REVENUE (0200)

Revenue Group Berhad (Revenue), established in 2003, is a cashless payment solution provider in Malaysia.

Revenue has more than 15 years of experience in the Malaysian

electronic payment industry. It provides a wide range of technology-led

multi-channel payment solutions for different customers, including

banks, non-banks, physical store merchants, and online merchants,

through its platform revPAY.

Revenue was listed on Bursa's Ace Market on July 18, 2018. On the day

of listing, the stock price rose from IPO price RM 0.37 to RM 0.625, an

increase of 69%. Even today, the stock price has maintained an upward

trend. Revenue is a cashless payment solution provider in Malaysia,

providing a platform to provide multichannel payment solutions for

different customers.

It has 3 main businesses:

1. EDC terminals business (accounting for about 60% of turnover)

-The main job is to provide distribution, deployment and maintenance services for EDC terminal.

Source of income:

a) Lease the EDC terminal to the customer every month and get the rent.

b) The maintenance service of EDC terminal can receive maintenance costs every month.

c) Sale of EDC terminal and some of its spare parts.

a) Lease the EDC terminal to the customer every month and get the rent.

b) The maintenance service of EDC terminal can receive maintenance costs every month.

c) Sale of EDC terminal and some of its spare parts.

2. Electronic Transaction Processing business (accounting for approximately 30% of turnover)

-Provides electronic transaction processing services for Credit Cards, Debit Cards and Electronic Money Payment Scheme. Revenue acts as an Acquirer, Master Merchant ("MM") or Third-Party Payment Processor ("TPP").

Source of income:

a) Earn Net Merchant Discount Rate ("MDR") by processing electronic transactions through the EDC terminal.

b) Pre-determined commissions for making electronic transactions through E-commerce / Mobile Channel.

c) Earn a Net MDR share as a TPP or MM.

a) Earn Net Merchant Discount Rate ("MDR") by processing electronic transactions through the EDC terminal.

b) Pre-determined commissions for making electronic transactions through E-commerce / Mobile Channel.

c) Earn a Net MDR share as a TPP or MM.

3. Solution & Services business (accounting for approximately 10% of turnover)

-It mainly provides solutions and services related to payment gateway, payment network security and payment infrastructure.

The source of revenue is sales of software, payment network security

and related hardware from sales, R & D and licensing companies,

which includes repair services.

Currently the company's business is mainly located in Malaysia. The

company acts as an Acquirer for Card Schemes and e-money payment schemes

for various local and international brands, undertaking Merchant

Acquisition services and enabling them to accept cashless payments at

home and abroad. These include MyDebit, UnionPay, Diners Club, NET S,

JCB, Alipay, Boost and Touch n’Go. In addition, the company also serves

as MM for Visa and MasterCard. Since Revenue was only incorporated in

September 2017, the performance of FYE2015 to FYE2017 is based on the

comprehensive historical financial reports of Revenue Harvest and its

subsidiaries.

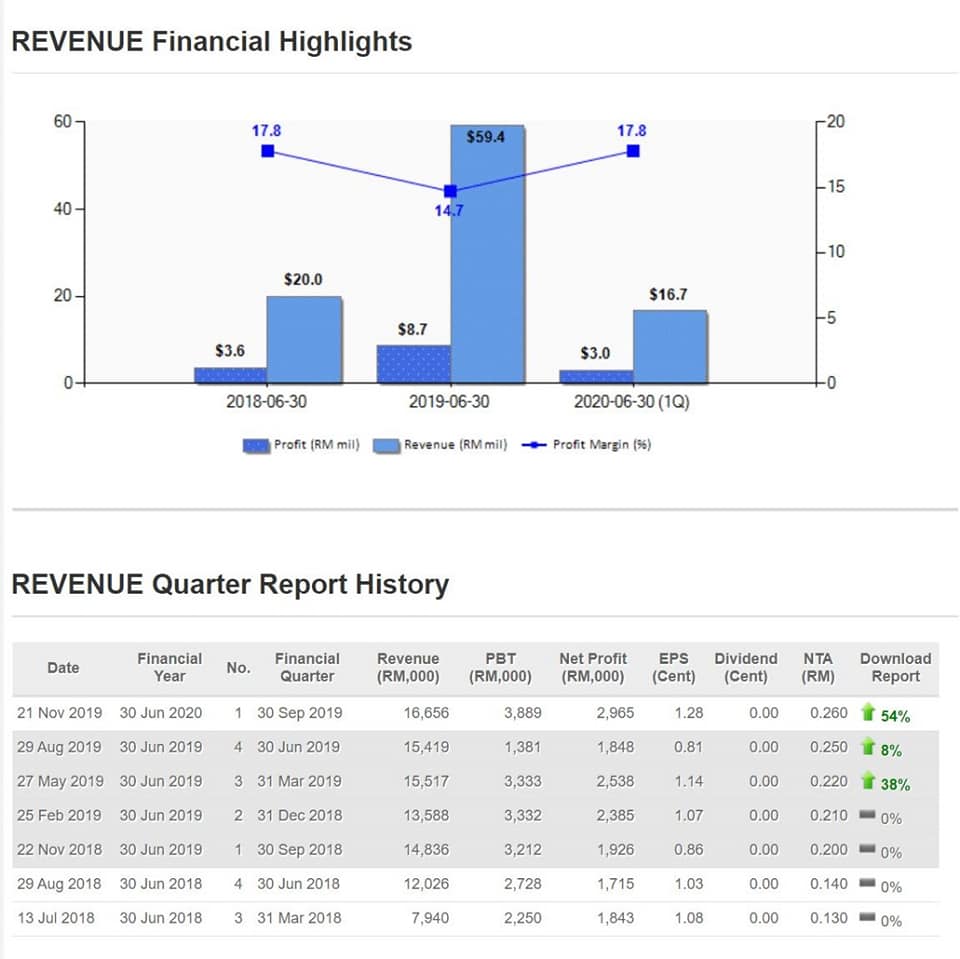

In the past 5 years, the company's turnover and profit (before tax)

have continuously exceeded new highs. The average annual growth rate of

turnover and profit in the past 5 years is 42.5% and 42.6%. It is a

amazing achievement. The company's Profit Before Tax (PBT) Margin

averages 24%, which is high compared to its peers. On the surface, the

PBT of the company FYE2018 increased by only 8.9% compared to FYE2017,

and the PBT Margin fell from 32.3% to 26.4%. But in fact, the company

has a one-time profit (selling investment properties) in FYE2017 and a

one-time expense (listing cost) in FYE2018. Assuming these deductions

are made, the company's PBT and PBT Margin at FYE2017 are RM 6.86 mil

and 25.9%; PBT and PBT Margin at FYE2018 are RM 9.83 mil and 27.8%. In

short, FYE2018's PBT has actually improved by 43% year-on-year!

And FYE2019's PBT also includes one-time expenses, assuming deductions,

PBT is RM 12.4 mil, an increase of 26% year-on-year. Overall, the

company's performance is very good, and continues to grow at a high

rate. According to the latest data (June 30, 2019), Revenue is a net

cash company with net cash of RM 18.4 mil. The company's net cash

increased by 166% over the previous year.

The company's current debt reaches RM 6.2 mil, and the annual interest

expense is about RM 0.35 mil. With the company's annual gross profit of

more than RM 30 mil and continuing to grow, there is no problem in

repaying interest. The company's net assets per share reached RM 0.25.

Overall, the company's assets and liabilities are very healthy. Although

the company is still growing, it can still maintain net cash, which is

excellent. From the cash flow statement, the company's net cash inflow

from its operations was RM 1.4 mil, which was a significant decrease of

89% compared with the previous year. This is mainly because Change in

working capital used close to RM 14 mil.

The company also invested a total of RM 10.1 mil in business expansion.

However, the company's cash has increased by RM 10.5 mil. This is

mainly because the company went listed in Q1 and successfully raised RM

20.6 mil. The company repaid a portion of the RM 1.7 mil from the funds

raised, so the company's debt was reduced. As of now, Revenue's cash

flow is healthy.

Revenue is indeed a very promising company, mainly because its industry

has great potential, and management capabilities are also very good.

Although Revenue's industry is highly competitive, when the cashless

trend comes, Revenue's ability will win market share. As the CEO of

Revenue said, the company's biggest competitor is not other peers, but

"cash."

Revenue was just listed in a short time, its past average PE was not

suitable for reference. The PE of the digital service provider industry

is generally between 25 and 40.

Louis Yap

Facebook:

Web Site:

https://klse.i3investor.com/blogs/LouisYapInvestment/2020-02-04-story-h1483046815-REVENUE_0200.jsp