Date : 12 May 2020

STOCK : SUPERMAX CORPORATION BERHAD

Current Price : RM2.98

Target Price : TP1: RM4.30 - TP2 RM5.50

Target Price : TP1: RM4.30 - TP2 RM5.50

Last target : RM8.00 (Year-end-2020 - after *bonus issue / * Share split and It will keep growing in price.)

Call Warrant: C84 & C85

*All target prices has been revised from 1.40 - 1.80 Buycall.

WHAT KIM SAID ABOUT SUPERMX?

1. "TOMORROW FLY TO RECORD A NEW HIGH AGAIN TO BREAK RM3.12"

2. "GRAB THIS OPPORTUNITY. THIS FRIDAY THE PRICE SHOULD BE TEST RM3.50"

"Issuing

of bonus share is same as making narrower slices of the same pie. The

total size of the pie doesn't change by how many times you cut it."- Kim

NEW WAVES READY TO KICK IN

- The new Entry Price (EP) at 2.95 - 3.00

- The new Stop Loss (SL) at 2.81

- 2.93 & 2.98 as a piled and supported.

- 2.93 & 2.98 as a piled and supported.

- The last supported at 2.89

- The stock will go higher once 3.07 & 3.12 channel break and play range 3.10 - 3.15 stable.

- New resistance at 3.16. Once this line break. We will see immediate target at 3.20 & 3.45

- So base on my experienced and the pattern movement. We will meet on 15 May (Friday) the price will be at RM3.48 - RM3.50

- Next immediate target RM4.30 (June)

THE WARRANT ( Supermx-C84 & C85 )

Supermx-C84

- Exercise Value 1.7

- Exercise Ratio 4:1

- Premium 0.12

- Premium 4.03%

- Gearing 2.13

- Maturity 30 Nov, 2020 (6 month)

- Issuer Maybank Investment Bank Berhad

- Target Price: TP1: 0.63 sen - Base on target price *RM4.30

Supermx-C85

- Exercise Value 1.65

- Exercise Ratio 3:1

- Premium 0.08

- Premium 2.68%

- Gearing 2.11

- Maturity 30 Nov, 2020 (6 month)

- Issuer Ambank (M) Berhad

- Target Price: TP1: 0.97 sen - Base on target price *RM4.30

(For target RM5.50. Both price wll going to hit invisible level. You may contact me for details.)

LET RECALL ITS BACK ABOUT THIS COMPANY

Supermax produces various types of natural rubber and nitrile latex gloves to over 165 countries

such as the USA, European Union, Middle East, Asia and South Pacific

countries. The company is also involved in trading of latex gloves,

generation of biomass energy, trading and marketing of healthcare

products, medical devices and property holdings activities.

As Malaysia’s very first home-grown contact lens manufacturing company, It has obtained the necessary license and approvals to export its products to over 60 markets globally, including the USA and Japan markets which are two of the largest contact lens market presently. The contact lens brand, namely AVEO is distributed via its own global distribution network located in 8 countries, through joint ventures and appointment of authorized dealers in over 50 other countries as well as via e-commerce online sites available in three countries such as USA, Malaysia and UK. The brands owned by Supermax such as Supermax, Aurelia and Maxter are trusted and recognized by laboratories, hospitals, pharmacists, doctors and surgeons around the world. As we knew all of those countries are affected by COVID-19.

From

my perspective and prediction there is a big-boom sales from this

country alone (USA). So we dont need to figure out the other sales from

other countries llike Europe.

FINANCIAL REVIEW

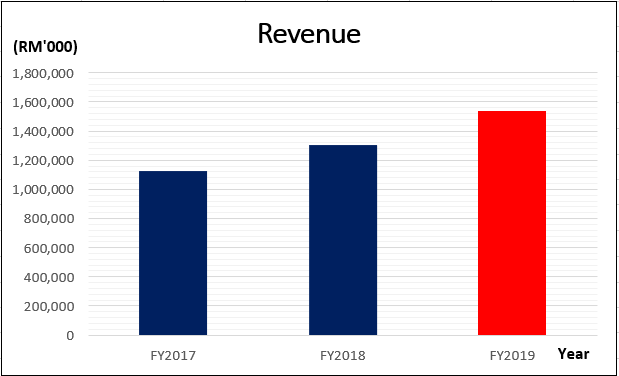

Supermax

has achieved a revenue growth of 17.92% from RM1.304 million in FY2018

to RM1.538 million in FY2019. Based on 3 years of CAGR basis, SUPERMX

has a revenue growth of 14.19%.

The increase in revenue was attributed on the back of increased of volume production arising from its ongoing rebuilding and replacement program as well as the ongoing efforts to fine-tuning and boost operational efficiency and production capacity.

The

commendable performance was achieved in the face of challenges such as

uncertainties caused by the on-going US-China trade war and Brexit, high

volatility in raw material costs and increased competition in the

global marketplace. Nevertheless, the company is committed to continue

working towards maximizing the company’s performance and stakeholders’

interest and values.

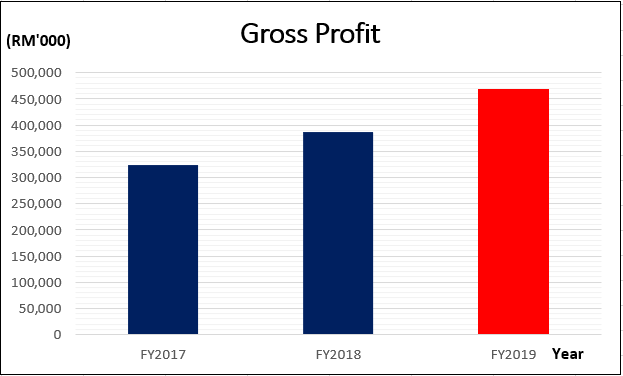

Supermax

has recorded a RM70.793 million increase in gross profit, translating

to a growth of 17.81% from RM397.523 million in FY2018 to RM468.316

million in FY2019. Based on 3 years CAGR, the company’s gross profit has

grown 8.48%.

The rise in gross profit was due to the increased output from newly commissioned lines at the company’s Perak plant under its rebuilding and replacement program, higher average selling prices (ASP) in response to higher raw material prices, a stronger dollar over the course of the year and resilient global demand for the medical gloves.

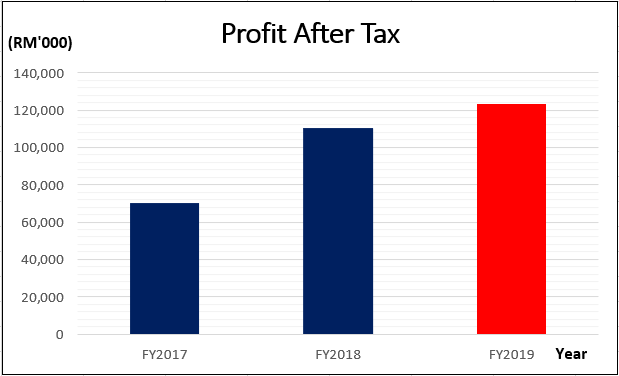

The

Profit After Tax (PAT) rose 11.77% from RM110.142 million in FY2018 to

RM123.103 million in FY2019. Based on 3 years CAGR basis, the Profit

After Tax (PAT) grew by 8.64% which was in line with the growth in

revenue and gross profit.

CASH FLOW STATEMENT

The

net cash from operating activities has provided a positive cash flow of

RM235.053 million in FY2019 as compared to RM177.188 million in FY2018

indicating that the company is healthy and has enough cash to use for

business expansion.

PROSPECT AND CHALLENGES

Supermax's

wholly owned subsidiary Maxter Glove Manufacturing Sdn Bhd has entered a

RM20 million sale and purchase agreement (S&P) with Nishimen

Industries (M) Sdn Bhd to acquire the industrial land measuring 16,654

square metres in Kapar. (Source: TheStar, 13 March 2020). The proposed

acquisition was for future expansion of it’s manufacturing capacity in a

strategic location near its existing cluster of manufacturing plants

(Plant No.12), which will facilitate the management control, operational

synergies and efficiency.

Towards end of 2019, the company has completed the acquisition of land in Meru, Klang on which it plans to build Plant #13, #14 and #15 that will contribute another 13.2 billion pieces of gloves to the group’s installed capacity over the next five years up to year 2024.

Supermax

also plans to build a new manufacturing plant (Plant 16th) over the

next few years, which will increase the production capacity by about 4.5

billion pieces per year.

For the contact lens business, the revenue is on the rise as Supermax continues to spend on advertising and promotions and managed its costs well. Even though this venture on the whole is not quite contributing to the company’s performance yet, it is becoming less of a strain on its performance which is positive for the company. Supermax will continue to work to obtain all the necessary licenses and approvals in order to export the products to more countries across the world. The company has spent over RM100 million to-date on this venture and remains optimistic and confident that over the medium to long term, it is building a business that will be value enhancing to all stakeholders.

INSIGHT

In

conclusion, Supermax has achieved a strong performance in FY2019 with

the highest revenue, gross profit and profit after tax over the past 3

years.

The

company’s prospect remains bright as the company continues to expand

its manufacturing capacity via acquisition, which enables the company to

grow its business to ultimately accrue long-term benefits.

The

demand growth is expected to continue particularly in the near-term

given the ongoing COVID-19 outbreak across the globe. This year

2020-2021 will be SUPERB for SUPERMX!

DID SHARE PRICES LOOKING TO BIG BULLISH?

- Shares Buyback

Recently,

30 Apr 2020 : 2.42 - 2.48 = 2,888,000

27 Apr 2020 : 2.34 - 2.45 = 1,672,100

23 Apr 2020 : 2.24 - 2.30 = 1,791,323

22 Apr 2020 : 2.08 - 2.14 = 2,660,600

21 Apr 2020 : 1.95 - 2.00 = 5,000,000

27 Apr 2020 : 2.34 - 2.45 = 1,672,100

23 Apr 2020 : 2.24 - 2.30 = 1,791,323

22 Apr 2020 : 2.08 - 2.14 = 2,660,600

21 Apr 2020 : 1.95 - 2.00 = 5,000,000

16 Apr 2020 : 1.87 - 1.91 = 5,888,000

15 Apr 2020 : 1.76 - 1.85 = 8,888,000

15 Apr 2020 : 1.76 - 1.85 = 8,888,000

= 28,788,023

So, my positive thinking and view as follows :.

1. Share buyback refer to a company repurchasing its own shares.

2. Share buyback boost share prices by reducing the number of outstanding shares in the market.

3.Share

buyback can benefit shareholders if they tick certain boxes. The best

use of cash, if there is not another good use for it in business, if the

stock is underpriced is a repurchase.

4. Share buyback should also be most beneficial when shares are bought back below their true value.

So, in simple terms.. share buyback means repurchase of shares by the company. It can happen in three ways.. :

1. Either the company purchases its own shares in open market

2. Issue a tender offer and lastly

3. Negotiate a private buyback

Also, for me there a some reason companies go for share buyback such as :

1. Attempt to boost earnings per share (EPS)

2. Reward shareholders

3. Undervalued shares

4. Lack of growth opportunities

5. Tax advantage

2. Reward shareholders

3. Undervalued shares

4. Lack of growth opportunities

5. Tax advantage

For this SUPERMX case, I had chose no. 3 (Undervalued shares)

When the company feels the shares are undervalued, a share buyback is

used to pump up the stock price, which acts like a support or new base

for the stock.

There

could be a number of reasons why shares of a particular company are

trading lower despite stable fundamentals. A buyback reassures investors

that the company has confidence in itself and is determined to work

towards creating value for shareholders.

So,

this is the time company protect their value of price. Of course its

among the best Glove Counter which is still 3rd liner lower P/E 38.76

now from the lowest P/E 25 on Feb-Mar 20. My target P/E is 70-80

Currenty Big 4 (Four) P/E now :

Harta = 60.77

Topglov = 49.09

Supermx = 38.76

Kossan = 33.28

Topglov = 49.09

Supermx = 38.76

Kossan = 33.28

I

just want to focus my fav Supermax. As we know this company is spending

RM1.1 billion to increase the production capacity from the current 24

billion pieces per annum to 27.4 billion pieces by 2020 and 44.1 billion

pieces per annum by 2024. I noticed the last pevious announcement that

company bought a 5-acre piece of industrial land in Meru, Klang Selangor

for RM20 million for future expansion of its manufacturing capacity.

This is a simple reason that we can see how much the confidence level

from management.

The

plan is to construct a new manufacturing plant No. 16 over the next few

years, which will increase the group's production capacity by about 4.5

billion pieces of gloves per year. This acquisition is in the best

interest of the group as it enables the group to expand and grow their

business to ultimately accrue long term benefits to the shareholders.

So,

from RM1.29 till current price. The movement has been done approx 130%.

With the available cash company, I am strongly believe the bonus issue

will happen again this year when significant prices has reach. My

estimation at RM5-RM6. If this happen, its good? or bad sign?

ISSUING OF BONUS BY COMPANY. IS IT A GOOD OR BAD SIGN?

- Bonus Issue occurs

when additional (free) shares are given to the existing shareholders,

based on the number of shares they already have. For instance, if a

company declares a 3:1 bonus, you will generally get 3 bonus share for

each share you own. Hence, making you to have 4 shares on hand after the

completion of bonus issue. Have a go at the quick test below to see if

you understand the concept of bonus issue.

- Bonus Issue is

a stock dividend, allotted by the company to reward the shareholders.

The bonus shares are issued out of the reserves of the company. These

are free shares that the shareholders receive against shares that they

currently hold. These allotments typically come in a fixed ratio such as

1:1, 2:1, 3:1, etc.

If the ratio is 2:1 ratio, the existing

shareholders get 2 additional shares for every 1 share they hold at no

additional cost. So if a shareholder owns 100 shares then he will be

issued an additional 200 shares, so his total holding will become 300

shares. When the bonus shares are issued, the number of shares the

shareholder holds will increase but the overall value of an investment

will remain the same.

To illustrate this, let us assume a bonus issue on different ratios – 1:1, 3:1 and 5:1

- Easy Picture

Company A announced to give out bonus share in the ratio of 2:3

Shareholder X has 6000 existing shares on hand.

Q : So how much shares would Mr.X have after the completion of bonus issue?

Calculation:

2 bonus shares for every 3 existing shares.

6000 shares entitle for: 6000*2/3 = 4000 bonus shares

Total shares after completion of bonus issue= 6000 + 4000 = 10,000 shares

6000 shares entitle for: 6000*2/3 = 4000 bonus shares

Total shares after completion of bonus issue= 6000 + 4000 = 10,000 shares

Sounds GOOD right? You just get some

FREE shares! But still, you need to know that there are several facts

that you need to know about bonus issue.

Firstly - bonus shares are normally paid using the company’s retained earnings. This means that the available cash reserve for the company will reduce, which could possibly lead to lower dividend in future.

Secondly - bonus issue is sometimes considered as a substitution to dividend, in the form of non-cash repayment.

Thirdly - when the number of shares increases, the market normally balances the share price. It’s hard to explain this without a real scenario. Thus, let’s ignore this for a while and come back to this statement after going through the case study later. At this point of time, you just need to be aware that after bonus issue, the share price will normally decrease accordingly.

Fourth - Bonus issue is in fact a way to encourage retail investors’ participation in buying a stock. In the third point, we have discussed that the share price will drop. Now, when the share price is lower, more investors could afford to chip in.

Fifth - Issuing bonus shares increases the issued share capitals (outstanding shares to be specific). This could create a delusion that the company is larger than it really is.

So, in this case. I am forsees the company will declare soon this BONUS ISSUE at RM5.50. The reason I chose is no Fourth -

Bonus issue is in fact a way to encourage retail investors’

participation in buying a stock. In the third point, we have discussed

that the share price will drop. Now, when the share price is lower, more

investors could afford to chip in.

ONCE the bonus issue declared - the shares price will come again and ready to go next level at my last target price RM8.00

LETS SEE SOME CASE STUDY

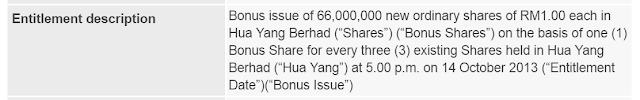

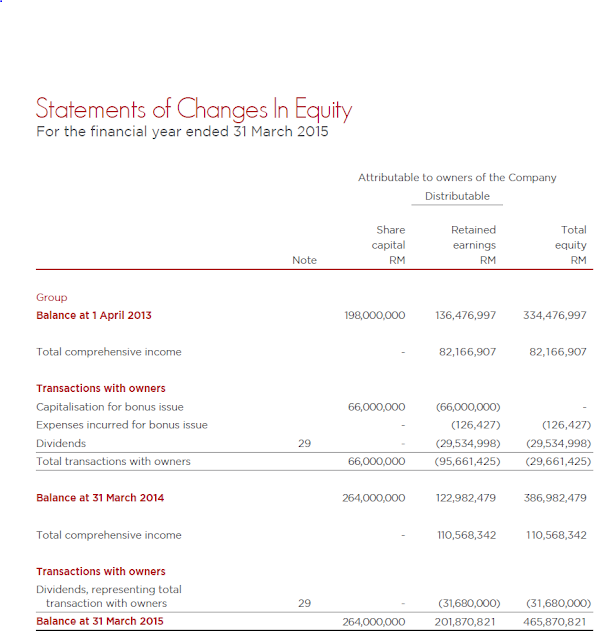

After understanding the concept, let’s have a look at a real case study. The selected stock is Hua Yang, a property counter. Back in 2013, the company announced bonus issue on the basis of 1:3. So, for every 3 existing shares, the shareholder will get 1 bonus share. From the notice, we can see that the company issued 66,000,000 of new bonus share. At the par value of RM1, therefore, the total share capital is increased by RM66 million. At the same time, RM66 million was deducted from its 2013 retained earnings, as the bonus issue was funded by the company’s retained earnings.

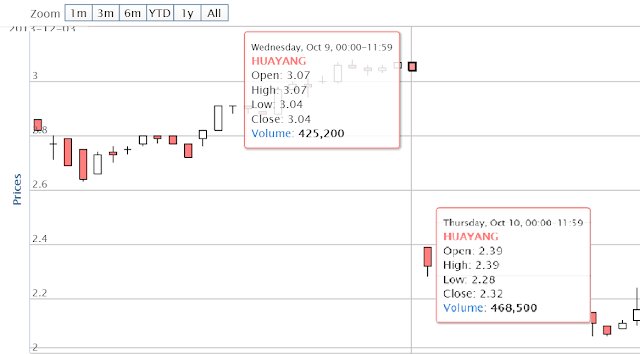

Now, recall back what we have

discussed in the third fact earlier, the market will readjust the share

price after bonus issue. Looking at the historical price chart below,

you will notice that HUAYANG share price dropped from RM3.07 to RM2.39

just in a day. See, this is how the market balances itself, which also

reflects the perceived fair price by the market.

To predict how much will the share

price change, it is not hard too. Using the basis of every 3 existing

stock produces 1 bonus stock, RM3.07* (3 stock)/(3+1)stock=RM2.31.

Advantages of bonus shares

Following are some of the advantages of bonus shares. I am looking the view from different persective.

1. From company’s point of view

Issue of bonus shares facilitates a company to conserve cash which can be further reinvested for carrying out different operational and functional activities. At times when a company is not in a position to pay dividends in the form of cash then the only means to satisfy shareholder’s desire for dividend is giving them some extra shares in the form of a bonus. Helps in building a better market image and attract more number of small investors.

2. From investors point of view

Investors get tax benefits as no tax is levied on additional bonus shares issued to them. Long term investors are benefited to large extent with these shares as they are willing to expand their investment in that company and believe in long term story of the company. In future when the company will pay a dividend in the form of cash, investors will receive more as they will be holding more number of shares.

Disadvantages of bonus shares

1. From company’s point of view

With this additional issue of shares, the company does not receive any cash which reduces the company’s ability to raise its capital. Issue of bonus increases the number of outstanding shares which will decrease future EPS (Earning Per Share).

2. From investors point of view

Not all investors are happy with the bonus shares. As they may be interested in cash to fulfill their other objectives for which they have made this investment. It does not give any extra wealth to shareholders as share price drops to some proportionate amount to maintain the market capital of the company same as before.

These are some of the advantages and disadvantages of bonus shares. They can be issued after twelve months from the issue of shares for consideration and only out of reserves which are created from profit realized in cash that is a company must have a significant amount of undistributed profit. Also this proposal made by the board of directors is first approved by existing shareholders in a general meeting.

Bonus shares do not directly affect a company’s performance. Bonus issue has following major effects.

1. Share capital gets increased according to the bonus issue ratio.

2. Liquidity in the stock increases.

3. Effective Earnings per share, Book Value and other per share values stand reduced.

4. Markets take the action usually as a favorable act.

5. Accumulated profits get reduced.

6. A bonus issue is taken as a sign of the good health of the company.

WHAT KIM SAY?

1. "TOMORROW FLY TO RECORD A NEW HIGH AGAIN TO BREAK RM3.12"

1. "GRAB THIS OPPORTUNITY. THIS FRIDAY THE PRICE SHOULD BE TEST RM3.50"

"Issuing

of bonus share is same as making narrower slices of the same pie. The

total size of the pie doesn't change by how many times you cut it."- Kim

Good luck and stay tuned! #staysafe #stayhome

Only the rubber sectors will have a big jump and bright prospect for now!

Best regards.

Kim

The Founder Of Kim's Stockwatch

https://klse.i3investor.com/blogs/spartan/2020-05-12-story-h1506852581-THIS_STOCK_HIGHLY_CHANCES_FOR_BONUS_ISSUES_SKY_S_LIMIT.jsp