FACBIND (2984) FACB INDUSTRIES INC BHD – 100% Upside Gain

Executive Summary

Share price : RM1.29 (as at 1 Jun 2020)

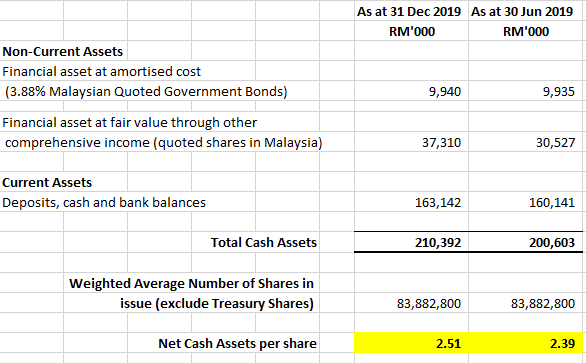

Cash Assets per share : RM2.51

NTA : RM2.69

Target Price : RM2.00 - RM2.60 (100% potential gain)

Background

FACB Industries Inc Bhd is an investment holding company. The Company through its subsidiaries is in manufacturing and sale of stainless steel butt-weld fittings, mattresses, bedding related products and furniture and investments in China. The Group comprises the following three reportable operating segments:

- Bedding;

- Steel Manufacturing; and

- Other operations.

FACB’s steel division is operated by its wholly owned subsidiary, KT Fittings Sdn Bhd. Due to losses over the years, FACB has cease the production of stainless steels fittings in the financial year ending 2018.

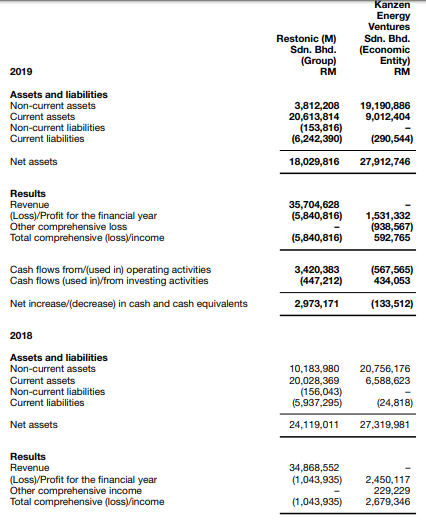

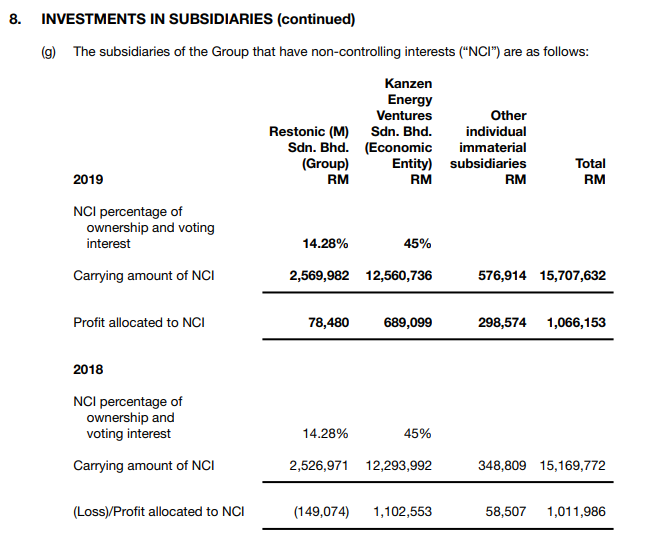

Other operations comprise investment holding, provision of management and secretarial services and marketing of steam. Investment holding, provision of management and secretarial services are in Malaysia whereas marketing of steam are via investments in associates in China held through subsidiary, Kanzen Energy Ventures Sdn. Bhd. (“KEV”). FACB owned 16.5% equity interest in power plant operations in China through KEV.

Based on the Annual Report 2019 (“AR 2019”) below, the power business associates will continue to be stable and generate satisfactory profit. The business to be well managed with continuous support from the major shareholder in term of steam supply.

Contribution from Associates Company

The power business of the associates above shown a strong financial position with very minimal liabilities. If to dispose off the associate, it will definitely generate a positive cash flow to the FACB.

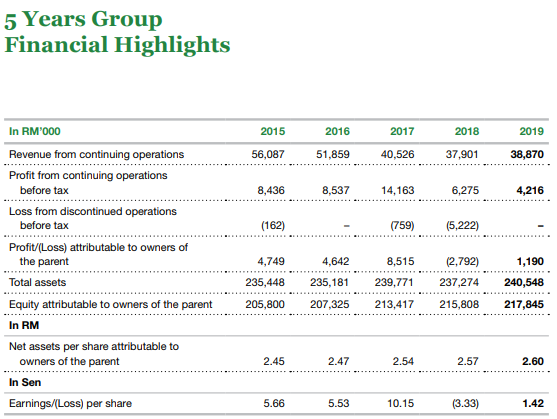

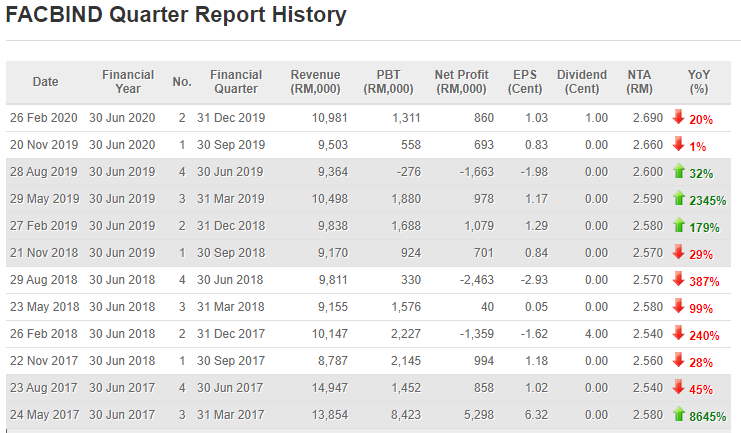

The quarterly results above doesn't show a fantastic profit earned over the years. However, one thing for sure - stability of the company as the Company continue to make profit (or incurred minor losses) over the year. Don't look into the profitability of this Company to determine the targeted share price but look at the cash assets of the Company (current worth).

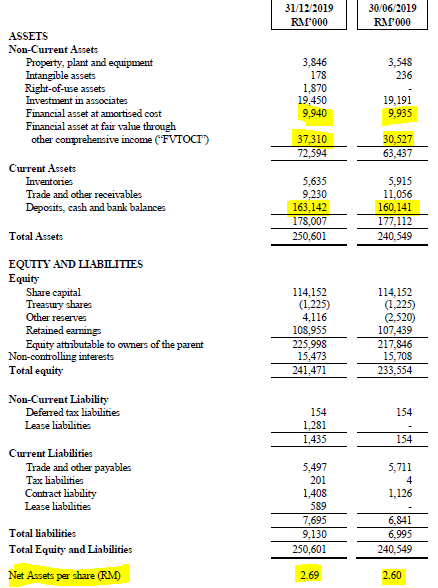

Consolidated Statement of Financial Position as at 31 Dec 2019

Cash Rich

As at 31 Dec 2019, FACB has MYR163m cash on hand with no borrowings. Based on its outstanding shares of 83.88m, FACB’s current net cash per share is RM1.94!!!!!!!!

IF to include the Non-Current CASH Assets (Quoted shares in Malaysia and Malaysian Quoted Government Bonds). Total cash assets per shares is RM2.51!!!!!!!!

Based on share price as at 29 May 2020 of MYR1.28 and it is only 50% of its net cash per share. In other words, in term of net assets, FACB was deeply undervalued. The share price has potential gain of 100% from RM1.29 to RM2.60.

Major Shareholder - Tan Sri Dr. Chen Lip Keong

Currently, Tan Sri Dr. Chen owned 30.16% equity interest in FACB and his wife Puan Sri Lee Chou Sarn owned 0.603% equity interest in FACB. According to Forbes 2020, he was the 4th richest man in Malaysia, with net worth of USD5.2bil.

He was also the controlling shareholder of Karambunai Corp Bhd. and Petaling Tin Berhad after privatised both Companies in 2019.

Conclusion

FACB is a very low profile stock with not much corporate exercise and news. FACB had set up a subsidiary in China to boast its online bedding sales previously. In Malaysia, consumer can buy the Dreamland beds through Lazada and Shopee during the CMCO period. It is expected to continue deliver good result.

With its huge chunk of cash on hand, FACB is considered a highly defensive stock in weak sentiment market due to Covid-19. In other words, its downside is limited. Technically, FACB is looking for a breakout soon, supported by an increase in volume.

Target Price : RM2.00 - RM2.60 (100% potential gain)

ps: Pls give a "LIKE" if you found this article useful

Disclaimer: All investment involves risk of loss. Nothing contained in this blog should be construed as an investment advice. Any reference to should not be construed as, a recommendation or as a guarantee of any specific outcome or profit

https://klse.i3investor.com/blogs/smartinvestorblog/2020-06-02-story-h1507952800-FACBIND_2984_100_Upside_Gain.jsp