Dear new and old investors,

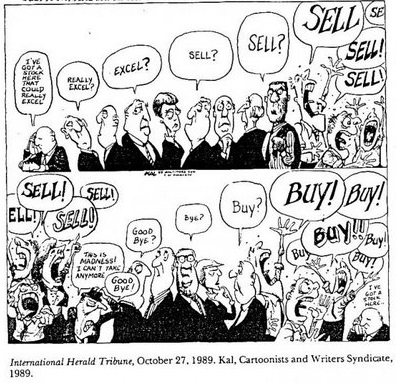

READ THIS BEFORE YOU PANIC AND START SELLING YOUR STOCKS!

Today there are a lot of rumours and market drops due to factors which may not even effect your businesses.

The following combination of 4 horsemen:

1. USA-CHINA trade war. (WAR)

2. CHINA COVID-19 VIRUS.(PESTILENCE)

3. MALAYSIA POLITICAL CRISIS. (DEATH)

4. RUSSIA REFUSAL TO CUT OIL PRODUCTION (FAMINE)

The big news today, https://www.bloomberg.com/news/articles/2020-03-08/oil-in-freefall-after-saudis-slash-prices-in-all-out-crude-war

Yes, oil price has dropped by 31% due to the OPEC disintegration as Saudi Arabia and Russia begin their battle to cut production. Russia has flat refused, possibly aiming to kill the USA shale oil producers with low prices in a price war to end all price wars.

What does that mean to you as an investor in Bursa Malaysia?

If you think about it using qualitative data,

https://www.treasury.gov.my/pdf/budget/budget_info/2019/revenue/section2.pdf

the petroleum revenue for Malaysia in 2019 is 18 billion or 6.9% of the entire federal government revenue. Of course this is not the full picture, as you also have 59.5 billion of investment income from dividends etc what makes up 22% (not all are oil and gas related). This is from a total revenue of 261.8 billion ringgit in 2019.

This tells you that, unlike countries like saudi arabia and brunei, Malaysia is a multi pronged country with many sources of income.

No need to jump of the roof or expect a bankrupt country.

So, firstly, we need to understand our malaysia government expenses.

"Total government expenditure is forecast to be RM297 billion in 2020, compared with RM277.5 billion in 2019. Total government revenue is expected to be RM244.5 billion in 2020, an increase of RM11.2 billion from 2019; however, if including the RM30 billion special dividend from PETRONAS in 2019, revenue is down 7.1 per cent in 2020."

Here we are looking at a few major problems with expenses versus revenue generation, meaning many projects will not have the budgetary to be expensed in 2020, as revenue will be much lower than the 244.5 billion expected in 2020, and a a deficit of almost 50 billion that needs to be addressed somehow.

This is the reality of the situation.

As a retail investor, you may have been caught unawares, and panicking as the share prices drops to incredible lows as everyone is trying to conserve cash and maintain business liquidity in this trying times. As you have no way to predict the FUTURE, all you can do is monitor quarter to quarter and plan your investments accordingly.

Here is my advise:

1. Everything is going to be cheap, so plan your investments carefully. Understand your businesses carefully. Choose those that have very strong cash positions, a strong history of 10+ years of profitable growth. A market or customer base where they have a market competitive advantage.

2. Avoid companies which do not have a strong cash position, have short term projects that rely on the price of oil, or projects that depend on government connections to win.

3. The first rule of investing is to NOT lose money. The second rule of investing is to follow the FIRST rule. Avoid usage of margin investment in averaging UP. Only consider usage of margin when averaging DOWN. The folly of this method of averaging up (win big lose big) by Mr KYY should be more than enough to dissuade you of this investing method. Martingale system is not for the faint of heart, nor for the intelligent investor. Always be prudent and buy quarterly after understanding the financial report. This way, if you made your investment decision correct at the first time of purchase, then any subsequent drop of price (but not of long term business fundamentals) should only give you more confidence to your analysis (assuming the fundamentals do not change).

4. Investing over the long term should be as boring and standardized as possible. Let profits take care of themselves. As long as you pick good boring but hyper efficient companies, you will do well. That reduces your margin of risk in changes in business fundamentals. I find that my best longest term investments are firstly in companies in very predictable and simple to understand businesses, and secondly they are the best at what they do in that industry. You have to pay more to invest in those companies, but I find it becomes worth it, especially when you can buy more during downturns.

Examples of companies that I have held for more than 5-10 years

- Public Bank ( very simple structure, no big corporate or investment banking to worry about. Just pure hire purchase, individual mortgage backed by huge collateral. The best savings and fixed deposit holdings base in Malaysia).

- QL Resources (Chicken and eggs. Huge market and easy to understand. But the outperformance is legendary, especially when they grow organically from just feedmill operator, then adding chicken and eggs to feed their operations, then adding fishmeal and surimi for grow the feed market, then moving into fish farming and seafood catching and freezing operations, then expanding farming activities into palm oil plantations and finally no into owning family mart end user retail. No other chicken and egg company in malaysia is that efficient in growing organically as most take the easy way and pump retained earnings into property development.

- Topglove ( it doesnt get easier to understand than producing rubber gloves). 25% of world market, currently tripling its capacity to produce nitrile gloves.

- Yinson (bus operator turned into barge operator producing and transporting oil barrels over a 25 year contract period. Nothing to do with selling oil and producing oil unlike bumi armada or sapura. Just simple, basic shipbuilding, operating and freightworks)

5. Don't go for the long big bet or the speculative deals. Many investors lost money on gambling projected scenarios from hengyuan and sumatec over a few quarters of good results but fail to see the overall long term business fundamentals. If it sounds to good to be true, just shake the hand of the guy who made millions from it and wish him well. Don't compare your bowl and his bowl to see how much you "could" have made if you bought. Instead consider the risks involved qualitatively (not quantitatively), ever seen a dead cat bounce? Neither have I.

6. Do not avoid the oil and gas industry. The fact remains, the best time to buy a stock is when everyone is leaving it. There are many companies that have a wonderful long term business fundamentals, but are covered in dirt when that rising tides that raises all boats go out. But that big boat is still there, and when the tides comes back (dont worry, it always does), those that bought those wonderful companies at cheap prices will never regret it. Years later, many will bemoan the fact that "Oh! If only I bought Apple at 7, Bank of America at 2.50, Amazon at 15."

7. The biggest rewards go the rational investor, not the ones that run around screaming in panic all of the time. As long as you bought a wonderful company at the fair price when you first bought it, when the price drops you will be more than happy to collect more of it. Those that buy bad companies with lossess on quarters, no dividend, high debt with the assumption that they will suddenly outperform and have good results in the future based on speculation will not have a good weekend.

I hope you stay sane and rational,

Philip

https://klse.i3investor.com/blogs/phillipinvesting/2020-03-09-story-h1484773724-MARKETS_CAN_STAY_IRRATIONAL_LONGER_THAN_YOU_CAN_STAY_SOLVENT_SO_WHAT_TO.jsp