Please be reminded that this is NOT a ”pump and dump” motivated article nor a recommendation. It is just my comprehensive studies on this interesting company. Please seek advice from licensed investment representative for the recommendation!

• Before we start, congrats to MINETECH followers given the share price rebounded as my comprehensive studies expected. Please refer to my previous article here. https://klse.i3investor.com/m/blog/fatprofitstock/2020-04-25-story-h1506132918-FORGET_GLOVE_RELATED_PLAY_THIS_STOCK_CAN_RALLY_A_SPIKE_EVEN_MORE.jsp

• Now, my next comprehensive studies are on the glove/healthcare-related stock, which is K1 Technology. It is relatively unknown to investors that K1 involves in glove/medical/healthcare products. The company is not a glove producer but its niche is in the healthcare/medical devices,

IoT devices, consumer electronics lifestyle products, automotive

aggregates, security/surveillance gadgets, industrial products and

mobile phone accessories' markets.

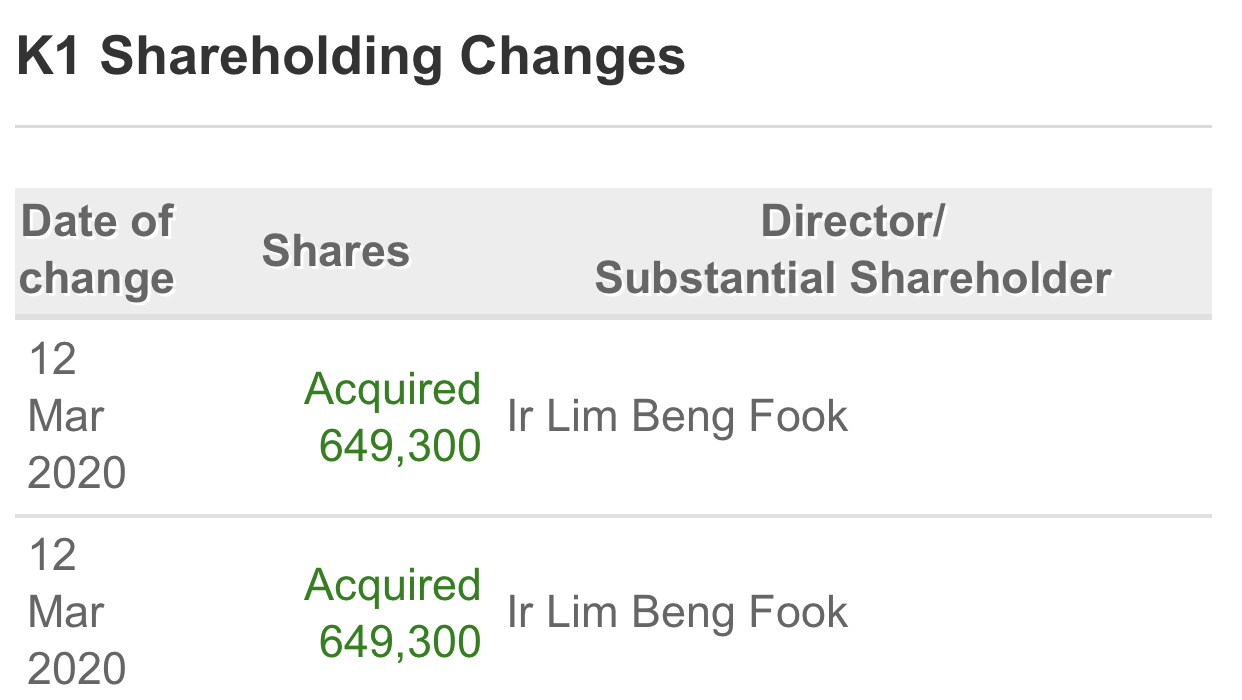

• The boss, IR. Lim Beng Fook acquired shares on 12 March 2020.

• According

to management, K1 has accelerated the extension of its

medical/healthcare product range to include Personal Protection

Equipment (PPE) in an effort to combat the spread of Covid-19. K1 has been constantly receiving requests on the supply of PPEs such as masks, face shields, gloves and disposable gowns and stepped up its efforts to supply the much-needed PPEs to meet the market shortage.

• K1

also ventured into the manufacturing of ventilators as announced on

13th April 2020 for the supply to the hospitals given ventilators are in

short supply in many parts of the world for use in hospitals, particularly Covid-19 patients. On top of this, K1 is assessing the design and development of swabs used to collect a sample from people’s nose for Covid-19 tests.

• Blessing in disguise, the demand for its medical/healthcare products will surge due to the prolong of Covid-19 crisis. According to Ministry of Health (MoH) director-general Datuk Dr Noor Hisham Abdullah, pointed

to the World Health Organization's (WHO) prediction that Malaysia will

still be at “war” with Covid-19 even until next year, unless a vaccine

for the coronavirus is found and made available to the public.

• K1 has been given approval from MITI for the company to operate during the MCO.

• Sum all these up, K1

is expected to register stronger earnings growth in the upcoming

quarters’ results like other glove makers and healthcare players will

do! The

recent surge in demand on the supply of its medical/healthcare products

could contribute to double-digit growth in its revenue and to the

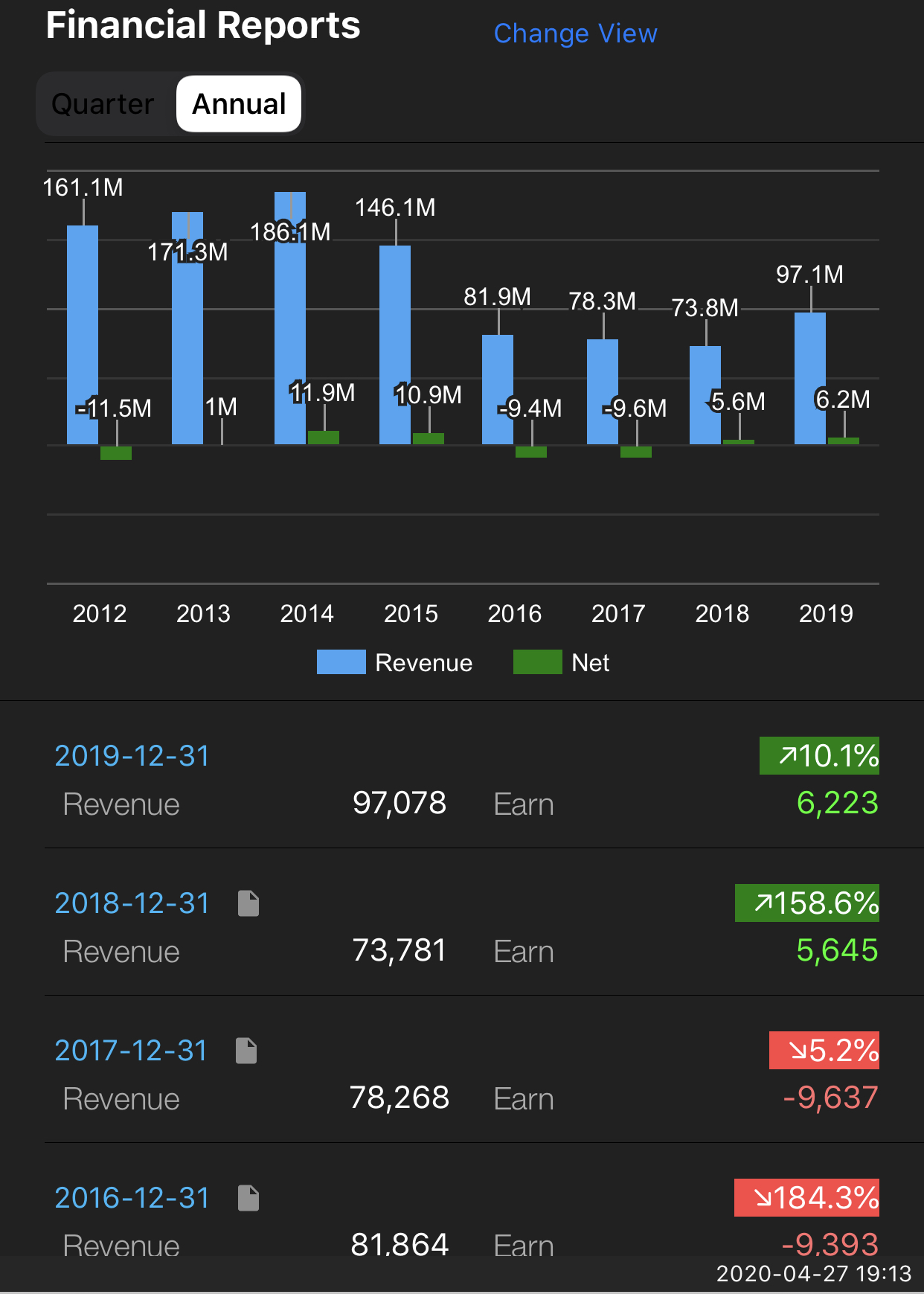

bottomline! In fact, both its annual revenue and earnings are improving

in an uptrend!

• In terms of PBV valuation, ignore PE ratio because we do not have a projection for other companies for comparison, K1

has been trading at 1.34x PBV, which is still below other Covid-19

related stocks’ PBV valuation, whom have been trading at a premium of

healthcare sector’s PBV valuation of 2x.

For example, a recent venture into Covid-19 test kit stocks:

HLT: 3.4x PBV as of today

HWGB: 3.3x PBV as of today

Meanwhile, healthcare equipment related:

LKL: 2.9x PBV as of today

• So, if those stocks above can be traded higher at around 3x PBV, why not K1? The stock has been unfairly traded at 1.34x PBV only. To be conservative, should K1 trades at 2x PBV, it would imply 32sen fair value!!! A blue sky-scenario, at 2.5x - 3x PBV to be same with others would imply 40sen - 48sen!

• From a technical perspective, the

stock has maintained above upwards 200-day SMA line for 3 days now and

the gap up has never closed, indicating a potential strong rally ahead,

pending a breakout of 23sen!

• The stock has also been trading above all upwards 5, 10, 20, 50 day-SMA lines. In fact, 20-day SMA has golden crossed over 50-day SMA. This indicates a bullish landscape.

• On a weekly basis, MACD histogram has turned into positive territory last week, above zero line and will expand further this week. This means the stock is very likely to trade higher this week! WILL K1 SKYROCKET LIKE SINOTOP TODAY?!

• Money flow Index indicator (MFI) has shown a spike in the inflow of money over the last two weeks. This indicates an aggressive accumulation in the stock ahead of the rally in the price this week!

https://klse.i3investor.com/blogs/fatprofitstock/2020-04-27-story-h1506163478-THIS_GLOVE_HEALTHCARE_RELATED_STOCK_IS_UNDER_RADAR_AND_WILL_SKYROCKET_T.jsp