For a copy with better formatting, go here, its alot easier on the eyes.

Petron Malaysia Refining & Marketing Berhad (PETRONM: 3042): A Love Letter to Ramon Ang

========================================================================

Well, as you can see from title above, there is clearly no love lost between me and the management of the company despite the falling share price.

At the end of the day, lower share prices are very good things for those such as us, who are likely to be net long term buyer of a company’s stocks. It’s very simple, lower prices allow you to buy more stock, while higher prices hurt you as you can now buy less stock.

And couple this with a stronger performance by the company (which is hidden due to fluctuations in industry dynamics), the discount one is getting increases.

PETRONM was one the first company I *almost* made 100%. This was back in 2017 (when I was a far greater fool), I remember buying it at around RM7.8 and got a front row seat to its meteoric rise to RM15. Back then I considered its fair value about RM15 (To be fair, it’s more like RM12-13) when given a discount versus Petronas Dagangan Berhad.

Logically, I should have sold around RM12-RM13, not chasing the last dollar and all. But I was younger and more foolish. I also really really wanted to see a 100% gain.

I never sold it and watched that ~85% plus gain evaporated. It wasn’t a large amount, but it was significant to me then.

I rediscovered valued investing in early 2018 and started buying again from RM7 all the way down the current price today.

So why am I writing about this?

Well other than talking about my book (as my position is large enough that I don’t see myself buying much more), I also wanted to compile everything and put it down on paper officially.

All of my research has always been just in my head. From experience, I know writing it down usually shows me something that I’ve missed (this time was no exception, but it was a happy surprise) and help me understand the company a little bit better.

I hope you found reading this even a bit as useful/pleasurable as it was for me to write this.

Prior to 30 March 2012, the company was owned by ExxonMobil International Holdings Inc (ESSO).

Prior to the acquisition, the company was under performing for a few years (nothing too serious, a pre-Afzal TIMECOME this is not), when they sold it to PETRON its earnings were close to its all-time best performance then due to the high oil prices.

When PETRON bought it over, the market promptly decided to crash (a year plus later).

For the purpose of the valuing the company, I will perform my analysis by looking at the two parts separately.

Do note that in this case, a significant amount of extrapolation and assumptions is needed, the company does not report its performance by the separate operating segments.

In the management’s own words,

“Petron’s Refinery is an integral part of the whole business of the Company. Unlike rival listed Companies who are either a marketing company or a Refinery, Petron is a combination of both. Both the Refinery and Marketing arms of Petron exist together, and the Refinery is an integral part of the supply chain that provides products to the Marketing arm of the Company. As the Company’s operations are always seen as a whole, Petron does not do segmental accounting to identify the profits and losses of each segment of the Company’s business.”

Let’s begin.

Industry Dynamics

In Malaysia, there are three kinds of business.

The first is your typical business, which is subjected to the full force of the local and global markets and competition. Occasionally, when the global impact is too large and threatens to destroy the entire industry, such as the steel sector. The government may intervene by placing tariffs on imports of those products.

Vice Versa, when prices of goods in those industries become too high due to global demand (while costs remain constant), the government may temporarily place export bans/tariffs to slow the overseas demand. This happened in 2017, when the government banned rubberwood exports to help the furniture industry.

The second, is the government regulated industries, where the government’s goal is to get prices and costs down as much as possible and prices are fixed by the government.

These are industries such as the egg, chicken, vegetables etc. The competition in this business is hellish. For example, in 2018, feed costs for chicken and eggs shot up due to the strength in USD, as well as increased prices for Soybean feedstock etc.

Technically, the prices set by the government are supposed to incorporate any increase/decrease in costs. But for industries like this where the product is so widely used and politically sensitive, the government is slow to recognize any increase in costs, while fast to recognize any decrease in costs.

There is a reason why companies in industries like these are usually privately owned with minimal government shareholding and run by non-bumiputra’s.

The third, is government regulated industries, where for one reason or another, the government regulates it to ensure profitability for the average. These are industries such as Banking, Insurance, Power, Water, Petrochemicals and Concession Assets etc.

They are typically run by Government Linked Companies, which due to micro incentives not being lined with macro incentives, require at minimum, an oligopoly to be average, and a monopoly to be above average.

And in industries like this, when just being average gets you a profit, being above average or outstanding, gets you super-normal profits. Companies like Public Bank, Hong Leong Bank and LPI etc are great examples.

The retail petrochemical industry happens to fall in this category.

Retail Petroleum Industry

In Malaysia, unlike in most countries. The margins obtained by the petrol station operators are determined by the Government.

Now, here is the interesting part. We all know that the margin earned by Petrol Dealers in Malaysia are set by the government. Ie: 15 sen per litre for RON 95 (up from 12.19sen in 2019) and 10 Sen per litre for Diesel (from 7 Sen per litre in 2019).

However, what most people do not know, is that the margins at which petrol station operators (not just the Petrol Dealers) can profit by are set by the government as well.

Here is how the petrol price is derived.

Needless to say, it is in essence, a cost-plus contract (modified in some ways) which is the only method usable if you want to enable the average to remain profitable.

The guarantee profit factor is so prevalent in this third kind of industries, that when the government announced the weekly price mechanism, and was considering allowing petrol stations to set lower prices.

The moment this whiff of potential competition happened.

The Petrol Dealers Association of Malaysia (PDAM) which represents more than 2000 petrol dealers in Malaysia, argued that the new mechanism will not to bring benefit to consumers in the long run and will create competition among oil companies and potentially can create a monopoly market by large companies with sound financial ability that are able to sell at lower prices over a long period of time, which will result in dealers closing shop.

Well.... I guess... thank you for forcing me to sell at a higher price?

So, how does an above average performer then obtain super-normal profit in this “guaranteed profit” industry.

The answer is two prong (and quite similar to pretty much any other industry).

Retail Market Share

When Petron took it over from ESSO back in 2012, its Retail market share was 9%.

By 2014, it had risen to 16.4%.

Based on management representation during the AGM's. It further increased to 17.7% in 2015, 17% in 2016, 19% in 2017 and 20.5% in 2018.

And finally, in 2019, it increased again to 21.1%.

Today it is third in the industry. With Shell taking first place with 35% and Petronas a close second at 30%.

This is on top of the industry average growth of about 6% per annum from 2012 to 2019.

Quite an impressive performance. In addition, due to the average industry growth of around 6%, this translates to growth in the low teens for PetronM to gain the market share it did.

This comes off the back of strong marketing performance (most of the gains came in the first 1-2 years after the takeover). Most petrol stations then actually recorded at immediate jump in sales volume after the re-branding.

In addition, the company have gotten many cost-efficient wins, that improve experience vastly, while not costing much.

It was one of the first to start installing air conditioners in toilets. In fact, in 2017 it won the recognition for having the cleanest toilets in the industry by Ministry of Housing and Local Government.

It also offers one of the best “Miles” cards, giving you effectively 0.75% discount on your petrol. And was the first to allow you to convert points directly to petrol, with no expiry date on the points, making customers very sticky.

They also focus very much on ensuring high margin products like the RON100 (which they are the first to launch) are available in all important locations and are perfectly marketed. The other RON100 fuel provider is Shell’s V Power Racing. Which to be honest, most people do not know it to be RON100 grade as well, therefore thinking PetronM’s is better.

Gross margins on the ROM 100 (this is from back in the day when I was an auditor for a Petron Station Dealer) is about 20%. Those of RON97 is about 10% and RON95 is about 5%.

The company is also aggressively expending petrol stations wherever they feel is lacking, in fact if you were to drive into Johor Bahru now, the first sight you see is a sea of Petron Stations.

All of which offers RON100 for Singaporean cars (which are usually Continental Cars, that perform much better on RON100 fuel, which is still very cheap for Singaporeans) , as well Kereta Hantu (Singaporean Cars with Cloned Malaysia license plates) the bulk of which are Continental Cars (I mean why not? A 2012 BMW 3 series is only RM8k, the price is about the same for Audit and Mercedes as well).

They were also one of the first to allow you to set the amount of petrol you would like to pump, directly at the machine, instead of having to head to the counter. This is unbelievably helpful to most motorcycle users who are also often in the B40 category for whom the RM200 hold on debit cards is very painful.

In fact in January 2020, they became to first to not have any holding charge for payments using ATM Debit Cards (and of course was smart enough to start a marketing campaign to make sure everyone knows).

All of which are either cheap value wins, or profitable initiatives that also gain you market share.

Lowest Cost Provider

Now, the second question, are they the lowest cost provider? Allowing them to make the additional margin from the “Operational Costs” component which is set based on industry average.

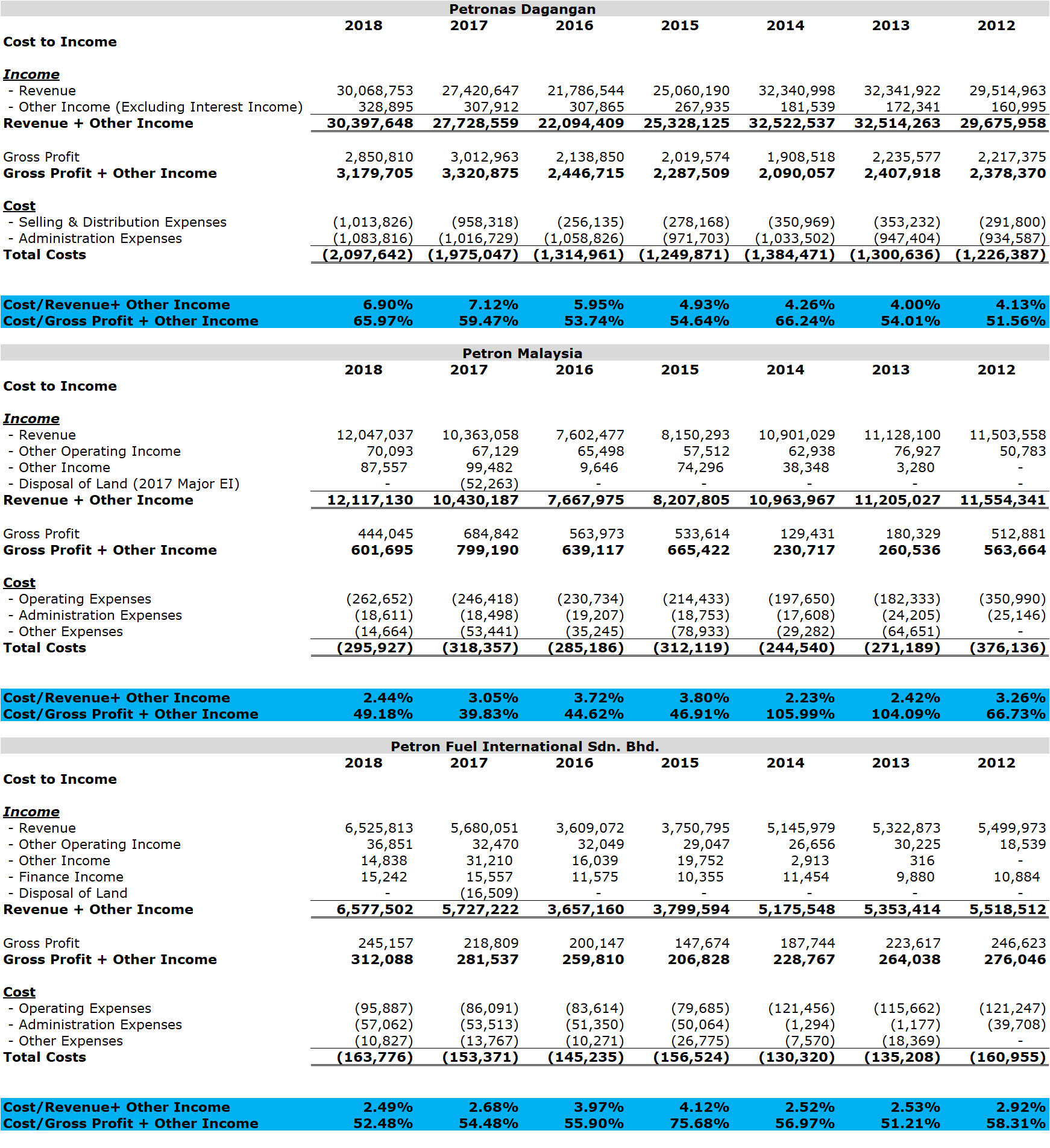

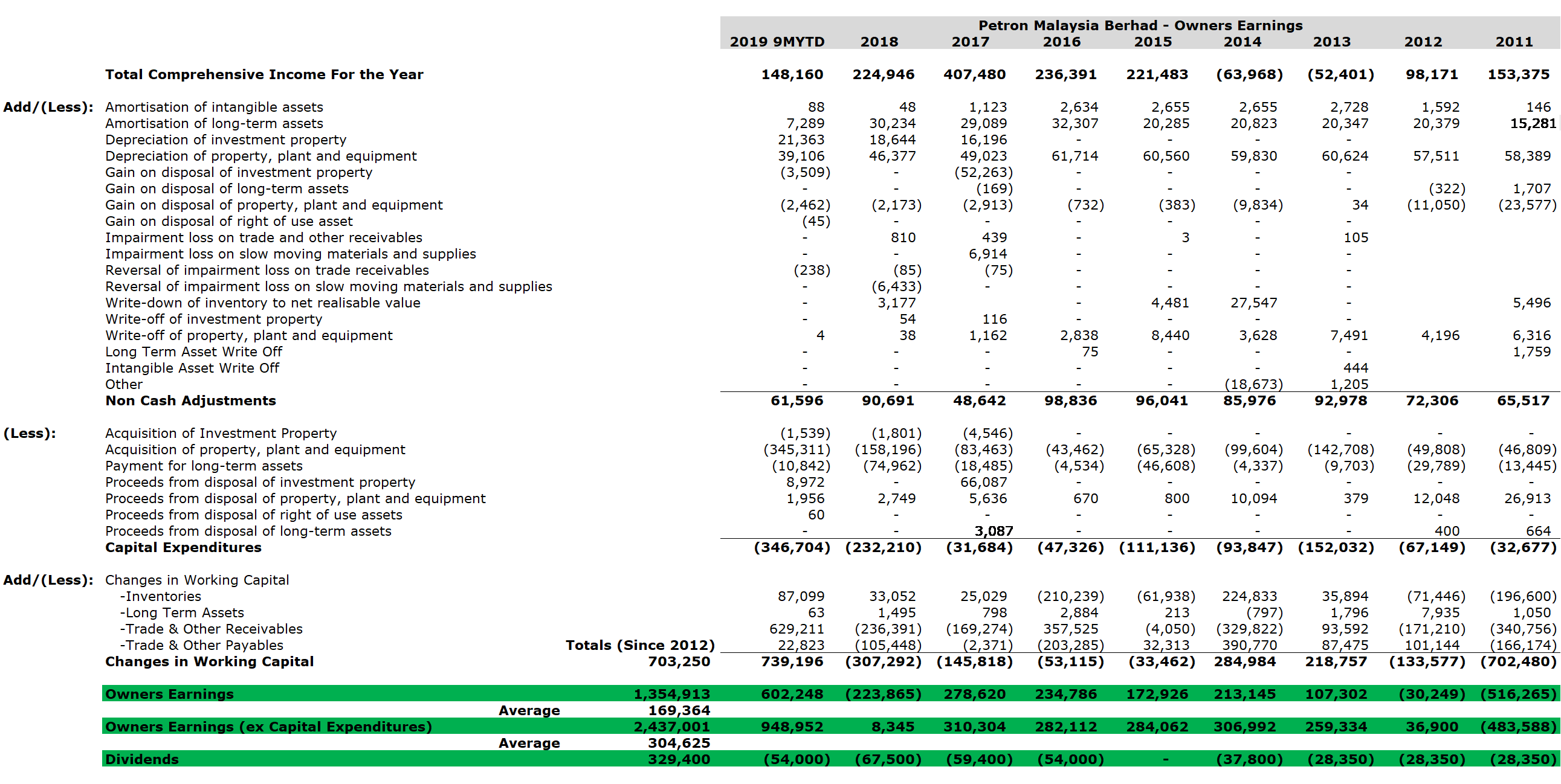

Well, let’s compare them against its listed counterpart, Petronas Dagangan.

What we will be using is Cost/Income %.

Cost will consist of Other Operating and Administrative cost, which is separate for the Cost of Goods/Fuel sold.

The thing about Petrol Companies is, their revenue is often decided by the price of fuel globally, which often outweigh any increase/decrease in volume sold.

Which is why we will supplement it by using Cost/Total Gross Income %.

For the purpose of this comparison, I’ve also included that of Petron Fuel International Sdn Bhd (“PFI”), which is the company privately held by Petron Corporation.

This company’s business consists solely of a portion of its petrol station business in Malaysia.

Now the first thing, you should note, is that what does into categories such as Operating Expenses and Administrative Expenses, may differ significantly for both companies.

Having said that, from what we can see here, in terms of cost, whether calculated on the basis of Cost/Income % or Cost/Total Gross Income % is far lower for Petron Malaysia and Petron Fuel International when compared against Petronas Dagangan.

Even if we are to ignore those issues due to potential classification issues, in terms of absolute figures, over the last 7 years, costs for Petronas Dagangan have steadily marched upwards at a compounded rate of 6% per year, while that of Petron Malaysia’s have either reduced or stayed largely even. And this is despite the large increase in retail market share.

In terms of efficiency and costs, Petron is clearly leading the pack. And this is despite the commercial arm of Petronas Dagangan being far larger and contributing significant amount of additional revenue/gross profit.

Having said that, do note that the Operating Costs for 2017 and 2018 for Petronas Dagangan likely did not suddenly increase for business reason, but is likely due to a change in accounting policy resulting in reclassification in cost categories.

Having said that, whether under the new classifications or old classifications, cost of Petronas Dagangan steadily marched up.

Lets find out if this is true.

Current, the company has roughly 640 petrol stations in Malaysia. Approximately 426 of them belongs to Petron Malaysia, while the other 214 belongs to Petron Fuel International.

That is an approximately 2/3 (PetronM) and 1/3 (Petron Fuel International) split.

Using the Petron Fuel International financial statements, we will extrapolate their earnings, and deduct it from the PetronM’s financial statements to see if it’s true.

And tada, no surpise. From the numbers above, that is probably true.

The thing to note here is, unlike other refineries in the region, the Port Dickson refinery taken over from ExxonMobil/Esso, can only process very light sweet crude, which is the type typically produced from Malaysia players and is typically more expensive.

Since the acquisition of the company and being dealt this bad hand, the company have also moved to improve the economic position of this refinery, by initiating a “Crude Optimization and Refining Improvement Program” to find alternative crudes that can be blended along with the low sulphur Tapis Crude (which is more expensive), while taking into account the finished product yields, such as Gasoline, Diesel, LPG, Jet A-1, Low Sulfur Waxy Residue (Bad) and Naphta (Bad).

Upgrades have also been done in order to get it to be able to process higher margin crudes.

Since then, the company have found a range of domestic and regional crudes that can be used. One crude companion that was found, had a higher distillate yield value due to being able to produce more Diesel and Jet A-1 while reducing Naptha yields.

Due to the fact the refinery is still not fully optimized, it is currently only run at roughly 55%-60% capacity, with about 60% of the finished fuels demand for PetronM being imported.

The management have indicated that they can run it at higher rates, but as its not viable economically at higher rates, they are currently not doing so.

Interestingly, this also means that turnarounds don’t affect profitability as much as other refinery oil companies. Though to be honest, I would far prefer our refinery being so amazing that any turnaround will drastically impact profitability.

The refinery division was also impacted by the fact it needed to undergo EURO 4 and EURO 5 upgrades, which had cost roughly RM500m (this is just an estimate) with the other upgrades and expansion over the years coming in at roughly RM250m. About RM350m of these expenditures came in 2019.

Luckily for us, with the government having just upgraded to EURO 4M for Petrol and EURO 5 for Diesel in 2020 (the last time we upgraded our fuel was RON92 which was phased out in 2009). EURO 6 is the next one and this standard is not yet widely adopted worldwide.

Given the balance of probabilities, there is unlikely to be any new extraordinary compliance and maintenance capital expenditure requirements, for the next few years (preferably for the next 10 years).

Capital expenditures in the future are likely to be more of the “increasing economic benefit” kind, which over the last few years, consisted mainly of installing more storage tanks to hold more fuel especially at the Bagan Luar Terminal , as well as connecting pipelines to the Klang Valley Distribution Terminals and Multi Product Pipeline to lower transportation costs.

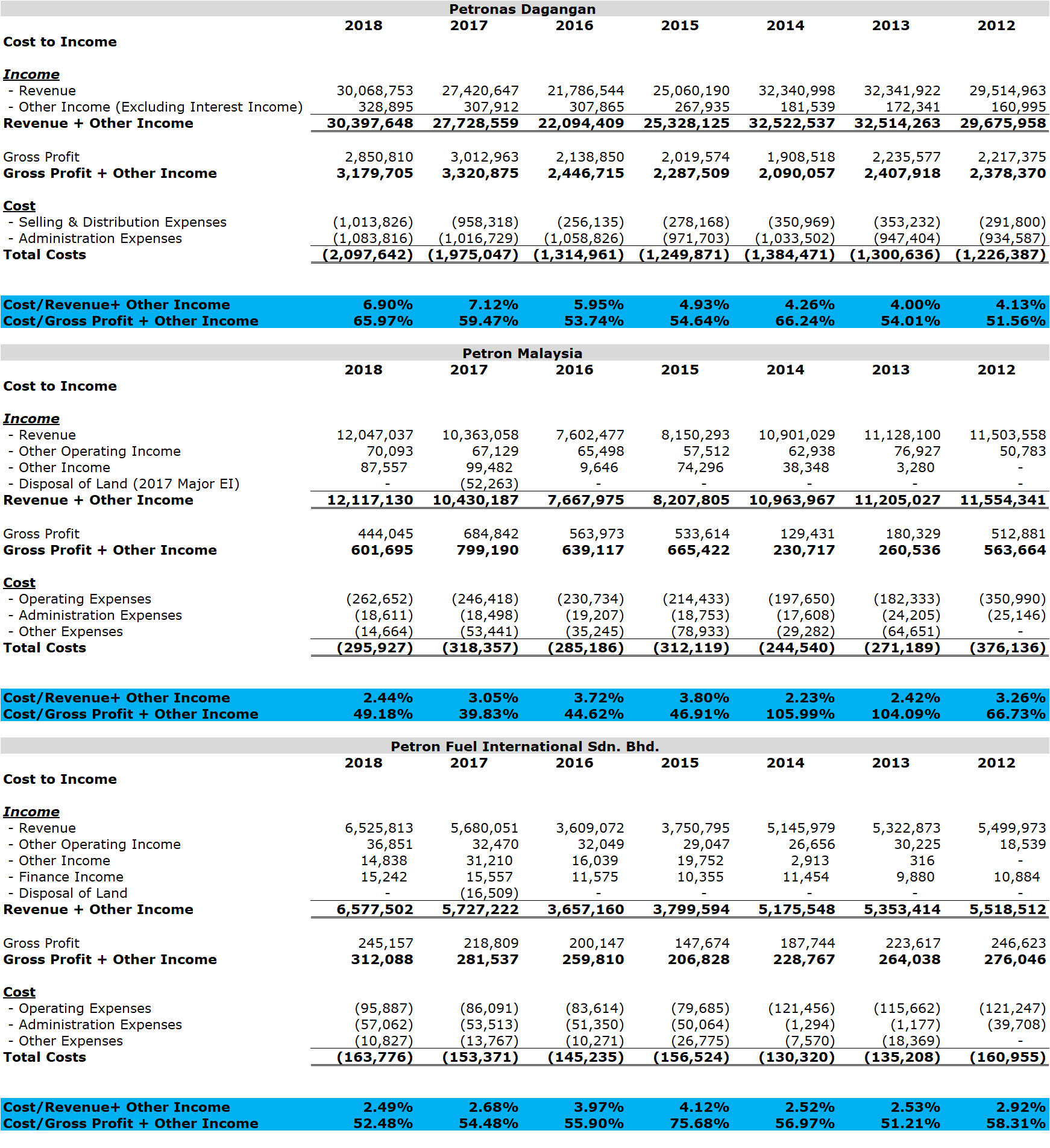

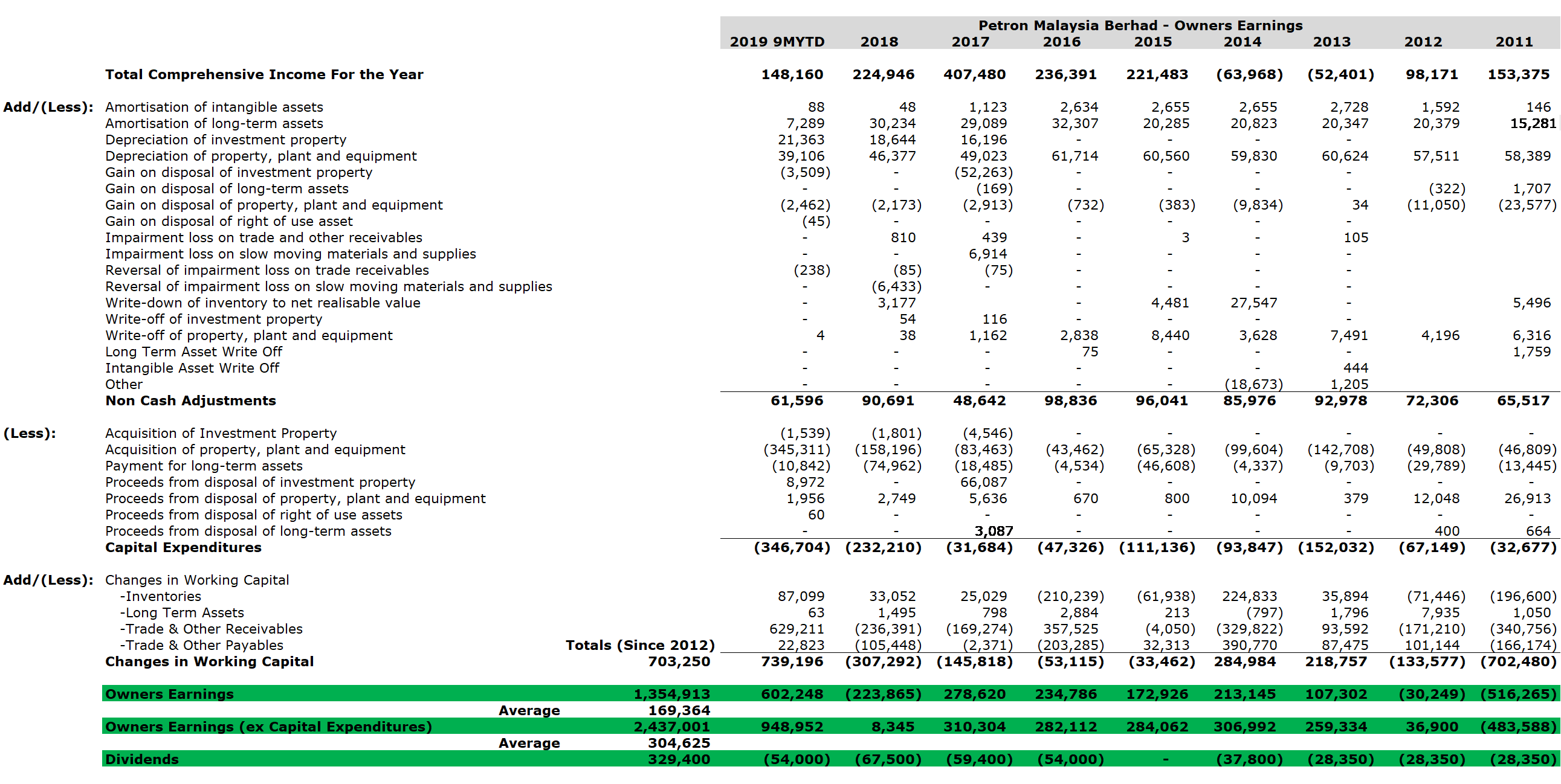

As we can see here, since being taken over by the new management, the company has generated “Owners Earnings” of RM1.35 billion from 2012 to September 2019.

This is despite all that onerous EURO4 and EURO5 maintenance capital expenditures, as well as the numerous upgrades needed under the “Crude Optimization and Refining Improvement Program”.

Excluding the these capital expenditures needed to meet the higher EURO 4 and EURO 5 requirements, the company would have generated RM2.4 billion in owner’s earnings instead.

With the large EURO 4M and EURO 5 capital expenditures expected to be completed by 2020 and most of the cost incurred, i foresee less significant maintenance capital expenditures in the future.

The most interesting point for to me to note here is, despite growing their Retail Petroleum market share in Malaysia from 9% in 2013, to roughly 21.1% in 2019, as well as, increasing sales volume from 28.8 million barrels of petrol in 2013 to 35.7 million barrels (extrapolated) in 2019.

The net working capital (Working Capital consist of Trade Receivables, Trade Payables and Inventory) required to run the business since 2013, have actually fallen by RM703m or about 30%.

Imagine this, since expanding the business significantly, the management actually require 30% less working capital to run it.

If this is not a sign of competent and efficient management, I don’t know what is. A Serba Dinamik Berhad, this company is not.

And interestingly, despite 2019 being the most challenging year for the company thus far, with extrapolated earnings of only RM200m (maybe less), which is half that of 2017’s profit of RM408m, and capital expenditures at an all time high of RM345m, more than double that of 2018 (the previous all time high).

The company still generated an all-time high owner’ earnings of RM602m, more than double that of 2017’s and this is only in the 9 months of 2019.

Even when normalized to account for the the RM390m owed by the government for fuel subsidies in 2018 that was paid in 2019. The company still generated roughly RM212m in cash.

Utterly Incredible.

A business that over the long term, can churn out owners’ earnings of roughly RM200m at its cyclical low, with its average over the long term likely to be significantly higher and increasing.

Well, as of today, Enterprise Value (Market Capitalization + Net Debt/Cash) of Petron Malaysia is roughly RM940mil, or about 4.4 times cyclical low owners’ earnings.

How much do I value this company?

Well, due to the fact that I had to extrapolate the retail earnings instead of seeing it properly, I would need to discount the current earnings a little from the current RM216m.

Lets say a 20% discount, putting long term earnings at RM170m, and to be conservative, we assume zero growth.

Recently, BHP was put up for sale from Boustead, and would have been sold by now if not due to Vitol currently blocking the sale. The valuation being put up was around 12 times earnings to 19 times earnings.

Now, I have no idea what the capital structure of that company is like, and I don’t want to buy a copy of the accounts from SSM (if someone here wants to buy one, you’re welcome to do so, and if you wish, update me so I can update this article), but as we are completely debt free (and I’m willing to bet BHP is not, looking at Boustead’s accounts).

Even if we are to blindly use the valuation used for BHP by private, we would likely still be undervaluing it.

Now, personally, I would like an IRR of 10% minimum when I’m looking at equities due to the additional risk I am taking. Since i'm assuming zero growth to be safe, and ignoring the growth in the low teens for the retail division.

It translates nicely to PE10, or RM1.7b.

What about the refinery?

Well, after the improvements made in 2013 and 2014, based on the extrapolated numbers, the refinery have no longer continued making a loss.

Personally, I think the refinery should make, maybe RM50m a year in its current state when normalized over the long term (gut feeling lol).

If upgraded (which to be fair , costs money), it should improve. However, its too hard for me, so I’ll just put it as zero.

Which puts my fair value at a minimum of RM8.5 and as high as RM12-15, depending on whether or not I want to include growth or refinery earnings (or god forbid, refinery losses).

Fat luck of this happening.

Petronas Dagangan is a RM22 bil kitty for the government, and Petrol Dealers in Malaysia consist of mostly Bumiputra’s. There is every incentive for the government to not deregulate and increase competition.

And even if they did, I doubt any GLC or MNC will be able to compete with Petron. They are just not incentivized to.

Sudden Fall in Fuel Prices and Sudden Increase in USD.

Currently the company holds about half month stock on hand (only slightly above PETDAG’s 0.4 month, despite having to ship in 60% of their finished goods), or about RM560m and Payables of RM1bil (most of which is denominated in USD) at any point in time.

Any drop in value of oil and increase in value for the USD will impact their earnings negatively. So this is a question of, if they are doing any hedging.

According to the company, for commodity hedging, they hedge about 40 to 60% of our exposure.

For currency hedging, they hedge about about 80 to 90% of its dollar-denominated liabilities on crude and product purchases with the balance is covered by the natural hedges or PetronM's export receivable which is denominated in USD.

So realistically, given the recent fuel price drop of about 20%, assuming only 40% (low range) of inventory is hedged, net impact to the PL should be about RM70m, and probably a bit higher as they will keep buying stock as prices drop and stabilize.

Well, it sucks, but when fuel prices increase, we would see a commensurate gain.

Typically, hedging can be considered an insurance policy, and it should cost you roughly 4% (typical option prices) of the value of the items you are hedging over the long term.

Having said that, this means that earnings for this company is going to be volatile, at least until the retail and commercial division grows to be the vast majority of the business, minimizing the fluctuations of the refinery end.

Is the management over-allocating more of their petrol stations to the 100% owned Petron Fuel International (“PFI”).

As we have seen very clearly from this analysis, the petrol station portion of the business is the most profitable of the two by far, and a natural fear is that the stations from the current portfolio will be sold to the 100% owned PFI, or that new stations will be allocated only to PFI.

Well, this is question that have been asked a few times during the AGM, and their answer, verbatim, is as follows.

“In determining which of the companies will be assigned ownership station, the key factor would be the logistics efficiency and cost of transport.

Thus the determination of assignment of ownership would depend on the the location of the closest distribution terminal and ownership of that terminal.

For instance if a new station was to be built in the Southern region of Johor, it is likely that it would be a PFI designated station, considering the nearest terminal in Pasir Gudang is PFI’s.

Similarly a new station in the North, eg Kedah would likely be designated to PetronM's due to its proximity to the PetronM's terminal in Bagan Luar.

Placing all new stations under PetronM may not be effective as the cost of transportation may not make the station’s operations economically viable. The Company has a stringent process in place to ensure that the process of designating the station is based purely on the factors that make the station viable economically.

The fact that PFI is a 100% owned entity does not factor in the equation. It is to be noted that the majority of the Petron stations in Peninsular Malaysia are PetronM's.”

Naturally, we cannot blindly believe this.

However, during the initial acquisition, 67% of the stations belonged PetronM. Over the years, petrol station additions have largely split according to this ratio as well.

Its just unfortunate the Johor Stations are not under PetronM. A real pity.

I would be very happy, if the management decides to consolidate its entire Malaysian Operations together.

However, considering how shrewd the management is in allocating capital and saving costs, I don’t see why they would do this kind of expensive and unnecessary restructuring exercise.

Well, we can always buy Petron Corporation shares I guess, its currently at its 15 year low.

However, that is a different animal altogether.

In the Philippines, they are currently facing problems from to oil smuggling in the Philippines by the blackmarket to avoid excise tax, which results in Petron’s prices being higher than the black market.

A problem we will never have, unless its cigarettes.

During my study of the company, one of the interesting things i found out was how Ramon S Ang got to there he is today.

For the most part, given the kind of person he was, Ramon was supposed to grow up successful, but a Billionaire, that is a stretch for anyone, no matter how smart or hardworking.

Back in the day, Ramon got to know Ambassador Eduardo “Danding” Cojuangco Jr. through his eldest son, car-racing aficionado and ex-Congressman Mark Cojuangco.

Eduardo Cojuangco made Ang manager of his Northern Cement business, where he excelled with entrepreneurial vigor.

After the 1986 EDSA uprising, when the Cojuangcos were in exile due to the Marco's being overthrown, most of their managers shunned and even stole from them.

Ramon Ang, on the other hand, honestly and loyally managed Northern Cement for the Cojuangco family. After some time, Eduardo Conjuangco eventually returned. He retook control of San Miguel Corporation and entrusted its management to Ramon Ang, who made it more far far successful.

He dramatically changed SMC from a beer and foods firm into one of Asia’s biggest, diversified multinational conglomerates. Eduardo Cojuangco eventually chose Ang as his successor and sold the bulk of his SMC shares to him, and helped him pay for it by loaning him the money.

Today, San Miguel Corporation is about 6-7% of the GDP of Philippines.

Now, the Conjuangco family was very much intertwined with the massively corrupt Marcos family, and despite this kind of environment which should only attract the most Najib like characters, there was someone like Ramon Ang who as the Chinese like to say "出淤泥而不染". Said in english, is represents the the lotus flower which grown from the mud and yet blossoms white.

Quite interesting. And precisely the kind of person i want in charge of a company i hold shares in.

The real question is, how are the economics of the business, the competence of the management and the value you are getting for the price you are paying.

I hope this article helps shed some light regarding the above.

As always, let me know if you disagree or feel I missed out on anything.

Disclaimers: Refer here.

Petron Malaysia Refining & Marketing Berhad (PETRONM: 3042): A Love Letter to Ramon Ang

========================================================================

Well, as you can see from title above, there is clearly no love lost between me and the management of the company despite the falling share price.

At the end of the day, lower share prices are very good things for those such as us, who are likely to be net long term buyer of a company’s stocks. It’s very simple, lower prices allow you to buy more stock, while higher prices hurt you as you can now buy less stock.

And couple this with a stronger performance by the company (which is hidden due to fluctuations in industry dynamics), the discount one is getting increases.

PETRONM was one the first company I *almost* made 100%. This was back in 2017 (when I was a far greater fool), I remember buying it at around RM7.8 and got a front row seat to its meteoric rise to RM15. Back then I considered its fair value about RM15 (To be fair, it’s more like RM12-13) when given a discount versus Petronas Dagangan Berhad.

Logically, I should have sold around RM12-RM13, not chasing the last dollar and all. But I was younger and more foolish. I also really really wanted to see a 100% gain.

I never sold it and watched that ~85% plus gain evaporated. It wasn’t a large amount, but it was significant to me then.

I rediscovered valued investing in early 2018 and started buying again from RM7 all the way down the current price today.

So why am I writing about this?

Well other than talking about my book (as my position is large enough that I don’t see myself buying much more), I also wanted to compile everything and put it down on paper officially.

All of my research has always been just in my head. From experience, I know writing it down usually shows me something that I’ve missed (this time was no exception, but it was a happy surprise) and help me understand the company a little bit better.

I hope you found reading this even a bit as useful/pleasurable as it was for me to write this.

Petron Malaysia Refining & Marketing Berhad (PETRONM: 3042)

Introduction

PetronM is a Malaysian listed company in the business of,-

Refining

petroleum products Petron Port Dickson Refinery (PDR) in Negeri

Sembilan which has a crude distillation capacity of 88,000 barrels per

day.

- A retail business which operates Petron service stations nationwide and markets fuel and non-fuel products and services to the retail and commercial markets.

Prior to 30 March 2012, the company was owned by ExxonMobil International Holdings Inc (ESSO).

Prior to the acquisition, the company was under performing for a few years (nothing too serious, a pre-Afzal TIMECOME this is not), when they sold it to PETRON its earnings were close to its all-time best performance then due to the high oil prices.

When PETRON bought it over, the market promptly decided to crash (a year plus later).

For the purpose of the valuing the company, I will perform my analysis by looking at the two parts separately.

Do note that in this case, a significant amount of extrapolation and assumptions is needed, the company does not report its performance by the separate operating segments.

In the management’s own words,

“Petron’s Refinery is an integral part of the whole business of the Company. Unlike rival listed Companies who are either a marketing company or a Refinery, Petron is a combination of both. Both the Refinery and Marketing arms of Petron exist together, and the Refinery is an integral part of the supply chain that provides products to the Marketing arm of the Company. As the Company’s operations are always seen as a whole, Petron does not do segmental accounting to identify the profits and losses of each segment of the Company’s business.”

Let’s begin.

The Retail Business

I will be starting with the retail portion, as this is the portion of the business i consider to be more valuable.Industry Dynamics

In Malaysia, there are three kinds of business.

The first is your typical business, which is subjected to the full force of the local and global markets and competition. Occasionally, when the global impact is too large and threatens to destroy the entire industry, such as the steel sector. The government may intervene by placing tariffs on imports of those products.

Vice Versa, when prices of goods in those industries become too high due to global demand (while costs remain constant), the government may temporarily place export bans/tariffs to slow the overseas demand. This happened in 2017, when the government banned rubberwood exports to help the furniture industry.

The second, is the government regulated industries, where the government’s goal is to get prices and costs down as much as possible and prices are fixed by the government.

These are industries such as the egg, chicken, vegetables etc. The competition in this business is hellish. For example, in 2018, feed costs for chicken and eggs shot up due to the strength in USD, as well as increased prices for Soybean feedstock etc.

Technically, the prices set by the government are supposed to incorporate any increase/decrease in costs. But for industries like this where the product is so widely used and politically sensitive, the government is slow to recognize any increase in costs, while fast to recognize any decrease in costs.

There is a reason why companies in industries like these are usually privately owned with minimal government shareholding and run by non-bumiputra’s.

The third, is government regulated industries, where for one reason or another, the government regulates it to ensure profitability for the average. These are industries such as Banking, Insurance, Power, Water, Petrochemicals and Concession Assets etc.

They are typically run by Government Linked Companies, which due to micro incentives not being lined with macro incentives, require at minimum, an oligopoly to be average, and a monopoly to be above average.

And in industries like this, when just being average gets you a profit, being above average or outstanding, gets you super-normal profits. Companies like Public Bank, Hong Leong Bank and LPI etc are great examples.

The retail petrochemical industry happens to fall in this category.

Retail Petroleum Industry

In Malaysia, unlike in most countries. The margins obtained by the petrol station operators are determined by the Government.

Now, here is the interesting part. We all know that the margin earned by Petrol Dealers in Malaysia are set by the government. Ie: 15 sen per litre for RON 95 (up from 12.19sen in 2019) and 10 Sen per litre for Diesel (from 7 Sen per litre in 2019).

However, what most people do not know, is that the margins at which petrol station operators (not just the Petrol Dealers) can profit by are set by the government as well.

Here is how the petrol price is derived.

|

Breakdown: Fuel Price In Malaysia

|

Comments

|

|

Cost of Product

Based on Mean of Platts Singapore

|

Mean

of Platts Singapore (MOPS) is the cost is the already refined product,

as tracked by S&P Global Platts and is based on the daily average of

all trading transactions between buyer and seller of petroleum-based

products. If you also own a refinery, you can earn the profit differential in this portion. |

|

Alpha

Petrol - RON95: 5 sen per litre

Diesel: 4 sen per litre

|

This

is the buffer given by the government to the petrol companies. If the

price of the fuel purchased by the petrol station operators is higher

than the MOPS price, and the difference is higher than the Alpha, the

petrol company will bear the cost. Vice Versa. Do note that the value of the alpha is from 2009, the amount may be different today (I can’t find the latest). However, the concept is still relevant. |

|

Operational Costs

Peninsular Malaysia – 9.54 sen per litre

Sabah – 8.98 sen per litre

Sarawak – 8.13 sen per litre

|

Now,

here is where you can really make the margin. The government sets the

operation costs at which you can allocate to the price of the petrol

every week, and this is based on the industry average for each region, the bulk of the industry average is contributed by Shell and Petronas Dagangan. Again, the numbers shown there is from 2009, the amount may be different today (I can’t find the latest). However, the concept is still relevant. |

|

Oil Company Margin

Petrol – RON95: 5 sen per litre

Diesel: 2.25 sen per litre

|

This is the profit that the government allocates to all petrol station operator companies. |

|

Petrol Dealer Margin

Petrol – RON95: 15 sen per litre

Diesel: 10 sen per litre

|

This

is the profit allocated to the petrol station dealers. They are two

kinds of dealers, they are called CODO (Company Owned Equipment and

Site, Dealer Owned Inventory) and DODO (Dealer Owned Equipment and Site

and Dealer Owned Inventory). For CODO Dealers, they are paid the Petrol Dealer Margin as set by the government. For DODO Dealers, they are paid another margin on top of the amount set by the government, this margin is set by the petrol company. In addition, Petrol Dealers also usually need to pay a licensing fee, as well as 10%-20% of the revenue from the convenience stores. |

|

Sales Tax/Duty or Fuel Subsidy

|

When

the price of fuel is above the fixed price set by the government, a

subsidy is given keeping hold everyone’s margins. Conversely, if the

government sets pump prices above the cost components, motorists will

have to pay duties. And oil companies like Petron, collects subsidies

from the Government (or pay duties to the Government) on behalf of motorists. This is where you will sometimes see amount owing by/to Government on the balance sheet. |

Needless to say, it is in essence, a cost-plus contract (modified in some ways) which is the only method usable if you want to enable the average to remain profitable.

The guarantee profit factor is so prevalent in this third kind of industries, that when the government announced the weekly price mechanism, and was considering allowing petrol stations to set lower prices.

The moment this whiff of potential competition happened.

The Petrol Dealers Association of Malaysia (PDAM) which represents more than 2000 petrol dealers in Malaysia, argued that the new mechanism will not to bring benefit to consumers in the long run and will create competition among oil companies and potentially can create a monopoly market by large companies with sound financial ability that are able to sell at lower prices over a long period of time, which will result in dealers closing shop.

Well.... I guess... thank you for forcing me to sell at a higher price?

So, how does an above average performer then obtain super-normal profit in this “guaranteed profit” industry.

The answer is two prong (and quite similar to pretty much any other industry).

- Build market share

- Lower cost.

Retail Market Share

When Petron took it over from ESSO back in 2012, its Retail market share was 9%.

By 2014, it had risen to 16.4%.

Based on management representation during the AGM's. It further increased to 17.7% in 2015, 17% in 2016, 19% in 2017 and 20.5% in 2018.

And finally, in 2019, it increased again to 21.1%.

Today it is third in the industry. With Shell taking first place with 35% and Petronas a close second at 30%.

This is on top of the industry average growth of about 6% per annum from 2012 to 2019.

Quite an impressive performance. In addition, due to the average industry growth of around 6%, this translates to growth in the low teens for PetronM to gain the market share it did.

This comes off the back of strong marketing performance (most of the gains came in the first 1-2 years after the takeover). Most petrol stations then actually recorded at immediate jump in sales volume after the re-branding.

In addition, the company have gotten many cost-efficient wins, that improve experience vastly, while not costing much.

It was one of the first to start installing air conditioners in toilets. In fact, in 2017 it won the recognition for having the cleanest toilets in the industry by Ministry of Housing and Local Government.

It also offers one of the best “Miles” cards, giving you effectively 0.75% discount on your petrol. And was the first to allow you to convert points directly to petrol, with no expiry date on the points, making customers very sticky.

They also focus very much on ensuring high margin products like the RON100 (which they are the first to launch) are available in all important locations and are perfectly marketed. The other RON100 fuel provider is Shell’s V Power Racing. Which to be honest, most people do not know it to be RON100 grade as well, therefore thinking PetronM’s is better.

Gross margins on the ROM 100 (this is from back in the day when I was an auditor for a Petron Station Dealer) is about 20%. Those of RON97 is about 10% and RON95 is about 5%.

The company is also aggressively expending petrol stations wherever they feel is lacking, in fact if you were to drive into Johor Bahru now, the first sight you see is a sea of Petron Stations.

All of which offers RON100 for Singaporean cars (which are usually Continental Cars, that perform much better on RON100 fuel, which is still very cheap for Singaporeans) , as well Kereta Hantu (Singaporean Cars with Cloned Malaysia license plates) the bulk of which are Continental Cars (I mean why not? A 2012 BMW 3 series is only RM8k, the price is about the same for Audit and Mercedes as well).

They were also one of the first to allow you to set the amount of petrol you would like to pump, directly at the machine, instead of having to head to the counter. This is unbelievably helpful to most motorcycle users who are also often in the B40 category for whom the RM200 hold on debit cards is very painful.

In fact in January 2020, they became to first to not have any holding charge for payments using ATM Debit Cards (and of course was smart enough to start a marketing campaign to make sure everyone knows).

All of which are either cheap value wins, or profitable initiatives that also gain you market share.

Lowest Cost Provider

Now, the second question, are they the lowest cost provider? Allowing them to make the additional margin from the “Operational Costs” component which is set based on industry average.

Well, let’s compare them against its listed counterpart, Petronas Dagangan.

What we will be using is Cost/Income %.

Cost will consist of Other Operating and Administrative cost, which is separate for the Cost of Goods/Fuel sold.

The thing about Petrol Companies is, their revenue is often decided by the price of fuel globally, which often outweigh any increase/decrease in volume sold.

Which is why we will supplement it by using Cost/Total Gross Income %.

For the purpose of this comparison, I’ve also included that of Petron Fuel International Sdn Bhd (“PFI”), which is the company privately held by Petron Corporation.

This company’s business consists solely of a portion of its petrol station business in Malaysia.

Now the first thing, you should note, is that what does into categories such as Operating Expenses and Administrative Expenses, may differ significantly for both companies.

Having said that, from what we can see here, in terms of cost, whether calculated on the basis of Cost/Income % or Cost/Total Gross Income % is far lower for Petron Malaysia and Petron Fuel International when compared against Petronas Dagangan.

Even if we are to ignore those issues due to potential classification issues, in terms of absolute figures, over the last 7 years, costs for Petronas Dagangan have steadily marched upwards at a compounded rate of 6% per year, while that of Petron Malaysia’s have either reduced or stayed largely even. And this is despite the large increase in retail market share.

In terms of efficiency and costs, Petron is clearly leading the pack. And this is despite the commercial arm of Petronas Dagangan being far larger and contributing significant amount of additional revenue/gross profit.

Having said that, do note that the Operating Costs for 2017 and 2018 for Petronas Dagangan likely did not suddenly increase for business reason, but is likely due to a change in accounting policy resulting in reclassification in cost categories.

Having said that, whether under the new classifications or old classifications, cost of Petronas Dagangan steadily marched up.

The Refinery Business

The other part of the PetronM business is its refinery business. For the most part, most people consider this to be a drag on the earnings, with the refinery earning the least money.Lets find out if this is true.

Current, the company has roughly 640 petrol stations in Malaysia. Approximately 426 of them belongs to Petron Malaysia, while the other 214 belongs to Petron Fuel International.

That is an approximately 2/3 (PetronM) and 1/3 (Petron Fuel International) split.

Using the Petron Fuel International financial statements, we will extrapolate their earnings, and deduct it from the PetronM’s financial statements to see if it’s true.

And tada, no surpise. From the numbers above, that is probably true.

The thing to note here is, unlike other refineries in the region, the Port Dickson refinery taken over from ExxonMobil/Esso, can only process very light sweet crude, which is the type typically produced from Malaysia players and is typically more expensive.

Since the acquisition of the company and being dealt this bad hand, the company have also moved to improve the economic position of this refinery, by initiating a “Crude Optimization and Refining Improvement Program” to find alternative crudes that can be blended along with the low sulphur Tapis Crude (which is more expensive), while taking into account the finished product yields, such as Gasoline, Diesel, LPG, Jet A-1, Low Sulfur Waxy Residue (Bad) and Naphta (Bad).

Upgrades have also been done in order to get it to be able to process higher margin crudes.

Since then, the company have found a range of domestic and regional crudes that can be used. One crude companion that was found, had a higher distillate yield value due to being able to produce more Diesel and Jet A-1 while reducing Naptha yields.

Due to the fact the refinery is still not fully optimized, it is currently only run at roughly 55%-60% capacity, with about 60% of the finished fuels demand for PetronM being imported.

The management have indicated that they can run it at higher rates, but as its not viable economically at higher rates, they are currently not doing so.

Interestingly, this also means that turnarounds don’t affect profitability as much as other refinery oil companies. Though to be honest, I would far prefer our refinery being so amazing that any turnaround will drastically impact profitability.

The refinery division was also impacted by the fact it needed to undergo EURO 4 and EURO 5 upgrades, which had cost roughly RM500m (this is just an estimate) with the other upgrades and expansion over the years coming in at roughly RM250m. About RM350m of these expenditures came in 2019.

Luckily for us, with the government having just upgraded to EURO 4M for Petrol and EURO 5 for Diesel in 2020 (the last time we upgraded our fuel was RON92 which was phased out in 2009). EURO 6 is the next one and this standard is not yet widely adopted worldwide.

Given the balance of probabilities, there is unlikely to be any new extraordinary compliance and maintenance capital expenditure requirements, for the next few years (preferably for the next 10 years).

Capital expenditures in the future are likely to be more of the “increasing economic benefit” kind, which over the last few years, consisted mainly of installing more storage tanks to hold more fuel especially at the Bagan Luar Terminal , as well as connecting pipelines to the Klang Valley Distribution Terminals and Multi Product Pipeline to lower transportation costs.

As a whole

For the company as a whole, in terms of the numbers, I decided to perform a full Owner’s Earnings Analysis,

As we can see here, since being taken over by the new management, the company has generated “Owners Earnings” of RM1.35 billion from 2012 to September 2019.

This is despite all that onerous EURO4 and EURO5 maintenance capital expenditures, as well as the numerous upgrades needed under the “Crude Optimization and Refining Improvement Program”.

Excluding the these capital expenditures needed to meet the higher EURO 4 and EURO 5 requirements, the company would have generated RM2.4 billion in owner’s earnings instead.

With the large EURO 4M and EURO 5 capital expenditures expected to be completed by 2020 and most of the cost incurred, i foresee less significant maintenance capital expenditures in the future.

The most interesting point for to me to note here is, despite growing their Retail Petroleum market share in Malaysia from 9% in 2013, to roughly 21.1% in 2019, as well as, increasing sales volume from 28.8 million barrels of petrol in 2013 to 35.7 million barrels (extrapolated) in 2019.

The net working capital (Working Capital consist of Trade Receivables, Trade Payables and Inventory) required to run the business since 2013, have actually fallen by RM703m or about 30%.

Imagine this, since expanding the business significantly, the management actually require 30% less working capital to run it.

If this is not a sign of competent and efficient management, I don’t know what is. A Serba Dinamik Berhad, this company is not.

And interestingly, despite 2019 being the most challenging year for the company thus far, with extrapolated earnings of only RM200m (maybe less), which is half that of 2017’s profit of RM408m, and capital expenditures at an all time high of RM345m, more than double that of 2018 (the previous all time high).

The company still generated an all-time high owner’ earnings of RM602m, more than double that of 2017’s and this is only in the 9 months of 2019.

Even when normalized to account for the the RM390m owed by the government for fuel subsidies in 2018 that was paid in 2019. The company still generated roughly RM212m in cash.

Utterly Incredible.

Valuation

And so, what is the value given to this business by Mr Market?A business that over the long term, can churn out owners’ earnings of roughly RM200m at its cyclical low, with its average over the long term likely to be significantly higher and increasing.

Well, as of today, Enterprise Value (Market Capitalization + Net Debt/Cash) of Petron Malaysia is roughly RM940mil, or about 4.4 times cyclical low owners’ earnings.

How much do I value this company?

Well, due to the fact that I had to extrapolate the retail earnings instead of seeing it properly, I would need to discount the current earnings a little from the current RM216m.

Lets say a 20% discount, putting long term earnings at RM170m, and to be conservative, we assume zero growth.

Recently, BHP was put up for sale from Boustead, and would have been sold by now if not due to Vitol currently blocking the sale. The valuation being put up was around 12 times earnings to 19 times earnings.

Now, I have no idea what the capital structure of that company is like, and I don’t want to buy a copy of the accounts from SSM (if someone here wants to buy one, you’re welcome to do so, and if you wish, update me so I can update this article), but as we are completely debt free (and I’m willing to bet BHP is not, looking at Boustead’s accounts).

Even if we are to blindly use the valuation used for BHP by private, we would likely still be undervaluing it.

Now, personally, I would like an IRR of 10% minimum when I’m looking at equities due to the additional risk I am taking. Since i'm assuming zero growth to be safe, and ignoring the growth in the low teens for the retail division.

It translates nicely to PE10, or RM1.7b.

What about the refinery?

Well, after the improvements made in 2013 and 2014, based on the extrapolated numbers, the refinery have no longer continued making a loss.

Personally, I think the refinery should make, maybe RM50m a year in its current state when normalized over the long term (gut feeling lol).

If upgraded (which to be fair , costs money), it should improve. However, its too hard for me, so I’ll just put it as zero.

Which puts my fair value at a minimum of RM8.5 and as high as RM12-15, depending on whether or not I want to include growth or refinery earnings (or god forbid, refinery losses).

Risks

Deregulation and Increased CompetitionFat luck of this happening.

Petronas Dagangan is a RM22 bil kitty for the government, and Petrol Dealers in Malaysia consist of mostly Bumiputra’s. There is every incentive for the government to not deregulate and increase competition.

And even if they did, I doubt any GLC or MNC will be able to compete with Petron. They are just not incentivized to.

Sudden Fall in Fuel Prices and Sudden Increase in USD.

Currently the company holds about half month stock on hand (only slightly above PETDAG’s 0.4 month, despite having to ship in 60% of their finished goods), or about RM560m and Payables of RM1bil (most of which is denominated in USD) at any point in time.

Any drop in value of oil and increase in value for the USD will impact their earnings negatively. So this is a question of, if they are doing any hedging.

According to the company, for commodity hedging, they hedge about 40 to 60% of our exposure.

For currency hedging, they hedge about about 80 to 90% of its dollar-denominated liabilities on crude and product purchases with the balance is covered by the natural hedges or PetronM's export receivable which is denominated in USD.

So realistically, given the recent fuel price drop of about 20%, assuming only 40% (low range) of inventory is hedged, net impact to the PL should be about RM70m, and probably a bit higher as they will keep buying stock as prices drop and stabilize.

Well, it sucks, but when fuel prices increase, we would see a commensurate gain.

Typically, hedging can be considered an insurance policy, and it should cost you roughly 4% (typical option prices) of the value of the items you are hedging over the long term.

Having said that, this means that earnings for this company is going to be volatile, at least until the retail and commercial division grows to be the vast majority of the business, minimizing the fluctuations of the refinery end.

Is the management over-allocating more of their petrol stations to the 100% owned Petron Fuel International (“PFI”).

As we have seen very clearly from this analysis, the petrol station portion of the business is the most profitable of the two by far, and a natural fear is that the stations from the current portfolio will be sold to the 100% owned PFI, or that new stations will be allocated only to PFI.

Well, this is question that have been asked a few times during the AGM, and their answer, verbatim, is as follows.

“In determining which of the companies will be assigned ownership station, the key factor would be the logistics efficiency and cost of transport.

Thus the determination of assignment of ownership would depend on the the location of the closest distribution terminal and ownership of that terminal.

For instance if a new station was to be built in the Southern region of Johor, it is likely that it would be a PFI designated station, considering the nearest terminal in Pasir Gudang is PFI’s.

Similarly a new station in the North, eg Kedah would likely be designated to PetronM's due to its proximity to the PetronM's terminal in Bagan Luar.

Placing all new stations under PetronM may not be effective as the cost of transportation may not make the station’s operations economically viable. The Company has a stringent process in place to ensure that the process of designating the station is based purely on the factors that make the station viable economically.

The fact that PFI is a 100% owned entity does not factor in the equation. It is to be noted that the majority of the Petron stations in Peninsular Malaysia are PetronM's.”

Naturally, we cannot blindly believe this.

However, during the initial acquisition, 67% of the stations belonged PetronM. Over the years, petrol station additions have largely split according to this ratio as well.

Its just unfortunate the Johor Stations are not under PetronM. A real pity.

I would be very happy, if the management decides to consolidate its entire Malaysian Operations together.

However, considering how shrewd the management is in allocating capital and saving costs, I don’t see why they would do this kind of expensive and unnecessary restructuring exercise.

Well, we can always buy Petron Corporation shares I guess, its currently at its 15 year low.

However, that is a different animal altogether.

In the Philippines, they are currently facing problems from to oil smuggling in the Philippines by the blackmarket to avoid excise tax, which results in Petron’s prices being higher than the black market.

A problem we will never have, unless its cigarettes.

Other Information

Why the title?During my study of the company, one of the interesting things i found out was how Ramon S Ang got to there he is today.

For the most part, given the kind of person he was, Ramon was supposed to grow up successful, but a Billionaire, that is a stretch for anyone, no matter how smart or hardworking.

Back in the day, Ramon got to know Ambassador Eduardo “Danding” Cojuangco Jr. through his eldest son, car-racing aficionado and ex-Congressman Mark Cojuangco.

Eduardo Cojuangco made Ang manager of his Northern Cement business, where he excelled with entrepreneurial vigor.

After the 1986 EDSA uprising, when the Cojuangcos were in exile due to the Marco's being overthrown, most of their managers shunned and even stole from them.

Ramon Ang, on the other hand, honestly and loyally managed Northern Cement for the Cojuangco family. After some time, Eduardo Conjuangco eventually returned. He retook control of San Miguel Corporation and entrusted its management to Ramon Ang, who made it more far far successful.

He dramatically changed SMC from a beer and foods firm into one of Asia’s biggest, diversified multinational conglomerates. Eduardo Cojuangco eventually chose Ang as his successor and sold the bulk of his SMC shares to him, and helped him pay for it by loaning him the money.

Today, San Miguel Corporation is about 6-7% of the GDP of Philippines.

Now, the Conjuangco family was very much intertwined with the massively corrupt Marcos family, and despite this kind of environment which should only attract the most Najib like characters, there was someone like Ramon Ang who as the Chinese like to say "出淤泥而不染". Said in english, is represents the the lotus flower which grown from the mud and yet blossoms white.

Quite interesting. And precisely the kind of person i want in charge of a company i hold shares in.

Conclusion

Crack Spreads, USD Exchange Rates and Oil prices are important items to know, but they are ultimately unknowable.The real question is, how are the economics of the business, the competence of the management and the value you are getting for the price you are paying.

I hope this article helps shed some light regarding the above.

As always, let me know if you disagree or feel I missed out on anything.

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Website: www.choivocapital.com

Email: choivocapital@gmail.com

https://klse.i3investor.com/blogs/PilosopoCapital/2020-02-10-story-h1483734883-_CHOIVO_CAPITAL_Petron_Malaysia_Refining_Marketing_Berhad_PETRONM_3042_.jsp