TECFAST

Techfast Holdings Berhad is a Malaysia-based investment holding company. The Company is engaged in the provision of management services. The Company’s business segments include manufacturing of self-clinching fasteners, manufacturing of mould cleaning rubber sheets and Light Emitting Diode (LED) epoxy encapsulant materials.

Its subsidiaries are Techfast Precision Sdn Bhd, Cape Technology Sdn Bhd and Oriem Technology Sdn Bhd.

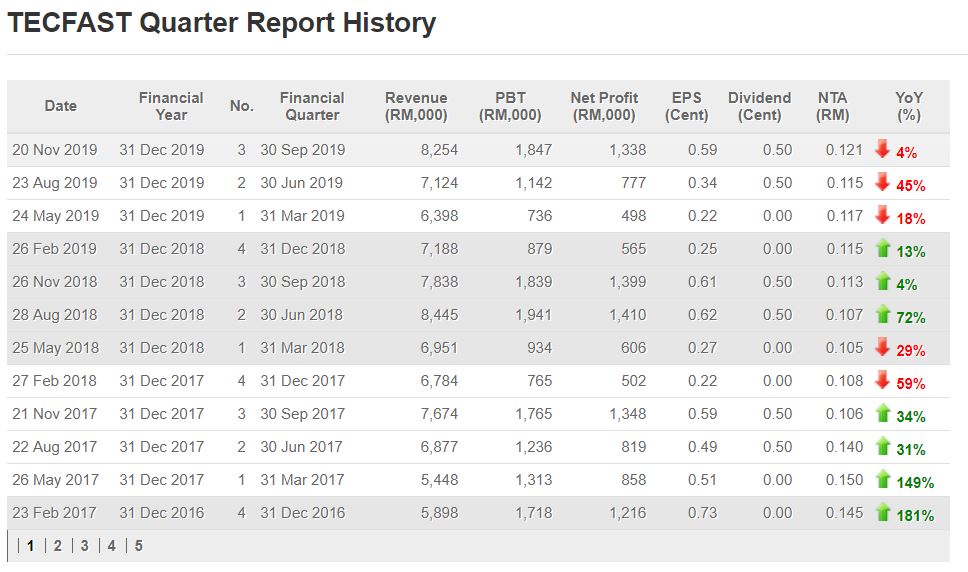

Quarter Results

Assuming a 20% growth for each quarter for TECFAST. Its very minimal for a technology company.

latest EPS will be 0.59cents.

For the next three consecutive quarter result, it will be around 0.71cents , 0.85cents & 1.02cents

The total EPS will be at 3.17cents. Average P/E for technology companies are around 25-30.

Assuming P/E 25, TECFAST will be worth around RM0.79

Assuming P/E 30, TECFAST will be worth around RM0.95.

Do not forget the latest Quarter Result for TECFAST is the second highest revenue in historical and third highest NET PROFIT. The difference between the highest net profit is like less than RM100K !!! which is easily to be achieve for this company. The latest 2 quarters shows a strong recovery in profit similar like year 2017 WHICH CAUSES THE STOCK SURGE MORE THAN 400% !!!

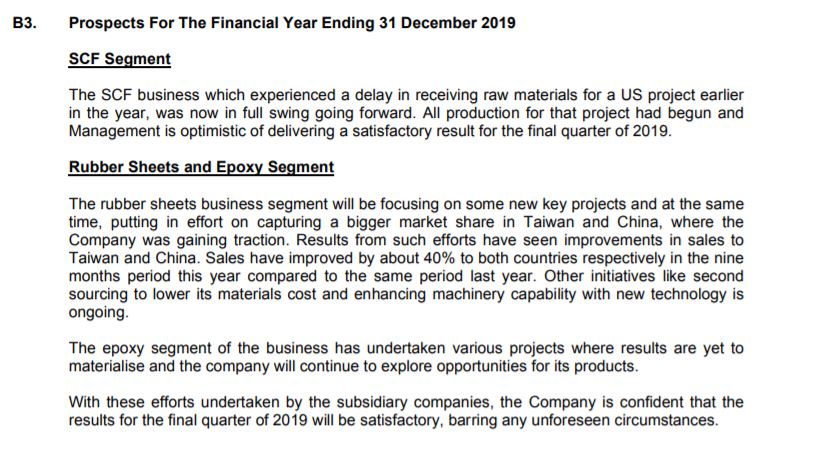

Future Prospect by TECFAST

Bright future for TECFAST because the company gaining traction in TAIWAN & CHINA. This two country is crazily improving with their latest TECHNOLOGY AND 5G !!! Sales improved about 40% for this both countries too !! Its obvious that the company is confident with their company performance in future.

Stock of the Year 2017 surges more than 400% appear in Bloomberg coverage !!!

Research Analysis Report by Kenanga

KENANGA given a Target Price of RM0.52. However, average P/E for current technology companies are at PEAK !!!

Example like

FRONTKN P/E : 39.77 !!!

FPGROUP P/E : 33.41 !!!

UWC P/E : 36.82 !!!

GREATEC P/E : 35.22 !!!

VITROX P/E : 49.53 !!!

TECFAST P/E : 35.92 !!!

A important hint need to remind everyone is TECFAST market shares is only 223mil !!! which is 10times smaller than anyone of the companies mentioned above. This is very important because the smaller company will have SUPER strong momentum when its net profit and revenue growth double or triple. So you have to take note of it. Unlike some of it because there are too big to grow. The potential of GROWING is smaller compared to TECFAST !!!

Technical Analysis

Strong support level at RM0.50

Uptrending since last year 2019 OCTOBER. Result released at Nov 20 but it surge to new high at end of December 2019.

52 weeks high RM0.575

High possibility to breakout from there at move towards above RM0.60.

Few catalyst will cause the momentum to continue,

Technology sector is extremely bullish.

INARI, UWC, GREATEC, VIS, PENTA & VITROX ALL AT NEW HIGH.

TECFAST washed out most of the contra traders from RM0.575.

First Target Price : RM0.60

Second Target Price : RM0.64

Timeframe: One week to 1month !!!

Feb result month will decide this stock can be like VIS surge more than 100% or not due to a strong quarter result reported. Trade at your own risk. I'm a experienced investor that invested most of the technology companies in Malaysia. Just to share my experience with everyone. Never chase high. But buy a stock which is uptrending nonstop towards the sky which strong fundamental. Good luck everyone.

Techfast Holdings Berhad is a Malaysia-based investment holding company. The Company is engaged in the provision of management services. The Company’s business segments include manufacturing of self-clinching fasteners, manufacturing of mould cleaning rubber sheets and Light Emitting Diode (LED) epoxy encapsulant materials.

Its subsidiaries are Techfast Precision Sdn Bhd, Cape Technology Sdn Bhd and Oriem Technology Sdn Bhd.

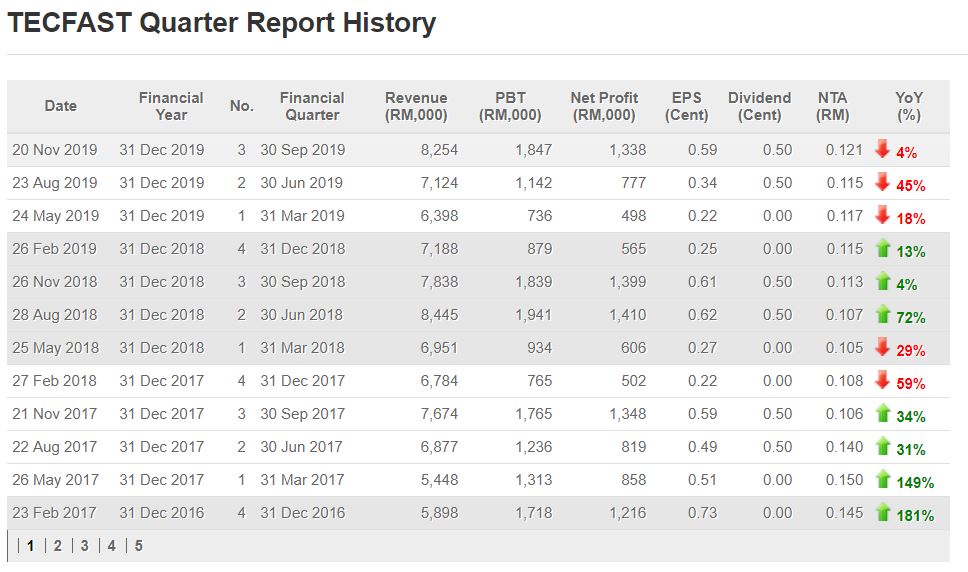

Quarter Results

Assuming a 20% growth for each quarter for TECFAST. Its very minimal for a technology company.

latest EPS will be 0.59cents.

For the next three consecutive quarter result, it will be around 0.71cents , 0.85cents & 1.02cents

The total EPS will be at 3.17cents. Average P/E for technology companies are around 25-30.

Assuming P/E 25, TECFAST will be worth around RM0.79

Assuming P/E 30, TECFAST will be worth around RM0.95.

Do not forget the latest Quarter Result for TECFAST is the second highest revenue in historical and third highest NET PROFIT. The difference between the highest net profit is like less than RM100K !!! which is easily to be achieve for this company. The latest 2 quarters shows a strong recovery in profit similar like year 2017 WHICH CAUSES THE STOCK SURGE MORE THAN 400% !!!

Future Prospect by TECFAST

Bright future for TECFAST because the company gaining traction in TAIWAN & CHINA. This two country is crazily improving with their latest TECHNOLOGY AND 5G !!! Sales improved about 40% for this both countries too !! Its obvious that the company is confident with their company performance in future.

Stock of the Year 2017 surges more than 400% appear in Bloomberg coverage !!!

Research Analysis Report by Kenanga

KENANGA given a Target Price of RM0.52. However, average P/E for current technology companies are at PEAK !!!

Example like

FRONTKN P/E : 39.77 !!!

FPGROUP P/E : 33.41 !!!

UWC P/E : 36.82 !!!

GREATEC P/E : 35.22 !!!

VITROX P/E : 49.53 !!!

TECFAST P/E : 35.92 !!!

A important hint need to remind everyone is TECFAST market shares is only 223mil !!! which is 10times smaller than anyone of the companies mentioned above. This is very important because the smaller company will have SUPER strong momentum when its net profit and revenue growth double or triple. So you have to take note of it. Unlike some of it because there are too big to grow. The potential of GROWING is smaller compared to TECFAST !!!

Technical Analysis

Strong support level at RM0.50

Uptrending since last year 2019 OCTOBER. Result released at Nov 20 but it surge to new high at end of December 2019.

52 weeks high RM0.575

High possibility to breakout from there at move towards above RM0.60.

Few catalyst will cause the momentum to continue,

Technology sector is extremely bullish.

INARI, UWC, GREATEC, VIS, PENTA & VITROX ALL AT NEW HIGH.

TECFAST washed out most of the contra traders from RM0.575.

First Target Price : RM0.60

Second Target Price : RM0.64

Timeframe: One week to 1month !!!

Feb result month will decide this stock can be like VIS surge more than 100% or not due to a strong quarter result reported. Trade at your own risk. I'm a experienced investor that invested most of the technology companies in Malaysia. Just to share my experience with everyone. Never chase high. But buy a stock which is uptrending nonstop towards the sky which strong fundamental. Good luck everyone.

Disclaimer:

All the views and opinions expressed in our post are for education and

informational purposes only and it should not be considered as

professional financial investment advices or buy/sell recommendations. I

strongly encourage you to do your own research and take independent

financial advice from a professional before you proceed to invest. I

make no representations as to the accuracy, completeness, correctness,

suitability, or validity of any information on our Facebook Page/Group

and will not be liable for any errors, omissions, or delay in this

information or any losses and damages arising from its display or usage.

All users should read the posts and analysis the information at their

own risk and I shall not be held liable for any losses and damages.

https://klse.i3investor.com/blogs/2020toppicks/2020-01-29-story-h1482963044-TECFAST_A_Top_Technology_Company_in_Malaysia_that_you_don_t_wish_to_mis.jsp