TAS still undervalued at current price of 37sen with potential upside to 53sen!

TAS' share price yesterday shot higher to 37sen and this was not a surprise. It has already been expected to rally! As said before in the previous article, TAS offshore is still far undervalued and offers cheaper alternative to Sealink. The upside is still huge!

More details, please refer to previous article here: https://klse.i3investor.com/blogs/trendtrading2030/2020-01-20-story-h1482842090-WHY_AND_WHEN_TO_USE_PBV_RATIO_FOR_O_G_STOCKS_AND_WHICH_ONE_STILL_UNDERV.jsp

While

Sealink has rallied to more than its NTA of 70sen in the last few days

and dropped back to 64sen yesterday, which seems fairly valued at 0.91x

PBV, TAS' NTA is at 92sen and at current price of 37sen, TAS' PBV is only trading at 0.4x!!!

A

little bird whispered to me that the stock could rally to 53sen soon at

least for the major impulsive Elliot Wave 1! At 53sen, it would imply

0.57x price-to-NTA! Still cheap though!

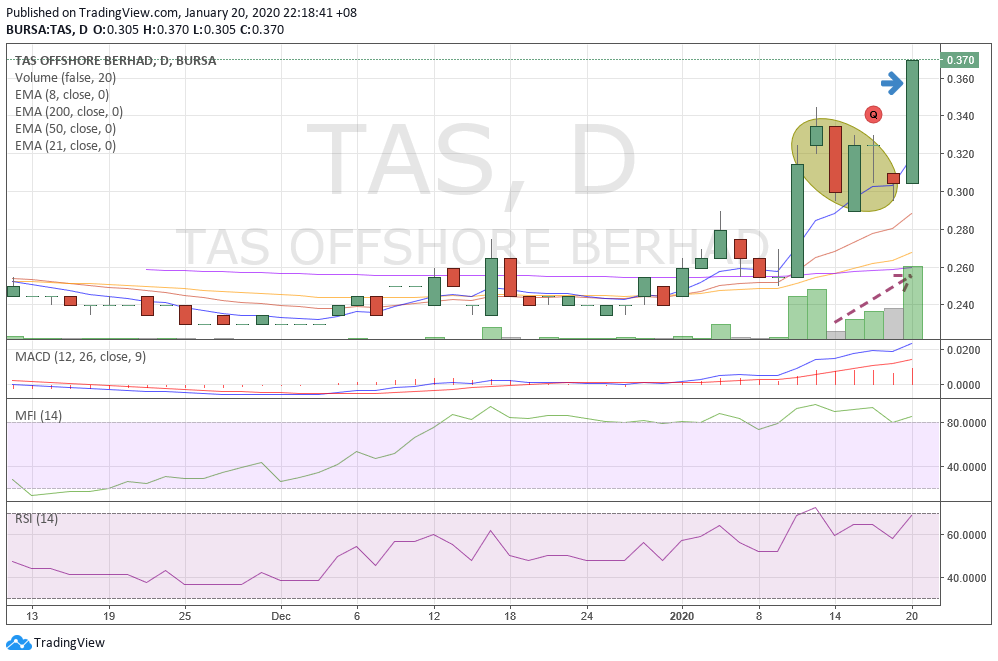

On technical analysis basis, given the stock closed at 37sen and broke above major consolidation resistance of 36sen,

the major (weekly) implusive Wave 1 started from this broken resistance

(become major support now) and is expected to rally to the next major

resistance of 53sen! The rally is strongly supported by strong inflow of

money into the stock as shown by the uptrend of MFI.

TP 53sen could probably hit today or tomorrow!

As

the CNY holiday draws near, operators or insiders may likely to push

TAS' share price higher by today or tomorrow so that they make profit as

much as possible and can cash out (withdraw) their profit on T+2 (on

Thursday or Friday before going off for holiday). The share price could gap up today to open higher from yesterday's close and may likely to break above 40sen in the morning or may actively trade above 40sen in the second half session just like yesterday's session.

If take a look at yesterday's VWAP of 34.5sen, operators or insiders may need 10sen higher from yesterday's VWAP level as their "base" profit, which would probably be 44.5sen at least so that they can operate to push share price higher to 53sen to clear off their shares! Evidently, look at the latest example is Gamuda-WE. It went up almost 10sen higher than previous day's VWAP level.

These operators or insiders had been aggresively accumulating TAS' shares in the past few days until yesterday (the final phase of accumulation) before they pushed it higher to close above major resistance of 36sen.

Evidently, the accumulation can be seen in chart below. The share price has made higher low structure in the consolidation phase in the last few days (despite reported net loss in the recent results) as operators took opportunity to absorb and accumulate from the weak holders. Then, the share price was significantly rising yesterday (formed long white/green candlestick), and also see rising volume associated with the move. This is a valid move higher, which supported by the operators and market sentiment. In other words, the operators and insiders are joining in the move, and we see this reflected in the volume.

Want to know more how the operators accumulate and distribute? Please read this book. It is well recommended!

https://klse.i3investor.com/blogs/trendtrading2030/2020-01-21-story-h1482870664-CNY_ANGPOW_FROM_TAS_OFFSHORE_WILL_CONTINUE_SKYROCKETING_TODAY.jsp