DIGITAL TRANSFORMATION

Why eKYC is Key To Unlocking Malaysia’s Digital Banking Revolution

I’ve moderated and sat in a fair

number of fintech panel discussions over the years, a question that is

brought up 9 out 10 of every panel discussion is “What do you think are the key technology shaping fintech and banking in Malaysia?” and some variation of that same question.

If you’re like me and have attended too many fintech conferences,

the answers will come as no surprise to you. The common answers are

often; blockchain, artificial intelligence, open banking, virtual

banking, and mobile payment.

Yet despite the importance of eKYC and digital identity, very rarely

do you hear any panelists in these conferences pointing out the impact

of eKYC and digital identity in Malaysia’s banking and fintech

ecosystem.

A study conducted by Mckinsey shows that there is a potential cost

reduction of 90% in customer onboarding cost by enabling eKYC. The same

study also indicated that digital identity could potentially enable 1.7

billion of the unbanked population to gain access to financial services.

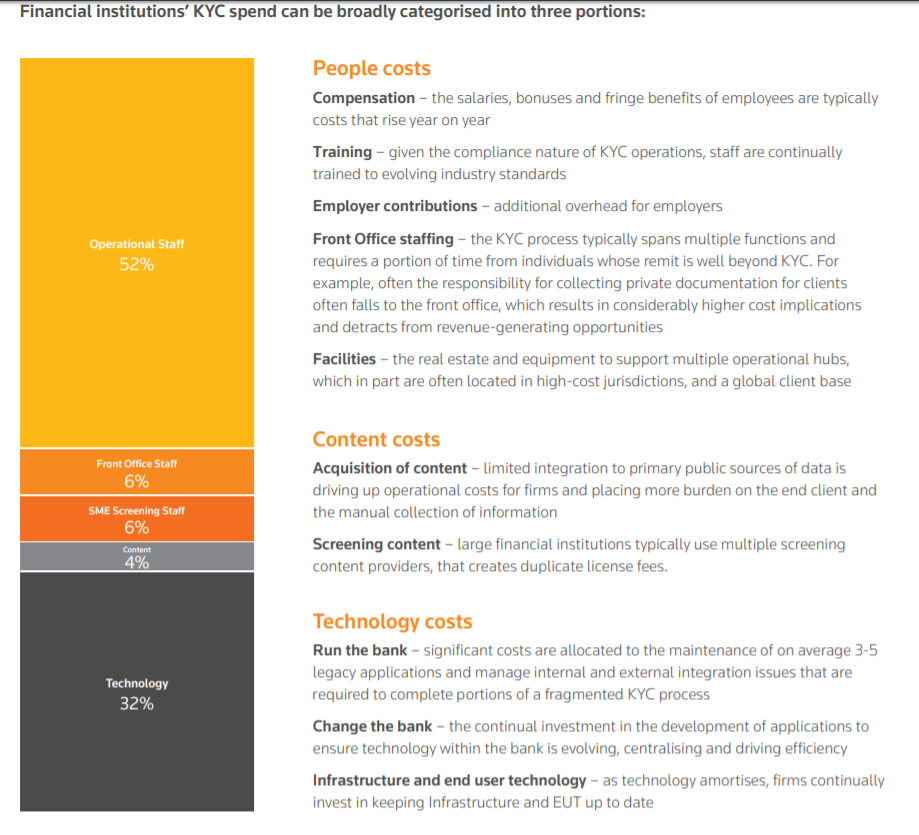

A separate study by Refinitiv further breaks down the cost KYC, much

of the cost is largely attributed to staffing costs, which supports

that idea that digitising the KYC process could significantly reduce the

cost of customer onboarding.

It is a fact that has not gone unnoticed by Bank Negara Malaysia, in

2017 the regulator issued the eKYC framework for remittance companies

and subsequently in 2019, a similar draft was issued for money changers.

Though there’s development particularly within the Money Services

Business (MSB) space, the regulator has not made any formal announcement

for eKYC guidelines for the wider financial services sector.

There have been some nuggets of information though, during the

MyFintech Week earlier this year, BNM’s financial development and

innovation department director Suhaimi Ali mentioned that there are

currently 11 banks trialing eKYC solutions.

Suhaimi did not disclose further the nature of the trial nor the

details of the provider but credit reporting agency CTOS who is also

present at the event shared in a separate session that they are trialing

their eKYC project with several banks and they are looking to enter

Bank Negara Malaysia sandbox.

Neither party has stated they are referring to the same thing,

though there’s a good chance that the snapshot below could be what it

looks like.

With Malaysia’s population becoming increasingly digital and eKYC

technology becoming more affordable, it would be very ideal for Bank

Negara Malaysia to release eKYC guidelines for the wider financial

services sector.

When you consider those factors alongside the fact Malaysia will be

dishing out virtual banking license soon, it’s clear that eKYC

regulation for the wider industry is inevitable.

But Malaysia doesn’t have to reinvent the wheel, there are already

plenty of countries who have launched digital IDs and eKYC, we just need

to learn from them.

Image Credit: Mckinsey

Meanwhile, Muhammad Ghadaffi Mohd Tairobi, the Vertical Director for Banking, Financial Services & Insurance acknowledges

that there are many benefits of Digital ID from a business perspective,

as it will save time and money by reducing it to over the counter

transactions, increasing productivity and enabling seamless and digital

driven experiences for customers.

He believes that eKYC then becomes an important process for the

banks to perform customer on-boarding faster compared to traditional way

of over the counter.

However, Ghadaffi’s key concern was on managing digital ID fraud. He said,

“This is why eKYC solution is in compliant with Risk Management in

Technology (RMiT) and Data Residency and Sovereignty requirements to

assist the BFSI industry in the successful implementation of this

initiative”

https://klse.i3investor.com/blogs/muze/2020-02-04-story-h1482038686-NETX_5G_The_National_Digital_ID.jsp