Jaks Resources - A Case Without Property Segment ?

Many of Jaks' potential investors are at least partially influenced by the underperformance of Jaks' property segment. In this article, I will carry out a stress test on Jaks' financial positions if its property segment is disposed at crisis valuation.

Jaks property segment continued

to make losses mainly due to LAD on delayed Pacific Star project.

Therefore, many are interested to know;

- How terrible is Jaks' property business ?

- Will its property business lead Jaks to severe financial difficulty?

- How is the prospect of Jaks Hai Duong Power Plant in Vietnam?

Jaks' property business is

carried out by its 51% owned subsidiary, Jaks Island Circle Sdn Bhd. Has

the ownership composition of the subsidiary changed ?

JAKS has 51% equity interest in JAKS

Island Circle Sdn Bhd in property development business. The company is

required to disclose any acquisition/disposal of interests in subsidiary

or JV or Associate. Any additional acquisition of interest in

subsidiaries is considered related party transaction which must be

reported to Bursa Malaysia. Acquisition of Non Controlling Interests

will be reflected in Cash Flow Statement as well. So far, there is no indication of any change in ownership in the subsidiary.

How large is Jaks' unsold property inventory ?

Extracted from Jaks' 2018 Annual Report :The current ongoing mixed development project at Section 13, Petaling Jaya known as Pacific Star achieved sales to-date of RM951 million (2017 : RM915 million). We have RM26.4 million worth of properties to be sold from the Pacific Star project. Our investment property at Ara Damansara remains challenging with the oversupply of retail space in the Klang valley and the Group will place more emphasis on social media marketing tools and special events to lure shoppers. The other investment property, a Business Hub at Pacific Star will be ready for operations by the end of this year

RM26.4m of unsold properties represents 2.4% of Pacific Star gross develoment value of RM1.1 billion.

What is the current stage of development of Pacific Star ?

Pacific Star. Photo taken in Nov 2019

Judging from the exterior, the project is 99% completed.

Affin (Nov 2019)

Despite the better-than-expected results, we lower our EPS forecasts for 2020/21 by 32% and

6% respectively to factor in the LAD charges arising from the delay in

the completion of the Pacific Star projects. Management had previously

guided that the overall project will be completed by end- 2019; however,

we believe that the whole project may only be completed earliest by

mid-2020. Nevertheless, there are some positive developments, as the Business Hub and Car Park has obtained the certificate of completion (CCC).

Publicinvest (Nov 2019) We understand that completion of the Star Tower and the remaining 3 blocks could take longer than expected with the initial target now being pushed back to 1H2020. We are disappointed by the delay but believe that it is adequately discounted for in our forecasts. Unbilled sales as at 3QFY19 stood at RM115m (from RM121m a quarter ago). Loss at property development was RM17.9m; mainly due to the LAD provided and lower rental income during the quarter. Separately, occupancy at the Evolve Concept Mall remains at 85%, though up from 62% in 1QFY19 with recent signing of an anchor tenant which took up 154k sf.

How is Jaks' financial positions ?

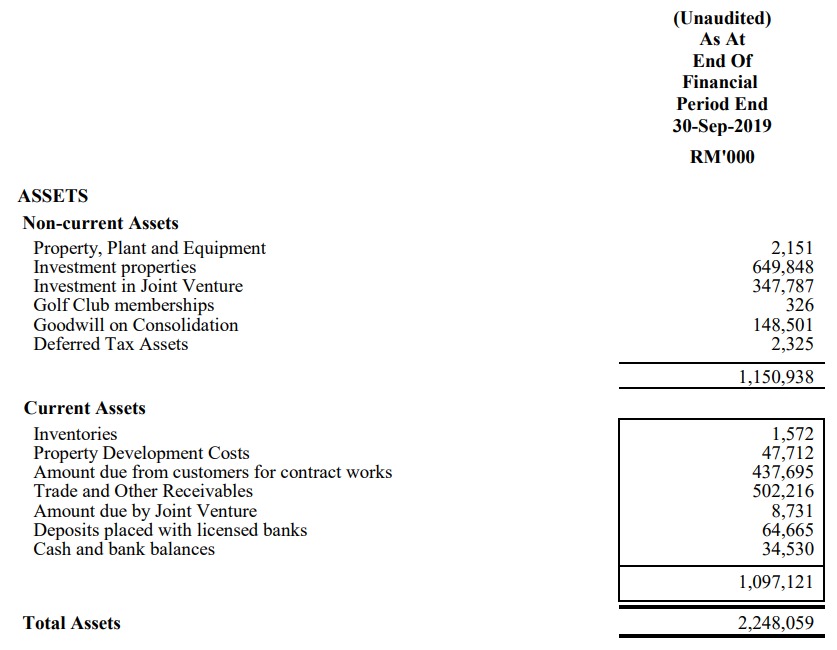

Jaks has total investment property and property development costs of RM698m (650m +48m)

Even one is to assume that the market value of Jaks' total property asset is only as high as its book value (costs) of RM698m, It is still 166% of its total bank borrowings of RM419m (318m+92m+9m). Jaks can afford to sell its property assets at 40% loss to cover its bank borrowings.

It has total receivables and cash of RM1,040m (438m+502m+65m+35m) which is a surplus of RM158m over its payables of RM882m. This surplus is sufficient to cover Jaks' RM42m contingent liquidated and ascertained damages (LAD) as at Sept 2019.

How about its future interest costs after Pacific Star is fully completed ?

As at Sept 2019, Jaks' total bank borrowings stood at RM419m (318m+92m+9). Assuming interest rate of 6% per annum, Jaks' potential interest costs per annum is about RM25m. Assuming these borrowings are fully related to its property business which Jaks has 51% ownership, Jaks has to account for interest costs of about RM13m per annum and gradually reduced over time on principal repayment.

How about operating losses of its property segment ?

Based on quarterly financial report as at Sept 2019, Jaks' property segment losses amounted to RM59m.

Breakdown as follows;

- Liquidated and ascertained damages (LAD) = RM27m

- Assume all Interest expenses are property related = RM15m

- Depreciation = RM10m

- Operating expenses = RM 7m

Do note that annual operating expenses is merely RM10m of which RM5m is attributable to Jaks.

Jaks will exit property market after completion of Pacific Star project

Eventually when Jaks exits its property business, either by hook or by crook, it only has its power plant in Hai Duong, Vietnam to rely on. In worst case, all else neutralised, Jaks is left with investment in JV in JHDP with book value of US$140m.

How about the prospect of Jaks' Hai Duong Power Plant ?

I have done extensive studies on the Hai Duong Power Plant.

Please read my following articles;

- https://klse.i3investor.com/blogs/Jaks%20resources/2019-01-13-story189891-Understanding_Jaks_Hai_Duong_thermal_power_plant_in_Vietnam.jsp

- https://klse.i3investor.com/blogs/Jaks%20resources/2019-03-21-story199051-Jaks_Resources_Perfect_Conditions.jsp

- https://klse.i3investor.com/blogs/Jaks%20resources/2019-04-29-story204451-Jaks_Resources_Peer_Comparison_With_Mong_Duong_II.jsp

- https://klse.i3investor.com/blogs/Jaks%20resources/2019-09-22-story226058-Jaks_Resources_An_excellent_joint_venture_deal_with_CPECC.jsp

- https://klse.i3investor.com/blogs/Jaks%20resources/2019-09-24-story226512-Jaks_Resources_Comparison_with_MFCB_Hydro_Plant.jsp

- https://klse.i3investor.com/blogs/Jaks%20resources/2019-09-27-story227063-Jaks_Resources_Valuing_the_Future_Cash_Flows_of_Hai_Duong_Power_Plant.jsp

- https://klse.i3investor.com/blogs/Jaks%20resources/2019-10-02-story228009-Jaks_Resources_Earning_Forecast_of_Hai_Duong_Power_Plant_based_on_Government_Data.jsp

- https://klse.i3investor.com/blogs/Jaks%20resources/2019-12-09-story245519-Jaks_Resources_Higher_Expected_Investment_Returns_from_JHDP.jsp

- https://klse.i3investor.com/blogs/Jaks%20resources/2019-12-29-story-h1481949253-Jaks_Resources_Why_JHDP_in_Vietnam_has_a_bright_future.jsp

- https://klse.i3investor.com/blogs/Jaks%20resources/2020-01-15-story-h1482158721-Jaks_Resources_Hydro_power_no_longer_cheaper_than_Coal_power_to_Vietnam.jsp

Conclusions

This article provides readers with a clearer view of Jaks' current positions on its property business in relation to;

- Current development of Pacific Star project

- Unsold properties

- Borrowings and Interest costs

- Operating losses

I m confident that the cash distribution

from Jaks Hai Duong Power Plant of at least RM100m will be more than

sufficient to pay for its property losses as well as repaying all its

borrowings and interest costs in a very short period of time. The power

plant will turn Jaks into a cash rich company in the near future.

Jaks' Vietnam BOT has a concession of 25 years.

With or without property business, I believe Jaks has a very bright future earnings prospect

Thank you for reading.

DK66

P/S: I m not a property expert. I could

not assess Jaks' property business prospects with confidence. Therefore,

I decided to do a stress test on Jaks' financial positions to examine

if its property segment will cause serious harm and result in Jaks'

bankruptcy. This article does not imply that Jaks' property segment will

indeed result in further losses after completion of the Pacific Star

project.Charlie Munger's Big Lesson: Prepare for Opportunity

What is the most important personal quality an investor can have?

Patience... followed by pretty aggressive conduct. It is given to human beings who work hard at it—who look and sift the world for a mispriced bet — that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.

Patience... followed by pretty aggressive conduct. It is given to human beings who work hard at it—who look and sift the world for a mispriced bet — that they can occasionally find one. And the wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t. It’s just that simple.

https://klse.i3investor.com/blogs/Jaks%20resources/2020-02-09-story-h1483732841-Jaks_Resources_A_Case_Without_Property_Segment.jsp