I will choose to paraphrase, since some individuals can definitely write a better story than I obviously can.

In the third week of the month of March 2020, the stock markets all around the world crashed. Many investors, me included, had experience sharp drop of the value of their stock portfolios. I sympathize the predicament of every investor who suffered during this period. This article is written purely for sharing of an investing behaviour for readers to ponder about its merits and pitfalls in order to make informed decisions, rather for criticizing anyone’s investing strategy.

Now, as many of you know by now, I am a qualitative investor, meaning I use qualitative valuation (scuttlebutt, or simply understanding the business first and foremost) analysis to make decisions about how to invest in the market, then applying FA and TA to my buying/selling methodology.

Recently, I have seen more and more "sifus" coming out during crisis periods to talk about the dangers of MF, or MARGIN FINANCING. Especially those who have not used margin before, or understand it well, far less take advantage of it to generate gains. They see dangers everywhere, and are always thinking of safety of margin, and not being in debt etc etc.

However, that is what equity investing is all about: managing risk to generate a superior return.

Here are 3 mental models about investing that you may or may not be aware of:

1. Risk/Reward is always most dangerous when the markets are full of positivity, Bull mode is at peak. Even if it doesn't feel like it, the WORST time to invest is actually when EVERYONE IS MAKING MONEY.

2. Risk/Reward is always safest when the markets are full of negativity, Bear mode is at peak. Even if it doesn't feel like it, the BEST time to invest is when EVERYONE IS LOSING MONEY.

3. The biggest hindrance to an intelligent investors is not intelligence or hard work, but emotions. RATIONALITY is the INTELLIGENT INVESTORS BEST TOOL.

This is why, in howard mark's latest memo on calibrating,

https://www.oaktreecapital.com/docs/default-source/memos/calibrating.pdf?sfvrsn=6

A wonderful phrase immediately came up to me, "WHEN THE TIME COMES TO BUY, YOU WON'T WANT TO." It's never easy to buy when the news is terrible, prices are collapsing and it's impossible to know where the bottom lies.

BUT DOING SO SHOULD BE AN INVESTORS GREATEST ASPIRATION.

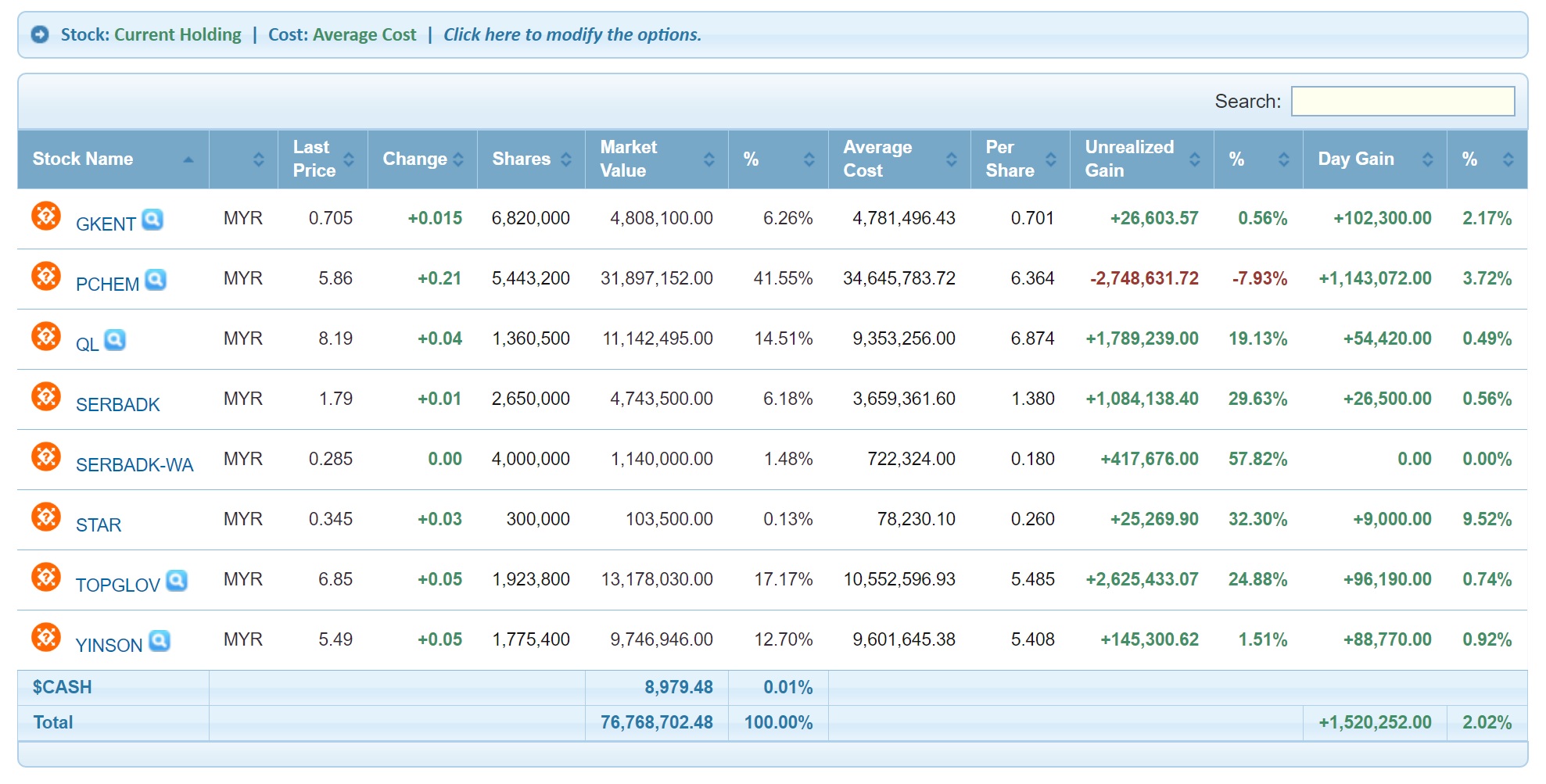

Now I have kept a trackable portfolio to explain my methodology and my actions to match this concept, and the results of my "storytelling" as sifu kcchongnz likes to put it, are here:

Now, before you go ahead to say that I am boasting or "showing off", please be advised that majority of the amounts is from a multiple sources, mainly MARGIN FINANCING. In essence, I personally believe in the power of margin financing, DONE RIGHT, can be a wonderful tool to generate debt that will drive superior returns in the long run.

DEBT can be a KILLER, or it can be a wonderul COMPOUNDER, if you know what you are doing.

Dont believe me? You can ask Warren Buffett on the application of COMPOUNDING OF BORROWINGS TO GET SUPERIOR GAINS.

Yes, that is 100 billion in borrowings, to grow a business. Does Warren Buffett shy away from applying debt to business? OF course not. Therefore, why should you avoid margin financing? Obviously, there is risk in borrowing money to put into a business that you know little about, but like in real life, you should never go into debt to borrow money for a startup, do a business you have no experience in, borrow to friends and family to help them start a business (unless you treat it as a donation from the beginning) etc.

But imagine if I could borrow you 1 billion for a year at 1%, and if you couldn't pay it back your entire family would be beheaded. Would you take the loan? I don't know about you, but I definitely would. I would simply put it in a fixed deposit for 12 months at 3%, and get 20 million free of risk (or as miniscule as you can plan it). The point I am trying to make is: if you know how to manage risk, and if you understand risk (not in a stock price action way, but in a real world business way) you would quickly know what businesses can be bought, which you can borrow money to, and which you should always avoid.

Simple enough? EXACTLY.

The problem is many sifus try to use hard to understand concepts like magic number, golden rule, SMA200, cup and handle etc to try to sell books and subscription classes and stretch a course learning length. The simple fact about investing is that long term wealth is made via the simple application of understanding a business, rationally investing in it, and participating the long term growth of the business. That is how buffett did it. That is how jeff bezos did it. That is how zuckerberg did it. Imagine what would have happened to them if they sold out early just because the price was going up? How do you know the future?

Now, to the title, let us understand what KCCHONGZ is doing and what KYY is doing with respect to applying margin financing.

Let me take a favourite sport of mine to give some "storytelling",

KCHONGNZ

KOON YEW YIN

Now if you were around in the 80s and 90s you would be familiar with these two and their playing styles. One is a very defensive player, who enjoys long rallies and defensive services to stretch the game and win via stamina battles. The other one is world famous for his heavy smashes and aggresive playstyle, which have captivated the world. Obviously one playstyle is more effective than the other in the real world (guess who has his own badminton racket company and won olympic gold medal).

But the point I am trying to make is this: Foo Kok Keong is famous for his defence, of not taking risk or the fancy play. He is someone who does not use smashes (lets call it MF here), but uses long rallies (value investing) to make drop shots and wear his opponent down. He doesn't win big, but he does win some. (you have to give KCChongnz credit here, for him to have the guts to write a stock investing book, it must be because he does have some returns to supplement his book writing activity). But the sad truth about Foo Kok Keong is this:

His results have always been less than spectacular, and his victories have always been marred because of the calculated risks that he did not take. And that is what winning(investing) is about in the end, taking calculated risks for a superior reward.

On the other hand, we have the legendary Yang Yang to proxy KYY. Everybody knows who Yang Yang is around the world, even today. He won the first Gold Medal for Badminton in the Olympics, he has an awesome badminton racket, and he is legendary for his smashes. A smash is a good analogy for taking on margin. A one shot, all in jumping body raised hit with all your strength to get the point. Yang yang was always famous for his cross court super smash. His multiple golds came from his dominance (golden rule), which led to many individuals preemptively fearing his smash (pump) and the followed by the dropshot (dump) that somehow no one seems to expect and are always suprised when it does happen. The problem with Yang Yang is also the same correlation, his smashing power and the aggresiveness of his play shortened his playing career. His success was followed by a very steep and sharp drop in competitiveness due to multiple injuries, which made him retire early after a string of losses and turned instead to coaching. ( a few successes in Liihen, hengyuan and Latitude tree followed by duds in JAKS and Dayang)

Of course the similarity ends here, KYY is no Yang Yang, and KCCHONGNZ doesn't even know who foo kok keong is. The point I am trying to make is simple, too much application of margin ALL the time will not give good results, as we now know. And the reverse is true as well, ZERO application of margin will also not give good results, especially if you take into account opportunity costs and loss of time (the most important commodity), when investing returns in the long run.

SO HOW TO USE MARGIN?

To dive down to the exact dates of my investments and purchases, you can go here:

https://klse.i3investor.com/servlets/pfs/120720.jsp#tabs_group2

I posit a more consistent way of using margin financing, that has worked for me over a long time. My first two investments that have allowed me to go into heavy margin (and the fact the the prices did not go down at all during the Covid19 crisis shows the importance of business prospects rather than accounting valuation, or PE50 companies are bad), is QL resources in 2009, and Topgolve in 2010. Now, I am not advocating you to buy these stocks at all, as I have owned them for a very long time, and I usually just reinvest dividends into them instead of outright purchase( which I neglected to do in topglove, due to my anger at their previous botched M&A activity).

However, owning these stocks was a godsend, as the collateral for these stocks were set at full price (by the bank unlike certain penny stock counters) instead of lowered valuation. I was therefore able to gain a lot of margin financing that I was able to deploy at high prices to average down on stocks whose valuation was cheap when I first bought them, and became more and more discounted during the crisis. As these two stocks buttressted my entire portfolio, I was able to continuously do my buying and averaging down on good wonderful stocks.

To simplify, NEVER use margin when the stock is going up, as you will never know when it is going up naturally or due to being manipulated. I find that the best use of margin is in averaging down, especially if you know the businesses and the companies that you are investing well in advance.

Remember rationality? When applying margin, you use it the same way, to collect undervalued stocks and cheap downtrodden prices. What fish did I shoot in the barrel? Imagine buying PCHEM at 4.09 (below IPO price, 12b in net cash), GKENT (0.46 almost nett cash), the STAR media (0.26, when cash is 40 sen per share), boon siew honda (oriental at RM4.62, genting RM3.05, hapseng RM7.02 my wife's personal bet). All of the wonderful companies in Bursa Malaysia, with huge cash positions, monopolies and long history of earnings.

If you want to apply margin, buy the guaranteed companies. The blue chips. Those with long history of making money, and cash pile to survive the crisis. Buy low, Sell High (don't forget to clear the debt, it is still borrowings). It is my long term experience to know that during the good times, the fastest and craziest to rise are the penny stocks that everyone is speculating on. During the bad times when the tide is up and everyone is swimming naked, the ones to recover fastest are those companies with huge cash pile, good balance sheet, wonderful management and good continous orders.

Before you know it, you would have slapped your forehead and asked why you didn't buy more of your stock when you could have. It is your fear, your misunderstanding of the word debt, and how to correctly apply it.

WHEN THE TIME COMES TO BUY, YOU WON'T WANT TO.

Philip

And just to end, lets support a creative writer in our midst:

More importantly, in order to be successful in investing, one must

treat buying a stock as investing in part of a business. He must

understand the business, its performance, finally if it is offering at

an attractive price. There are some good investment books in the market

to provide you with some guidance. This book below is one of them.

If you are interested to purchase one and posted to you within a few

days during this lockdown period, you may email him. Just don't expect

him to provide proof of investment results.

Happy investing.

KC Chong - ckc15training2@gmail.com

https://klse.i3investor.com/blogs/philip4/2020-04-20-story-h1506046419-THE_PROPER_APPLICATTION_OF_MARGIN_OR_HOW_KCCHONGNZ_AND_KOON_YEW_YIN_GOT.jsp