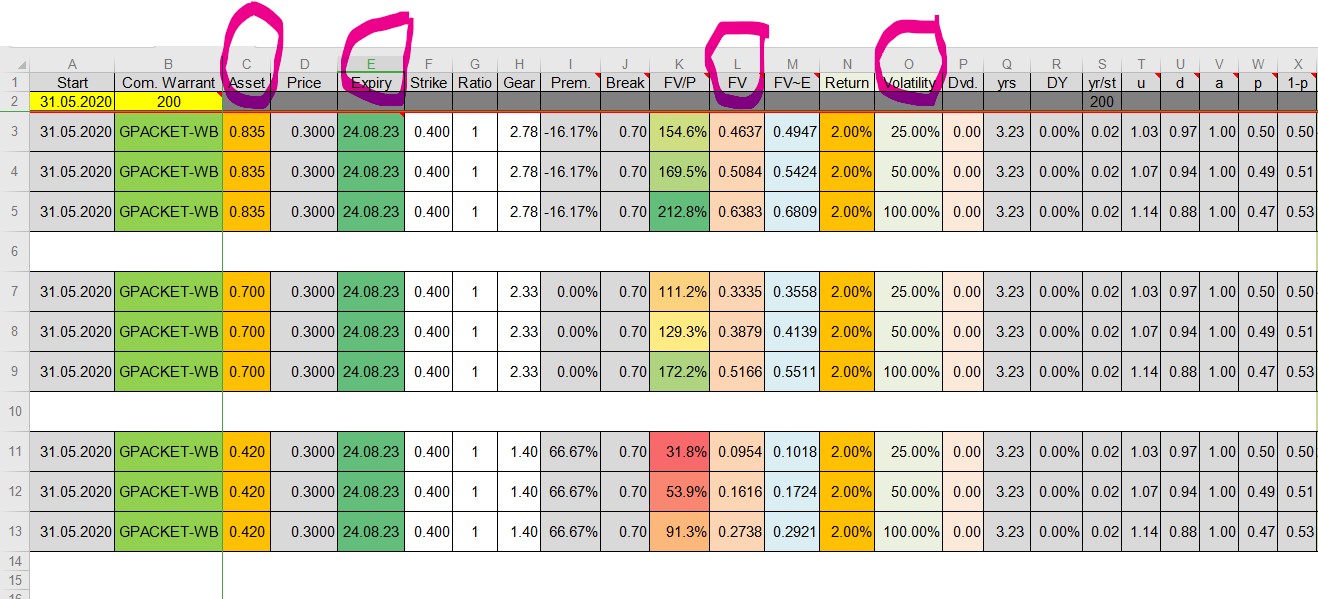

I want to busy body and calculate its fair value by using 200 steps binomial method.

The input required:

A) Expiry: I prefer to input Aug 2023 instead of Nov 2023, ie. 3 months earlier, as I believe any company warrant will be trading at discount when it is approaching expiry due to troublesome of conversion.

B) Asset, ie Mother Share Price, here I input 3 different prices:

B1) RM0.835, the current market price.

B2) RM0.700, equal to WB's price plus exercise price, ie. RM0.300 + RM0.400 = RM0.700.

B3) RM0.420, the lowest day closing price from the last 150 trading days.

C) Volatility, I suppose to input the average volatility for the period from now to expiry. I have to look at its historical volatility and assume it will remain more or less the same in future.

C1) 100%, as the volatility calculated from the last 90 trading days is 103%.

C2) 50%, be safe and chop half.

C3) 25%, the lowest volatility found in the last 150 trading days, before GPACKET became excited.

Look at the attached screenshot, the fair values are shown in column L.

Hehehe.....the fair values are ranging from RM0.095 to RM0.640, very much depending on the inputs.

Trade at your own risk, I neither own any GPACKET nor GPACKET-WB.

https://klse.i3investor.com/blogs/gambler/2020-05-31-story-h1507924158-GPACKET_WB_a_Big_Frog.jsp