The top 5 market capitalisation of REITS in Malaysia

1. KLCC

2. IGB REIT

3. SUNREIT

4. PAVREIT

5. AXREIT

I would not buy this 5 reits now because the Dividend Yield (DY) are

the lowest as well, from 4.69% to 5.24% before deducting the 10% tax.

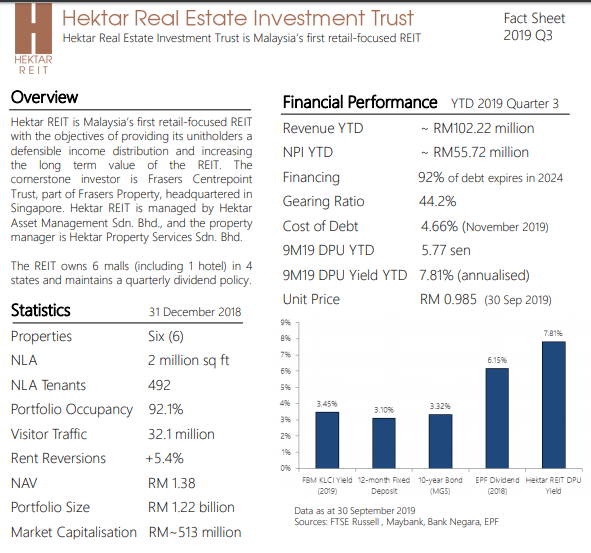

What about the top 5 Dividend Yield REITS? (Refer to the first pictures)

1. Hektar is the first retail focused reit in Malaysia. Gearing is the

highest as well at 44.2%. It has strong cornerstone investor which is

Frasers Centrepoint Trust, listed in Singapore.

2. ARREIT has gearing of 43.65% and involved in office building,

educational, industrial, hotels and retail mall. This reit has 2 vacant

properties which is Holiday Villa Alor Setar and Wisma AIC. Overall, I

don't think this is a good management REIT based on their way of

managing their properties.

3. MQREIT owns Menara Shell, TESCO Jelutong and many other office

buildings. MQREIT gearing is at 37.8% with around 50% of long term

tenants.

https://www.theedgemarkets.com/article/positive-outlook-expected-mqreits-assets-rental-income

4. AMFIRST is one of the earliest REIT in Malaysia and controlled by

AMBANK. The price has been dropped continously from 94 sen at 2015 to 50

sen at 2020. But with current price, the downside is limited.

5. CMMT main contribution is from Gurney Plaza. CMMT also owns Sungai

Wang. Sungai Wang business is terrible before the renovation. Not sure

about the future of Sungai Wang which change its name to Jumpa. KL

people, what do you think about Jumpa? The dividend yield of CMMT is not

as high as it looks like as the future dividend should be lower.

Personally, I like reit very much 12 years ago, that time, reit is

offering a very good yield. But with more and more people choosing to

invest in reit, the price of the reit especially the big capitalisation

reit has been rising and cause the dividend yield to drop. So,

currently, I don't hold much in reit. If I see any good reit and its

price is good to buy, then I would buy back because reit can offer very

stable income over the years.

Personally, with the e-commerce over supply of office and retail mall

plus the bad economy in Malaysia, I don't feel comfortable to hold many

reit. I prefer to buy niche reit like Alaqar because hospital business

is more sustainable. But I won't buy now as the price is not attractive

yet.

Hope you like this article. Wish you all a very Happy Chinese New year 2020.

马来西亚房地产投资信托基金的前五名市值

1. KLCC

2. IGB REIT

3. SUNREIT

4. PAVREIT

5. AXREIT

2. IGB REIT

3. SUNREIT

4. PAVREIT

5. AXREIT

我现在不买这5个地产,因为股息收益率(DY)也是最低的,从4.69%降至5.24%,再减去10%的税。

那排名前5位的股息收益率房地产投资信托呢? (请参阅第一张图片)

Hektar是马来西亚第一家零售零售房地产投资信托。资产负债率最高,为44.2%。它拥有强大的基础投资者,即在新加坡上市的Frasers Centrepoint Trust。

2. ARREIT的资产负债率为43.65%,涉及办公楼,教育,工业,酒店和零售商场。此房地产投资信托有2个空置物业,分别是Holiday

Villa Alor Setar和Wisma AIC。总的来说,根据他们管理财产的方式,我认为这不是一个好的管理房地产投资信托。

3. MQREIT拥有Menara Shell,TESCO Jelutong和许多其他办公大楼。 MQREIT负债比率为37.8%,约有50%的长期租户。

https://www.theedgemarkets.com/…/positive-outlook-expected-…

4. AMFIRST是马来西亚最早的房地产投资信托基金之一,由AMBANK控制。价格从2015年的94仙连续下降到2020年的50仙。

5. CMMT的主要贡献来自格尼广场。 CMMT还拥有Sungai Wang。翻新之前Sungai

Wang的生意真糟糕。不确定将Sungai Wang改名为Jumpa的未来。吉隆坡人,您如何看待Jumpa?

CMMT的股息收益率并不像看起来的那样高,因为未来的股息收益率应该更低。

就个人而言,我非常喜欢12年前的REIT,那时REIT提供了非常好的收益。但是,随着越来越多的人选择投资于房地产投资信托,房地产投资信托的价格,特别是大型资本化房地产投资信托,一直在上涨,导致股息收益率下降。因此,目前,我对房地产投资信托的持有不多。如果我看到任何优质的房地产投资信托基金,并且其价格可以买到,那么我会回购,因为房地产投资信托基金多年来可以提供非常稳定的收入。

就个人而言,由于办公室和零售商店供应过剩的电子商务,以及马来西亚的经济不景气,我不愿意持有很多信托。我更喜欢购买像Alaqar这样的利基房地产投资基金,因为医院业务更具可持续性。但是由于价格还没有吸引,我现在不买。

希望您喜欢这篇文章。祝大家2020年新年快乐。

https://klse.i3investor.com/blogs/GTRONIC/2020-01-19-story-h1482841928-The_Top_5_Dividend_Yield_REITS.jsp

https://klse.i3investor.com/blogs/GTRONIC/2020-01-19-story-h1482841928-The_Top_5_Dividend_Yield_REITS.jsp