Just like the movies, the famed Fast & Furious is ALL ABOUT SPEED.

So wear your seatbelt and get ready for ride of your KLSE life!

3rd show: PCCS / 6068

PCCS GROUP - Company Introduction

Founded

in 1973, PCCS Group is a diversified investment holding group major in

textile industry. The coverage involves manufacturing, trade, services,

and investment. For more than 40 years, PCCS Group has always adhered to

the corporate culture of “people-oriented, inheritance, and

simplification and pragmatism”, and has embarked on a transformation of

factor-driven to value creation, from assemble manufacturing to

independent innovation. The Group's current mission and vision is to

“Make investments create a better world and great platform with happy

stakeholders”.

PCCS Group was listed on the main board of the Kuala Lumpur Stock Exchange in Malaysia in 1995. The group has more than 4,000 employees, more than 20 wholly-owned and holding companies, and a number of state-level high-tech and international standardization companies

PCCS Group was listed on the main board of the Kuala Lumpur Stock Exchange in Malaysia in 1995. The group has more than 4,000 employees, more than 20 wholly-owned and holding companies, and a number of state-level high-tech and international standardization companies

------------------------------------------------------------------------------------------------------------------------

------------------------------------------------------------------------------------------------------------------------

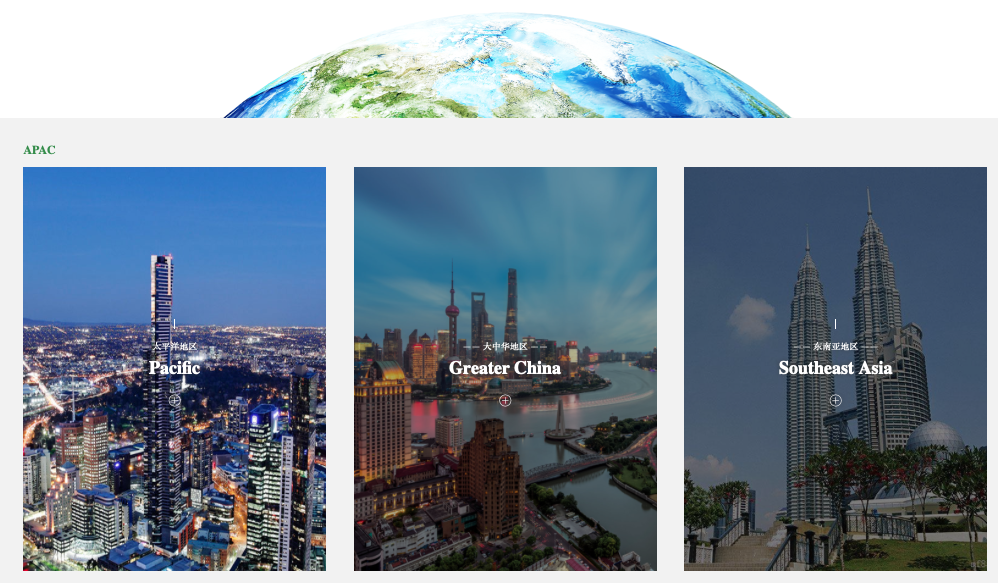

Analysis on Earning Per Share (EPS)

Announcement Date / EPS

29 Nov 2019 / 1.77

30 Aug 2019 / 0.53

30 May 2019 / 3.57

27 Feb 2019 / 2.17

---------------------------------

SUBTOTAL / 8.04 x PER (Price Earning Ratio) 10 = RM0.804 Target Price

Current Price as of 3 Jan 2020 = RM0.445

------------------------------------------------------------------------------------------------------------------------

IMPORTANT NOTICE:

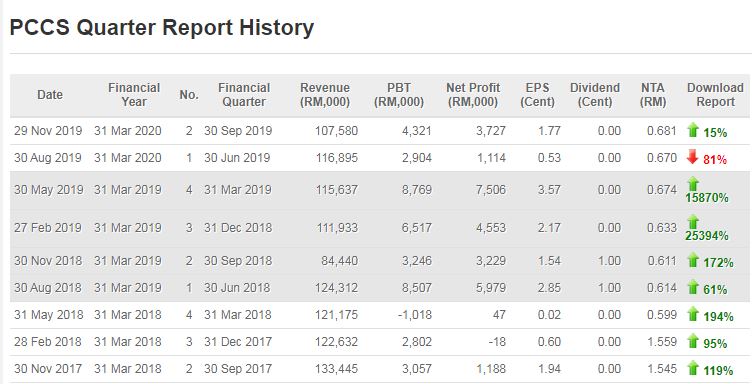

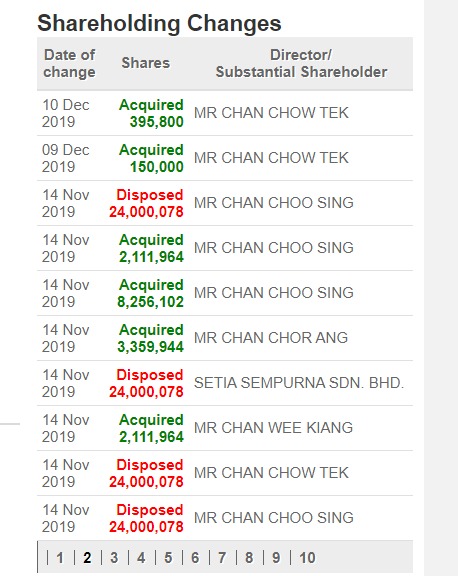

Major Shareholders are buying LARGE QUANTITIES to accumulate for the positive prices uptrend.

------------------------------------------------------------------------------------------------------------------------

NEWSFLASH!

PCCS sees 11.43% stake crossed off market

KUALA LUMPUR (Nov 14): PCCS Group Bhd saw 24 million shares, or an 11.43% stake, in the company crossed off-market today.

The shares were transacted at 40 sen apiece or a total of RM9.6 million, according to Bloomberg data.

This

price represents a discount of 1.23% over today’s closing market price

of 40.5 sen, which values the company at RM85.07 million.

The parties involved in the transactions have not been identified.

The largest shareholder of PCCS is Chan Choo Sing, with an indirect interest of 111.52 million shares or 53.1% as at Oct 8.

Shares

in PCCS closed unchanged at 40.5 sen today with some 1.2 million shares

traded. Over the past year, the counter has risen by 102.5%.

------------------------------------------------------------------------------------------------------------------------

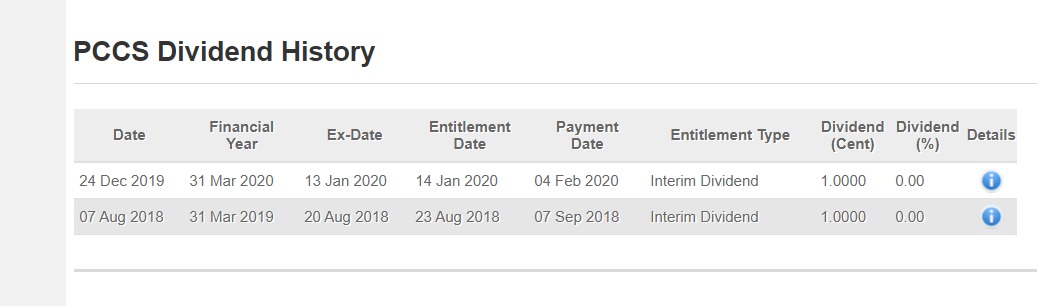

REMARKS:

Noted, on dividend paid

For 2010 onwards,

Only 2 announcements

(i) 7 August 2018

(ii) 24 December 2019

------------------------------------------------------------------------------------------------------------------------

Technical Chart Analysis

From

announcement 7 Aug 2018 on Interim Dividend 1.0000 Cent (meaning one

lot of 1,000 shares payable by company to investor equals to RM10.00)

2019

The dividend play plus Chinese New Year pay from 8 Feb 2019 (RM0.22) to 12 April 2019 (RM0.50).

Total number of days = 70 days. Total Price Increment RM0.50-RM0.22 = RM0.28.

2020

Expect a gigantic rally from 3 Jan 2020 to 13 Mar 2020 (Number of days = 70 days)

From price RM0.445 (3 Jan 2020 Closing Price) + RM0.28 = RM0.725 Target Price

RECAP

Analysis on Earning Per Share (EPS)Announcement Date / EPS29 Nov 2019 / 1.7730 Aug 2019 / 0.5330 May 2019 / 3.5727 Feb 2019 / 2.17---------------------------------SUBTOTAL / 8.04 x PER (Price Earning Ratio) 10 = RM0.804 Intrinsic ValueCurrent Price as of 3 Jan 2020 = RM0.445

------------------------------------------------------------------------------------------------------------------------

Technical Chart

Summary for

30 December 2019 (Monday) to 3 January 2020 (Friday)

Total trading for the week

= 4 trading days

(Reason: 1 January 2020 is not trading day)

Volume traded

Mother share

(i) 3 January 2020 - 15, 076 lots

(ii) Week volume - 20, 491 lots

3 trading days =

5,415 lots that is little,

Per day = 1,805 lots

Comparing on

3 January 2020 - this

particular day

volume :15,076 lots.

========================

Warrant WA

Week Volume = 10,794 lots

3 January 2020

Day Volume = 6,894 lots

Other 3 days Volume = 3,900 lots

Per trading day only = 1,300 lots

++++++++++++++++++++++++++

Remarks

The technical chart does not lie,

For PCCS,

on the 4.15 pm,

3 January 2020 is the actual beginning of the new rally for the uptrend thrusts to revisit and surplus the previous highs

(a) Old high

RM 0. 635 (mother)

(b) Old high

RM 0.315 (WA)

------------------------------------------------------------------------------------------------------------------------

This year 2020 - also a representation of the perfect vision and eyesight 20/20.

Do you have what it takes to capture this moment and WIN BIG CAPITAL GAINS by this Chinese New Year rally?

Issued By

SEE_Research

(Sensing Eagle Eye Research)

https://klse.i3investor.com/blogs/see_research/2020-01-06-story-h1482034722-The_Trilogy_of_FAST_FURIOUS_Shows_PART_3_FINAL_SHOWDOWN_KLSE.jsp