Please be reminded that this is NOT a ”pump and dump” motivated article nor a recommendation. It is just my comprehensive studies on this interesting company. Please seek advice from licensed investment representative for the recommendation!

After my comprehensive studies on MINETECH, which saw the share price skyrocketed from 12.5sen (at the time of writing) to as high as 29sen yesterday despite nearly miss my own assumption TP of 33sen, it was a handsome profit for those readers and followers!

My next comprehensive studies is as below:

SYMLIFE - UNDISCOVERED GEM AND HUGE UNDERVALUED

• Although the share price has been disappointed over the past 3-5 years, this year could be a glory year for SYMLIFE!

• Majority shareholder - Tan Sri Azman Yahya. He added more shares in Nov 2019 via dividend reinvestment plan.

•

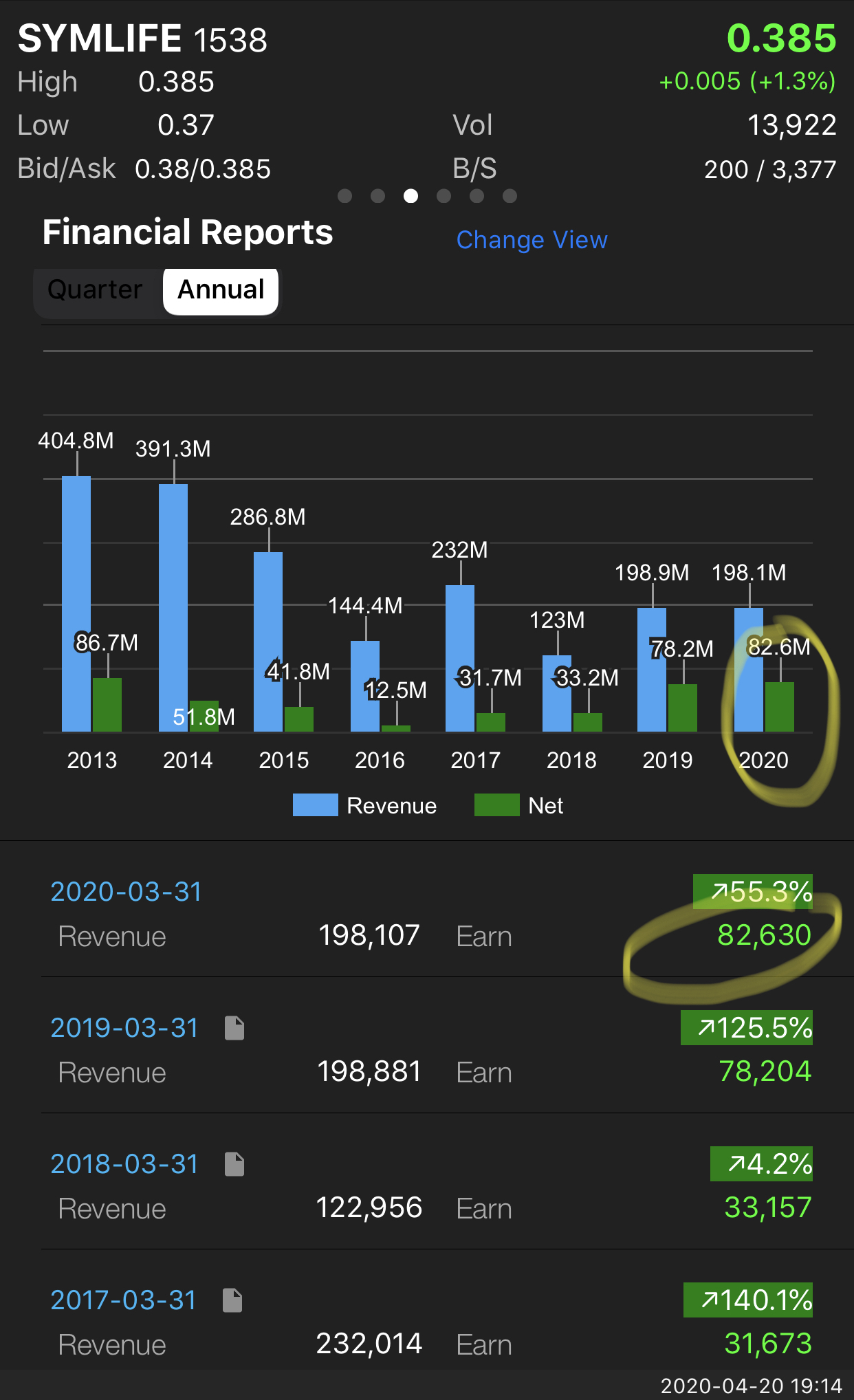

During the past 6 years, the Company’s net profit just recorded as low

as RM12.5 million in FY16 (ended in March) to as high as RM51.8 million

in FY14 before showing improvement to a record high of RM78.2 million in

FY19.

•

Unlike past years, in the current FY20 (ended March 2020), its 9MFY20

has shown a drastic increase in its earnings to RM82.6 million, thanks

to its JV project, Star Residences through 50%-stake in Alpine Return

Sdn. Bhd. This 9MFY20 earnings alone almost surpassing its historical

high earnings of RM86.7 million in FY13. This was despite gloomy in

property market. This should thanked to a well execution plan and

selective project implementation by a strong management of the Company,

led by Tan Sri Azman.

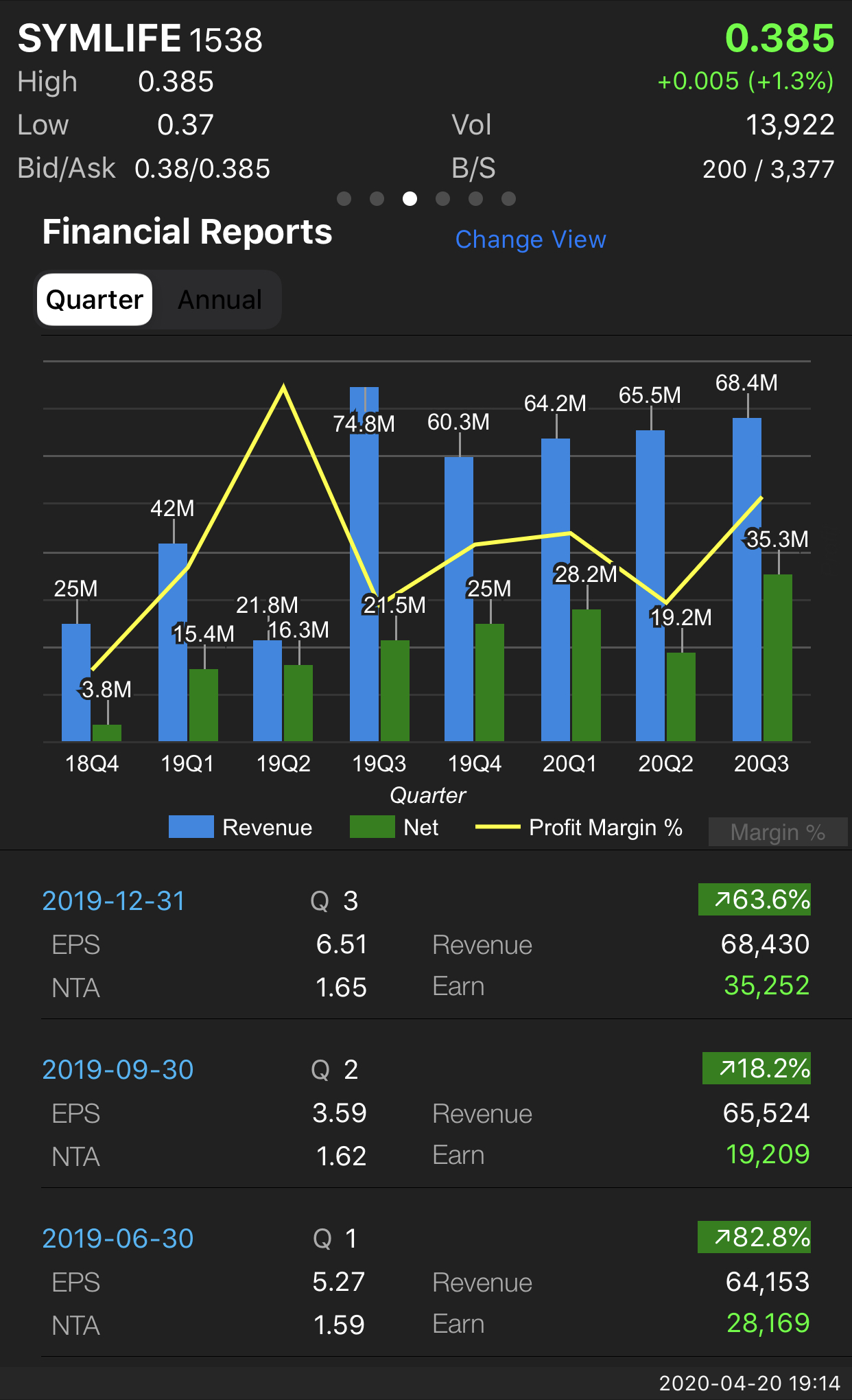

• Quarter-on-quarter, the results have shown improvement with an uptrending in both revenue and net profit since 4QFY19!

• According

to Management in recent quarter results statement, the JV will continue

to contribute and become the largest contributor to its earnings in the

next 2 financial years. Assuming conservatively its 4QFY20 would

only be half of its 3QFY20 of RM35.3 million or EPS of 6.51sen due to

MCO in March, its FY20 earnings could reach RM100 million or EPS of

16.7sen surpassing its historical high earnings record in FY13! At

current price of 38.5sen, it only implies P/E ratio of 2.3x!

• So,

now assuming its 1QFY21 earnings only half of its 3QFY20 earnings due

to MCO in April and the remaining 3 quarters of FY21 would be similar to

its 3QFY20 to be conservative (without any growth), its estimated FY21

earnings would be around RM123.6 million or EPS of 20.6sen. Could be

all-time high earnings! This implies even cheaper forward P/E ratio of

1.87x!

• Assuming SYMLIFE

trades at 6x small cap forward P/E ratio, it would imply a targeted

price of RM1.23! The implied price of RM1.23 would still be below its

NTA.

• At its NTA of RM1.65, its PBV is trading at steep discount of 0.23x only. Even,

if it trades at 0.3x or 0.4x PBV, the implied price would be around

49.5sen to 66sen! Still a bargain at current price of 38.5sen!

• Technical-wise, there has been a spike in the inflow of money into the stock. In

fact, current consolidation in share price has only seen very minor

selling (small volume). It means big sharks have been aggressively

accumulated this stock and supported the price in anticipation of price

rally ahead soon. Evidently, we can see long-legged candlesticks in

recent days and yesterday, it closed higher at 38.5sen despite negative

market sentiment at the closing period.

•

The stock has now been trading above all upwards 5, 20 and 50-day SMA

lines and now on the verge to break above 200-day SMA line.

• On a weekly basis, MACD histogram has just turned upwards/positive to above zero line. This indicates the share price could trade higher this week or next week!