[GFM (0039) - Facility Management Company]

GFM is a company that operates Facility Management. Facilities

management services include electromechanical systems, security,

cleaning and maintenance services.

GFM was founded in 2000 and has grown into one of the best facility

management services companies. GFM has been in the industry for almost

20 years and has a regular customer from the government / private

sector.

Most of the companies would like to focus on their core business, and

usually outsourcing the facilities service property/premises management

to other professional companies, as to have a better cost control,

maintain the property value, safety and cleanliness for their employee

and customer

GFM is aware of this, so it provides services as such to help

organizations solve the difficulties of facility management. Customers

can continue to work for their core business without having to worry

about facility management.

The contracts for facilities management services usually last for

several years, and it will not very frequent replacement of facility

management companies. Unless GFM is not properly manage on client’s

property and premise. Therefore, the company's revenue can be quite

stable.

Based on June 2019, the company has 2 business lines:

1) Facilities management services (accounting for 74% of total turnover)

2) Franchise (26% of total turnover)

1) Facilities management services (accounting for 74% of total turnover)

2) Franchise (26% of total turnover)

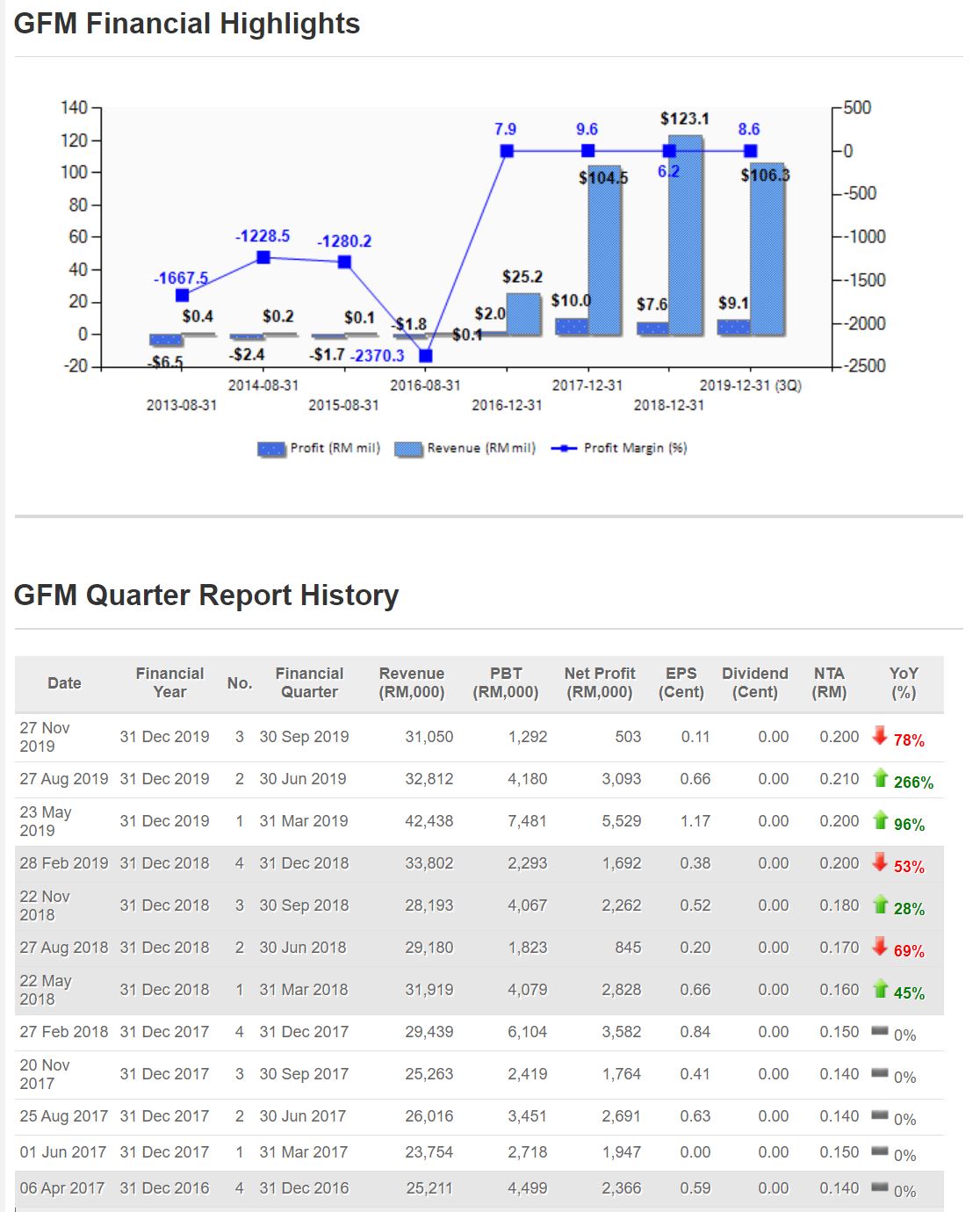

In the past 5 years, the company's turnover has continued to improve,

from RM 57mil to RM 123mil in 2018, and the growth rate is amazing, with

a CAGR of about 21%. Gross Profit Margin has remained at 27%-29% for

the past 3 years, and the profit is remain high. Although a record peak

turnover was recorded in FY2018, after-tax profit fell to RM 12mil

compared to previous years, mainly due to the one-time expenses incurred

by GFM's purchase of KPMD (KP Mukah Development Sdn Bhd) and some

corporate activities last year. And it is believing that this one-time

expenses will not be in the future, and the company's profit will return

to normal.

GFM's current dividend policy is to pay 40% of PATAMI (based on core

earnings). GFM pays dividends once a year, usually in July. The last

dividend paid by the company was 4 Jul 2019, and one cent was paid out.

Based on the current stock price of RM 0.365, the dividend yield is about 3%, which is not very attractive.

The fiscal year 2019 will be included in the KPMD account. Based on the

performance of the past 7 months, KPMD has earned an average of RM

3.3mil, and it is expected to increase profits by 40mil in one year.

Assuming facility management services maintain 2Q19 performance

throughout the year, the performance will grow to RM 17.1mil. Compared

with last year, the operating profit of facility management services

will be greatly improved. Adding KPMD's 40mil profit and deducting

internal trading is about 8.8mil. GFM's operating profit is expected to

climb to RM 47.7mil, but interest expenses will surge to RM 26.6mil due

to higher loans.

The operating profit for 2018 was only RM15.5mil, and the dividend was

paid 1.1 cents. If the operating profit in 2019 rises to RM 16mil, we

believe that the dividend should remain at the same level.

Of course, all these are just predictions, investors still need to pay

attention to ensure the company will continue to maintain good results.

GFM is still focusing on to strengthen facilities management services

and will also bid for more facilities management projects. The company's

Order Book currently has RM 1.35bil. In addition, KPMD has also brought

a new business model to GFM, which can bring profitable growth and

increase profit margin. Management is very much looking forward to meet

the profit brought by KPMD in FY2019, and will ensure that this

long-term profit can be stable. After all, the franchise rights of KPMD

and UiTM still have 17 years of contracts.

To ensure that the company remains competitive, GFM will also provide

high-quality services and more innovative technology to many customers.

In addition to focus on the growth of GFM, GFM continues to look for

more opportunities for future development.

The company's Order Book is currently about RM 1.35 bil. Prior to the

company's acquisition of KPMD, GFM's Order Book was approximately RM

280-300 mil, which could support a turnover of 2-3 years. Although Order

Book all the way up to RM 1.35 bil, and most of it was about UPM TM

franchise of KPMD. It is not difficult to find that the company's Order

Book has gradually declined on a quarterly basis, mainly because GFM

will implement a part of the Order Book every quarter. Therefore, the

company still needs to continue to find more management facilities

projects and extend existing contracts to improve the company Order

Book.

Assuming the GFM core business reaches RM 47.7mil, deducting interest

and taxes will earn about 16mil. Considering that the EPS in the next

year can reach 3.37 cents, PE 15 is about RM 0.505, and PE 10 is RM

0.335.

Although GFM acquires KPMD, its profit will be guaranteed in the next

16-17 years, but GFM's interest expenses will surge 24 times. It also

virtually bottomed out GFM's pre-tax / post-tax profit. It is considered

a risk to invest in GFM.

Louis Yap

Facebook:

Web Site: