THIS STOCK MIGHT APPRECCIATES FURTHER IN NEAR TIME !!!

Hello to all readers out there. Recently, you must have noticed that I did not share many write-ups with the public, as recently we experienced a very sharp drop in March 2020, due to COVID19 pandemic worsening and fight for oil market share between Saudi Arabia and Russia. All of these factors had caused our market (and global) to be on a constant and furious downtrend.

However, recently I saw that the market has recovered from its lows in March 2020, and I see that investors' confidence are starting to be boosted up by the efforts of government in fighting COVID19, and the stimulus packages launched to stabilize the economy. Therefore, from here onwards, I would like to continue to share my opinions on the facts of certain counters for the benefit of our investment community.

The stock which I'd like to talk about today is PCCS Group Berhad (PCCS - Stock Code 6068, Main Market, Consumer Products & Services - Personal Goods)

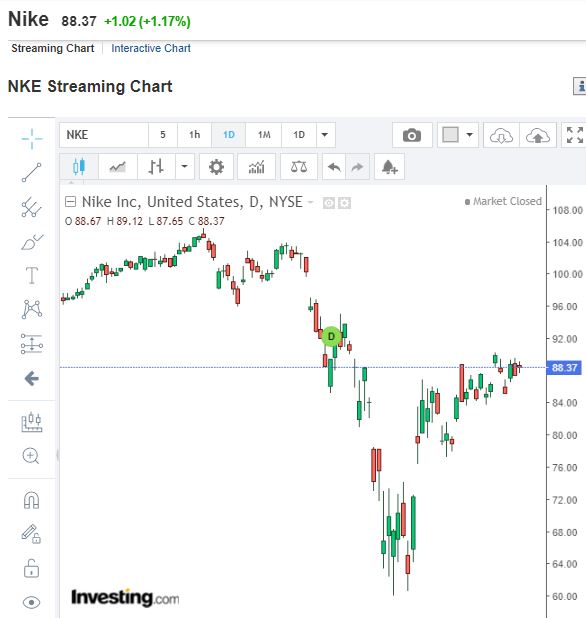

As usual, I would like to see the global indicator (or market leader) in APPAREL business, before we can determine the trend of our local apparel stocks. Let us look at NIKE (Dow Jones : NKE), chart taken from investing.com :

NIKE had hit a low of USD 60 in March 2020, but at the most recent closing on 24th April 2020, had cloesd at USD 88.37, which is a gain of USD 28.37 from its lows (+47.3%). Therefore, as the global market leader in apparel stocks is able to strongly rally, I would expect that other apparel companies around the world to be able to stage such a recovery momentum as well.

BASIC INFORMATION ABOUT PCCS

PCCS is a diversified investment holding group mainly involved in textile industry. The company was founded in 1973 and listed in BSKL in 1995.

The total share float of this company is 210.4 million, which translates to a market cap of RM 55.76 million.

WHY INVEST IN PCCS ???

Currently, there are a few factors which make the investment at current price look attractive. I will explain below.

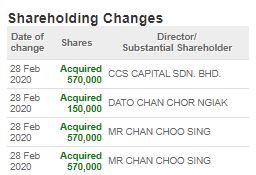

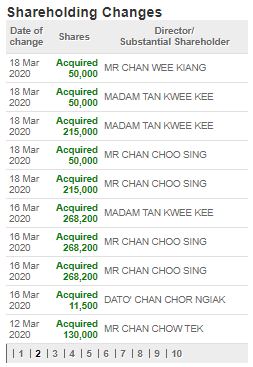

1. MAJOR SHAREHOLDERS OF PCCS, HAVE BEEN ACCUMULATING SHARES SINCE 28 FEBRUARY 2020

Refer below screenshots in the major shareholding changes from 28/2/20 till recent. A rough calculation which I did, shows total of 2.6 million shares being bought up by these major shareholders starting from 28 FEB 2020 (before the price crash). The price range was as high as 35.5c on 28 FEB 2020 to its low of 16c on 17 MARCH 2020.

However, there hasn't been a single sell off by one of these major shareholders during this period. Therefore, this shows their confidence in the long term prospects of the company, moving forward.

2. PCCS HAVING A HEALTHY CASH PILE TO WEATHER THE STORMS OF COVID19 PANDEMIC

With current COVID19 pandemic, Movement Control Order (MCO) has caused non-essential business to close up. However, taking a further look at PCCS accounts, it seems that they have enough cash pile to stay afloat and continue business as usual after COVID19 cases subside and the economy is allowed to reopen.

Net cash stood at RM 65 million as of FEB2020 QR, which translates to a Cash Per Share of 31c (which is higher than the last closing price of 26.5c)

3. CHARTS - CUP AND HANDLE PATTERN FORMING, PENDING A BREAKOUT OF ABOVE 30C

I would like to use a simple price and volume chart, with FIBONACCI levels to see price movements in this counter. Refer below.

As we can see, there is a cup and handle pattern forming with resistance level at the 38.2% FIBO level. Cup and handle pattern bullish continuation pattern that marks a consolidation period followed by a breakout.

(for basics on Cup and Handle pattern, refer link: https://school.stockcharts.com/doku.php?id=chart_analysis:chart_patterns:cup_with_handle_continuation)

Should the momentum be able to thrust this level, then next FIBO level can be monitored for resistance.

Also, notice that there was a big volume upthrust on 7 APRIL 2020, which price spread from 23 - 28c. Then the price retraced on the back of small volume, indicating weakness in selling.

I will be watching the 30c level very closely, to determine a successful breakout in the near term.

SIDE NOTE : LOWER CAPITAL INVESTORS CAN CONSIDER ENTRY INTO PCCS-WA INSTEAD OF MOTHER SHARES

Refer the profile of PCCS-WA below. A few good things about the profile of this warrant is, the expiry is December 2022 (another 31 months to expiry). So there would be sufficient time to allow the mother shares price to appreciate, hence making a gain on the warrant price too.

CONCLUSION

Considering all the above, I opine that current price for PCCS is attractive due to below:

i) Major shareholders accumulating shares since FEB2020

ii) PCCS having net cash per share of 31c, able to weather the COVID19 pandemic storm

iii) Cup and handle pattern formed in the daily chart, pending breakout above 30c

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-04-25-story-h1506134771-THIS_STOCK_MIGHT_APPRECCIATES_FURTHER_IN_NEAR_TIME.jsp