Why DPIH will benefit from the low of petroleum price?

DPIH produce aerosol which made from liquefied petroleum gas.

Their cans getting low cost also benefit from low metal n aluminum cost.

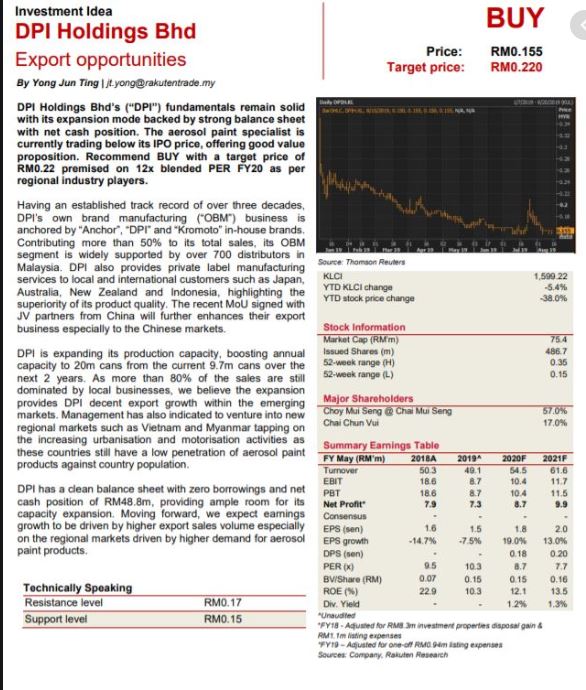

- No debts for company expansion.

- New plant ready to run

- Growth company with PE only 10

- Dividend yield 1.67%

- Increase profits steadily year over year

- Breakout chart.

- IPO price at 25cents. Now close at 15 cents only, crash about 40%.

- Rakuten target price given at 22cents!

Prospects for DPIH

1) Expansion of Production Capacity

The group plans to construct a new factory and office building at Lot 11078 with scheduled completion by 2H2019. The factory will have 4 fully-automated aerosol filing lines and it is scheduled to commence production in 1H2020. Besides, the group also plans to upgrade existing aerosol filling lines at the K69 Factory. The total annual production capacity will increase from the existing 9.7mn aerosols cans to 20.0mn aerosol cans by 1H2020.

2) Increase in Sales, Marketing and Advertising Initiatives

The group targets to further penetrate into export markets through active marketing initiatives such as participating in international trade fairs and exhibitions in order to gain access to potential customers around the world.

Join our Telegram Channel for our latest stock discussion.

All the information is available online and I compile for readers reference, this is not a buy call or sell call. Good night.

https://klse.i3investor.com/blogs/DPIH/2020-04-27-story-h1506164352.jsp