Investors are rushing to buy glove companies’ shares because they believe the demand for gloves is more than supply due to the Covid 19 pandemic fear.

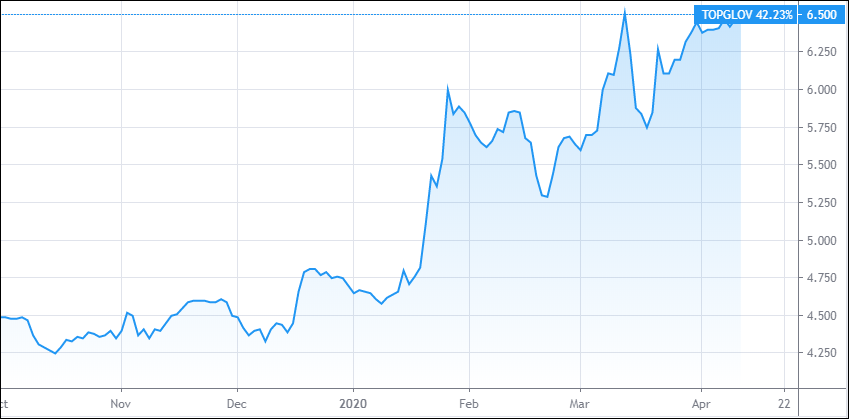

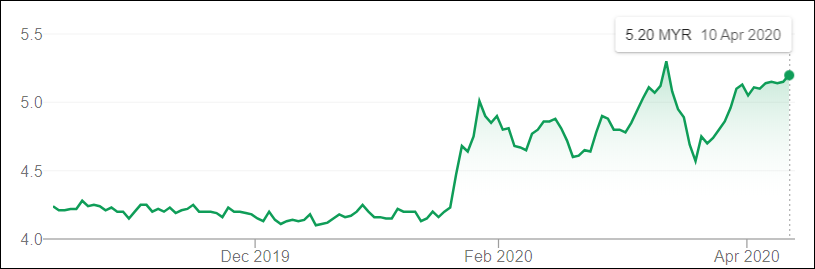

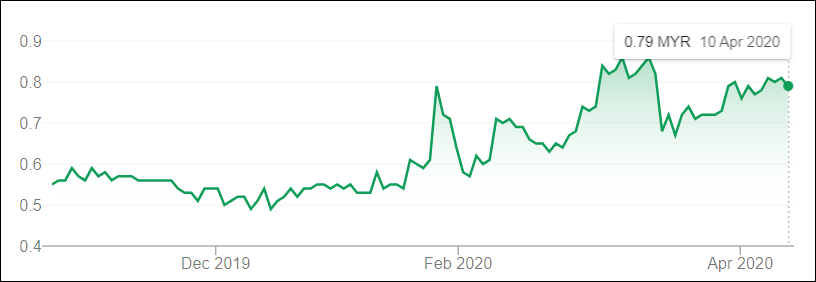

All the glove companies’ share prices are shooting up like rocket as shown on their price charts below. If you had bought glove companies’ shares about 3 months ago, you should be laughing to your bank.

Based on the latest audited accounts, Hatalega is selling at P/E 62, Top Glove is selling at P/E 45, Kossan is selling at P/E 30, Suppermax is selling at P/E 22, Rubberex is selling at P/E 18 and Comfort is selling at P/E 15.

P/E ratio is the share price divided by its earning per share. For example, Hatalega is selling at P/E 62 means that if Hatalega were to give all its earning to shareholders, an investor would take 62 years to recover all his capital, assuming its EPS is the same for 62 years. Of cause the company’s earnings will fluctuate up and down over the years.

My sole purpose of writing this piece is not to recommend you to buy or sell your glove companies’ shares. I just want you to understand the risk of buying shares with high P/E ratio.

Hatalega price chart

Top Glove price chart

Kossan price chart

Rubberex price chart

Comfort price chart

https://klse.i3investor.com/blogs/koonyewyinblog/2020-04-12-story-h1505927977-Glove_share_prices_shooting_up_Koon_Yew_Yin.jsp