Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

MESB BERHAD OR MESB (Code 7234, MAIN Market, Consumer Products & Services - Personal Goods)

Some basic info on this company:

i. Number of shares float : 91.1 million

ii. Market Cap : RM 26.87 million

iii. Last closing price : 29.5c

iv. MESB is a company focusing on apparel (men & women) and accessories (e.g. wallets, handbags). Some of the brands they are selling are : ALAIN DELON, PIERRE CARDIN, GIOSSARDI, GIAMAX, LOUIS FERAUD, CROCODILE, DUCATI and JEEP SPIRIT.

v. They are also doing ONLINE SALES via website in addition to brick & mortar stores and malls. Their website (a lot of sales right now, those of you looking for bargain may visit):

https://www.miroza.com.my/

MESB - APPARELLY, THIS STOCK IS ATTRACTING ATTENTION !!!

1. Fundamentally Strong & Undervalued (Low PE Ratio)

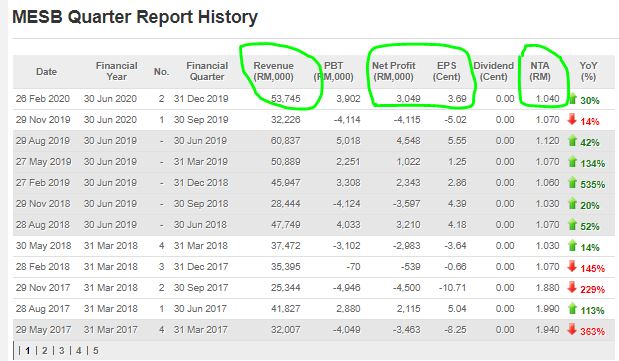

Refer below image extract of their latest 3 years QR :

A few observations:

i. Latest QR FEB2020, Revenue was on the high side at RM 53.75 million .

ii. Net Profit of RM 3 million (EPS 3.69) which was a 3 year high. Based on this earnings, the full year EPS should be 3.69c X 4 = 14.76c. However, we should be discounting the COVID19 effect on business, therefore let's say we take a discount of 50%, implies a full year EPS of 7.38c. At current price, it is still merely trading at 4X Forward PE, which is still on the low side.

iii. Taking a 7-8X Forward PE (50% discounted due to COVID19), would impute a fair price of between 51 - 59c.

iii. NTA at RM 1.04. Current closing price of 29.5c means a 74.5c DISCOUNT to its company NTA.

2. Further Look at NTA - High Net Cash Position, Asset > Liabilities

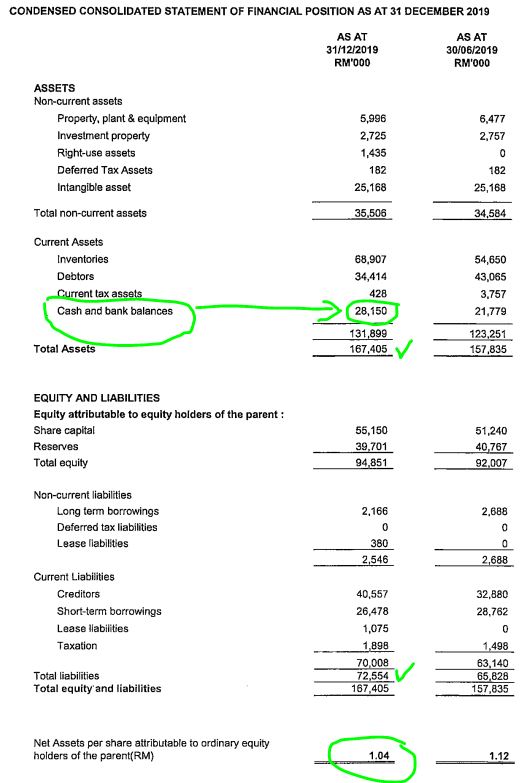

Refer below the breakdown of financial position of its NTA as of latest FEB2020 QR :

A few observations:

i. The cash position of this company of RM 28.15 million represents Net Cash Per Share of 30.9c. THE NET CASH ITSELF IS HIGHER THAN ITS LATEST CLOSING PRICE !!!

ii. Total assets stood at RM 167.4 million, versus liability of RM 72.55 million (a WHOPPING difference of RM 94.85 million)

Based on the above, it seems that the company is more than able to sustain itself in the current COVID19 pandemic situation as it has sufficient cash pile.

3. Technical Analysis - V_Shape Recovery, Pending Breakout Above 30c

Let's take a look at the daily chart of MESB:

A few observations below:

i) MESB was at recent high of 53c in OCT 2019 when there were rumors of major shareholders buying up shares to secure board seats. Since that failed attempt, price went uptrend. During latest March 2020 flash crash, price went to low of 15.5c, however the selling volume was small

ii) Volume started to surge to 12.6 million on 20th April 2020 (14% volume from total float), where the price jumped from 24.5c to 32.5c high, and ended up closing at 31c

iii) The past few trading days, saw significant volume maintained on a daily basis

iv) EMA14 and EMA43 has been crossed, however pending to cross EMA200 at 30c and EMA365 at 32c to confirm bullish direction

v) MACD, stochastics and RSI showing upward momentum

4. TECHNICAL ANALYSIS - Homily Chart - Red Chips Maintaining Position, Green Chips Reducing

Let's take a look at the 60 minutes chart of MESB, using Homily software:

A few observations below:

i) Recent retracement in price, shows that red position are still maining their position in the stock

ii) After retracement had finished, price started to trend upwards again, and green chips are seen reducing (weak holders such as contra players have sold off to longer term shareholders)

iii) Current momentum shows that red chips holders, are expecting higher prices in future

CONCLUSION

Based on my opinion, MESB should be given attention, based on below:

i. Fundamentally Undervalued, Trading at Low PE

ii. NTA RM 1.04, where 30c is in net cash, strong position to sustain in COVID19 pandemic

iii. TA - shows V Shape Recovery and Pending breakout above 30c

iv. TA - Homily Chart indicating red chips expecting higher prices

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2020-04-25-story-h1506133786-APPARELLY_THIS_STOCK_IS_ATTRACTING_ATTENTION.jsp