UPDATED VERSION - PLEASE READ IT UNTIL THE END OF THE PAGE!

TAS OFFSHORE

-

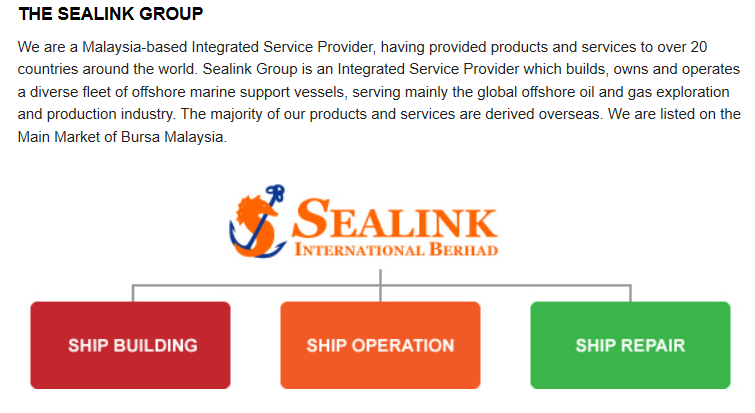

The company is principally

involved in shipbuilding and ship repairing activities. The services

are similar with Sealink Group. Interestingly, both companies are in

Sarawak. Details of the company's business overview, and products and

services are as below and link here: http://www.tasoffshore.com/products-services

TAS Offshore

-

The

emergence of co-founder of Serba Dinamik, Datuk Awang Daud as major

shareholder in Sealink in late last year, has led to the share price

shot higher to 74sen from 45sen in the past two weeks in January 2020.

In fact, it started rally before that from 16sen since June 2019.

-

Would

that mean potential earnings turnaround or strong jobs flow in Sealink

just like SCIB and Kpower after the founder of Serba Dinamik, Dato'Dr.

IR. Mohd Abdul Karim bought stake in SCIB and Kpower?

-

Given

TAS offshore offers similar services to Sealink in Sarawak, TAS' share

price should also follow the rally of Sealink's share price to reflect

the potential brighter business outlook or maybe something else that can

be seen as a positive catalyst despite its net loss in 2Q20 (Sept - Nov

2019 period) results as reported on Thursday. It could be a blip only. Sealink also still reported net loss!

-

TAS Offshore is optimistics with its prospects:

-

On O&G prospects. According to Maybank-IB, 2020 to be equally exciting, if not better. The

O&G market is on a cyclical upward trend. Global sanctioning of

projects is rapidly increasing. Greenfield project commitments,

especially offshore investments have clearly picked up. Putting

things into perspective, oil price is expected to be at USD65/bbl in

2020, a level that would continue to instill confidence (i.e. capex/

sentiment). Maybank-IB is seeing positive developments across the value chain. As offshore activities rise, the OSV segments will benefit from stronger dayrates and utilization. This will likely boost TAS' orderbook for the construction of its OSVs for the O&G industry. Evidently,

Perdana Petroleum has benefited from the rising demand for its OSVs,

which primarily come from Dayang. FYI, Perdana also operates in Sarawak!

-

On tugboat's prospects. Analysts

from Technavio, a global market research company, had pointed out that

the tugboat market will register a compounded annual growth rate of

close to 17% by 2022. The

tugboat market will remain attractive. Shipyards will also benefit from

tugboat contracts as the industry enters a golden period of tug

construction, driven by regulation and environmental concerns. Fifty-six

towage vessels were added to the global order book in the first six

months of 2019 in what is perceived as a bullish industry. These

new shipbuilding contracts boosts the global order book for tugs of

more than 20 meters in length to 297 vessels, keeping some shipyards

busy into 2020 and a few to 2022. These development augurs well for the group.

-

While

Sealink has rallied to more than its NTA of 70sen and now at 68sen,

which seems fairly valued at 0.97x Price-to-NTA (Book value), TAS

offshore is still far undervalued and offers cheaper alternative to

Sealink. TAS Offshore's NTA is at 92sen and this means TAS' price-to-NTA

is only at 0.35x!!!

-

A

little bird whispered to me that the current share price of 32.5sen

could rally to 53sen soon at least for the first phase! At 53sen, it

would imply 0.57x price-to-NTA! Still cheap though!

-

From technical analysis angle,

it looks operators or insiders have already started accumulate the

stock aggresively in the last few days until yesterday despite the gap

down due to reported 2Q20 net loss! The operators or insiders took

opportunity from the selling (gap down) to accumulate more! Volume has jumped abnormally - stronger than average (chart below as of Thursday).

-

This

can be seen in money flow index too! The uptrend in the money flow

actually started from Dec 2019 with small volume with nobody noticed it.

How to know the operators movement? Please read this book. It is well recommended!

-

TAS'

share price had been trading sideways for a long time until it broke

above 28sen and 200-day exponential moving average (EMA), long-term

outlook last week. It has also now traded above 50-day EMA, mid-term

outlook and the share price is still above short-term outlook - 21-day EMA of 28sen despite the price gapped down yesterday. In fact, the gap down was occured in the consolidation range between 33.5sen and 29sen. Therefore,

the drop could be temporary and not a significant sell or bearish

signal. Thus, the share price will recover to fill in the gap down

anytime soon.

-

There

is golden cross between 20-day EMA (purple colour) and 200-day EMA

(gold colour), which indicates a long-term bull outlook going forward.

-

Next resistance stands at 36sen / 40.5sen / 48sen / 52.5sen

-

Support stands at 28.5sen