[PPHB (8273) - Packaging Company]

Public Packages Holdings Berhad (PPHB) is a retail and trading company

engaged in the manufacture of corrugated boxes, packaging materials,

gift boxes and display boxes in Malaysia.

The company was founded in 1976 and is headquartered in Penang, Malaysia.

In addition to the retail trade business of cartons and packaging, the

company is also involved in real estate development and civil

construction.

The company's main peers are MUDA, MASTER, ORNA and BOXPAK.

In general, PPHB is a company in the field of industrial packaging, with a current market value of about RM 204 mil.

✅ PPHB mainly has 5 businesses:

1) Manufacturing

It mainly manufactures and retails corrugated boxes, packaging materials, gifts and display boxes. Accounted for 90% of turnover. The performance of this business is seasonal. Generally, the demand in the previous year is low, and then it gradually catches up. According to our statistics, the company's strongest quarter is Q3, then Q4, then Q2, and the weakest is Q1.

2) Trading

It is mainly trade, design and sales of paper products, accounting for about 5% of turnover.

3) Investment

Investment holding and provision of financial, administrative and advisory services. About 1% of turnover.

4) Properties

Mainly real estate investment and real estate developers, but this business accounts for less than 1% of the company's turnover.

5) Hotel Business

This is a new business that PPHB did only in FY19 Q2, mainly operating Prestige Hotel, accounting for about 4% of turnover.

The company's business covers domestic and foreign countries: Malaysia,

other Asian countries, European countries, and the United States, but

most of its business is in Malaysia and other Asian countries,

accounting for 94% and 5%, and the remaining less than 0.5%.

The company has a factory dedicated to offset printing. Offset printing

packaging is suitable for a variety of industries, including

electronics, food and beverage, agriculture, industrial products and

various consumer products. To meet growing market demand, the company

has been investing in design and development facilities.

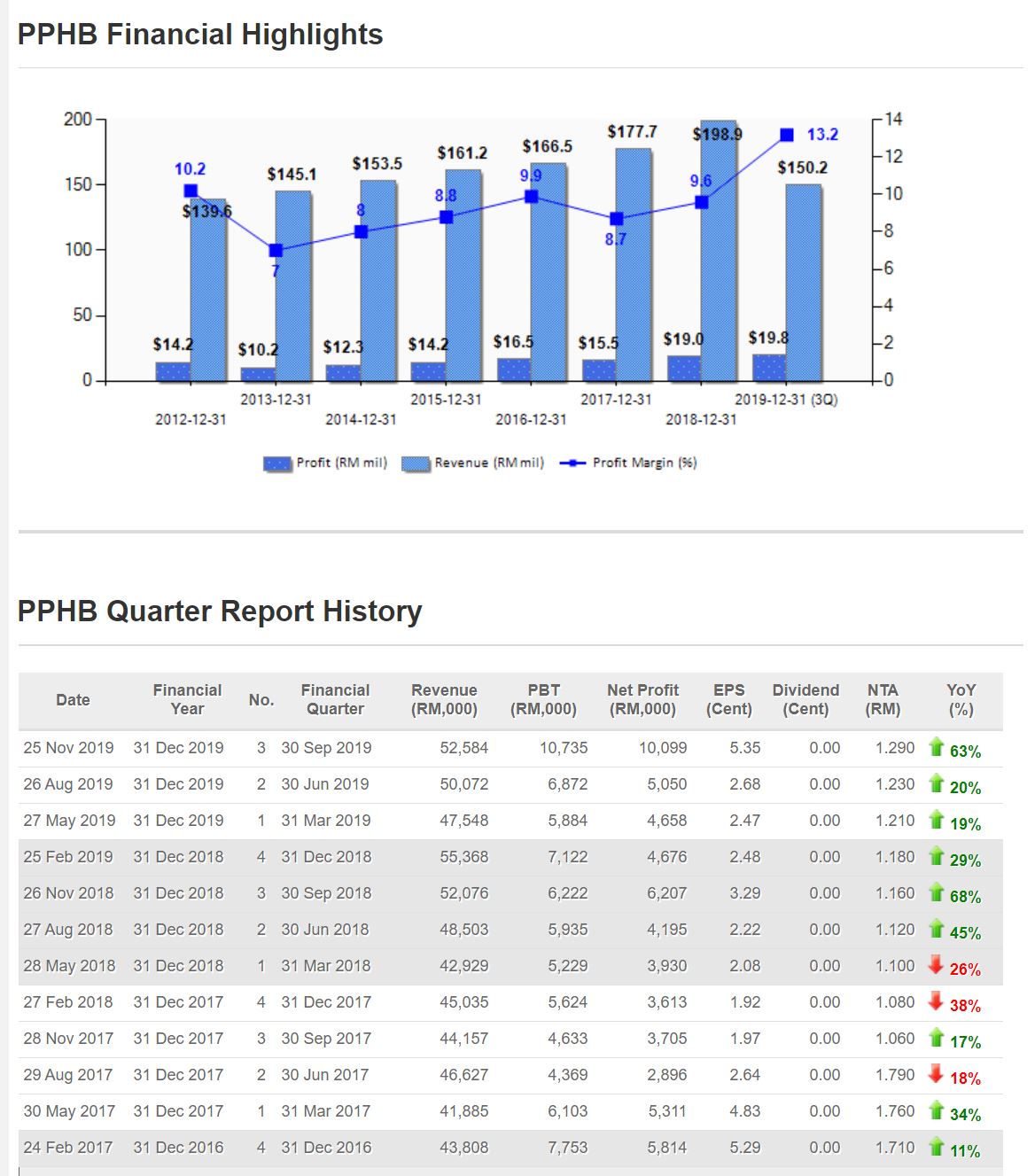

From FY2015 to FY2018, the company's turnover has gradually increased.

Although the company's FY2019 Q4 results have not yet been released, the

first three quarters of sales have increased year-on-year. The average

annual growth rate of the company's turnover is about 5%. Although it is

not dazzling, it is at least stable.

As for the profit before tax (PBT), the stability is not as good as the

turnover, mainly because the profit margin will fluctuate slightly, but

the overall progress in the past 5 years, especially FY2019, only 3

quarters have been close to catch up with PBT in FY2018. The company's

PBT average annual growth rate is about 13%.

The company's profit improvement is mainly due to the improvement in

profit margin and the company's cost control has also improved.

Overall, the performance of PPHB is good, especially in the past 3 years, it has grown significantly.

Obviously, the company's single-quarter turnover and profit are growing year by year, and almost every quarter.

The quarters that showed a clear quarterly decline were FY18 Q4 and FY19 Q1.

Although the turnover of FY18Q4 still increased on a quarterly basis,

the after-tax profit fell by 24.7% quarterly, mainly because FY17's tax

excess was then processed in FY18 Q3, so the FY 18 Q3 tax was reduced a

lot, resulting in After-tax profit has declined compared to Q3, but in

fact PBT has improved by 14.5% quarter-to-quarter.

The turnover of FY19 Q1 decreased by 14.1% quarter-on-quarter, purely

due to the decrease in the number of working days in this quarter. This

quarter's earnings were almost flat.

The company's latest quarter (FY2019 Q3) results have improved

year-on-year and quarter-to-quarter, both in terms of profitability, and

the progress is even more amazing. This is mainly because the profit

margins of the manufacturing and trading businesses have improved

significantly. This, coupled with the Prestige Hotel's operation in

June, has also increased the company's revenue.

It is worth mentioning that this quarter there was a one-time small profit, and the bad debt recovered RM 0.8 million.

In FY2018's annual report, management expects that 2019 will be a challenging year and competition will continue to be fierce.

Management also mentioned that although FY2018 was not an easy year,

the company continued to improve its competitiveness through the

implementation of various strategies including production process

automation and procurement optimization.

Management is committed to seizing any growth opportunities and

expanding its product range, and unless there are any surprises, the

company expects FY2019's performance to be satisfactory.

If we observe the current performance of FY2019 PPHB (the first 3 quarters), management has clearly fulfilled their commitment.

Management mentioned in each FY2019 quarterly report that FY2019 is a

challenging year, but management has been working hard to expand its

customer base, do a good job of cost control and improve operating

efficiency, and it is expected that the performance in the coming year

will be reasonable.

We have observed that the current performance of PPHB FY2019 is

improving, and it seems that the management's outlook wording tends to

be conservative and not overly confident.

Overall, PPHB is a very good company and the management is very honest.

As for the value is not worth investing, just test your vision. I

believe members have entered the market before the low price.

Louis Yap

Facebook:

Web Site: