Solarvest; Full Throttle Expansion

Recently there has been one announcement that basically pull a question

mark on investors mind as Solarvest has established a new subsidiary

company namely Solarvest Asset Management Sdn. Bhd. (SAMSB) which is a

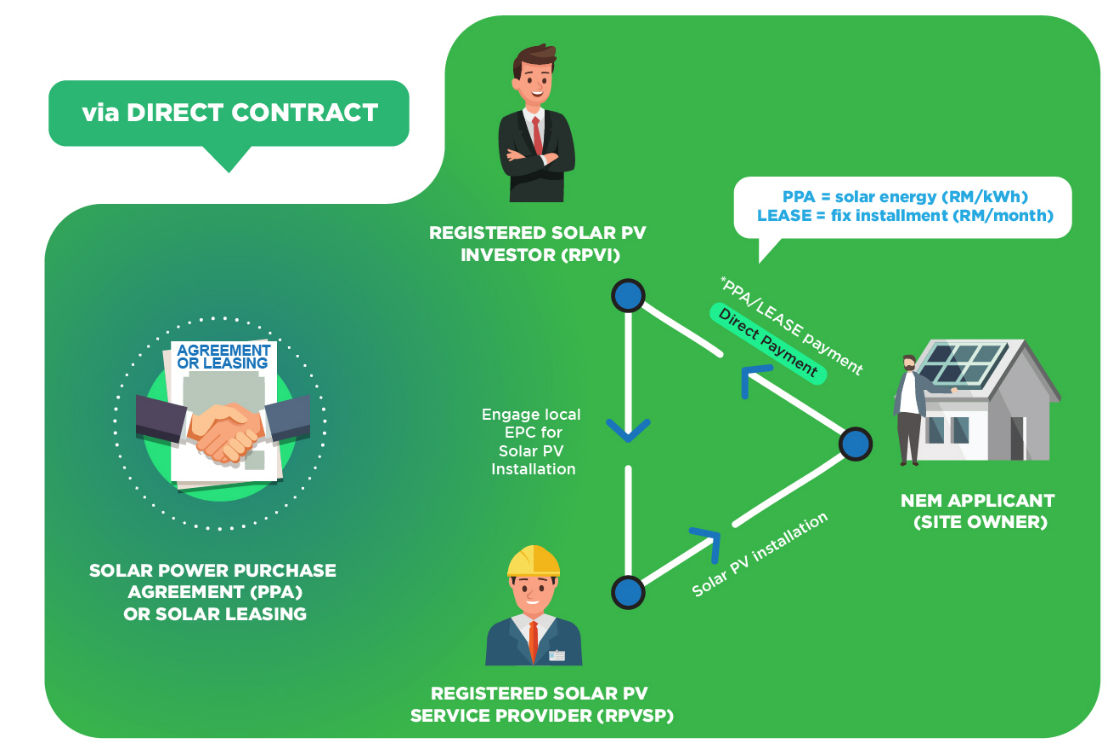

100% owned subsidiary by Solarvest Holding Berhad.Solarvest Asset Management Sdn. Bhd. (SAMSB) formation intention is to carry out the business of solar leasing and other related activities, where SAMSB will provide finance leasing and lending services in relation to the solar rooftop projects undertaken or to be undertaken by Solarvest and group of companies, mainly to facilitate the expansion of the Group’s businesses into solar leasing and other related activities.

Intention Versus Progression

Many investors have been wondering about the true Solarvest Asset

Management Sdn. Bhd. (SAMSB) business model which is related to Solar

Leasing Model and how it actually works. First of all, like it or not,

the fact is in Malaysia, Solar PV system still cost heaps or more

professionally speaking “cost intensive”. To be able to purchase and

install the system, user will need to lay a huge amount of upfront lump

sum investment. Wealthy aside, for most retail user or even CNI

(Commercial & industrial) user, the huge upfront lump sum investment

without any financing option will be an issue that yet to be solved.

Most banks are still conducting feasibility studies on solar financing

option with only a few that are positive towards the idea of financing

solar PV system. Hence due to all these reasons, potential user will

find it unaffordable and reluctant which in another sense hinder the

utmost potential growth of the overall renewable energy industry.

SAMSB; Here Comes the Solution

Before anything, let me introduce to you the concept of Solar Leasing.

Solar leasing is similar to leasing/renting a car to drive, without the

need of you actually paying for the cost of the vehicle. Solar panel

leasing lets you lease solar panels to generate electricity. You may

also hear it referred to as other terms such as solar financing, solar

power purchase agreements, or solar rental programs. A solar lease will

typically include maintenance and repairs, system monitoring, insurance,

and a roof penetration warranty. You are essentially paying a fixed

monthly amount to use the energy generated by the solar system on your

roof (Credit to MAQO Solar).

SAMSB; Banking the Role of Financier

As what we have discussed above that lacking of financing options are

hindering the growth of the renewable energy industry, and here comes

SAMSB who are willing to be the Banker/Financier of the Solar PV System.

Basically, when Solarvest got themself listed, they are handful of cash

and cash balances and they are net cash even before listing. Thanks to

the industry practice that demands upfront payment prior to installation

of PV system. Now that they have these unutilized cash, and what they

are going to do with this stalled cash? Fix Deposit? Short term

investment? Nope! They are going to channel these funds to SAMSB to be a

financier of the projects that they have secured. In another word, they

are actually the one stop centre of solution including financing

option. Hence there are no need for Banks or Financial institution to be

a financier; they are the financier themselves; they are the Banks and

Financial institution themselves in layman term.

How does this contributes to the future growth of Solarvest Holdings ?

When there are financing options available for potential users, things

are basically much easier. It’s much more likely for them to strike more

jackpot deal which potentially contribute to its future earning

visibility / prospect.

Is Solarvest overpriced? and what is the underlying prospect behind such valuation

First of all, we do concur that future prospect is one of the many

factors that determine the price of a stock. No doubt that when it goes

to bargain hunting, investors preferences are for the cheap stock,

especially for cliche low PE stocks or even high NTA stocks, but one of

the greatest factors that will sustain the price of a particular stock

is simply the future prospect or future earning visibility.

What is the future bright prospect for Solarvest that investors are looking at?

- First 9 months of FY20 earnings already exceeded full year FY19 earnings which beats consensus estimates, hence using annualized method after deducting one off listing cost, full year estimates for FY20 should be around RM15-16m of profit.

- Plenty of rooms for growth and business especially for rooftop commercial and industrial (CNI) and residential, as the market still unsaturated at this moment. CNI and Residential unit will contribute to a better overall profit margin for the company compared to LSS.

- The recent memorandum of collaboration with Advancecon subsidiary Advance Solar, which states that both Parties agree to use their best endeavour to assist and co-operate with each other towards successful implementation and execution of the Projects, including participating in bidding for the Projects. Advance Solar has already on its way to secure 586.08 kWp CNI project with OCR berhad, hence Advance Solar might engage Solarvest for part of the development process.

- Memorandum with Teo Seng Capital Berhad to develop 4,000 kWp project across their farms in Johor.

- The recent 2020 stimulus package to address the economic slowdown which also includes open bidding of 1400 MW power generation project which is worth RM5 billion, and thus create an opportunity for Solarvest to participate and be part of the picture.

Technical Analysis

SLVEST is currently in correction mode with great potential and minimal potential downside, hence the risk and reward is still worth the bet.

Author: Equitic Capital

Disclaimers: Information and comments presented does not represent the opinions whether to buy, sell or hold shares of a particular stock. Information shared above shall be treated solely for educational purpose only. The author may have positions in some of these instruments. The author shall not be responsible for any losses or lost profits resulting from investment decisions based on the use of the information contained herein.

https://klse.i3investor.com/blogs/EquiticCapital/2020-03-11-story-h1484806337-Solarvest_Full_Throttle_Expansion.jsp