Straits Inter Logistics (0080) - Riding on higher OIL PRICES

• The always lagging O&G stock. The company is one of the largest offshore premium oil bunker in companies.

•

The company is direct beneficiary from rising O&G activities in

Malaysia. About 90% of its customers are consists of O&G players, -

PETRONAS, Repsol, Bumi Armada, Alam Maritim, Icon Offshore, just to name

a few.

•

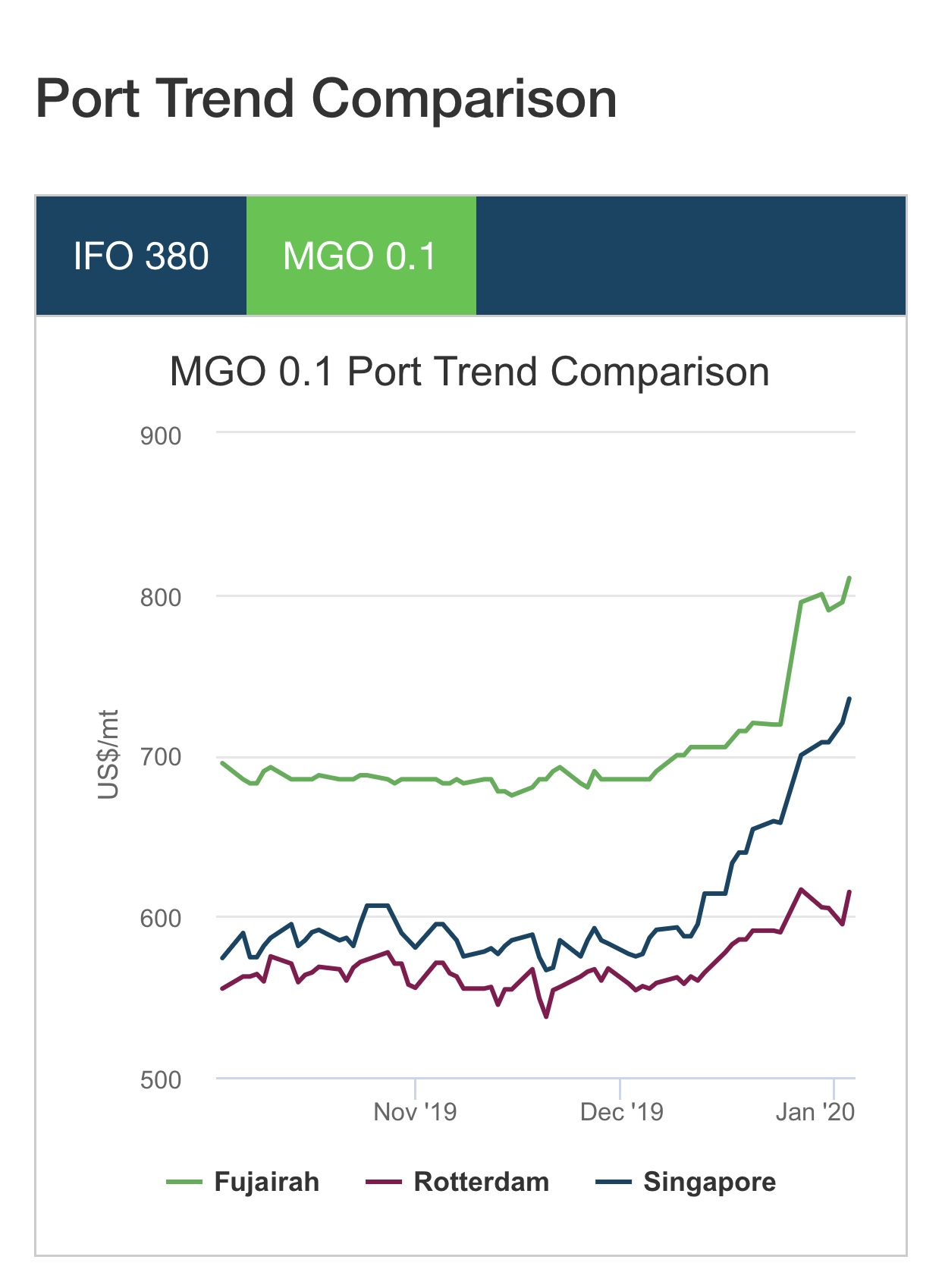

Like Hibiscus, its earnings growth also tied to the oil prices. The

bunker price (MGO and MFO products that the company supply) moves in

tandem with oil prices. The higher the oil prices, the higher bunker

price, the higher its revenue value and earnings value, which would

imply higher EPS and cheaper PE ratio. In fact, the bunker

prices has been trending up since the potential signing agreement

US-China trade deal. Yet, the stock has not reacted to both the US-China

deal and current higher oil prices events!

Investors

have yet realised this. We can expect that Straits’s share price will

likely to skyrocket sooner than later to reflect the higher bunker

prices! You can see the benchmark bunker price chart below or see this link: https://bunkerindex.com/prices/portfreels_xmdo.php?port_id=682

•

The company would also benefit from the migration of residual fuel to

MGO and MFO due to the implementation of IMO’s global sulphur cap,

starting January 2020.

• Maybank has a BUY call on Straits Inter Logistics with a TP of 42sen based on FY20 EPS.

•

The most interesting part, its warrants is only trading at marginal

premium with gearing only 1.8. Normally, the warrants moves double than

the mother share price moves whenever gearing below 2.0.https://klse.i3investor.com/blogs/fatprofitstock/2020-01-06-story-h1482039559-PART_2_My_O_G_stocks_TOP_PICKS_for_6_1_20.jsp