Deleum Berhad is an investment holding company and through its subsidiaries, provides a diverse range of supporting specialised products and services to the oil and gas industry, particularly in the exploration and production sector.

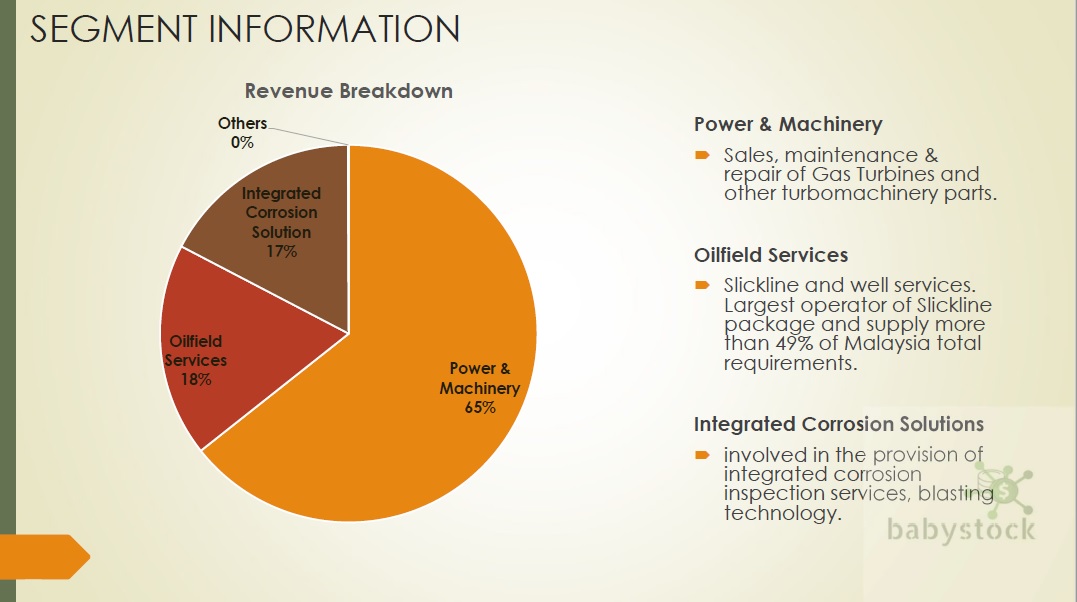

The followings are Deleum's core business segments:-

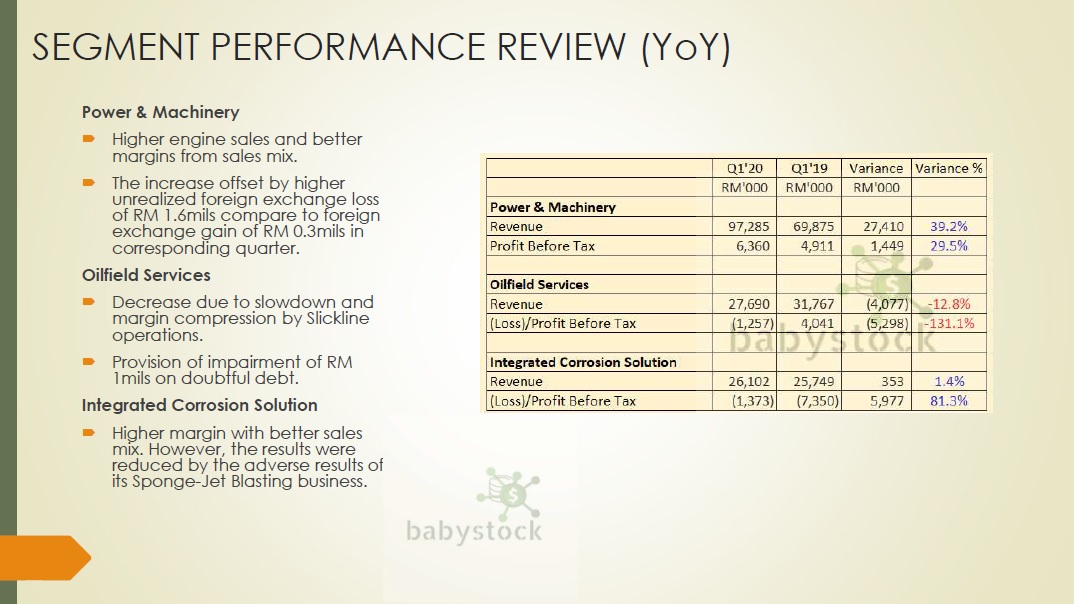

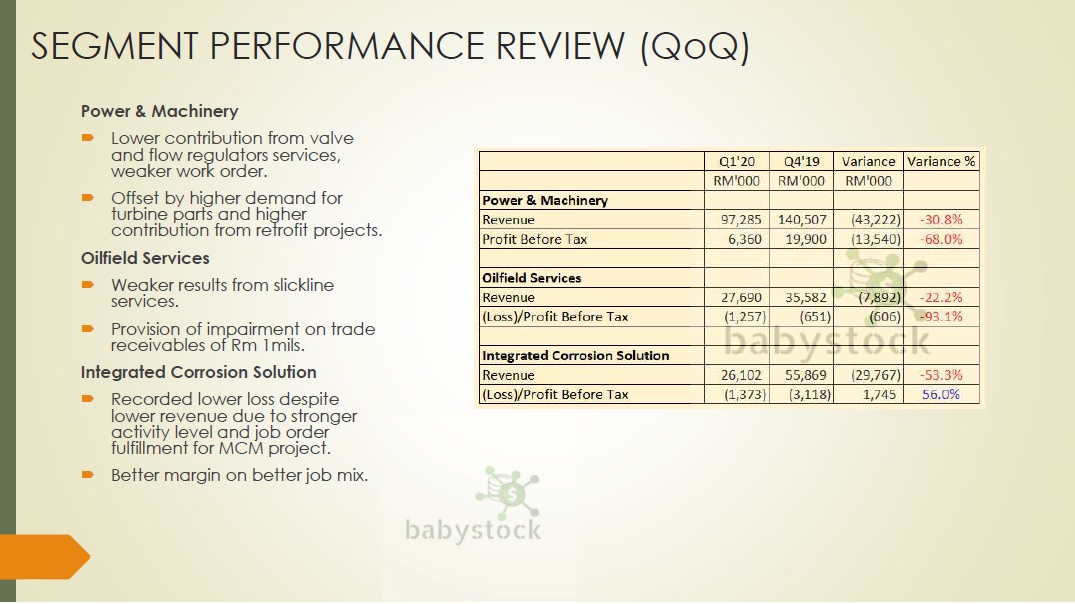

1) Power & Machinery

2) Oilfield Services

3) Integrated Corrosion Solution

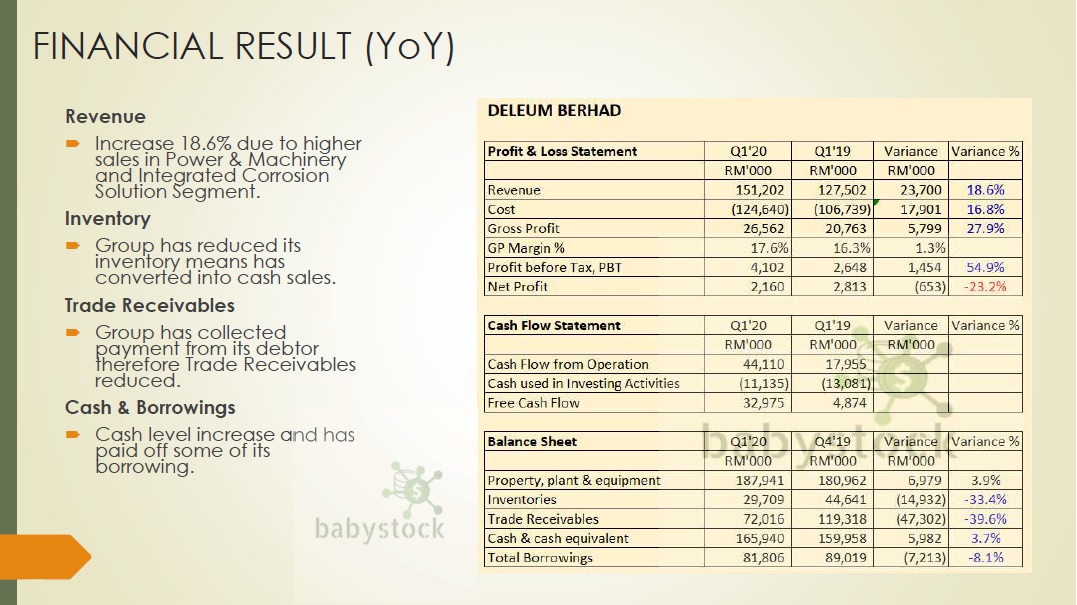

Deleum's has published their Q1 FY20 financial report on the 21st May 2020. Followings are the summary of the report. Deleum's having a net cash of RM 84 mils.

Global oil price have taken a plunge of 77% since Jan 2020 to 21-year low of USD14 per barrel. Being at Net Cash position has put Deleum in better position to overcome this challenging period as compare to its peer industry which mostly heavily in debt. The recovery of the oil price will bring benefits to the oil and gas company.

DISCLAIMER: THE ABOVE INFORMATION SOLELY BASED ON PERSONAL OPINION FOR RESEARCH, DISCUSSION AND EDUCATIONAL PURPOSE ONLY. THE ABOVE INFORMATION IS NEVER INTENDED TO BE A BUY/SELL CALL OPINION.

Stay tune and please follow our Telegram Channel for more latest information:-

Public Channel:

https://t.me/babystockchannel

Public Group Chat:

https://t.me/babystockpublicchat

https://klse.i3investor.com/blogs/babystockchannel/2020-05-31-story-h1507925144-Deleum_The_NET_CASH_Oil_Gas_Company_Riding_the_Recovery_of_Oil_Price.jsp